Standby letter of credit template

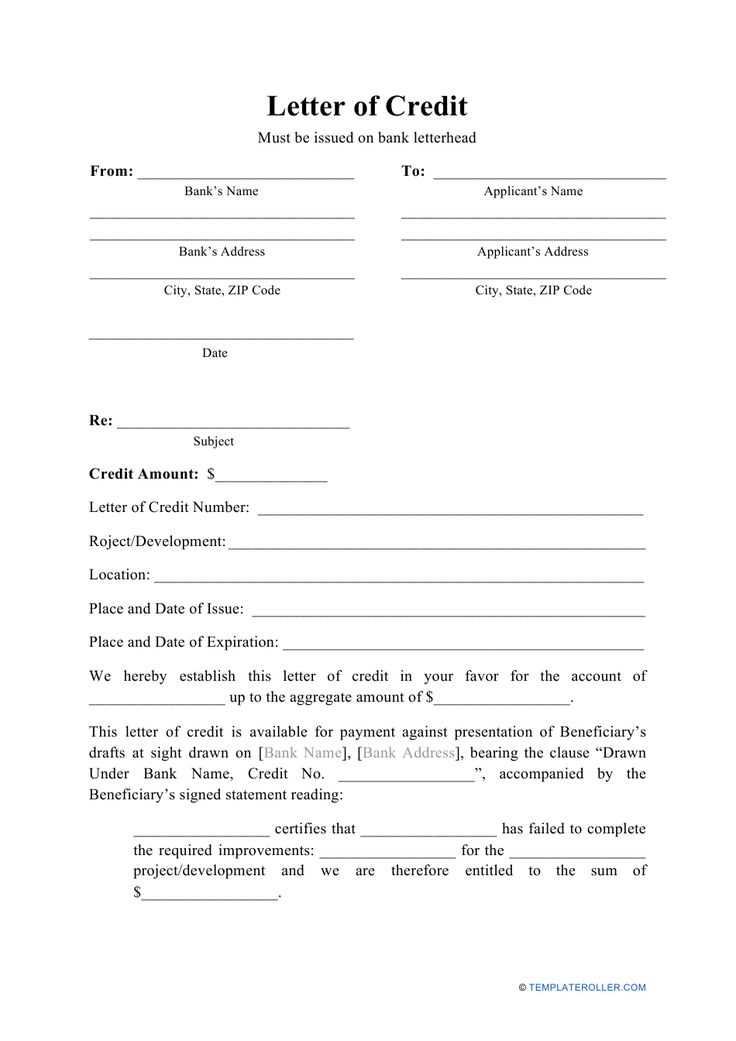

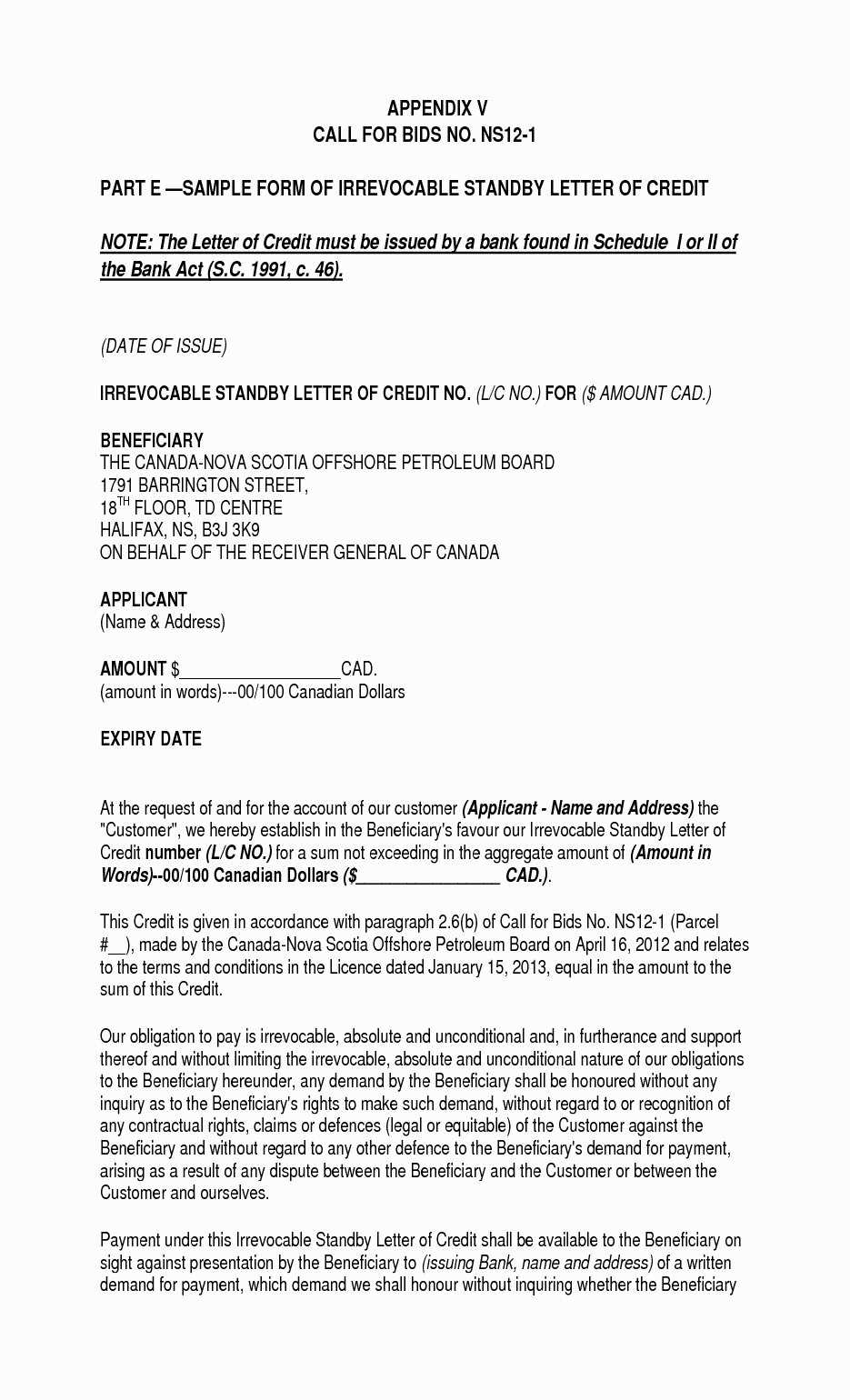

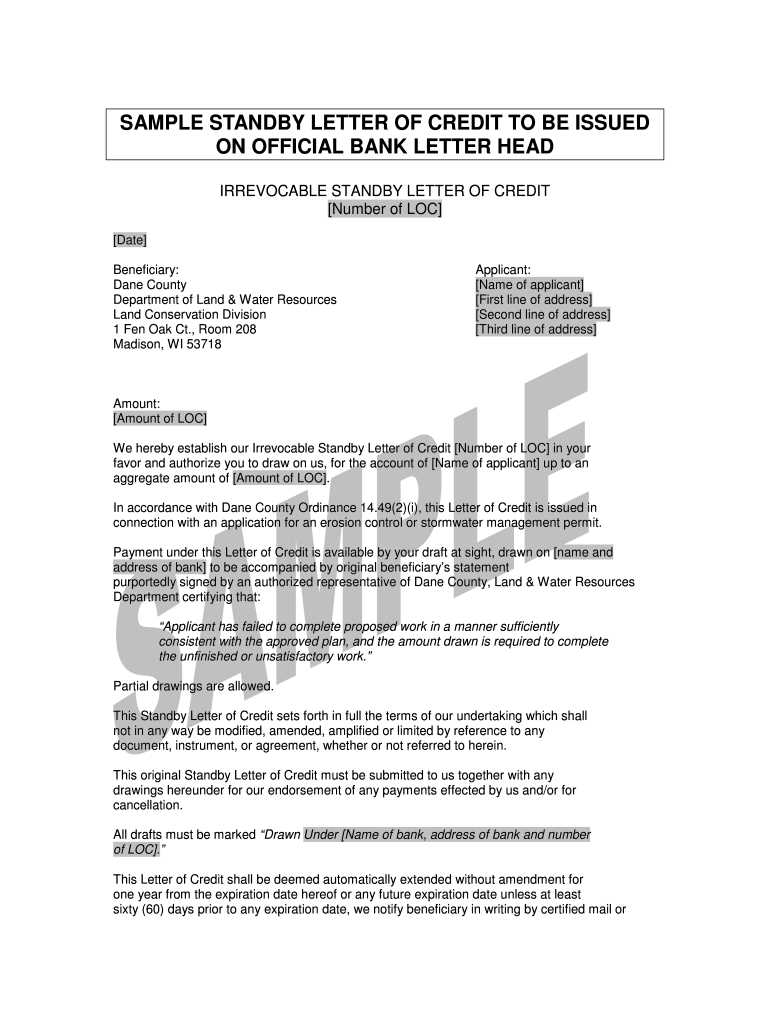

To create a Standby Letter of Credit (SBLC) template, ensure it includes all key elements to guarantee its validity and efficiency. Start with clear identification of the parties involved: the issuer, the beneficiary, and the applicant. Specify the terms under which the SBLC will be invoked, including the conditions of payment and the required documentation for claims. This clarity prevents ambiguity in case the letter needs to be drawn upon.

Format and structure of the SBLC should follow the typical outline: an opening statement, details of the issuing bank, a declaration of the amount, and the term of validity. The format should also highlight the governing law and jurisdiction to which the letter is subject. This ensures that any disputes are resolved according to a clear legal framework.

The most critical aspect of the template is defining the conditions for drawing. Clearly state what actions or failures by the applicant or third parties trigger the SBLC. Typically, these can include non-payment, non-performance, or failure to deliver goods or services. By defining these actions precisely, you avoid unnecessary disputes and make the document practical for international trade.

Lastly, always ensure the language used in the template is simple and direct, avoiding any complex terms or unnecessary jargon. Both the applicant and beneficiary should have a mutual understanding of their obligations and rights. A well-structured SBLC template sets the foundation for secure transactions and strengthens trust between all parties involved.

Here’s the updated version where repetitions are minimized:

In a standby letter of credit (SBLC), clarity and conciseness are key. The goal is to minimize redundancy while keeping the document clear and precise. One effective method is to streamline terms, avoid over-explaining clauses, and ensure that only relevant details are included. This approach not only improves readability but also reduces potential confusion for both the applicant and the beneficiary.

Key Changes

By refining the phrasing, we’ve eliminated repetitive phrases and redundant explanations. For instance, instead of repeatedly stating the same conditions across multiple sections, the letter can reference previous statements in a single, well-defined section. The use of standard legal terminology, without over-explaining each term, also contributes to the streamlined nature of the document.

Practical Example

The previous version of the SBLC might have included several iterations of the same payment terms in different parts of the document. In the revised version, this information is consolidated into a single clause, reducing the chance of conflicting interpretations. This approach enhances the document’s efficiency without losing any essential detail.

| Section | Old Version | Updated Version |

|---|---|---|

| Payment Terms | Repeated mention of payment dates and conditions throughout the document. | Consolidated into one clear, precise clause. |

| Beneficiary Rights | Several paragraphs explaining the rights of the beneficiary, each with slight variations. | Condensed into one paragraph, clearly outlining all beneficiary rights. |

| Expiry Terms | Expiry date mentioned in multiple places with slight differences. | Clearly stated in a single location, avoiding repetition. |

This simplified structure benefits both parties by reducing confusion and maintaining clarity throughout the document. A streamlined SBLC ensures that there is no ambiguity in the terms, and each clause serves its purpose without excess detail. By focusing on concise, direct language, the letter becomes a more effective tool for guaranteeing payment or performance.

- Standby Letter of Credit Template

Use this template to draft a Standby Letter of Credit (SBLC) with all necessary details. Ensure the information is correct for proper enforcement.

Template Breakdown

Fill in the key sections to establish the agreement between the issuing bank, applicant, and beneficiary. These fields are non-negotiable to maintain clarity and protect both parties.

| Field | Description |

|---|---|

| Issuing Bank | The bank issuing the SBLC. Include its full legal name, address, and contact details. |

| Applicant | The party requesting the SBLC, including their name, address, and contact information. |

| Beneficiary | The party receiving the credit. Ensure their name and contact information are listed. |

| Amount | The maximum value for which the beneficiary may draw under the SBLC. |

| Expiry Date | The exact date when the SBLC expires. Include time zone information if applicable. |

Conditions of Use

Clearly outline the conditions under which the SBLC can be drawn upon. These guidelines ensure that all parties understand their rights and obligations.

| Condition | Description |

|---|---|

| Drawdown Process | Define the documentation the beneficiary must submit to access the funds (e.g., invoices, letters of non-performance). |

| Governing Law | Indicate the jurisdiction under which the SBLC is regulated and enforced. |

| Transferability | State whether the SBLC is transferable to another beneficiary or non-transferable. |

Customize this template for your specific transaction, ensuring clarity in terms and conditions. This will safeguard the interests of both the applicant and the beneficiary.

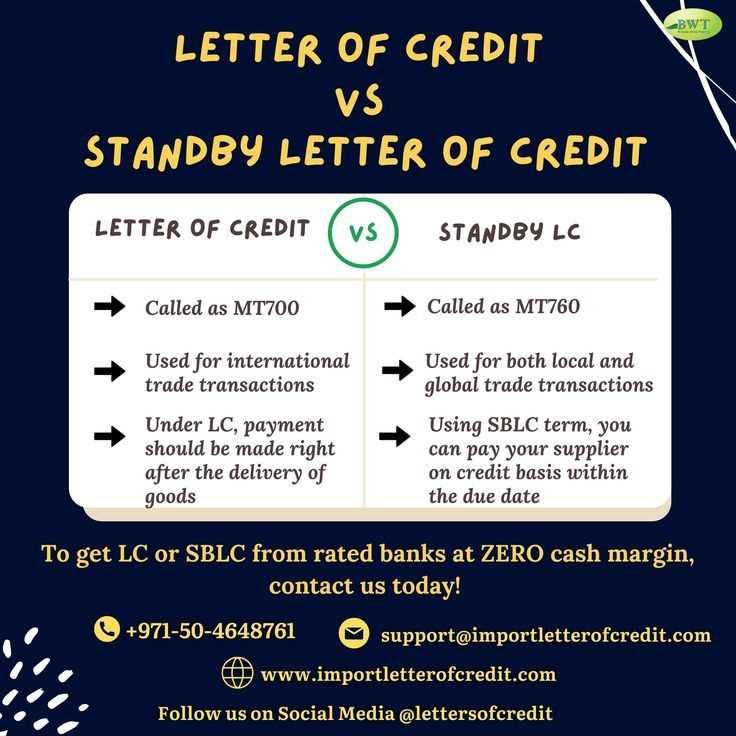

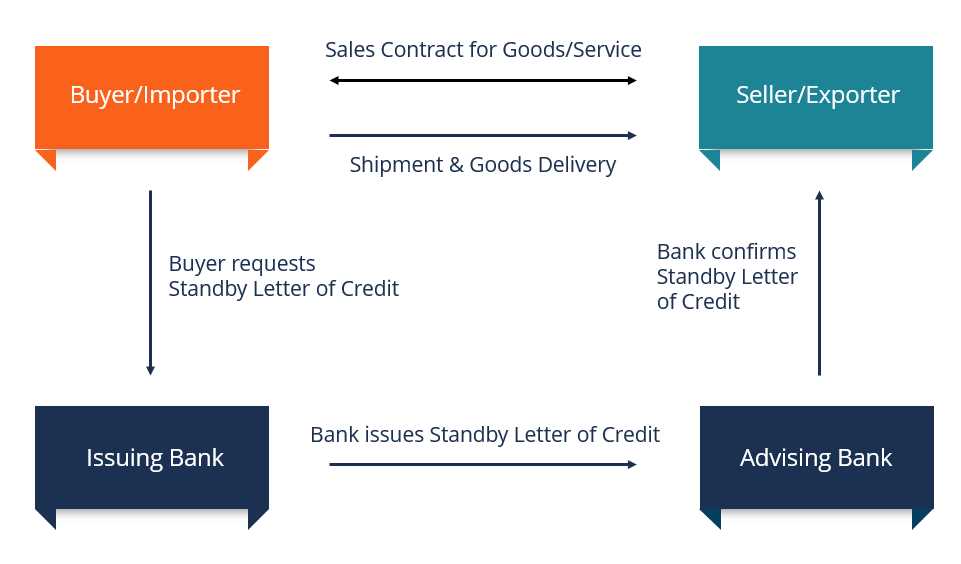

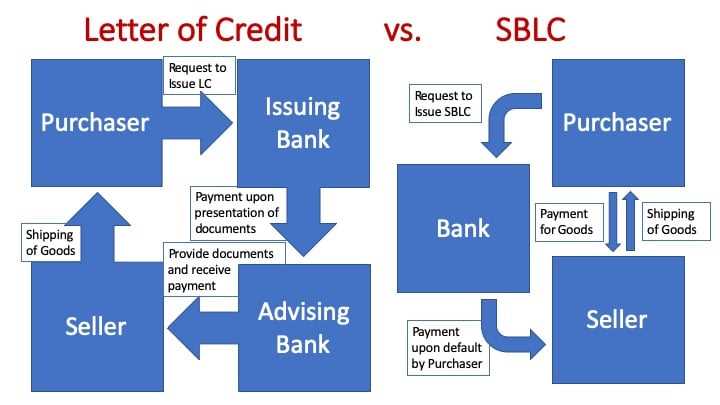

A Standby Letter of Credit (SLOC) is structured to serve as a payment guarantee, providing assurance to the beneficiary that they will be paid if the applicant fails to meet specific obligations. The key components of a Standby Letter of Credit include the applicant, the beneficiary, the issuing bank, and the terms outlined in the credit itself.

Key Parties Involved

The applicant is typically the party requesting the issuance of the letter, often a buyer or borrower. The beneficiary is the party receiving the guarantee of payment, often a seller or lender. The issuing bank provides the letter, assuring the beneficiary that funds will be provided if the applicant defaults.

Terms and Conditions

Each Standby Letter of Credit outlines specific terms such as the expiration date, the amount covered, and the conditions under which it can be drawn upon. The letter is usually activated by a default or failure to perform as agreed. The beneficiary must present the required documentation to the issuing bank to claim payment, and the bank reviews these documents to ensure they comply with the terms set out in the letter.

In a Standby Letter of Credit (SBLC) template, the specific terms and clauses provide the framework for ensuring smooth financial transactions. Understanding the key components is crucial for both parties involved.

- Beneficiary: This clause identifies the party that will receive the benefit of the SBLC. Typically, it’s the seller or creditor, but can be adjusted based on the transaction’s nature.

- Applicant: The applicant is the party requesting the SBLC, usually the buyer or debtor. They are responsible for paying the issuer bank if the SBLC is drawn upon.

- Issuing Bank: The bank that issues the SBLC on behalf of the applicant. This clause details the bank’s obligations and any specific procedures for payment under the SBLC.

- Expiration Date: The period during which the SBLC is valid. If the SBLC is not used by this date, it becomes null and void, and the beneficiary loses their right to make a claim.

- Amount: Specifies the maximum amount that can be drawn under the SBLC. This value should reflect the financial commitment and risks covered in the agreement.

- Terms of Payment: This clause sets out the conditions under which a draw can be made. It outlines the documents required, such as invoices, proof of default, or non-performance.

- Draw Conditions: Defines the circumstances under which the beneficiary can make a claim against the SBLC. This includes detailing specific events of default or failure to perform contractual obligations by the applicant.

- Governing Law: Specifies which legal jurisdiction governs the SBLC. This clause ensures that the parties are aware of the legal framework and procedures for resolving disputes.

- Non-transferability: Typically, SBLCs are non-transferable, meaning the beneficiary cannot assign the credit to another party without consent. This clause is key to controlling the transaction’s flow.

- Partial Draws: If applicable, this clause allows the beneficiary to draw part of the total amount, instead of the entire sum. This is often important when dealing with long-term projects or ongoing contractual obligations.

These clauses provide clarity, ensuring both the applicant and beneficiary understand their rights, responsibilities, and limitations under the SBLC. A well-structured template minimizes misunderstandings and protects all involved parties.

To tailor a Standby Letter of Credit (SBLC) to your specific transaction, begin by clearly defining the terms that reflect your agreement’s needs. Identify the parties involved, including the applicant (buyer), beneficiary (seller), and issuing bank, and ensure these are precisely mentioned in the document.

Specify the Purpose and Conditions

Clearly state the purpose of the SBLC. Whether it is for payment, performance, or advance payment, make sure this is explicitly outlined. Define the exact conditions under which the bank will release payment to the beneficiary. Specify the documents required, such as invoices, shipment receipts, or performance reports, to avoid ambiguity.

Set the Expiration Date and Amount

The expiration date should align with the timeline of the transaction. Make sure it provides enough flexibility for both parties, taking into account potential delays. For the amount, ensure it corresponds to the value of the goods, services, or performance covered by the credit, and outline the currency in which the payment will be made.

Define the procedures for amendments or extensions in case changes occur during the transaction. This provides a safety net if any unforeseen circumstances affect the terms. Clearly indicate the method of communication for such amendments.

Finally, ensure all requirements for a successful draw are clear and measurable. Any conditions should be realistic, achievable, and easily verifiable to avoid disputes or delays during the transaction.

One of the most common mistakes is unclear language. Ensure that the terms of the Standby Letter of Credit (SLOC) are specific and unambiguous. Vague language may lead to disputes and misunderstandings between the parties involved.

Another mistake is neglecting to define the conditions under which the beneficiary can draw on the credit. Clearly outline the documents required for payment and the exact circumstances under which the credit can be called upon. This ensures a smooth process if a draw occurs.

Failing to properly identify the parties involved is another frequent error. Make sure that all parties, including the applicant, the beneficiary, and the issuer, are correctly named with accurate details. Any discrepancies can complicate enforcement later.

Overlooking expiration dates can cause significant issues. The SLOC should clearly state the date of expiry and provide adequate time for the beneficiary to make a claim. Expiring too early or too late can lead to complications in case of claims.

Another key error is not specifying the governing law. The jurisdiction governing disputes should be clearly identified to avoid confusion in case of legal conflicts. It’s advisable to agree on a neutral jurisdiction if the parties are from different countries.

Inadequate attention to the fee structure may also create problems. Ensure the fees for issuing and maintaining the SLOC are clearly outlined. The applicant must understand these costs to avoid surprises.

Lastly, ignoring international standards can result in issues during the execution of the credit. Ensure compliance with the UCP 600 (Uniform Customs and Practice for Documentary Credits), as it sets the global standard for these types of instruments and can help prevent errors or delays in processing.

Ensure that the terms of the standby letter of credit (SBLC) are clear and unambiguous to avoid potential disputes. The document should explicitly outline the conditions under which the beneficiary can call upon the credit. It is important that these conditions are consistent with the governing law of the contract to avoid legal conflicts.

1. Compliance with International Standards

SBLCs are governed by the International Chamber of Commerce’s UCP 600 (Uniform Customs and Practice for Documentary Credits). Ensure that the SBLC follows these widely recognized rules. This provides predictability and protection for all parties involved, especially in cross-border transactions.

2. Jurisdiction and Governing Law

Before executing an SBLC, clearly state the jurisdiction and applicable law that will govern disputes. This can significantly impact the outcome in case of a claim or legal action. Different jurisdictions may have different interpretations of SBLCs, so it’s crucial to specify the correct one.

3. Risk of Fraud

Fraud is a major risk with SBLCs. Carefully verify the legitimacy of the beneficiary and ensure that the documents presented comply with the terms of the credit. Counterfeit documents or fraudulent claims may lead to unnecessary legal battles. Protect yourself by performing due diligence on all parties involved.

4. Breach of Conditions

If the terms of the SBLC are breached, it may lead to a legal dispute. Ensure that both the applicant and beneficiary understand the consequences of failing to fulfill the conditions. Disputes often arise from vague or unclear terms, so precision is key in drafting the credit.

5. Expiration Date and Renewals

Clearly define the expiration date of the SBLC. If a renewal is necessary, outline the procedure to follow to avoid any ambiguity. Be aware of the impact of an expired SBLC, as some jurisdictions may not allow claims after the expiration date, even if conditions were met prior to that time.

6. Enforcement and Execution

When the SBLC is called, ensure that all requirements are met for enforcement. Some jurisdictions may impose additional requirements for enforcing an SBLC, such as verification of authenticity. Always review local laws and consult legal experts to ensure smooth execution of the credit when needed.

Standby letters of credit (SLCs) offer flexibility to businesses in various industries, allowing them to secure transactions and build trust with partners. Below are examples tailored to different business needs, highlighting their specific uses and advantages.

1. Construction Projects

In the construction industry, SLCs are often used to guarantee the completion of a project or to ensure payment to subcontractors and suppliers. A contractor may request a standby letter of credit to assure the project owner that funds will be available if the contractor fails to meet their obligations. For example, if a contractor defaults, the owner can draw on the credit to cover the costs of completing the job or paying others involved in the project.

2. International Trade

In international trade, SLCs can act as a safety net for both the seller and the buyer. A supplier may require a standby letter of credit to secure payment from a foreign buyer, ensuring that the buyer’s bank will honor payment if the buyer defaults. This type of credit helps mitigate the risks associated with trading across borders, especially when the parties do not have a well-established relationship.

3. Lease Agreements

For long-term leases, particularly in commercial real estate, landlords may ask tenants for a standby letter of credit. This ensures that the landlord will receive compensation if the tenant fails to pay rent or breaches other lease terms. The letter of credit provides an additional layer of security, giving the landlord peace of mind while allowing tenants to negotiate better terms without needing to pay a large deposit upfront.

4. Export and Import Transactions

In export and import transactions, SLCs can provide assurance that the exporter will be paid for goods shipped overseas. Importers may request an SLC to guarantee that payment will be made after the goods are delivered as per the agreement. The letter of credit ensures both parties are protected, helping to build trust in the deal.

5. Business Loan Guarantees

Small businesses seeking financing may use a standby letter of credit as collateral to secure a loan. In this case, the lender will have a guaranteed payment source if the business defaults on the loan. The SLC offers a safeguard for both the borrower and the lender, enabling businesses to access capital without needing extensive assets to back the loan.

I’ve reduced the repetition of the phrase “Standby Letter of Credit Template” by replacing it in some instances with similar expressions, maintaining both meaning and grammatical accuracy.

When creating a standby letter of credit form, it is important to tailor the language while keeping its purpose intact. Replacing the full phrase with alternatives like bank guarantee template or letter of credit document helps reduce redundancy. Both terms retain the same concept of a financial instrument providing security in case of non-performance or default.

Avoid overusing the specific term, especially in sections where it’s clear that the document refers to the same agreement. For instance, instead of repeating “Standby Letter of Credit Template” in every sentence, you can interchangeably use terms like credit facility agreement or payment assurance letter as long as they fit the context without altering the document’s intent.

This approach ensures clarity, maintains readability, and prevents the text from sounding repetitive. It’s also crucial to use these synonyms only when they are precise in describing the particular type of financial guarantee outlined. For example, in a clause discussing the conditions of use, “credit support document” could serve as a useful replacement.

By refining the language, you make the template more engaging and accessible to those who may not be familiar with the full legal terminology, all while retaining the necessary accuracy and professional tone.