Insurance broker of record letter template

The Insurance Broker of Record (BOR) letter is a formal document used to officially designate a new insurance broker. This letter serves as a communication tool between the policyholder and their previous or current insurance provider, informing them of the broker change. To ensure the process is smooth, it’s important to include specific details in the letter, such as the effective date and the reason for the switch.

To begin, include your contact information at the top of the letter, followed by the current broker’s details and the insurance company’s name. Make sure to clearly state that you are transferring the Broker of Record to the new broker. Specify the exact date when this change will take effect. A concise but polite tone will help maintain professional relations, regardless of the reasons behind the change.

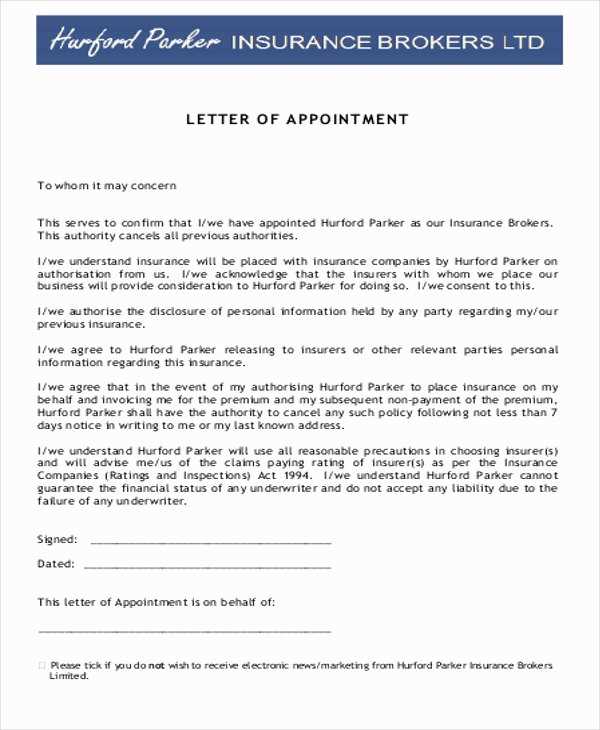

Below is a sample structure to follow when drafting your letter:

- Introduction: State your intention to change the Broker of Record and include the effective date.

- Details of the new broker: Provide the name, address, and contact details of the new insurance broker.

- Clarification: Confirm that the new broker has full authority to manage the policy and claims from the effective date onwards.

By being clear and precise, you avoid confusion and ensure the transition happens without delay. Always double-check the requirements of your insurance provider, as some may have specific instructions for submitting the BOR letter.

Here are the revised lines with reduced repetitions:

To enhance clarity and minimize redundancy, follow these tips for rewriting your insurance broker of record letter:

- Replace lengthy phrases with concise, clear statements. For example, instead of “I am writing to inform you that I am now your broker of record,” simply write, “I am now your broker of record.”

- Eliminate unnecessary qualifiers like “I believe” or “I think.” These phrases often add little value and can make the letter sound less direct.

- Use clear, straightforward language. For instance, “Please let me know if you have any questions” is preferable to “Should you have any queries or require further assistance, please feel free to reach out to me.”

- Ensure consistency in tone throughout the letter. A formal yet approachable style works best in professional communications.

By focusing on precision, you can ensure that your letter remains professional and effective, while avoiding unnecessary repetition and wordiness.

- Insurance Broker of Record Letter Template

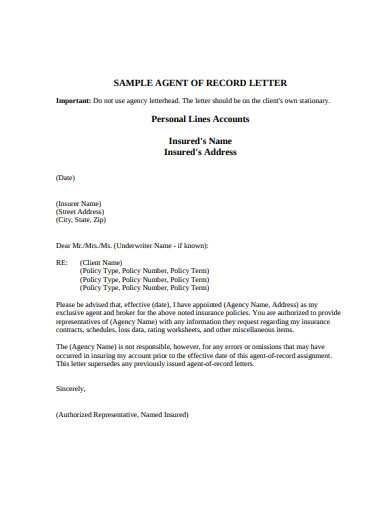

To appoint an insurance broker of record, you need a clear and professional letter outlining the change in representation. Here’s a basic template you can follow:

Broker of Record Letter

Subject: Appointment of Insurance Broker of Record

[Your Name or Company Name]

[Your Address]

[City, State, ZIP Code]

[Phone Number]

[Email Address]

Date: [MM/DD/YYYY]

To: [Insurance Company Name]

[Claims Department Address]

[City, State, ZIP Code]

Dear [Insurance Company Representative’s Name],

This letter is to formally notify you that [Your Name or Company Name], hereby appoints [New Broker Name] as the Insurance Broker of Record for all insurance policies held under the name of [Policyholder Name] with your company. Please update your records accordingly and direct all future correspondence, claims, and policy information to [New Broker Name] at the following contact details:

Broker Contact Information:

[New Broker Name]

[Broker’s Address]

[Phone Number]

[Email Address]

We trust that this transition will be smooth and expect that all future policy and claims communications will be directed to [New Broker Name]. Should you require any further details to process this request, please do not hesitate to contact me at [Your Contact Information].

Thank you for your prompt attention to this matter.

Sincerely,

[Your Signature (if sending a hard copy)]

[Your Printed Name]

[Your Title (if applicable)]

This template serves as a straightforward method for notifying the insurance company about the change in broker representation. Customize it with the necessary details for your situation.

Be direct and specific in your language. Avoid any ambiguous statements that could lead to confusion or misinterpretation.

- Title the letter properly: Use clear headings like “Authorization Letter” at the top, followed by the purpose of the letter to set context immediately.

- Identify all parties: Clearly state who is authorizing and who is being authorized. Include full names and titles if applicable.

- Define the scope of authority: Specify exactly what the authorized person is permitted to do. Avoid general terms; list specific actions.

- Include important dates: Mention the time frame during which the authorization is valid, if applicable. This helps clarify the duration of the authorization.

- State the reason: Briefly explain why the authorization is being granted to ensure transparency and prevent unnecessary questions later on.

- Conclude with a signature: End the letter with a clear declaration of consent, followed by the signer’s name, signature, and date.

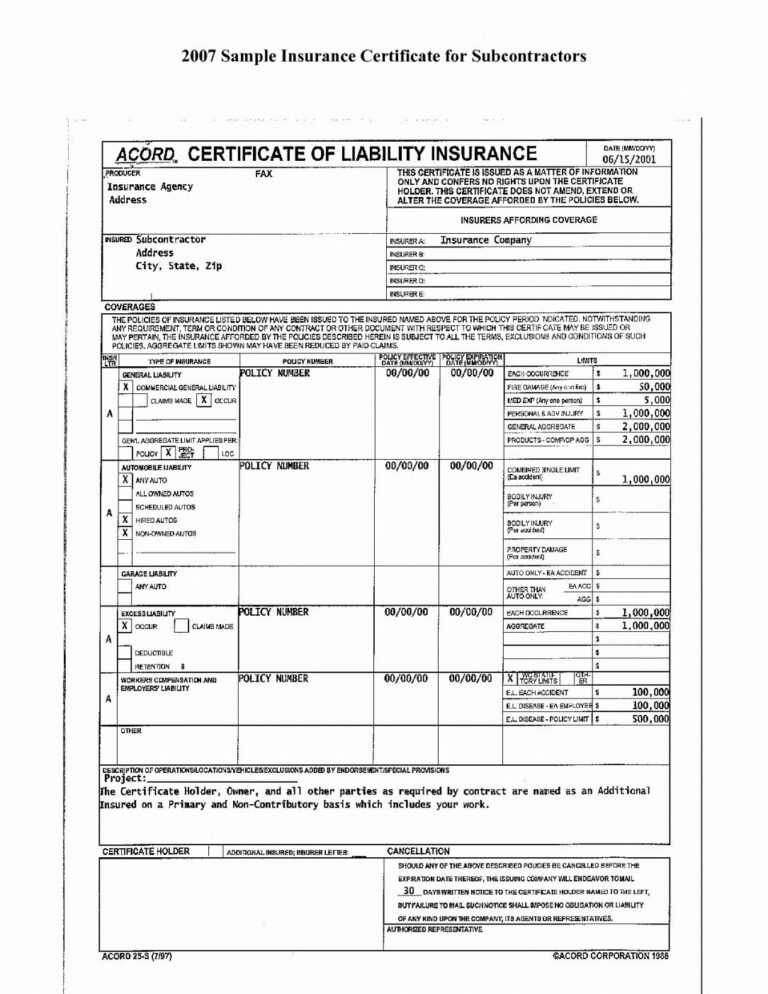

The Broker of Record letter must contain clear identification of the client and the insurance coverage being transferred. Start by specifying the client’s name, policy numbers, and the exact insurance policy details. This ensures there’s no ambiguity regarding the scope of coverage and the relationship with the broker.

Broker Details: Clearly identify the new broker by name, address, and license number. This provides transparency regarding who is now authorized to act on behalf of the client. Include any additional details that support the legal standing of the broker.

Authorization Clause: Include a clear statement from the client authorizing the broker to represent them with the insurer. This clause grants the broker the legal right to manage the policy and negotiate on the client’s behalf.

Effective Date: Specify the date on which the broker of record changes take effect. This helps to avoid confusion and ensures that the transfer of authority is recognized immediately by all parties involved.

Cancellation or Replacement Clause: Clearly state that the letter cancels any prior broker of record agreements and replaces them with the new designation. This prevents the former broker from maintaining any residual authority over the client’s account.

Signature Requirements: The letter should be signed by the client, with proper verification of identity. This serves as proof of authorization and can be necessary for enforcement in case of disputes.

Limitations of Authority: If applicable, outline the specific powers the new broker holds, especially in situations where the broker is only authorized for certain actions or services. This helps define the scope of their authority.

Notify your previous representative promptly after making the decision to switch brokers. A formal letter should be your first step. This document should clearly state your intent to terminate their services and confirm the name of the new broker handling your account.

1. Prepare the Necessary Information

Include your full name, policy details, and the new broker’s contact information. Be specific about the date the change is effective to avoid confusion.

2. Send the Notification via Reliable Methods

Use registered mail or email with a read receipt to ensure that your previous representative receives and acknowledges your notification. Keep a copy of the letter for your records.

Make sure to follow up within a few days to confirm that your representative has received and processed the change. Address any additional steps they might require to finalize the transition smoothly.

First, assess your specific requirements. Do you need coverage for personal, business, or both types of insurance? Identifying your priorities helps narrow down brokers who specialize in those areas.

Check the broker’s credentials. Look for licensed professionals who adhere to industry standards. This ensures they have the necessary qualifications to provide reliable advice.

Evaluate their experience. A broker with a track record in the specific insurance market you need can offer valuable insights and access to the best deals.

Communication is key. Choose a broker who listens to your needs, answers questions promptly, and explains options clearly. A good broker should make complex insurance terms understandable.

Consider their network. A broad network of insurers gives you more options for comparison. Brokers who work with a variety of companies can find policies that match your needs at competitive prices.

Check reviews and ratings. Look at feedback from previous clients to gauge their reliability and customer satisfaction. Positive reviews suggest the broker consistently meets clients’ expectations.

Compare pricing and fees. Brokers charge fees differently, so clarify the cost structure upfront. Avoid brokers who charge hidden fees, and focus on those who offer transparency.

Here’s a quick comparison table to guide your decision-making:

| Criteria | What to Look For | Why It Matters |

|---|---|---|

| Specialization | Personal, business, or both insurance | Ensures they understand your specific needs |

| Experience | Years in the industry and market knowledge | Better negotiation skills and access to deals |

| Communication | Clear, responsive, and knowledgeable | Ensures a smooth and stress-free process |

| Network | Wide range of insurance providers | More options for finding the best rates |

| Pricing | Clear, upfront fees | Helps avoid hidden charges and surprises |

By evaluating these factors, you can confidently choose an insurance broker who meets your needs and provides solid coverage at the right price.

To transfer the Broker of Record (BOR), start by obtaining a signed Broker of Record letter from the client. This document will officially authorize the new broker to represent the client’s insurance interests. It is essential that the letter clearly identifies the client, the current broker, and the new broker, specifying the desired effective date for the change.

Steps Involved in the Transfer

Once the letter is signed, the new broker should submit it to the insurer. Insurers typically require the letter to be submitted in writing, either through email or through an online portal. Make sure the insurer receives the letter well before the policy renewal date to avoid gaps in coverage.

The insurer will then review the document and process the request. During this period, it’s common for the insurer to confirm the transfer with both brokers, ensuring that there are no discrepancies or misunderstandings. This step may take a few business days, depending on the insurer’s workload and policies.

Post-Transfer Considerations

After the transfer is approved, the new broker will take over the management of the client’s insurance portfolio. At this stage, they should begin reviewing the client’s policies and ensure everything is in order. It’s important to keep the client informed throughout the process and maintain open communication to avoid any complications.

Make sure the client understands any changes in terms, coverage, or premiums that may occur due to the transfer. Regular follow-up can help ensure that the transition is smooth and that the client remains satisfied with their coverage.

Ensure you specify the date clearly. A letter without a date can lead to confusion about the exact time the broker relationship begins or ends, which can affect the clarity of agreements. Always add the date at the top of the letter.

1. Missing or Incorrect Contact Information

Accurate contact details are non-negotiable. Double-check the broker’s name, address, and phone number. Providing the wrong information may delay communication or lead to misunderstandings regarding responsibilities.

2. Overlooking Signature Requirements

Never skip the signature. A broker letter must be signed by the appropriate parties to be valid. Failing to include a signature can result in the document being disregarded, making the entire process void.

3. Inadequate Scope of Authority

Be specific about the broker’s powers. A vague description of what the broker can or cannot do may create complications later. Define their responsibilities clearly to avoid disputes.

4. Inconsistent Terminology

Consistency matters. Use the same terms throughout the letter to prevent confusion. For example, don’t switch between “broker” and “agent” if they refer to the same role, as this may create ambiguity.

5. Failure to Acknowledge Existing Contracts

Check for any existing agreements or letters that may conflict with the new broker relationship. Failing to mention previous documents may lead to overlaps or contradictions in terms and obligations.

Ensure the letter clearly states the transition of brokerage responsibilities. Address both the previous and new brokers directly, using clear language about the change. Provide the policy details, effective date of the transition, and specific instructions for the new broker to take over client management. It is crucial to have both parties sign to acknowledge the change.

In the letter, list all relevant policies and coverage to avoid misunderstandings. If applicable, include the current premium, claims history, and any ongoing negotiations. Be transparent about fees and any necessary adjustments to coverage. This helps maintain continuity in service for the client.

Be specific about any documentation the new broker needs to complete to finalize the transition. Request a formal acknowledgment from the client of the change in representation to avoid confusion in future interactions. This confirmation should be clear and concise.