Payment commitment letter template

Creating a payment commitment letter is a straightforward way to ensure that financial agreements are clear and enforceable. This letter serves as a formal assurance from one party to another, guaranteeing payment for goods or services within a specified period.

Begin by clearly stating the names and contact information of both parties involved. Include specific details about the agreed payment amount, the due date, and the method of payment. This section removes any ambiguity and sets clear expectations.

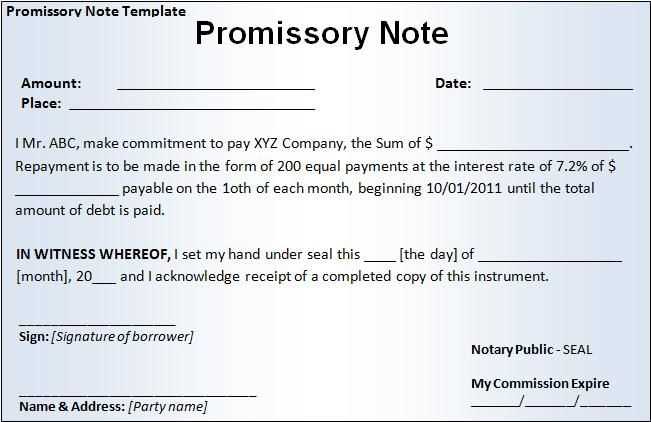

Define terms of the agreement explicitly. Specify whether the payment will be made in full or in installments. Include any relevant information, such as the interest rate, late fees, or penalties for missed payments. Ensuring clarity here helps avoid misunderstandings later.

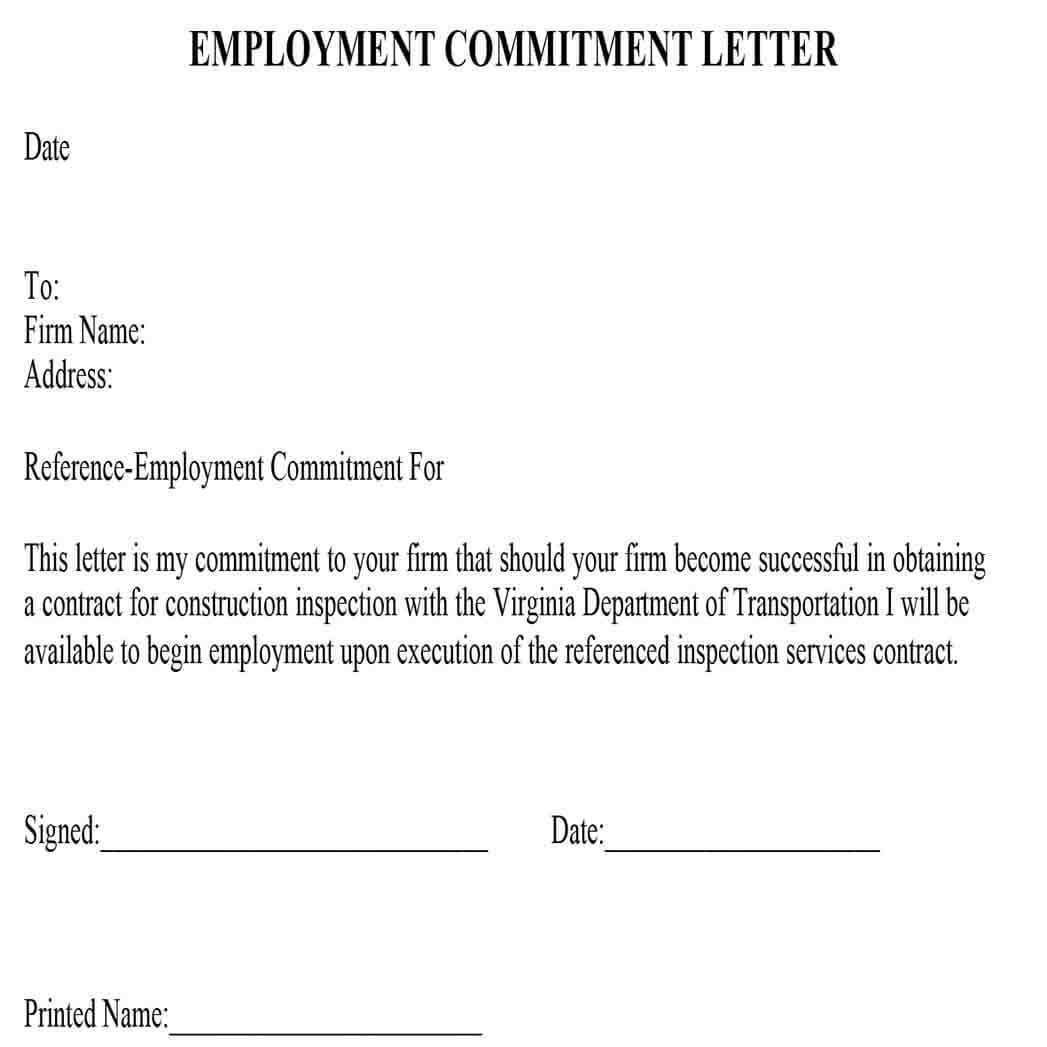

Lastly, include a signature section where both parties can confirm their agreement. This part solidifies the commitment and serves as a legal document should disputes arise.

Sure! Here’s the revised version without repeating the same words excessively:

When drafting a payment commitment letter, focus on clarity and precision. Outline the exact amount due, the payment schedule, and any terms that may apply, such as penalties for delays or conditions for early payment. Specify the method of payment–whether it’s via bank transfer, check, or another option–and include all necessary details to ensure smooth processing. Be sure to state the due date clearly, along with any actions that will follow in case of non-compliance. Make it easy for the recipient to understand their obligations and how to fulfill them.

Additionally, avoid using vague or complex language. Stick to simple, direct statements, ensuring that both parties are fully aware of their responsibilities. If there are multiple installments or payment milestones, break them down with clear deadlines. By providing all necessary information upfront, the letter will serve as a solid agreement for both sides.

Payment Commitment Letter Template: A Comprehensive Guide

Key Elements to Include in a Payment Commitment Letter

How to Define Payment Conditions and Amount

Selecting the Appropriate Language for Clarity and Precision

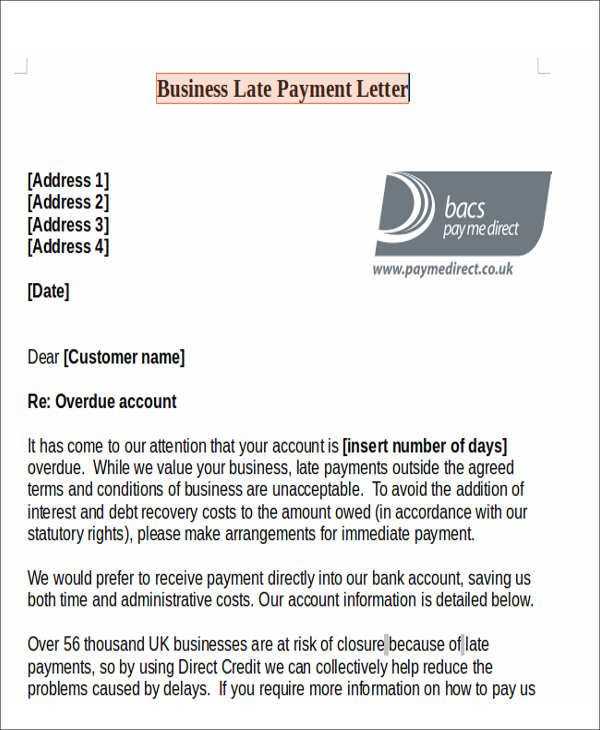

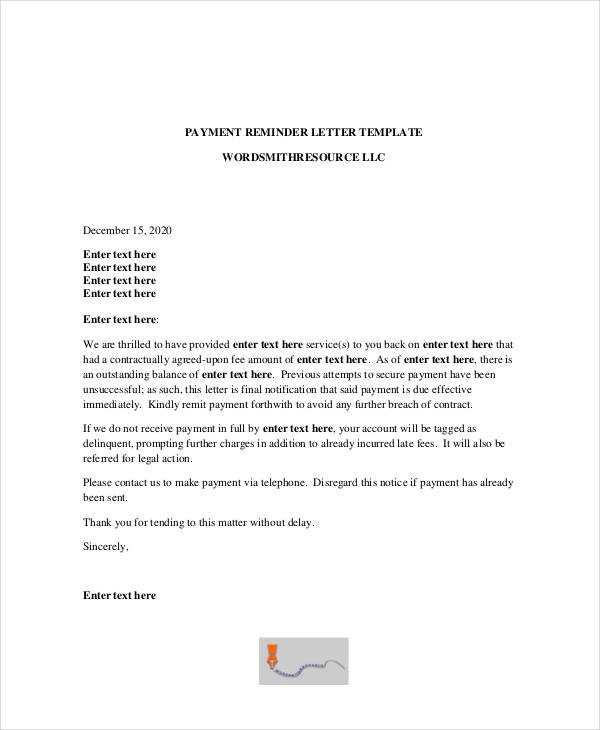

How to Handle Late Payments and Penalties

Establishing the Legal Framework and Jurisdiction

When to Use a Payment Commitment Letter in Business Deals

Start with clear payment terms. Specify the total amount owed, the due date, and the payment method. This reduces confusion and ensures both parties are on the same page. Make sure to outline any agreed-upon installments and deadlines for each payment.

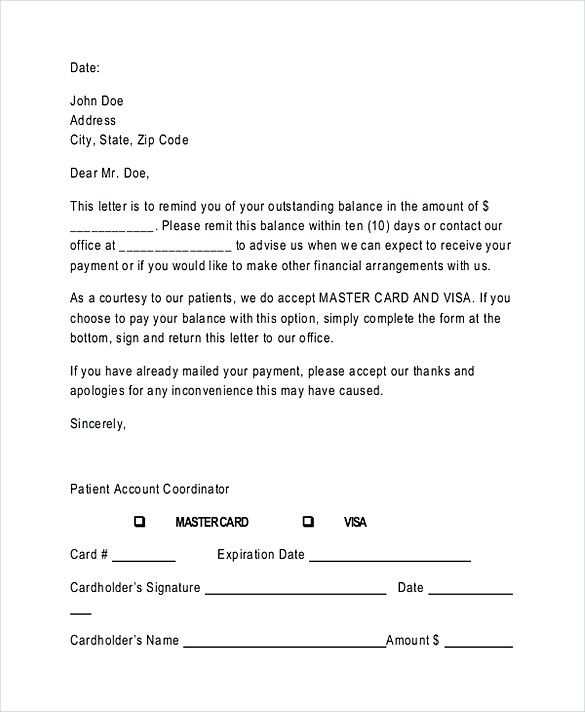

Next, define the payment conditions. Detail how the payments should be made, such as through bank transfers, checks, or other methods. Include the relevant bank details if necessary. Being specific helps prevent misunderstandings later on.

Use straightforward language. Avoid complex terminology and legal jargon. Clarity is key in preventing future disputes. The letter should be easy for both parties to understand without the need for interpretation.

Specify penalties for late payments. Clearly state the interest rate or flat fee that will apply if payments are delayed. Also, outline any grace periods if applicable. Being upfront about these terms motivates timely payments.

Set the legal framework. Include the jurisdiction that will govern the letter in case of legal issues. This section ensures that both parties know where to seek resolution if the payment terms are not met.

Lastly, recognize when a Payment Commitment Letter is necessary. Use this document when entering into business agreements that require formal payment guarantees, especially for larger sums or ongoing projects. A commitment letter strengthens accountability and transparency between both parties.