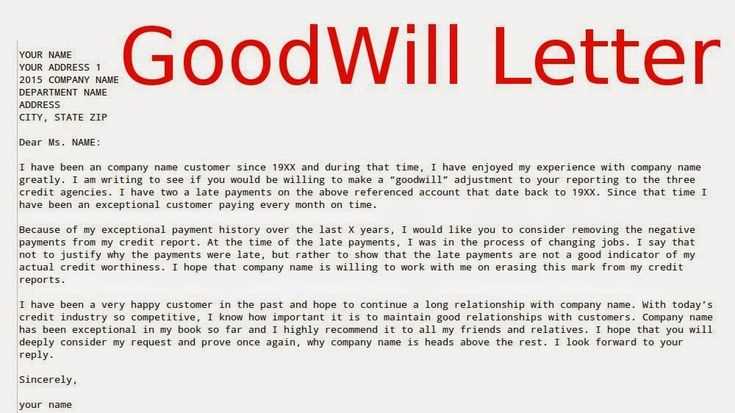

Goodwill credit letter template

Writing a goodwill credit letter is a straightforward way to request the removal of a negative mark on your credit report. Focus on explaining the situation clearly and politely, making sure to show your willingness to resolve any past issues. Your letter should reflect a genuine desire to maintain a positive relationship with the creditor.

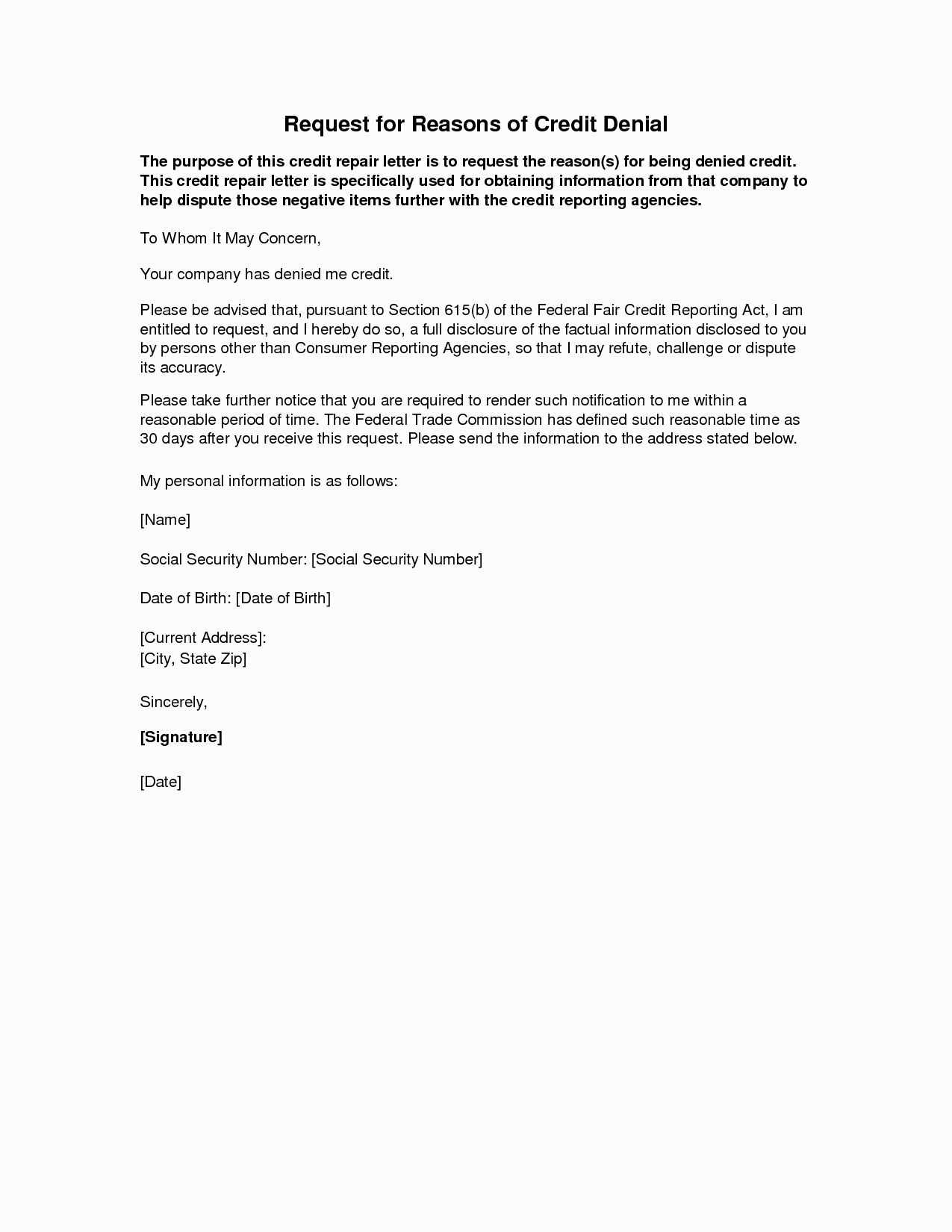

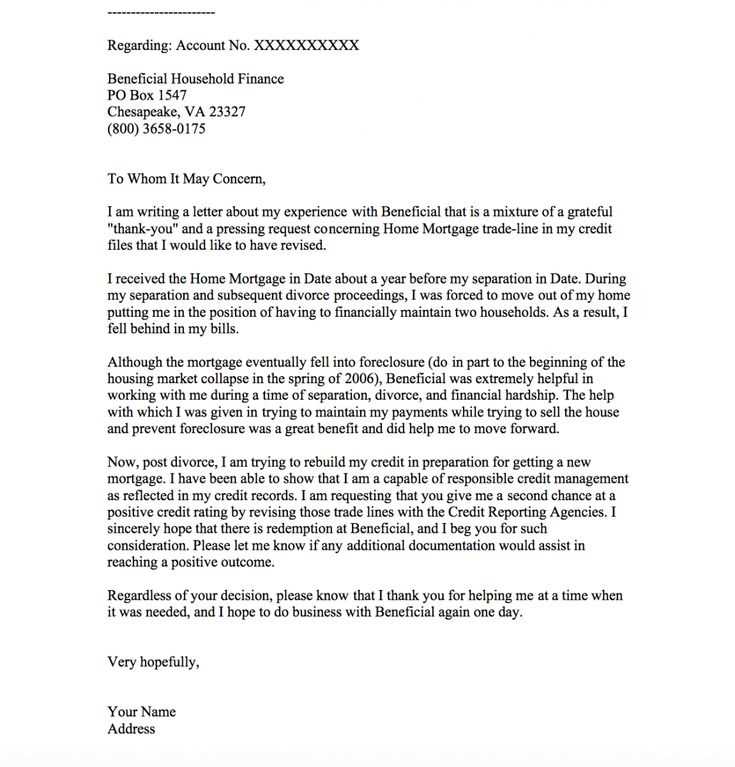

Start with a brief introduction. Address the creditor by name and mention your account number. This will make it easier for them to identify your account and process your request. Keep the tone respectful and focused on your intent to resolve the issue, not on blame or past mistakes.

Explain the situation. Clearly describe the reason for the missed payment or late payment, but avoid making excuses. If there were extenuating circumstances, such as a medical emergency or job loss, explain them briefly. Ensure that you take responsibility for your actions, as this shows accountability.

Request a goodwill adjustment. After explaining the situation, ask the creditor to consider removing the negative mark from your credit report. Be concise and emphasize that you’ve taken steps to prevent similar issues in the future, such as setting up automatic payments or improving your financial management.

Close the letter professionally. Thank the creditor for their time and consideration. Express your hope that they will review your request and make the necessary adjustments. A polite closing leaves a positive impression and keeps the door open for future communication.

Here are the corrected sentences with redundant words removed:

Ensure the credit letter directly addresses the key issue, maintaining clarity and professionalism. Remove unnecessary phrases to avoid confusion and make the message more concise. Always check for overused terms that may make the letter sound repetitive.

For example, instead of writing, “We are writing to inform you that we are reaching out to you regarding your account,” simply say, “We are contacting you regarding your account.” This cuts down on redundancy while preserving the message’s intent.

Another common issue is the excessive use of polite fillers, such as “We kindly ask” or “We would like to request.” Instead, directly state the action required, like “Please review the attached document” or “We request that you consider this adjustment.”

Removing overused terms helps streamline communication and ensures your letter remains clear, polite, and to the point.

Goodwill Credit Letter Template: A Practical Guide

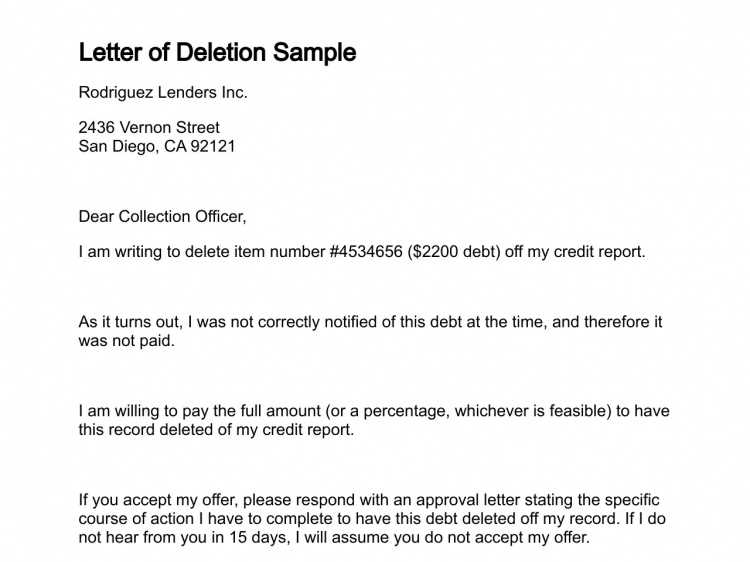

What to Include in a Goodwill Letter

How to Address the Letter to the Right Person

Common Mistakes to Avoid in the Letter

When to Send a Goodwill Request

How to Phrase Your Request for an Adjustment

What to Do After Sending Your Letter

When writing a goodwill credit letter, make sure to include the following key points:

- Your account details: Clearly state your account number and any other relevant information to help the recipient locate your account quickly.

- A concise explanation of the issue: Mention the specific circumstances that led to the credit request, such as a late payment or a missed deadline.

- A polite request: Ask for the adjustment in a respectful manner. Avoid demanding or sounding entitled.

- Reason for the request: Explain why you’re asking for the adjustment, whether due to extenuating circumstances, a one-time issue, or a genuine mistake.

- Your commitment to improving: Show that you’re committed to keeping your account in good standing moving forward.

How to Address the Letter to the Right Person

Make sure to direct your letter to the appropriate department or individual. If you’re unsure, contact customer service to find out the correct contact. Addressing your letter properly increases the chances of a favorable response. Avoid generic salutations like “To Whom It May Concern” when possible. Use a specific name or title, such as “Dear Mr. Smith” or “Dear Customer Service Manager.”

Common Mistakes to Avoid in the Letter

Several common errors can hurt your chances of a successful request:

- Being too vague: Be specific about the situation and why you deserve the credit.

- Using a harsh or demanding tone: Always remain polite, even if you feel frustrated.

- Neglecting to explain how the mistake occurred: Provide context for why the issue happened, especially if it was outside your control.

- Sending the letter to the wrong department: Ensure you’re addressing the right person or team to handle your request.

When to Send a Goodwill Request

Send your letter soon after the issue arises, preferably within a month. If too much time passes, it may be harder to convince the company to make an adjustment, especially if they don’t have a clear record of the situation.

How to Phrase Your Request for an Adjustment

Phrase your request politely and positively. For example: “I kindly request your assistance in removing the late fee from my account due to [reason]. I have been a loyal customer and believe this situation was an isolated incident.” Keep it straightforward and focus on how you can work together to resolve the issue.

What to Do After Sending Your Letter

After submitting your letter, follow up if you don’t hear back within two weeks. If you receive a response, review it carefully. If the request is granted, make sure to confirm that the adjustment has been applied to your account. If your request is denied, don’t hesitate to politely ask for further clarification or a reconsideration of your case.