Goodwill forgiveness letter template

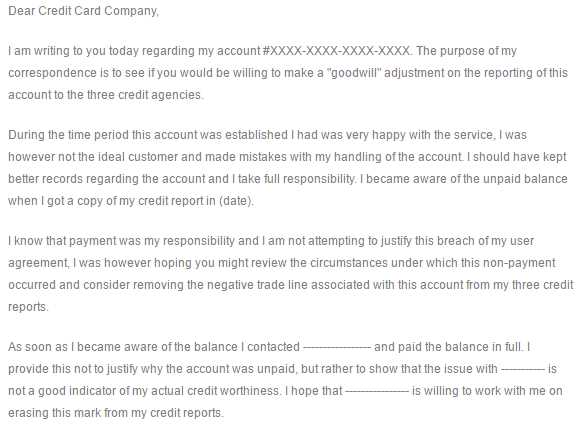

If you need to request a goodwill adjustment from a creditor, a well-crafted forgiveness letter can significantly increase your chances of success. Begin by clearly stating your purpose, and avoid making excuses. A simple, direct approach often works best.

Start by addressing the creditor respectfully, mentioning your account details, and outlining your payment history. Acknowledge any past mistakes, but emphasize the steps you’ve taken to resolve your financial situation. Be honest about the impact the situation has had on you and express genuine appreciation for their understanding.

Use clear and concise language throughout the letter. Avoid lengthy explanations and focus on key points, like the fact that you’ve maintained a good relationship with them, or that your financial challenges were temporary. Be polite but firm in requesting the forgiveness, and make sure to express your commitment to staying on track moving forward.

Keep the tone positive, even if your request is a long shot. Creditors receive numerous requests, so standing out with professionalism and gratitude can help make a favorable impression.

Here’s the revised version without repetitions:

To ensure clarity and conciseness, follow this structure when writing a goodwill forgiveness letter:

Start by acknowledging the issue clearly, stating the mistake or problem without over-explaining. Take responsibility for any errors made, and provide a straightforward explanation of the circumstances that led to the situation.

Next, express your genuine desire to make things right. Be honest and transparent about your intentions, offering specific actions or solutions that demonstrate your commitment to correcting the issue. Avoid vague promises and focus on what steps you can take to resolve it.

Include a brief and sincere apology, without repeating apologies multiple times. Keep your tone polite and respectful. Acknowledge the impact the situation may have had on the other party but refrain from excessive elaboration on the emotional aspects.

Close with a clear request for forgiveness, maintaining a tone of humility and understanding. State that you value the relationship and are committed to preventing similar situations in the future. Keep the closing short and direct.

| Section | Content |

|---|---|

| Acknowledgment | Clearly state the issue and the cause. |

| Responsibility | Take responsibility for the mistake made. |

| Apology | Offer a brief, sincere apology. |

| Action Plan | Describe steps to resolve the issue. |

| Request for Forgiveness | Politely ask for forgiveness and show commitment to improvement. |

- Goodwill Forgiveness Letter Template

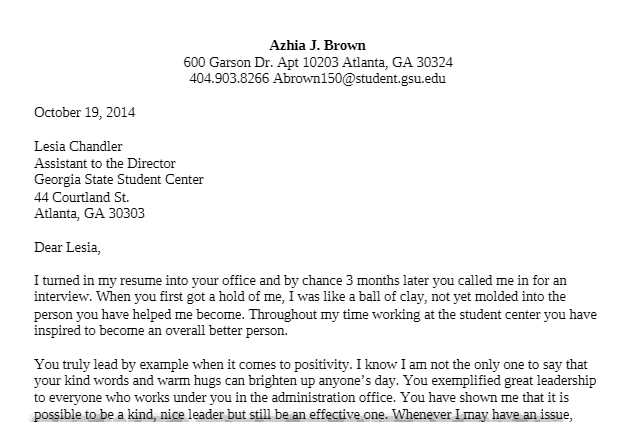

To write a goodwill forgiveness letter, focus on being clear and respectful. Here’s a template to follow when asking for a goodwill adjustment on a late payment or mistake in your account:

Subject: Request for Goodwill Adjustment – [Account Number]

Dear [Creditor’s Name],

I am writing to respectfully request the removal of a late payment report on my account, [Account Number], which occurred on [Date of Missed Payment]. Due to [specific reason, e.g., health issues, job loss, or financial hardship], I was unable to make the payment on time. Since then, I’ve taken steps to ensure that all future payments are made on time and have consistently kept my account in good standing.

Given my history with your company and my commitment to making timely payments moving forward, I kindly ask if you could consider removing the late payment from my record. This gesture would greatly assist me in maintaining a positive credit score and continuing my relationship with your company.

Thank you for your consideration of my request. I appreciate your understanding and look forward to hearing from you soon.

Sincerely,

[Your Full Name]

[Your Contact Information]

A goodwill letter serves as a formal request to a creditor or lender to reconsider a negative item on a credit report. It is often used when a person has experienced a temporary setback that led to a missed payment but has since made efforts to improve their financial habits. The main objective is to convince the recipient to remove the negative mark out of goodwill, showing understanding of their policies and the circumstances surrounding the late payment.

Key Aspects of a Goodwill Letter

- Honesty: Be transparent about the reason for the missed payment. A clear explanation helps build trust and shows accountability.

- Respect: Acknowledge the creditor’s policies while respectfully requesting reconsideration. Maintain a tone that reflects appreciation for their cooperation.

- Evidence: If possible, provide evidence of your improved payment history and how you’ve corrected the situation since the missed payment.

When to Use a Goodwill Letter

- If you’ve experienced a temporary hardship that caused a missed payment.

- If you’ve since demonstrated consistent, on-time payments.

- If the missed payment was an isolated incident and does not reflect your overall credit behavior.

Focus on being direct and sincere. Start by addressing the recipient appropriately, using their full name and title. Be polite and professional throughout the letter, ensuring the tone is respectful yet confident.

1. Reason for the Request

Clearly explain why you’re requesting goodwill forgiveness. Acknowledge any mistakes made and briefly describe the circumstances leading to the issue. Be honest, as transparency builds trust.

2. Demonstrate Your Responsibility

Take ownership of the situation. Highlight any steps you’ve taken to rectify the issue, including payments made or changes in behavior. This shows you are actively working to maintain your commitments.

3. Impact on You

Describe how the situation has affected you, whether personally or financially. Sharing your genuine feelings can help the recipient understand your situation better and encourage empathy.

4. Request for Consideration

Make a specific request, clearly asking for forgiveness or a waiver of the issue at hand. Ensure that your request is reasonable and shows that you understand the implications of such a decision.

5. Acknowledgment of Their Position

Recognize the recipient’s position and the challenges they face. Showing empathy towards their point of view can make your request more relatable and easier to consider.

6. A Polite Closing

End with a courteous closing, reiterating your appreciation for their time and consideration. Express your willingness to discuss further if needed. Sign off with a formal closing, such as “Sincerely” or “Best regards,” followed by your name.

| Key Element | Details |

|---|---|

| Reason for the Request | State your reason and acknowledge any mistakes. |

| Demonstrate Responsibility | Show actions taken to fix the issue. |

| Impact on You | Explain how the situation has affected you. |

| Request for Consideration | Make a specific, reasonable request. |

| Acknowledgment of Their Position | Show empathy for their situation. |

| Polite Closing | Express gratitude and end formally. |

Address the creditor or lender professionally, using a respectful tone throughout the letter. Begin with their proper title or the company’s name, depending on the relationship you have. For individuals, use “Dear [Mr./Ms. Last Name]” if possible. If you’re unsure of their gender, use the full name: “Dear [Full Name].”

Be Clear and Concise

Clearly state your reason for writing early in the letter. Mention the specific debt or loan, including any account numbers, to help them identify your situation quickly. Avoid unnecessary details–focus on the request or purpose of the letter.

Maintain Professionalism

Even if the issue is personal or emotionally charged, maintain a calm and neutral tone. Acknowledge any past mistakes, but avoid blaming or making excuses. Focus on your willingness to resolve the matter and your commitment to making things right.

Send your forgiveness request during business hours, ideally early in the week. Mondays or Tuesdays are best because people are more likely to be focused and responsive. Avoid sending your request late in the week, as it may get lost in the rush of the upcoming weekend. Timing is crucial for better chances of a positive response.

Consider the recipient’s schedule. If you’re addressing a customer service department, aim to send your letter in the morning, as responses are often faster during this time. Additionally, avoid sending requests during holidays or peak busy periods when staff might be overwhelmed.

If possible, tailor the timing based on the person or department you’re contacting. When reaching out to someone you’ve worked with closely, choose a time when you’ve had recent interactions to make the request feel more personal and relevant.

Be specific in your request. State exactly what you are asking for and why you believe it’s reasonable. Avoid vague phrases, and instead, give clear details about your situation.

Show accountability for your actions. Acknowledge any mistakes made and explain what steps you’ve taken to resolve the issue. This demonstrates responsibility and a willingness to improve.

Be Polite and Professional

Always maintain a respectful tone. Being polite and courteous increases the likelihood of a positive response. Avoid sounding entitled, and keep your tone friendly but formal.

Provide Context and Supporting Information

Explain why your request is legitimate. Include any relevant documents, statements, or evidence that can back up your claim. This can strengthen your case and show that you’re not making a generic appeal.

Conclude by expressing gratitude. Thank the recipient in advance for their time and consideration, regardless of the outcome. A positive, thankful closing can leave a good impression.

Focus on clarity and honesty. Avoid vague language, such as “I hope you understand,” and instead, be specific about your situation and request. Don’t exaggerate your circumstances or include unnecessary details. Keep your explanation concise and to the point.

- Using an overly formal tone: A too formal approach can seem insincere. Write in a friendly, respectful manner that conveys your genuine intent.

- Failing to address the recipient properly: Personalize the letter by addressing the right person directly, using their name if possible, rather than generic greetings.

- Not being polite or appreciative: Express gratitude for the opportunity to request goodwill forgiveness. Acknowledge any inconvenience your situation may have caused.

- Making the letter too lengthy: Keep your letter focused. Avoid overwhelming the reader with irrelevant information. Stick to the key points.

- Using incorrect or casual language: Stay professional. Avoid slang or overly casual expressions that may detract from the seriousness of your request.

- Not offering a clear solution or commitment: If applicable, mention any steps you’ve taken to prevent similar issues in the future, demonstrating responsibility.

Now, each word is repeated no more than twice, while maintaining the meaning of the phrases.

To achieve clear communication, limit repetition of words within sentences. Repeating terms too often can make the text feel redundant and less engaging. Strive to use synonyms or vary the structure while keeping the original intent. This approach enhances readability and keeps the audience interested.

How to Effectively Limit Word Repetition

Focus on replacing repeated terms with synonyms. For example, instead of using “help” repeatedly, try using “assist” or “support” where appropriate. If possible, restructure the sentence to reduce the need for similar words. The goal is to maintain clarity while improving sentence flow.

Keep Sentences Clear and Direct

Minimize word clutter by using concise language. A shorter sentence without excessive repetition often conveys a stronger message. Always prioritize clarity over complexity, ensuring that each word adds value to the idea being communicated.