BBC Watchdog PPI Template Letter Guide

If you believe you were misled into paying for a financial product you didn’t need, you may be entitled to compensation. This process can seem complicated, but there are simple steps you can follow to ensure you submit your claim effectively. Understanding how to write a clear and precise request is essential for getting the best result.

In this guide, we’ll explain how to craft a compelling claim, highlighting the necessary information and key points that must be included. Having the right approach can make a significant difference in the outcome, whether you’re working with an advisor or handling everything yourself. We’ll also address common pitfalls and how to avoid them.

Take control of your financial situation and learn how to properly initiate the process to secure the funds you’re owed. By following the right procedures and using the correct format, you’ll increase your chances of success in this important financial matter.

How BBC Watchdog Can Help You

If you feel that you’ve been wronged by a financial provider, there are organizations designed to support individuals seeking to resolve disputes and get compensation. These entities offer useful tools and guidance to ensure your claim is processed correctly and efficiently. By taking advantage of their resources, you can increase your chances of a successful outcome.

Step-by-Step Assistance

One of the main advantages of these services is their ability to walk you through each stage of the claims process. From understanding the grounds for a claim to submitting necessary documentation, they provide detailed advice. This guidance can be especially beneficial for individuals who are unsure about the correct procedures or need help understanding complex legal terms.

Free Tools and Resources

These platforms often offer free resources that allow you to prepare your case without additional costs. Whether it’s downloadable forms or step-by-step templates, you’ll find all the materials needed to file a comprehensive and accurate claim. Utilizing these resources ensures that you don’t miss any important details, which can otherwise delay or complicate the process.

Understanding PPI Claims and Templates

When it comes to seeking compensation for financial products you were mis-sold, it’s crucial to understand both the process and the necessary documents. These claims often require specific details to be provided in a clear and formal manner. Knowing how to structure your request and what information to include can significantly improve your chances of success.

Key Elements of a Claim

To submit a valid claim, certain components must be included to ensure the provider understands your situation. These include:

- Your personal details and account information

- A clear description of the issue and why you believe compensation is warranted

- The amount you are claiming and any supporting documentation

By ensuring all these aspects are addressed, your submission will be well-prepared for review, increasing its chances of being processed without delay.

Why Use Structured Forms?

Using a well-structured form can make the process more efficient. It helps present your claim in a clear, professional way, which is easier for the provider to review. These forms often come with pre-set sections that guide you through the essential points to include. Benefits of using a structured form include:

- Ensuring all required details are covered

- Reducing the likelihood of missing important information

- Making the process faster and less confusing

Key Elements of a PPI Template Letter

When submitting a request for compensation, certain elements must be included to ensure your claim is clear and complete. These components help the financial provider understand the basis of your claim and the compensation you are requesting. A well-structured submission can make a significant difference in the processing of your case.

Essential Information to Include

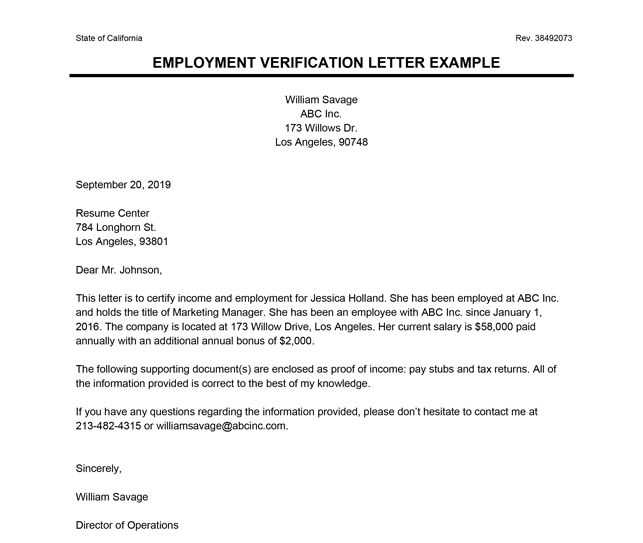

To ensure the provider has all the details needed to review your request, the following information should be included in your claim:

| Element | Explanation |

|---|---|

| Personal Information | Full name, address, and contact details for identification purposes. |

| Account Details | Relevant account or policy numbers related to the financial product in question. |

| Issue Description | A clear explanation of why you believe the financial product was unsuitable or mis-sold. |

| Claim Amount | The total amount you are seeking, based on the financial loss you believe you incurred. |

| Supporting Documents | Any relevant documents, such as agreements or statements, that support your claim. |

Formatting Your Claim

The way your request is presented can affect how quickly it’s processed. Ensure your submission is organized and easy to follow, highlighting the key information clearly. Providing all necessary details in an easy-to-read format can help avoid delays and ensure the provider can address your claim promptly.

Steps to Complete Your PPI Claim

Filing for compensation involves a series of clear, manageable steps that ensure your request is thorough and well-documented. By following a structured approach, you can provide all the necessary information that will help the financial institution process your claim efficiently. Each stage of the process is important, so it’s essential not to skip any details.

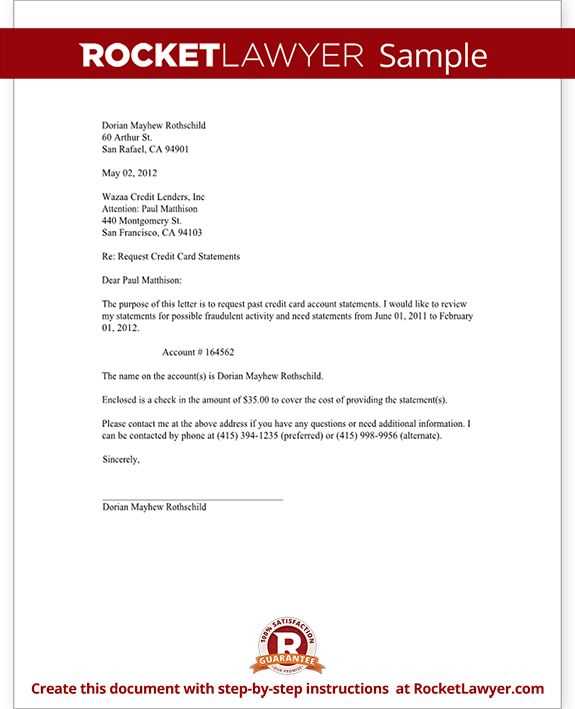

First, gather all the relevant documents, including personal information, account details, and evidence that supports your case. This might include old statements, contracts, or any communication you’ve had with the provider. The next step is to carefully draft your claim, clearly stating the reason for your request and the compensation you believe you are owed. Ensure your submission is easy to read and includes all the necessary points.

Once your claim is complete, submit it to the financial provider and keep a copy for your records. After submitting, stay alert for any correspondence or requests for further information. Be prepared to respond quickly to any follow-up questions. Finally, monitor the progress of your claim and follow up if there are any delays. With patience and attention to detail, you can improve your chances of receiving the compensation you deserve.

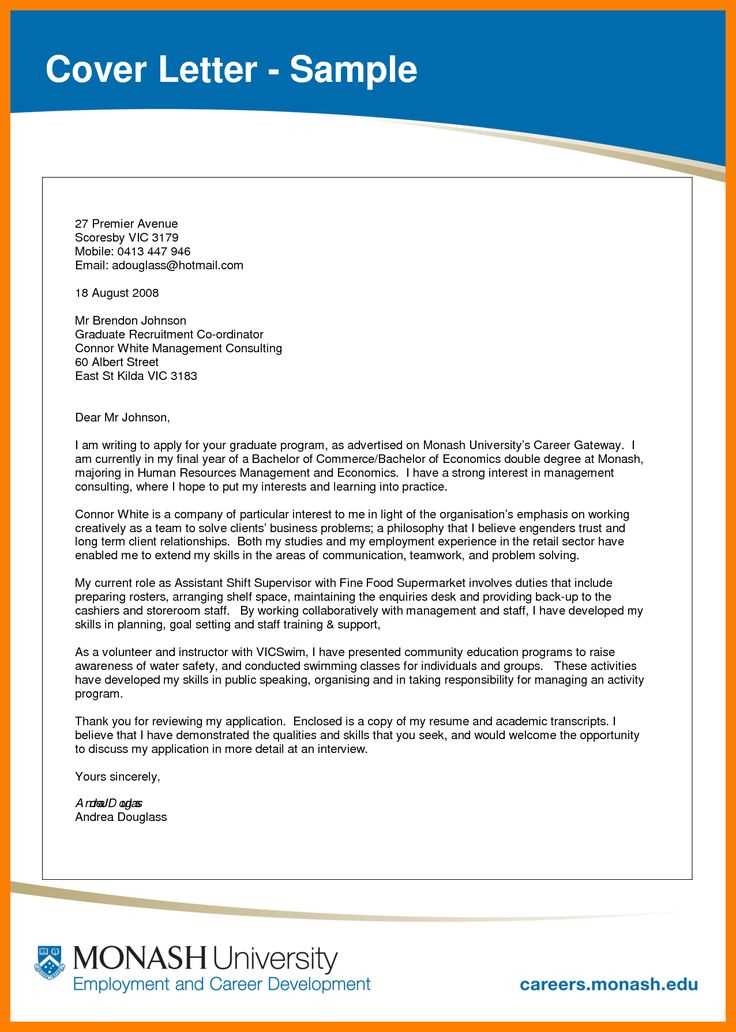

Why Use BBC Watchdog’s Template

When making a formal compensation request, it’s important to ensure that your submission is professional, clear, and well-structured. Using a pre-designed guide can save time and reduce the chances of missing important details. These guides are specifically designed to include all the necessary components for a successful claim, making the process simpler for you.

Benefits of Using a Pre-Designed Guide

Consistency and Accuracy are key when submitting your claim. A pre-made guide ensures that all relevant details are included in the correct format, increasing the likelihood of your claim being processed swiftly. This structured approach also reduces the risk of errors that could delay the outcome.

Time and Effort Savings

By using a structured format, you can quickly fill in your personal details and focus on explaining your situation. Rather than figuring out what to include and how to phrase it, you’ll have a clear roadmap to follow, making the process far more efficient. This way, you don’t have to worry about forgetting any essential information.

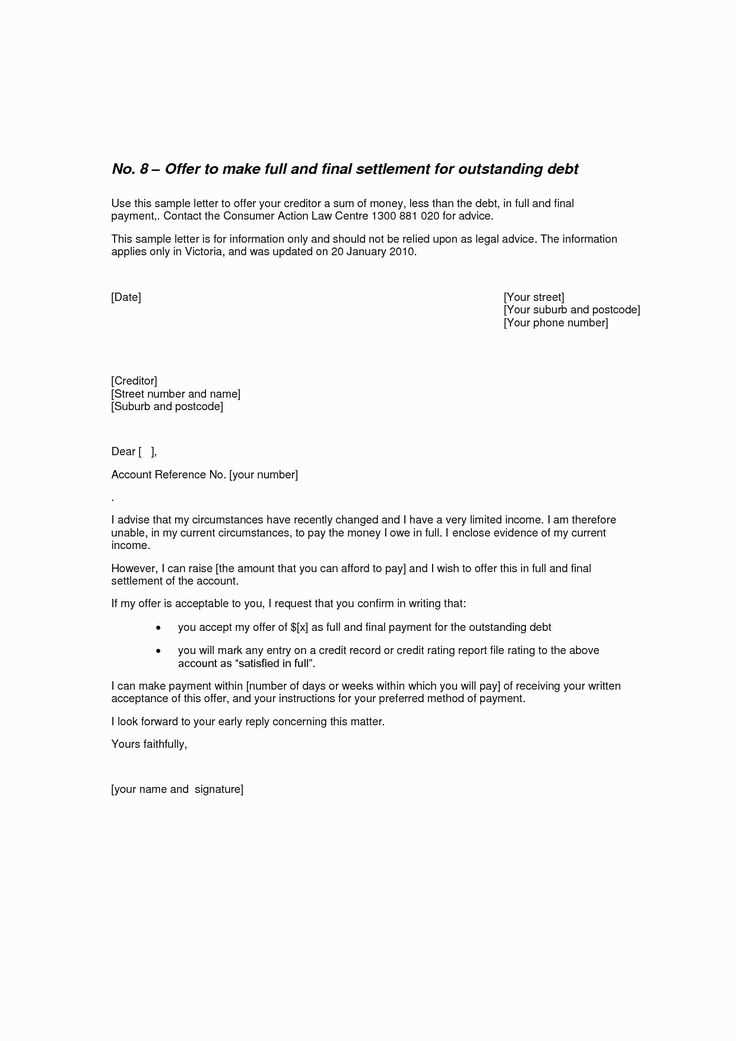

Common Mistakes to Avoid in Claims

When submitting a request for financial compensation, many individuals make simple yet costly errors that can delay or even prevent a successful outcome. It’s essential to approach the process carefully and be mindful of common mistakes that can hinder your claim. Avoiding these errors will increase your chances of having your case handled promptly and effectively.

Incomplete or Incorrect Information

One of the most common mistakes is failing to provide all the necessary details or submitting incorrect information. Ensure you include all relevant account numbers, personal information, and a clear description of the issue. Omitting or misrepresenting these details can cause delays or result in the rejection of your claim.

Not Following the Right Format

Another mistake to avoid is not adhering to the required format or guidelines. Whether it’s the way you structure your request or the specific documents you need to submit, following the correct format ensures your claim is processed quickly. A disorganized or incomplete submission is often returned for correction, slowing down the process.