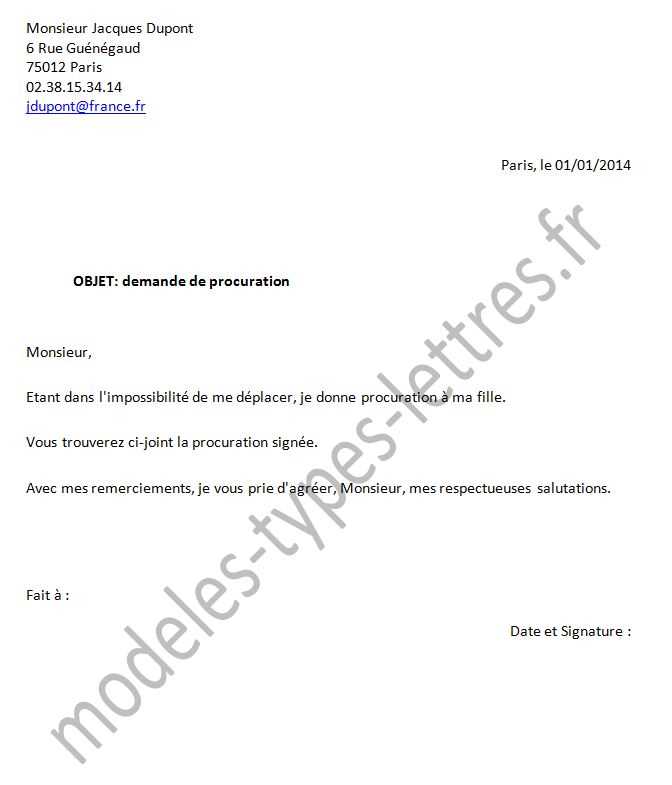

Procuration letter template

A procuration letter allows one person to grant another the authority to act on their behalf for specific legal or business matters. It is vital to clearly define the scope of authority and ensure all involved parties understand the terms. Below, you will find a straightforward template to help you draft a procuration letter quickly and correctly.

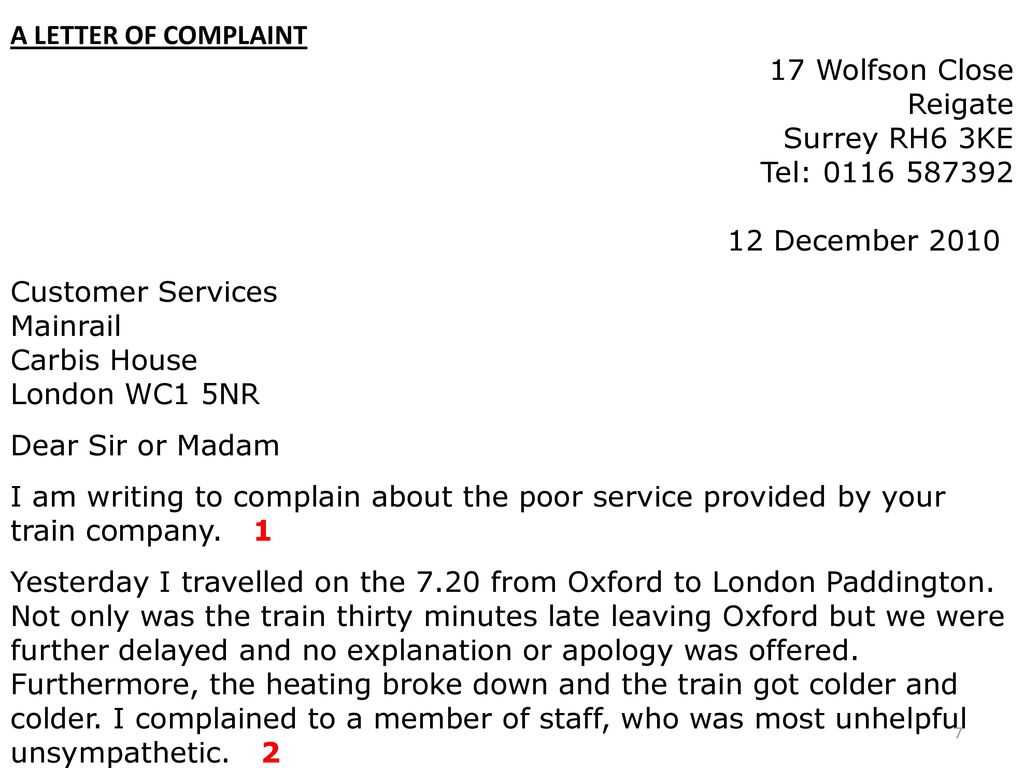

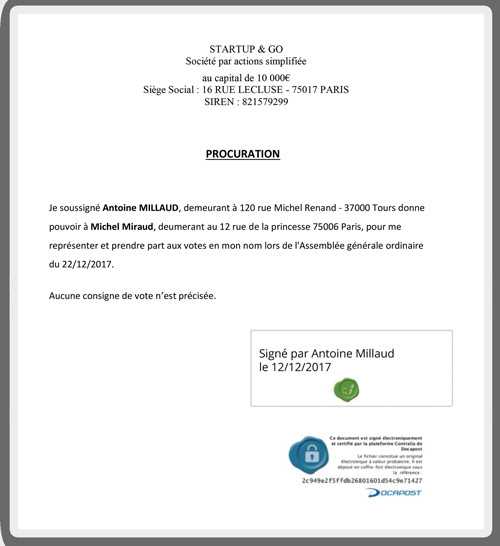

Begin with the title of the document, such as “Procuration Letter,” followed by the names and roles of both the principal (the person granting authority) and the agent (the person receiving authority). In the introduction, explicitly state the purpose of the letter, outlining the specific actions the agent is permitted to perform. Avoid vagueness–clarity ensures there are no misunderstandings.

Define the powers granted to the agent in clear, concise language. For instance, you may want to allow the agent to manage financial transactions, represent you in legal meetings, or handle business decisions. Ensure that each responsibility is listed in separate bullet points or paragraphs for easy reference.

Include a timeframe for the authority granted, whether it’s for a single transaction or a longer duration. Always mention the start and end dates for the authorization to prevent any uncertainty. The letter should also include any conditions under which the power is revoked or altered.

Finally, sign and date the document to make it legally binding. It is often a good idea to have a witness sign as well, depending on the jurisdiction. Double-check for any local requirements to ensure full legal recognition of the procuration letter.

Here’s the corrected version with minimal repetitions:

When drafting a procuration letter, precision in language is key. Focus on clarity by specifying the duties, limits, and duration of the authorization without redundancy. Use straightforward language and avoid over-explaining each section. Below is a simple example:

Sample Procuration Letter

Subject: Power of Attorney

Dear [Recipient’s Name],

I, [Your Full Name], hereby appoint [Agent’s Full Name], residing at [Agent’s Address], as my authorized representative to act on my behalf in all matters related to [specific tasks, e.g., financial transactions, legal actions, etc.]. This power of attorney is valid from [start date] until [end date], unless revoked earlier.

The appointed agent may sign, execute, and file any necessary documents on my behalf as described above. The agent’s authority is limited to [specific exclusions or conditions].

Conclusion

This letter is signed by me, acknowledging full responsibility for the actions taken by my appointed agent within the scope outlined. Any further permissions or restrictions may be communicated separately as needed.

Kind regards,

[Your Full Name]

- Procuration Letter Template

A procuration letter should be clear, concise, and precise. The main purpose of this letter is to authorize someone to act on your behalf in specific matters. Ensure that the document includes key details such as the scope of authority, duration, and any limits to the power granted.

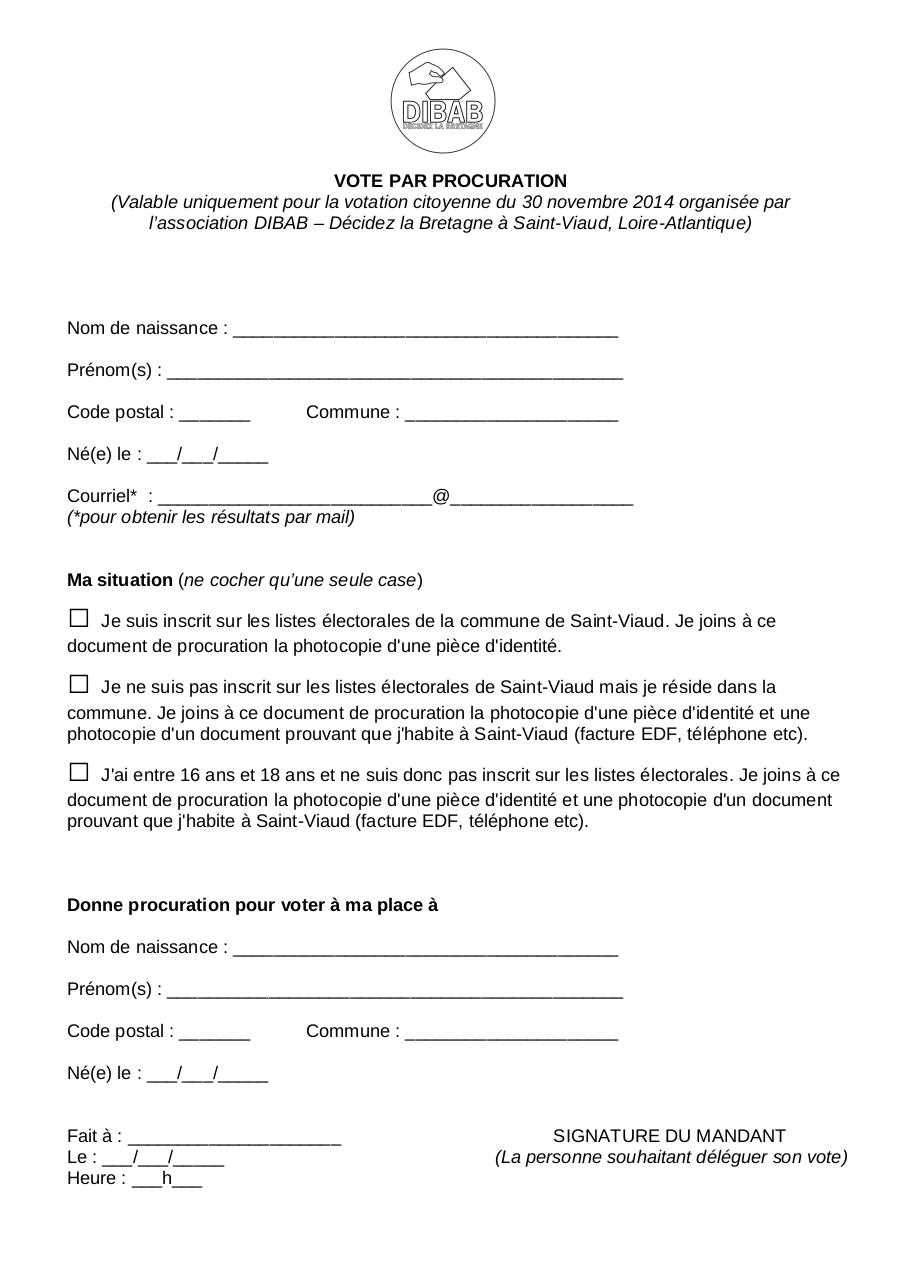

Start with the full name of the principal and the agent. This ensures clarity on who is giving the authority and who is receiving it. Include their address and contact details, if necessary, to avoid any confusion.

Clearly define the authority being granted. Specify what actions the agent can take, whether it’s signing documents, making financial decisions, or representing the principal in legal matters. Be as detailed as possible to avoid misunderstandings later.

Specify the time frame. Indicate the exact duration for which the agent has the authority. If the power is limited to a specific task, mention that as well.

Include a revocation clause. This gives the principal the ability to cancel the letter if they no longer want to give power to the agent. A simple statement like “This procuration may be revoked at any time by the principal” will suffice.

Close with the signatures. Both the principal and agent must sign the document. It is recommended that a witness or notary public also signs to authenticate the agreement and add legal weight.

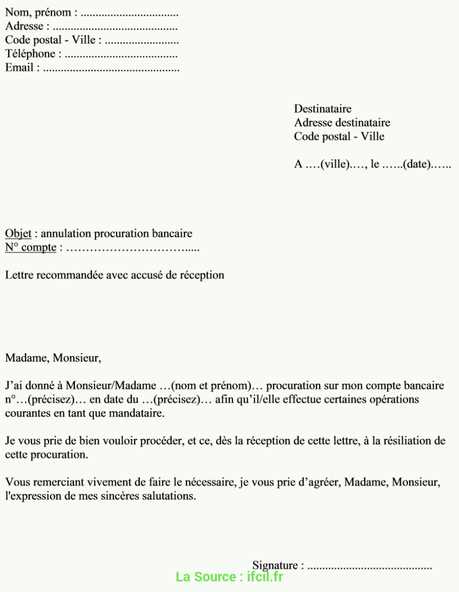

Clearly state the names and roles of the principal (person granting authority) and the agent (person receiving authority). This ensures there’s no confusion about who holds the power to act.

Define the scope of authority granted. Specify what actions the agent is allowed to perform on behalf of the principal, whether it’s financial transactions, signing contracts, or handling specific legal matters.

Include the effective date and duration of the letter. Specify when the authority starts and, if applicable, when it expires. This helps avoid ambiguity regarding the timeline of authorization.

State the limits of the authority. If the agent is restricted from taking certain actions, those limitations should be clearly outlined. This can include restrictions on selling property or making high-value transactions.

Describe any conditions or requirements for the agent’s actions. If there are specific procedures or documentation needed for the agent to act, mention them clearly.

Ensure the letter is signed and dated by the principal. This is a legal requirement to validate the letter. In some cases, notarization might also be necessary to add extra legal weight.

If applicable, add a witness signature. While not always required, having a third party sign the letter can help validate the document’s authenticity in some jurisdictions.

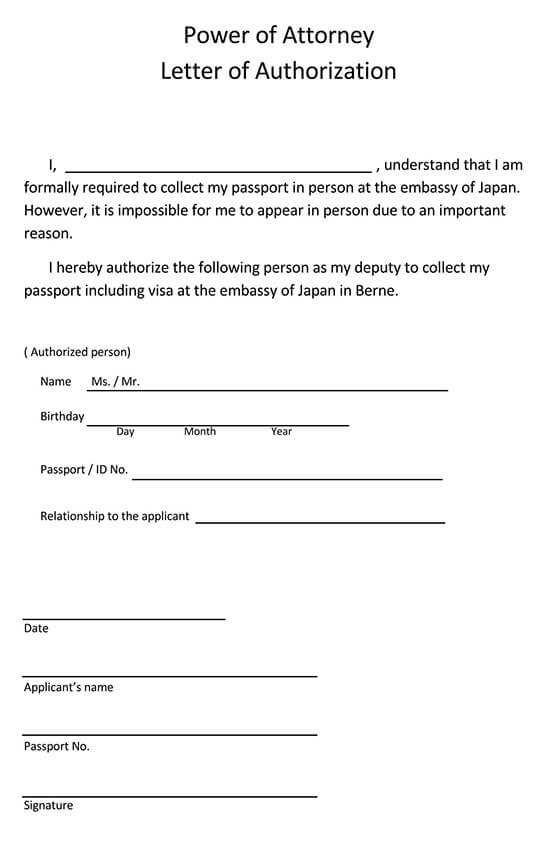

Begin by selecting the type of Power of Attorney that fits your needs, such as a general or limited POA. Identify whether it’s for healthcare or financial matters, as this will affect the content.

Clearly name the principal–the person granting the power–and the agent–the person receiving it. Be specific with the agent’s authority, detailing the scope of actions they can take on behalf of the principal.

Specify the duration of the POA. It could be durable (lasting even if the principal becomes incapacitated) or non-durable (ending if the principal is incapacitated).

Ensure the POA includes any necessary limitations or conditions that apply to the agent’s actions. For instance, specify if there are any financial transactions that require prior approval from the principal.

Have the document signed in front of a notary public to confirm its authenticity. Depending on your jurisdiction, you may need witnesses as well.

Ensure the document clearly explains how the power can be revoked. It’s common to include a statement that allows the principal to terminate the POA at any time while they are still of sound mind.

Ensure the letter is clearly structured. A common mistake is including unnecessary details that can confuse the reader. Focus on the key information: who is being authorized, what they are authorized to do, and the duration of the authorization.

Double-check the recipient’s details. An incorrect name or title can undermine the validity of the letter. Always verify the spelling of names, job titles, and other important identifiers.

Avoid using ambiguous language. Be specific about the actions the authorized person can take. Instead of vague terms like “manage,” use “sign documents” or “access accounts” to eliminate any confusion.

Ensure the letter includes the proper signature and date. An unsigned letter or one without a date may be seen as incomplete or invalid. Both the authorizer’s signature and the date of signing should be clearly visible.

Don’t overlook the importance of a witness. If required by law, include a witness to sign the document. Failure to do so could make the authorization unenforceable in legal settings.

| Common Mistakes | Why to Avoid |

|---|---|

| Unclear Authorization Scope | Leads to confusion about what actions the authorized person can take |

| Incorrect Details | Invalidates the document if names, titles, or dates are wrong |

| Lack of Signature or Date | Undermines the validity of the letter |

| Failure to Include a Witness | Can make the letter unenforceable in legal situations |

Ensure the document clearly states the scope of authority granted. Specify the powers the agent will have, such as financial management or healthcare decisions. Ambiguity can lead to complications or disputes. It is important to include a date when the power of attorney takes effect, whether it’s immediate or triggered by a certain event, like the principal’s incapacity.

Make sure the document is signed by the principal, and witnesses or a notary may be required depending on local laws. These witnesses should not be the agent or anyone directly involved in the transaction. Without proper signatures, the document may be deemed invalid.

It’s also wise to consider limiting the duration of the power of attorney. Specify an end date or conditions under which the authority is revoked, ensuring it’s clear when the agent’s powers are no longer in effect. Without clear revocation, the agent’s authority may persist even if the principal no longer wants them to act.

Tailor your procuration letter by adjusting key details to match the specific context. Begin by including the correct names and addresses of both the principal and the agent. Ensure these are accurate to avoid any potential misunderstandings. Customize the scope of authority granted to the agent by specifying the tasks they are permitted to handle. This can range from financial transactions to legal matters, depending on your needs.

Modify the Letter to Reflect the Purpose

Clearly outline the reason behind the letter. Whether it’s for managing business dealings, signing contracts, or handling personal matters, state the purpose directly. Mention the specific duration for which the powers are granted–this could be a fixed period or until a particular task is completed. Adjust the language to reflect the level of formality or informality required by the situation.

Include Specific Instructions

- Set boundaries for the agent’s actions if necessary.

- Specify any limitations on financial decisions or legal actions.

- List required documents or signatures to support the authorization.

Lastly, ensure that the letter is signed by both parties involved. If necessary, include a witness’s signature for additional validation. Review the letter for clarity to avoid ambiguity in the language used, ensuring that both parties understand the terms fully.

Update or revoke a Power of Attorney (POA) when any major life event impacts your choice of agent or your needs. These include:

- Change in relationships – If your relationship with the agent deteriorates or you no longer trust them, it’s time to revoke the POA.

- Change in health status – If your medical or mental health conditions change, you may need to adjust the powers granted to your agent.

- Relocation – If you move to another state or country, consider updating your POA to comply with local laws.

- Agent’s incapacity or death – If your designated agent becomes unable or unwilling to act, a new POA should be created.

- Changes in laws – When laws governing POA change in your jurisdiction, updating your document ensures it remains valid and effective.

Revoke a POA by notifying your agent and all parties that rely on it, and by officially canceling the document. To prevent confusion, destroy all copies of the revoked POA. Always consult with an attorney when making changes to ensure they align with your current intentions.