Letter of direction template bank

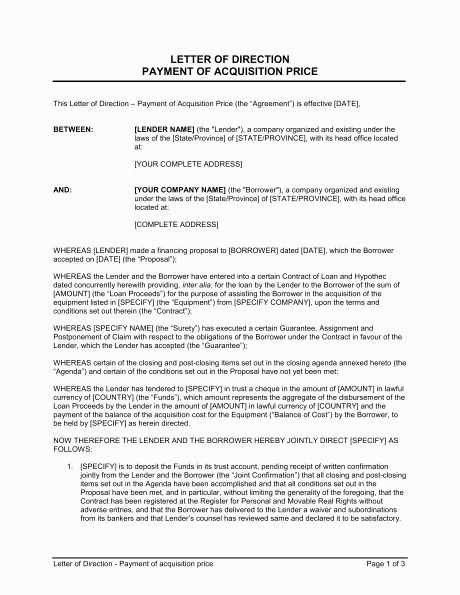

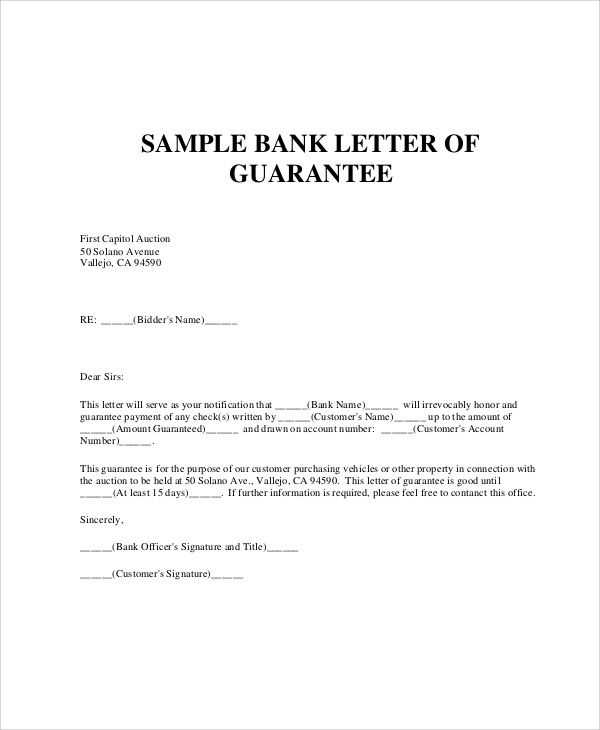

To create a solid letter of direction, you need to be direct, clear, and concise. This document serves as a formal request from one party to another, typically instructing an action to be taken or a task to be completed. Whether it’s about authorizing a financial transaction or directing a service provider, your letter should leave no room for ambiguity.

The letter’s structure should begin with a clear identification of both parties involved, followed by a statement of the purpose of the letter. Specify the requested action or directive, and provide any necessary details or documentation to support the request. Clarity in wording ensures that the recipient can easily follow the instructions and act accordingly.

Incorporating a closing section that includes any deadlines, follow-up actions, or contact information enhances the letter’s functionality. It keeps communication transparent and ensures a smooth process. Keep your tone formal but approachable, making sure that the content serves its purpose efficiently.

Here’s the revised version:

Ensure the letter of direction is clear and concise, specifying all required details. Avoid vague language and provide direct instructions on actions to be taken. Indicate any necessary steps, dates, and relevant documents. Make sure the recipient understands the request fully to avoid delays or misunderstandings.

Key Elements to Include

Start with the recipient’s full name and address, followed by a clear explanation of the action required. Be specific about any relevant dates, including deadlines. If applicable, include references to related documents or transactions for clarity.

Format and Presentation

Use a professional tone and a structured format, with each section clearly labeled. Ensure the document is free from unnecessary jargon, and that any legal or financial terms are accurately used. Keep the formatting simple but formal, with a focus on readability.

- How to Draft a Letter of Direction for Bank Transactions

Begin with a clear header that includes the date and your name or business name. Use a formal salutation such as “Dear [Bank Name] Representative” to address the bank or the specific individual responsible for processing the request.

Provide Account Information

Next, specify the account details, including the account holder’s name, account number, and any other identifiers required by the bank. This ensures the letter is directed to the correct account and prevents confusion.

State the Request Clearly

Clearly describe the transaction or actions you are requesting. Whether it’s a fund transfer, withdrawal, or account update, outline the specifics like amounts, dates, or recipients involved. Be as precise as possible to avoid misunderstandings.

Lastly, include a polite closing and sign the letter with your name and any additional necessary contact details. Double-check all provided information for accuracy before submission to ensure a smooth process.

Make the letter clear and direct. Include specific information such as account numbers, recipient details, and transfer amounts. Below are key components to ensure clarity and accuracy:

- Sender’s Information: Include your full name, address, and contact details at the top. This ensures the bank or recipient can verify the source of the request.

- Recipient’s Information: Clearly state the full name, account number, and address of the recipient. Any additional details, such as the bank’s name and branch, should also be included for accuracy.

- Transfer Amount: Specify the exact amount to be transferred. If applicable, state the currency to avoid confusion.

- Reason for Transfer: Briefly explain the purpose of the transfer. This adds context and can help resolve any potential queries from the bank or recipient.

- Transaction Date: Mention the desired date for the transfer to take place. If the transfer is urgent, make sure to highlight this clearly.

- Signature: Include your signature to authorize the transaction. Without it, the transfer may not proceed as requested.

Additional Tips:

- Ensure all details are accurate. Even a small mistake can delay the transfer or result in funds being sent to the wrong account.

- If the transfer involves large sums or special circumstances, consider including additional documentation, such as contracts or agreements, to clarify the purpose.

Adjust your direction letter based on the specific requirements of the banking task at hand. Whether you are requesting a transfer, authorizing account access, or confirming payment instructions, each purpose demands different details. Start by clearly specifying the type of request–whether it’s a wire transfer, account verification, or loan payment instructions–so the bank can quickly process your request. Always include relevant reference numbers, account details, and the exact amount or terms involved in the transaction.

For Transfer Instructions

When authorizing a bank transfer, make sure to mention the sender and recipient’s full account details, including the account numbers, routing codes, and any intermediary bank information if applicable. It’s helpful to specify the purpose of the transfer and the date on which the transaction should be completed. This ensures clarity and prevents delays.

For Loan Payments or Account Access

For loan payments, indicate the loan reference number, the payment amount, and any special instructions like partial or full settlement. If the letter is for granting account access, clearly state the person or entity being granted access and the scope of their permissions, such as view-only access or full transaction rights. This prevents misunderstandings and sets clear boundaries on the permissions being granted.

Ensure the letter is clear, specific, and unambiguous. A well-drafted letter should explicitly outline the instructions, the parties involved, and the actions required from the bank. Ambiguities can lead to disputes or delays in processing.

Obtain written consent: If you’re authorizing someone else to manage your bank account or transactions, secure their agreement in writing. This will confirm their understanding and agreement to act on your behalf. Without this, the bank may not process the instructions as requested.

Verify authority: If you are acting on behalf of a company or another person, confirm that you have the proper legal authority to submit the letter of direction. A lack of authority can render the letter invalid and any actions taken could be contested.

Document your intent: Clearly state your intentions and reasons for issuing the letter. This can help protect you legally if questions arise later regarding your decision or instructions.

Review applicable laws: Ensure that the letter complies with relevant banking regulations and local laws. Different regions may have specific requirements or limitations regarding the use of such letters, and failure to adhere to them can invalidate the letter.

Bank’s policy adherence: Banks may have their own requirements for processing letters of direction. Check with the bank to ensure you meet all the necessary criteria to avoid delays or complications.

Ensure clarity in your instructions. Ambiguous language or unclear directives can cause confusion, delaying the process. Always specify exact actions and deadlines.

1. Lack of Specific Details

When drafting a direction letter, provide all necessary details. Missing account numbers, dates, or transaction specifics can lead to misunderstandings. Double-check all provided information to avoid mistakes.

2. Incomplete Signatures and Authorization

Ensure that all required signatures and authorization details are included. The absence of a signature or an incomplete authorization can cause the letter to be rejected or delayed.

3. Vague Language or Legal Terms

Avoid using complex legal jargon that may confuse the reader. Be straightforward with your language to ensure that your instructions are easily understood.

4. Not Including the Correct Contact Information

Include accurate contact details so the bank can follow up if needed. Missing or outdated information may prevent prompt resolution.

5. Failing to Review for Errors

Before submitting, carefully review your letter for grammatical and typographical errors. Mistakes can make the document appear unprofessional or lead to confusion.

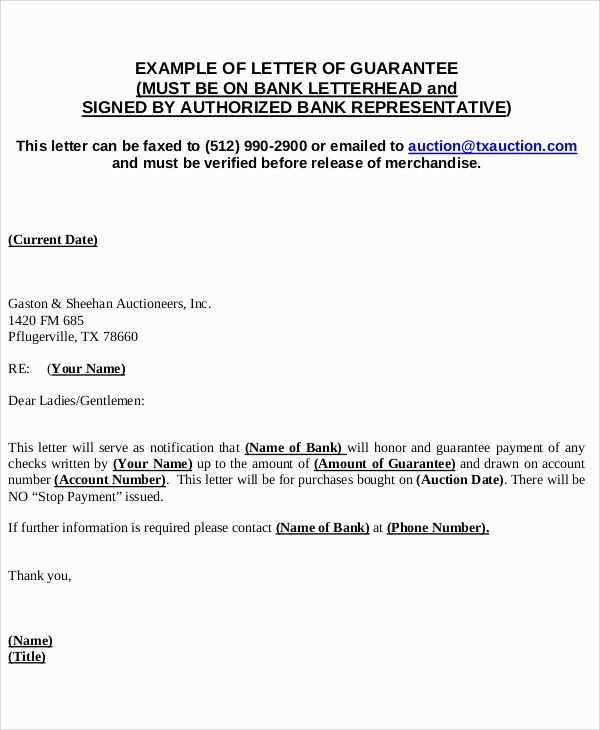

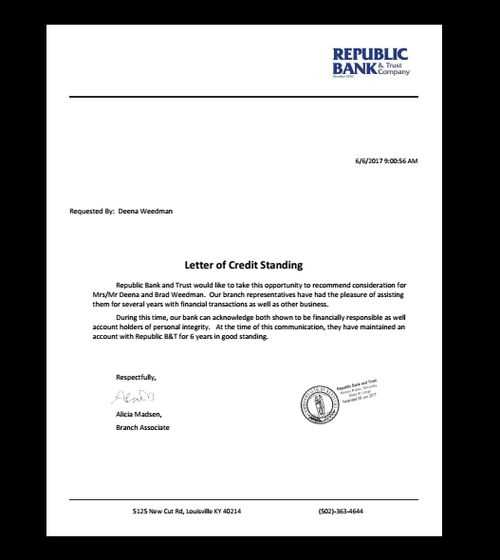

6. Not Using Official Letterhead

Use official company or personal letterhead to enhance credibility. This helps ensure that the bank takes your letter seriously.

7. Not Confirming the Method of Submission

Verify the bank’s preferred method of receiving direction letters. Whether it’s by mail, email, or through an online portal, submitting the letter through the correct channel will ensure faster processing.

8. Ignoring Bank-Specific Requirements

Different banks may have specific requirements for direction letters. Research and understand these before drafting your letter to avoid unnecessary rejections or delays.

Ensure your letter of direction is clear and concise. Always include the following details: account number, beneficiary information, transaction amount, and any specific instructions related to the request. Double-check for accuracy to avoid delays or errors in processing.

Use Secure Channels

Send your letter through a secure communication method, such as registered mail or encrypted email. Verify the bank’s preferred method of receipt to ensure it is accepted and processed efficiently. Avoid sending sensitive information through unsecured channels like regular email or unverified fax numbers.

Provide Supporting Documentation

If applicable, include supporting documents with your letter. This may include contracts, account statements, or identification verification. Make sure to reference these documents in your letter so the bank can quickly match them to the request.

| Required Information | Suggested Action |

|---|---|

| Account Number | Verify accuracy before submitting |

| Beneficiary Information | Confirm spelling and details |

| Transaction Amount | Ensure the amount matches the request |

| Additional Documents | Include copies of relevant documents |

Once submitted, follow up with the bank to confirm receipt and processing of the letter. Keep a copy of the letter for your records in case any discrepancies arise.

Ensure that the letter is clear and concise. Provide the necessary details such as the bank name, account number, and specific instructions. Be specific with the request to avoid any ambiguity, including details on the transaction type, amount, and recipients, if applicable. Make sure to include your contact information for any follow-up questions.

Include any reference numbers or account details that may be required for processing. Be sure to specify the exact date and time the transaction should be processed. This helps the bank understand your needs clearly.

Confirm the purpose of the letter, whether it is to authorize a transfer, provide payment instructions, or any other action. Clarifying this upfront helps the bank to take the right action quickly.

Sign the document at the end and ensure that all necessary fields are filled out. An unsigned letter may lead to delays or complications in processing the request.