Fake Loan Approval Letter Template Guide

When seeking financial assistance, some individuals may attempt to deceive others with fabricated documents that appear to show formal agreements. These documents are often designed to look convincing but lack authenticity, leaving those who rely on them at risk. Understanding how to identify and avoid such false representations is crucial in protecting oneself from potential harm.

Key Features of Deceptive Financial Documents

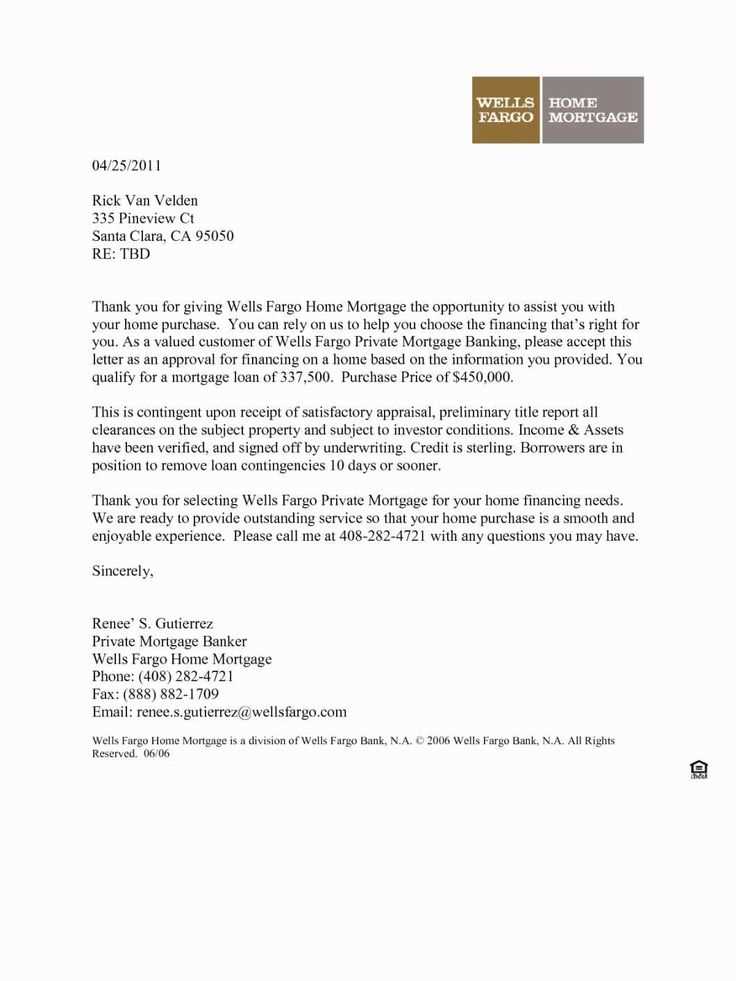

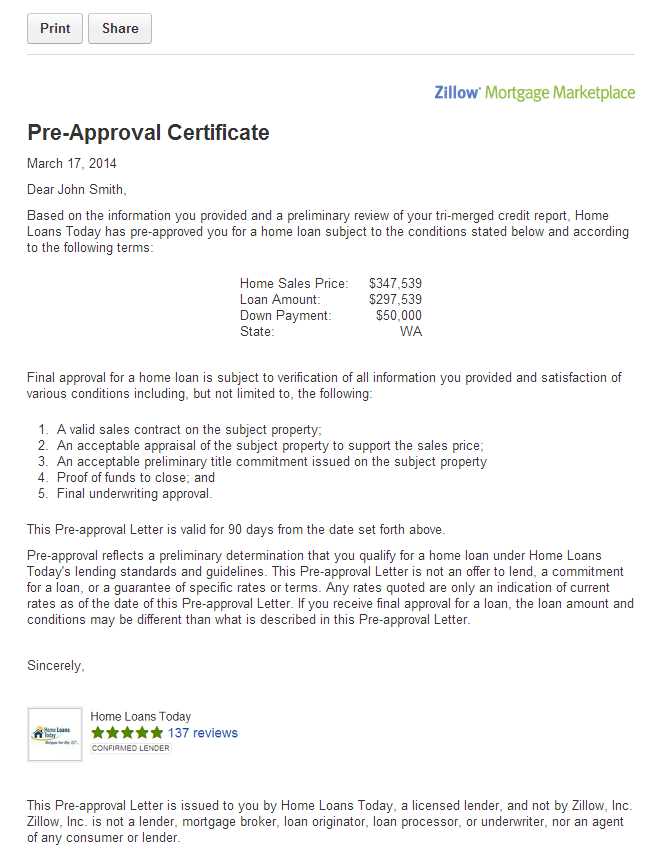

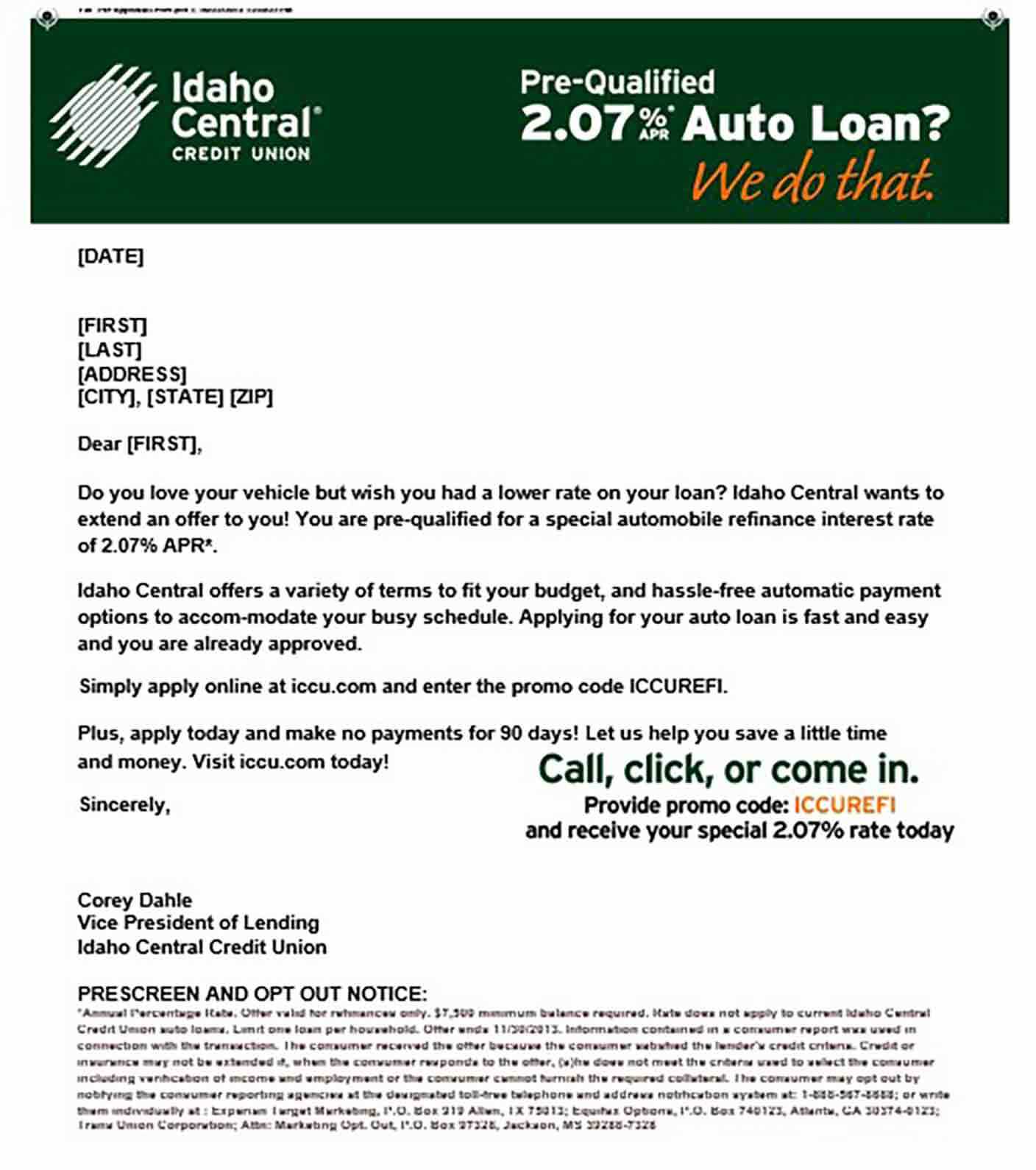

Phony financial agreements often share several common characteristics that can help distinguish them from legitimate paperwork. These features might include unusual formatting, inconsistent language, or vague information that cannot be verified. Below are some common signs that a document may not be trustworthy:

- Unprofessional layout or strange fonts

- Vague or missing contact details

- Absence of official stamps or signatures

- Inconsistent or unusual terms and conditions

How to Detect a Fake Financial Document

It is important to be vigilant when reviewing financial paperwork. Scrutinizing each detail can help reveal discrepancies that suggest a document has been fabricated. Some helpful steps include:

- Compare the document with known authentic forms

- Verify contact information through independent sources

- Look for official seals or verifiable signatures

Consequences of Using False Financial Documentation

Relying on fabricated financial documents can lead to serious consequences. From legal issues to financial loss, individuals involved in fraudulent activities face penalties and significant risks. It is essential to avoid using deceptive papers to safeguard one’s reputation and avoid legal trouble.

Protecting Yourself from Financial Deception

Awareness and caution are key to protecting yourself from scams. Always verify any financial paperwork before proceeding with any decisions. Utilize trusted sources for verification, and consider seeking legal advice when necessary to ensure that all documents are legitimate.

Understanding Fraudulent Financial Documents

Deceptive financial paperwork can appear convincing, leading individuals to make decisions based on false information. Recognizing the key characteristics of such documents is essential to avoid falling victim to scams. These documents are often designed to mislead recipients, making it crucial to examine them carefully before proceeding with any action.

What makes a financial document misleading is often subtle but significant. Common indicators include inconsistent formatting, missing official markings, and irregular language. These signs may not always be immediately obvious, but a closer inspection can reveal discrepancies that expose their fraudulent nature.

Counterfeit documents typically feature signs like unprofessional layout, vague terms, or a lack of verifiable contact information. The absence of necessary details such as official seals or signatures is a major red flag. A legitimate document should have clear and verifiable identifiers that can be cross-checked with official sources.

Using or relying on fabricated financial papers carries serious consequences. From potential legal action to financial penalties, individuals involved in such activities may face substantial risks. It’s important to understand that using fraudulent documents can result in legal charges and reputational damage.

Borrowers who encounter fraudulent financial documents may experience significant personal and financial repercussions. These include the possibility of being scammed, facing wrongful claims, or losing trust in legitimate institutions. Being cautious and well-informed can help mitigate these risks.

To verify whether a financial document is legitimate, it’s crucial to cross-check the information with trusted authorities or organizations. Contacting the issuing institution directly or using online resources to confirm details can ensure the authenticity of the document.

To avoid falling victim to deceptive paperwork, always ensure you are working with verified and trusted sources. Double-check the credentials of anyone offering financial services and be cautious when faced with documents that seem too good to be true. By staying informed and cautious, you can protect yourself from scams and fraudulent activities.