Appeal letter to insurance company template

Begin your appeal letter with a clear and direct statement of the issue you are addressing. Outline the details of your claim and explain why you believe the decision made by the insurance company was incorrect. Be specific about any documents or evidence that support your position.

Clearly state the reason for your appeal and ensure that the language is straightforward and precise. Highlight the key facts, such as policy numbers, dates, and the circumstances surrounding the claim. This helps the insurance company quickly understand the nature of your request.

Support your appeal with relevant information such as medical records, photographs, or any other documentation that strengthens your case. Attach these supporting documents to your letter and refer to them where necessary to make your argument more compelling.

Conclude your letter by stating your desired outcome, whether it’s a reconsideration of the claim or a specific settlement amount. Be polite, yet firm in your request, maintaining a professional tone throughout the letter.

Here are the corrected lines where words are not repeated more than two to three times:

Insurance claims require clarity and precision. Focus on the facts and avoid overcomplicating the message. Stick to key points while keeping the tone respectful and professional.

| Incorrect Example | Corrected Example |

|---|---|

| We are writing to appeal the decision regarding our claim submission, which was rejected. We believe the rejection is unfair and wish to appeal this decision. | We are appealing the rejection of our claim and seek reconsideration based on new evidence. |

| The circumstances surrounding our claim are as follows. Our car was damaged, and we believe the insurance policy should cover the costs. | Our car was damaged, and we believe the policy should cover the repair costs. |

| We are requesting that the insurance company review the claim again, as we believe it was not assessed properly. | We request a reevaluation of our claim due to improper assessment. |

Avoid using redundant phrases. Simplify sentences to communicate your message directly and concisely. This will make your appeal clearer and easier to understand.

- Appeal Letter to Insurance Company Template

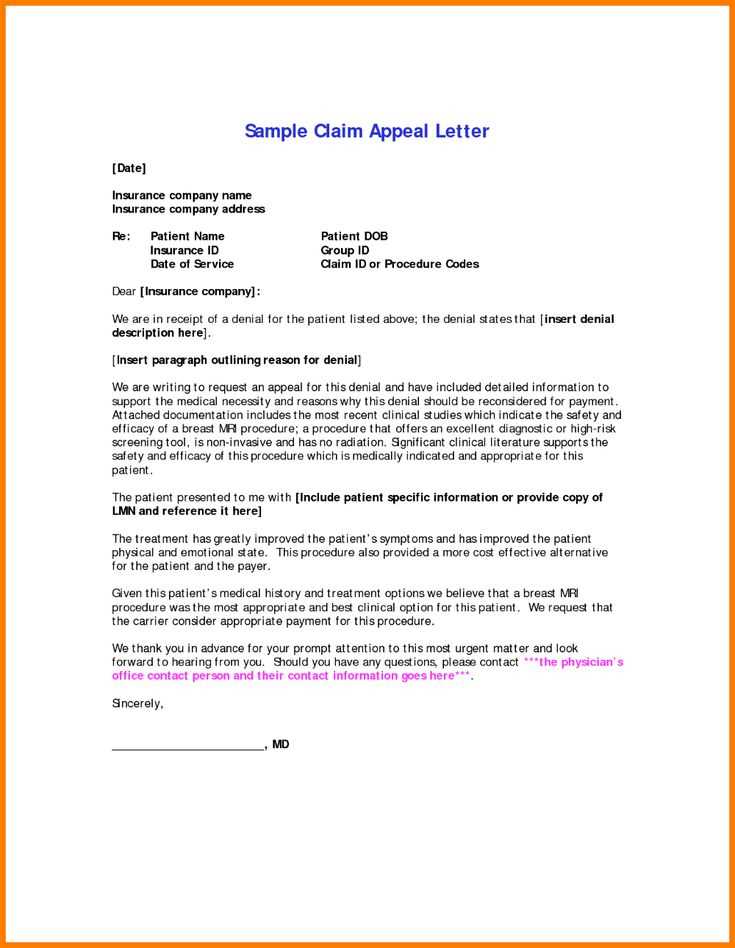

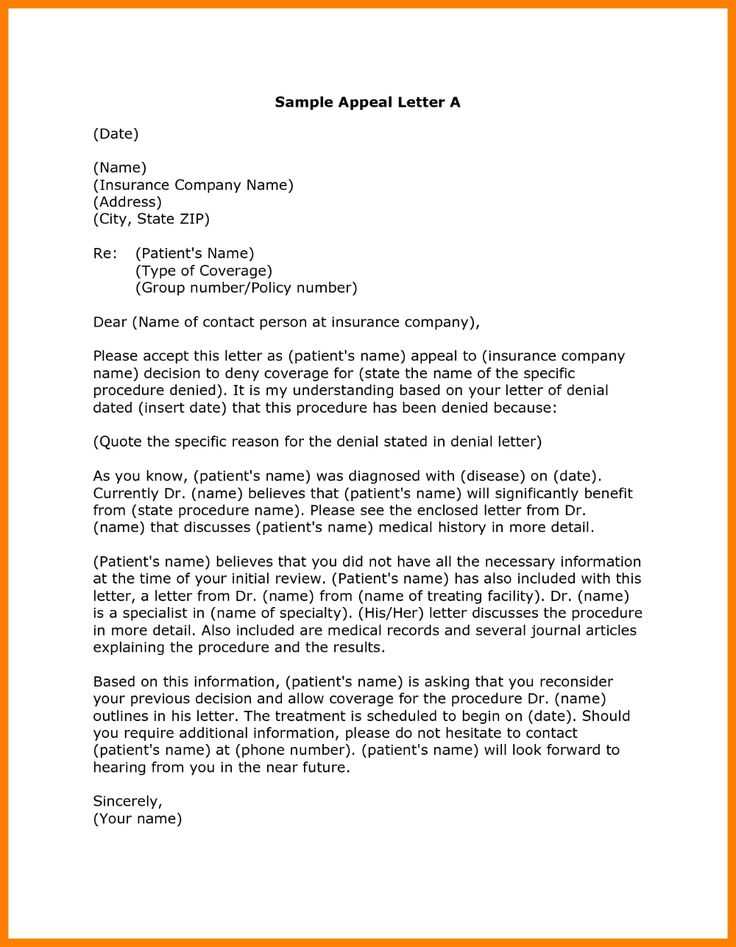

To create a clear and compelling appeal letter to your insurance company, focus on providing all necessary details in a structured manner. Below is a suggested template you can use to communicate your case effectively.

Template for Appeal Letter

Dear [Insurance Company Name],

I am writing to formally appeal the decision regarding my claim, [Claim Number], filed on [Date]. After reviewing your response, I believe there has been a misunderstanding or oversight in your assessment of the situation. I am requesting a thorough reevaluation of my claim based on the following points:

- Claim Overview: Provide a brief summary of the claim, including the type of claim (e.g., medical, auto, property) and the circumstances surrounding it.

- Reasons for Appeal: List specific reasons why you disagree with the decision. Be clear and concise, referencing any evidence that supports your position.

- Supporting Documentation: Attach any relevant documents, such as medical records, invoices, photographs, or witness statements, that can help clarify your case.

- Previous Communication: Mention any previous attempts to resolve the issue, including dates of contact or any correspondence that supports your appeal.

Conclusion

In conclusion, I respectfully ask that you reconsider your decision regarding this claim. I am happy to provide any additional information or documentation required to assist with the review process. Please confirm the receipt of this appeal and provide an update on the next steps as soon as possible.

Thank you for your time and attention to this matter. I look forward to your prompt response.

Sincerely,

[Your Full Name]

[Your Address]

[Your Contact Information]

Begin with a clear, professional structure. Keep the content organized and easy to follow. Here’s a recommended format:

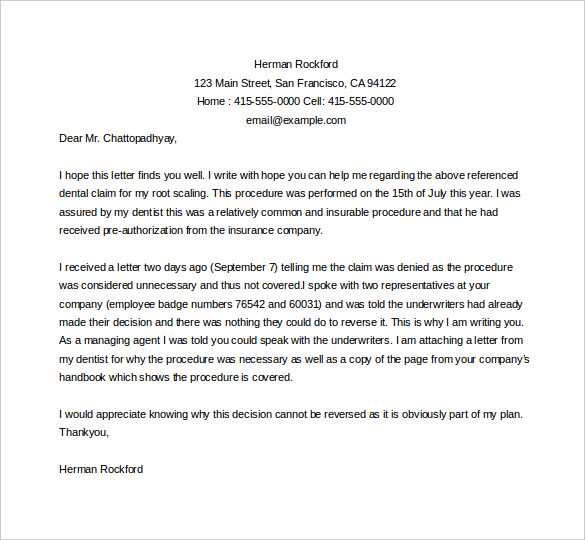

- Your Contact Information: Start with your name, address, phone number, and email at the top of the letter. Make it easy for the insurance company to contact you.

- Claim Details: Include your claim number, policy number, and the date of the incident. This ensures your appeal is tied to the correct record.

- Subject Line: Write a concise subject line that clearly states the purpose of your letter. For example, “Appeal for Claim Denial – [Claim Number].” This helps the recipient understand the letter’s purpose right away.

- Salutation: Address the letter to the appropriate claims officer or department. If you are unsure, use a generic salutation like “Dear Claims Department.”

- Body of the Letter:

- Introduction: Briefly state the purpose of your letter. Reference the claim number and the reason for your appeal.

- Explanation of Appeal: Explain why you believe the decision was wrong. Use facts and specific details that support your argument. Avoid vague statements or emotions.

- Supporting Documents: Mention any additional documents that back up your case, such as medical records, photos, or expert opinions.

- Conclusion: Politely request a review of your case. Be direct but courteous in asking for a reconsideration or adjustment to the decision.

- Closing: Close the letter with “Sincerely” or “Best regards,” followed by your full name and signature.

- Follow-Up: Include a note on your intentions to follow up if you do not receive a response within a reasonable time frame, such as 10–14 days.

Double-check for clarity and ensure there are no errors. A well-organized appeal letter increases your chances of a positive outcome.

Begin by including your full name, address, policy number, and claim number. This makes it easy for the insurance company to locate your case quickly.

Details of the Disputed Claim

Clearly describe the claim you are appealing. Include the date of the event, any relevant facts, and a summary of the insurance company’s initial decision. Be specific about why you disagree with the decision.

Supporting Documentation

Attach any documents that strengthen your case. This can include medical records, police reports, or receipts. Make sure these are organized and referenced in your letter, so the reviewer can see how they support your appeal.

- Medical reports or invoices

- Expert opinions or third-party assessments

- Photos, videos, or other physical evidence

Explanation of Your Appeal

Explain why you believe the decision was wrong. Provide a concise argument supported by facts or specific policy terms that you think were overlooked or misinterpreted. This section should be clear and focused.

Desired Outcome

State what resolution you are seeking. Whether it’s a full payout or a reassessment of certain aspects, make your request explicit.

Contact Information

Include your phone number and email address for further communication. Ensure that the insurance company can easily reach you for clarification or updates.

Rushing the Appeal is a common mistake. Take your time to carefully review the insurance policy and the reason for the denial. Write your appeal with clear facts and evidence, rather than reacting impulsively.

Being Too Vague in your explanation can lead to misunderstandings. Instead of broad statements, include specific details that support your case. For example, reference specific clauses in your policy or medical records that demonstrate why the claim should be approved.

Ignoring Deadlines is a critical error. Always check the time frame within which you need to submit your appeal. Missing the deadline could result in an automatic denial, regardless of the strength of your case.

Overloading with Irrelevant Information can overwhelm the reviewer and make it harder to focus on the important details. Stick to the facts that are directly related to the claim denial and provide supporting documentation only when necessary.

Failing to Stay Professional in your tone can negatively impact your appeal. Even if you’re frustrated or upset, maintain a respectful and professional tone throughout the letter. Avoid emotional language or accusations that could alienate the reader.

Not Following Submission Guidelines is another mistake to avoid. Some insurance companies require specific formats or methods for submitting appeals. Make sure you follow the instructions precisely to avoid delays or rejection of your appeal.

Begin by stating the claim number and the date of the denial letter. Be clear and concise, mentioning your intent to appeal the decision. Reference the specific reason for the denial and explain why you believe the claim should be reconsidered. Use facts and provide any supporting documentation to back up your argument. If applicable, point out any misunderstandings or errors that may have occurred during the evaluation of your claim.

Provide Additional Evidence

Attach any additional documentation that was not included with your original claim. This could include medical records, invoices, or expert opinions that support your case. Be sure to highlight any new information that directly addresses the reasons given for the denial.

Maintain a Professional Tone

Even if you disagree with the decision, keep your letter professional and respectful. Avoid emotional language or accusations. The goal is to present your case logically and effectively, showing that you’ve thoroughly reviewed the decision and have valid reasons for appealing it.

Attach only relevant and organized documents to strengthen your appeal. Gather all records that directly support your claim, such as medical reports, photos, and invoices. Make sure these documents are legible and clearly labeled to avoid confusion. If submitting paper documents, ensure they are not wrinkled or faded. If possible, include the original documents and scans to keep an accurate copy trail.

Include a Clear Timeline of Events

A concise timeline of events helps provide context for your claim. List important dates and details, such as when the incident occurred, when you reported it, and any communications with the insurer. This helps the insurance company track the sequence of events and see how your claim fits into the bigger picture.

Get Support from Professionals

If necessary, consult with medical experts, repair specialists, or legal professionals. Their statements can clarify technical points and offer an objective perspective. Make sure their documentation is straightforward and aligns with your appeal. This type of support can significantly enhance the credibility of your appeal.

Contact the insurance company 7 to 10 business days after submitting your appeal to confirm they have received it. Check for any missing information or documents that could delay processing.

When following up, call the customer service department or use their online portal if available. Make sure to have your appeal reference number and personal details ready for quick identification.

Ask about the expected timeline for a decision. If they are unable to provide a specific date, request regular updates on the status of your appeal. This will help you stay informed and address any issues promptly.

If you don’t receive a response within the time frame they provide, follow up again. Keep a record of all your interactions, including dates, names of representatives, and any responses received.

Stay polite and patient, but assertive in your communications. If you feel the process is taking too long or being mishandled, escalate the matter to a supervisor or the appropriate department.

Appeal Letter to Insurance Company Template

Start your appeal letter by stating the purpose clearly. Use a direct, concise tone to express that you are challenging the decision. Avoid being overly emotional or aggressive in your language.

Key Components

Begin with your policy number and personal details at the top, followed by a polite but firm introduction stating your disagreement with the claim’s denial or settlement. Ensure your reasons are clear, listing facts or evidence that support your case.

Supporting Evidence

Attach any relevant documents to strengthen your argument, such as medical records, photographs, or repair estimates. Highlight key points in the letter that correspond with the supporting evidence for easy reference.