Chargeback Template Letter for Disputing Transactions

When you find discrepancies in your financial statements due to an unexpected or erroneous transaction, it’s crucial to take action promptly. Writing a formal request to reverse the charge is a necessary step to resolve the issue and recover your funds. This guide outlines how to structure such a request clearly and professionally, ensuring that you provide all the necessary information for a successful outcome.

Essential Information to Include

When crafting your reversal request, it’s important to be specific and concise. Including all relevant details helps to avoid delays or confusion in the process. Here are some critical points to cover:

- Transaction details: Mention the date, amount, and description of the charge in question.

- Reason for the dispute: Clearly state why the transaction should be reversed. Whether it’s due to fraud, a duplicate charge, or an unsatisfactory service, be sure to explain thoroughly.

- Supporting documentation: Attach any evidence that supports your claim, such as receipts, correspondence, or proof of unauthorized activity.

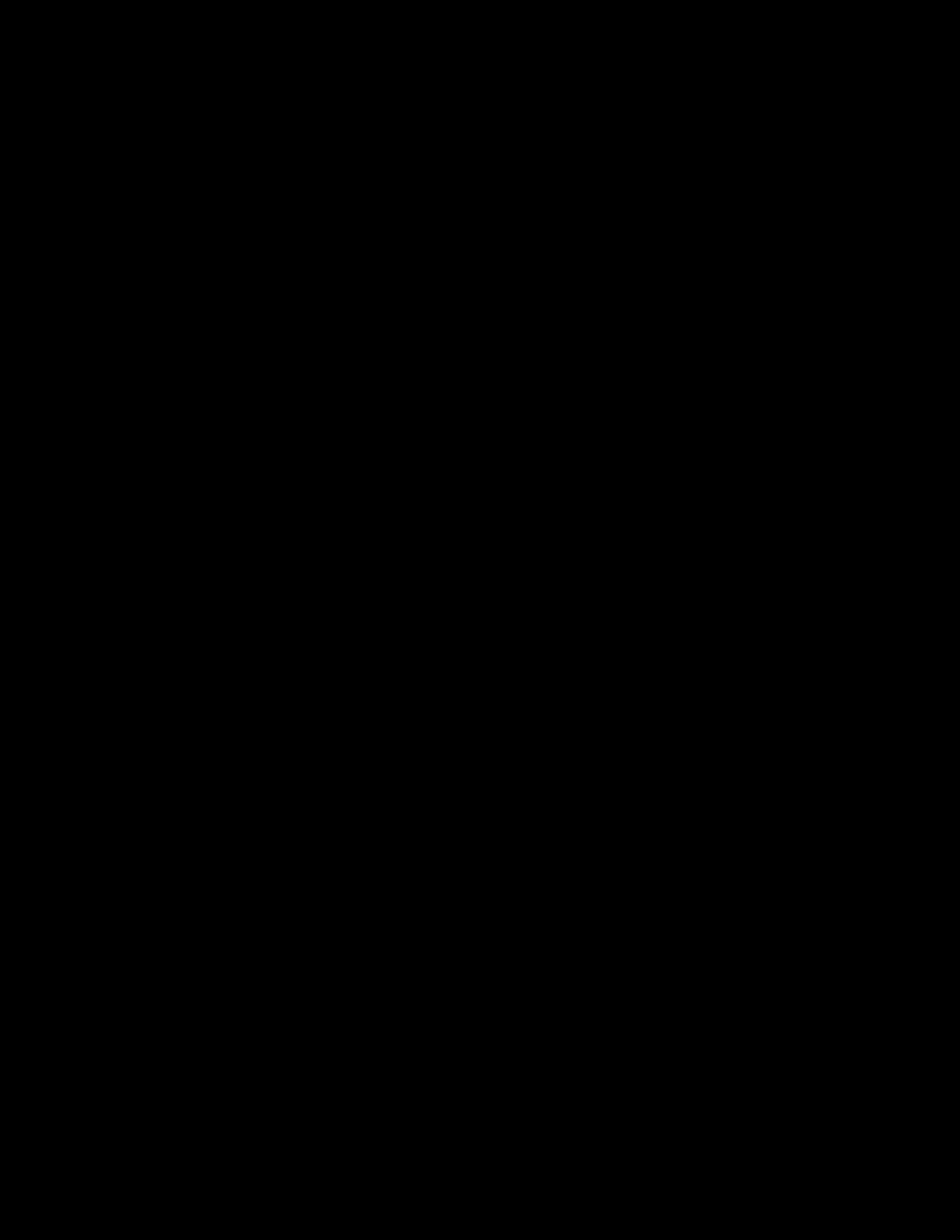

Structure Your Request Professionally

It’s essential to maintain a professional tone and format throughout your communication. A well-structured request can increase your chances of a favorable response. Follow these basic steps:

- Start with a formal greeting: Use a polite and respectful salutation, addressing the recipient appropriately.

- State your intention: Begin with a clear statement of your goal – to reverse the charge in question.

- Provide detailed information: Include all the transaction details and reasons for your dispute.

- Request a resolution: Ask for the desired outcome, such as the reversal of the charge or further investigation into the issue.

- End with a courteous closing: Sign off professionally, thanking the recipient for their attention and assistance.

What to Do if Your Request is Denied

In some cases, your initial request may not be successful. If this happens, don’t be discouraged. Consider the following options:

- Review the reason for denial: Ensure you fully understand why your request was rejected. There may be missing information or other issues to address.

- Provide additional evidence: If necessary, gather more documentation that supports your claim.

- Appeal the decision: If the issue persists, you may have the option to escalate the matter to a higher authority or seek external support.

By following these steps and staying persistent, you can increase the likelihood of a successful resolution to your dispute.

How to Handle Transaction Disputes Effectively

When dealing with an unexpected or unauthorized charge, it’s essential to take appropriate action by submitting a formal request to reverse the transaction. This process involves providing a clear explanation, supporting documents, and a structured request to ensure your claim is properly addressed. Below, we cover the key steps in submitting such a request and potential challenges you may face during the process.

Key Steps in Writing a Dispute Request

To begin the process of resolving an unwanted charge, it’s crucial to write a well-organized and clear request. Focus on providing all necessary details to make the process as straightforward as possible. Here are the essential steps:

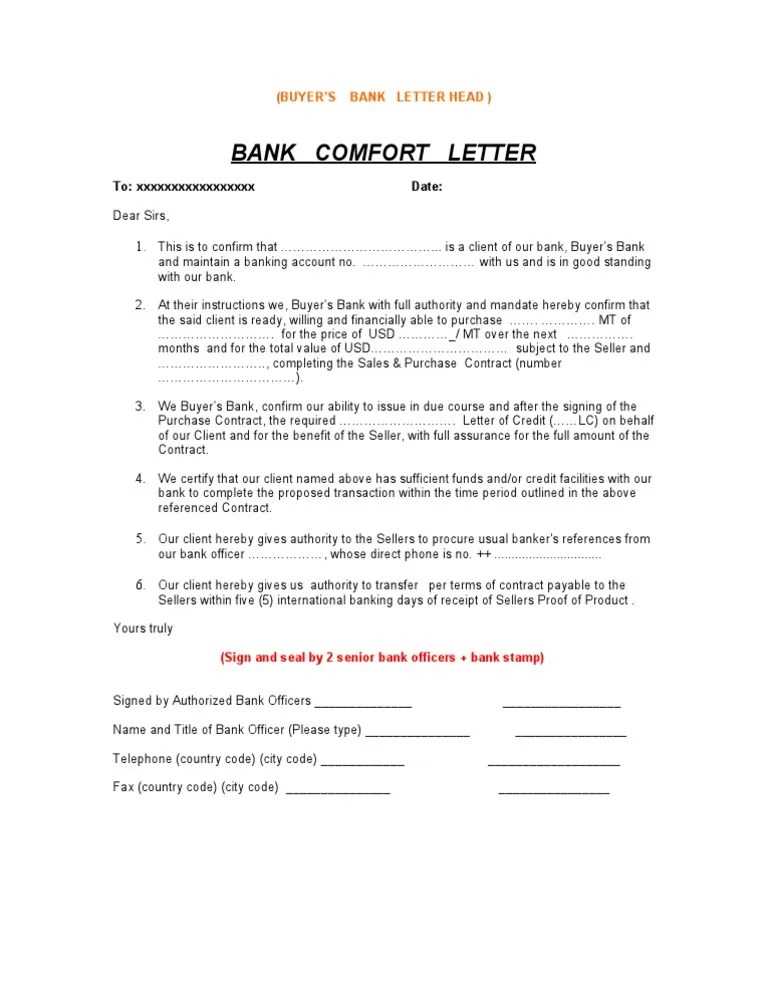

- Identify the charge: Clearly mention the transaction details such as date, amount, and merchant name.

- State the issue: Explain the reason for disputing the transaction, whether it’s an error, unauthorized charge, or poor service.

- Provide supporting evidence: Attach any relevant documents like receipts, email correspondences, or proof of fraud.

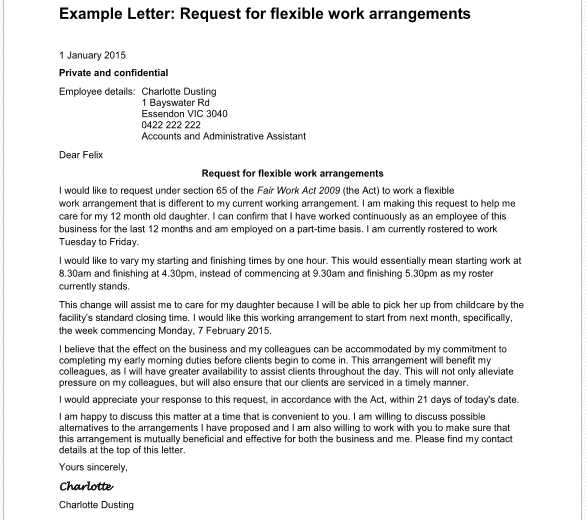

Important Information to Include in Your Dispute

Accurate information is vital for ensuring your dispute is processed without unnecessary delays. Make sure to include:

- Full transaction details: Date, amount, and description of the charge.

- Your contact information: Make it easy for the recipient to reach you for follow-up.

- Proof of communication: Include any correspondence you’ve had with the merchant regarding the issue.

Common Errors to Avoid

When drafting your dispute request, be mindful of common mistakes that could jeopardize your claim. Some common issues to avoid are:

- Incomplete or inaccurate details: Missing or incorrect information can delay the resolution process.

- Unclear reasoning: Vague explanations may not provide sufficient grounds for the dispute.

- Lack of supporting documents: Failing to include proof can result in your request being dismissed.

How Long Does the Dispute Process Take?

The time it takes to resolve a dispute can vary, depending on the institution and the nature of the charge. Typically, the process may take anywhere from a few days to several weeks. It’s important to stay informed and follow up if necessary.

Handling Rejected Claims

If your request is rejected, it’s essential to review the reason carefully. In many cases, you may be able to appeal the decision by providing additional evidence or clarifying certain aspects of your claim. Be persistent and explore all options available to ensure a favorable outcome.