Effective Payment Collection Letter Template for Businesses

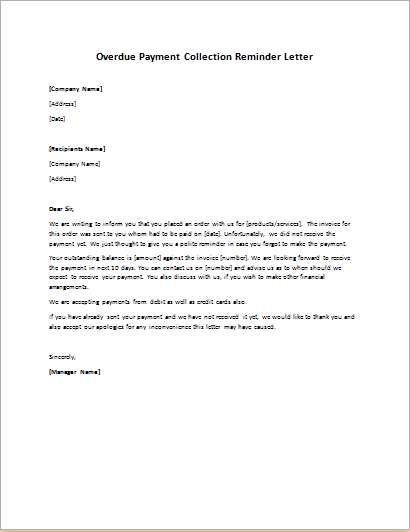

For businesses, managing unpaid invoices can be a challenging task. When clients delay their payments, it’s important to address the issue professionally and efficiently. One of the best ways to handle this situation is by sending a formal communication that clearly outlines the amount owed and requests immediate action.

In this article, we will explore how to create an effective document that encourages prompt payment. This communication should be firm yet polite, ensuring that the recipient understands the seriousness of the matter while maintaining a positive relationship for future transactions.

We will guide you through the key components of such a message, offering insights on structure, tone, and wording. By following these tips, you can improve the likelihood of a quick resolution and maintain a professional approach to managing overdue accounts.

Why Use a Payment Collection Letter

In business, securing timely payments is crucial for maintaining cash flow and ensuring operational efficiency. When clients or customers fail to fulfill their financial obligations, it’s essential to reach out in a professional manner. Sending a formal request helps remind them of their due amount and outlines the necessary steps to resolve the issue.

Encourages Quick Action

Formal requests can speed up the resolution process. By outlining the expectations clearly, you create a sense of urgency. This approach often leads to faster responses, as it communicates the seriousness of the situation while preserving a professional tone. Without such communication, delays may continue, causing unnecessary strain on both parties.

Maintains Professional Relationships

While addressing overdue payments, it’s important to keep communication respectful and courteous. A well-crafted request allows businesses to handle the matter without damaging their relationship with the client. By focusing on professionalism, you protect the integrity of your business and foster trust, which is essential for future dealings.

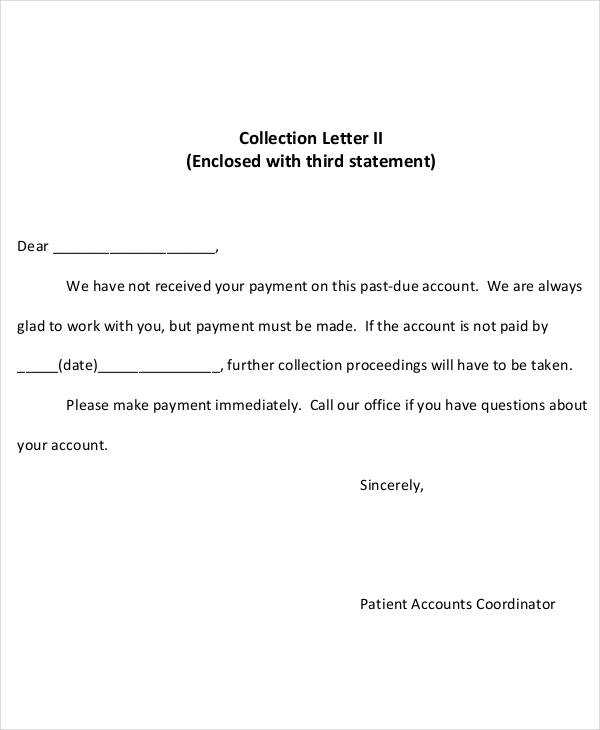

Key Elements of a Collection Letter

When drafting a formal request for unpaid amounts, it’s crucial to include specific components that ensure clarity and effectiveness. A well-structured message should outline the necessary details in a straightforward manner, so the recipient understands the urgency and can take prompt action. These key elements will help in crafting a professional and impactful request.

Essential Information to Include

To ensure all relevant details are communicated, make sure to include the following in your message:

- Client Information: Clearly state the name and contact details of the individual or company responsible for the outstanding balance.

- Amount Due: Specify the exact amount owed, including any additional fees or interest, if applicable.

- Due Date: Mention the original due date for the payment and, if applicable, any overdue period.

- Payment Instructions: Provide clear instructions on how the recipient can settle the amount, such as preferred payment methods or account details.

- Consequences of Non-payment: Briefly explain the next steps if payment is not made within the specified timeframe, such as legal actions or service interruption.

Tone and Clarity

The tone of the message is crucial to its effectiveness. Maintain a professional yet firm tone to convey the importance of the situation without being overly aggressive. Additionally, ensure that the language is clear and concise, avoiding any ambiguity that could delay action.

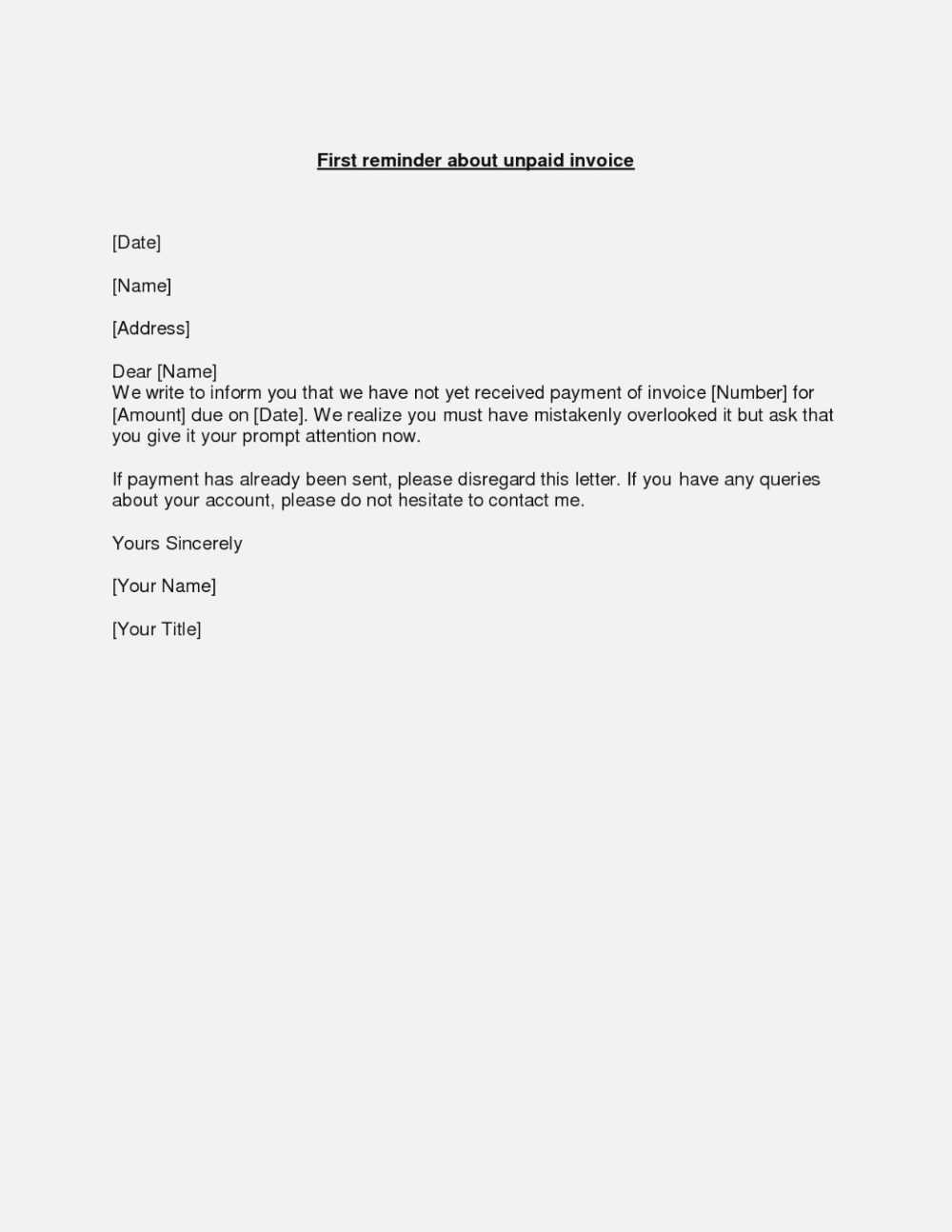

How to Write a Clear Payment Request

Crafting a direct and understandable message is essential when requesting overdue amounts. To ensure your communication is effective, it should be straightforward, polite, and provide all necessary information. Clear requests lead to quicker resolutions, reducing the chances of misunderstandings or delays.

Start by stating the purpose of the message at the beginning, so the recipient knows immediately what the communication is about. Be sure to include important details such as the total amount due, the original due date, and any specific instructions on how to settle the balance. Avoid overly complex language, and keep the structure simple to ensure the recipient can easily follow the instructions.

It’s also helpful to set a deadline for payment and mention the consequences of non-payment, but do so in a respectful and professional manner. Offering flexible payment methods or an opportunity for the recipient to reach out in case of issues can also encourage prompt action.

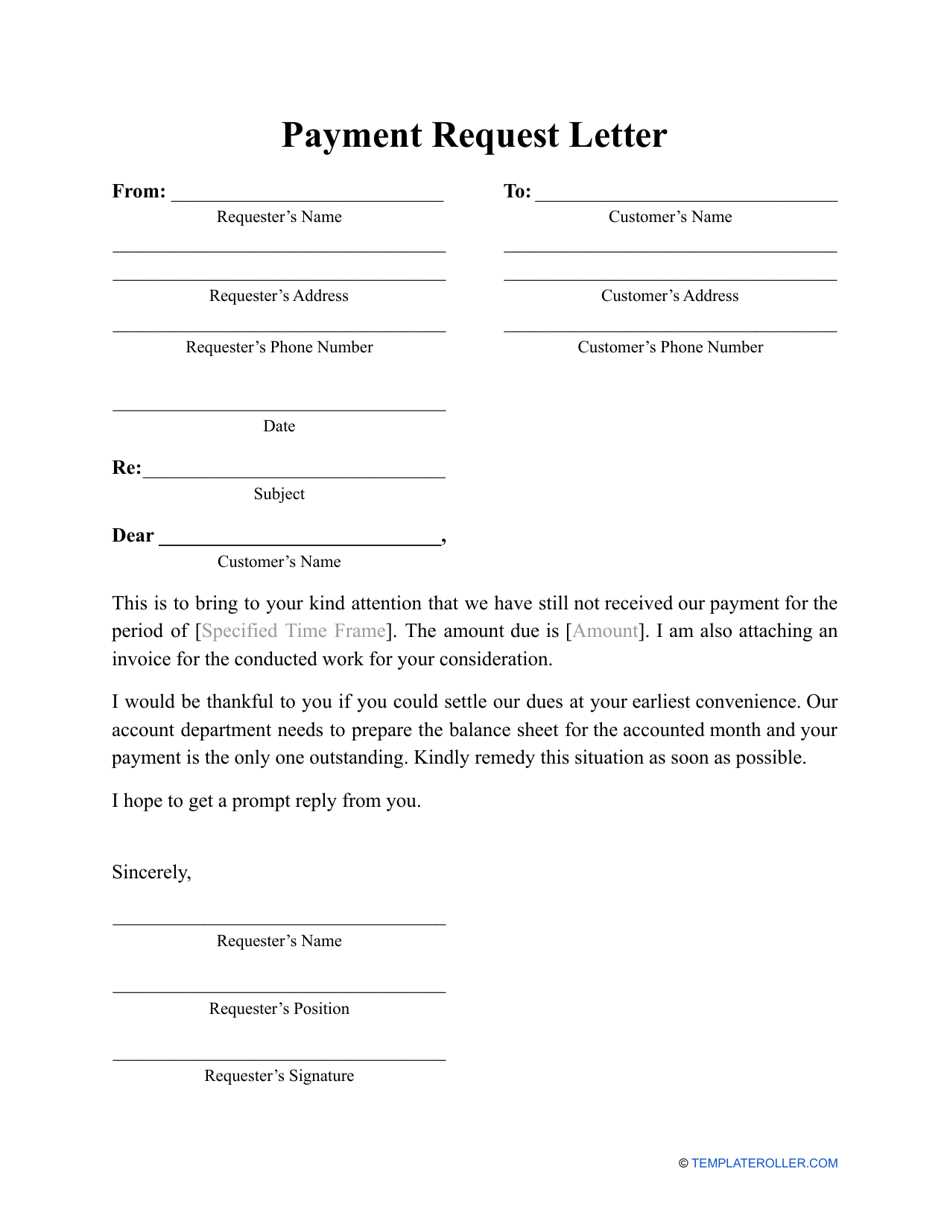

Best Practices for Tone and Language

When requesting the settlement of overdue amounts, the way you communicate plays a significant role in the outcome. Maintaining the right balance of professionalism, clarity, and respect is crucial to encouraging prompt resolution without damaging relationships. The tone and language you use can greatly impact how the message is received and acted upon.

It’s important to remain polite and respectful, even when addressing a potentially sensitive issue. A firm yet courteous approach will help maintain a professional rapport while clearly stating your expectations. Avoid using aggressive or overly harsh language, as this may create resistance or tension.

Be direct but tactful in your communication. Clearly outline the details, such as the amount owed and the payment method, but do so in a way that encourages cooperation. Offering assistance or flexibility in case of difficulty with the payment can also help maintain a positive relationship with the recipient while still emphasizing the importance of resolving the matter quickly.

Common Mistakes in Payment Collection Letters

When requesting overdue amounts, several common errors can undermine the effectiveness of your message. These mistakes can lead to delays, misunderstandings, or even damage to your professional relationships. Avoiding these pitfalls is key to ensuring a smooth and successful outcome.

| Mistake | Consequence | Solution |

|---|---|---|

| Using aggressive or threatening language | May create tension and resistance | Maintain a polite, firm, and professional tone |

| Failing to include specific details (e.g., amount owed, due date) | Can lead to confusion and delay | Clearly state the exact amount, due date, and any penalties |

| Not offering a payment solution or flexibility | May prevent the recipient from resolving the issue | Provide clear payment instructions and offer assistance if needed |

| Overloading the message with unnecessary information | Can overwhelm or confuse the reader | Keep the message concise and to the point |

Avoiding these errors ensures that your request is clear, professional, and more likely to be acted upon promptly. Focusing on clarity, respect, and professionalism will help maintain positive business relationships while addressing outstanding balances efficiently.