Past Due Payment Letter Template for Effective Collection

When managing business transactions, it’s crucial to maintain clear communication with clients who have missed their financial obligations. Sending a formal request for outstanding balances is an essential part of this process. Knowing how to craft a professional and polite message can significantly improve the chances of securing the owed amount without damaging business relationships.

Understanding the structure of a request is key to making it effective. A well-composed message ensures that the request is clear, respectful, and easy to follow, making it more likely that the recipient will take the necessary actions to resolve the matter. This approach helps avoid misunderstandings and encourages prompt attention to the outstanding balance.

In the following sections, we will explore the essential components that should be included in a request, common pitfalls to avoid, and tips for personalizing your communication. By the end, you’ll have a strong understanding of how to approach this task with confidence and professionalism.

Crafting an Effective Payment Reminder

When requesting outstanding amounts from clients, the tone and structure of your communication play a critical role in the outcome. The objective is to create a message that is firm yet respectful, ensuring the recipient understands the importance of resolving the matter while maintaining a positive relationship. A well-crafted reminder not only increases the likelihood of receiving funds but also reflects professionalism and efficiency.

Key Elements of a Strong Request

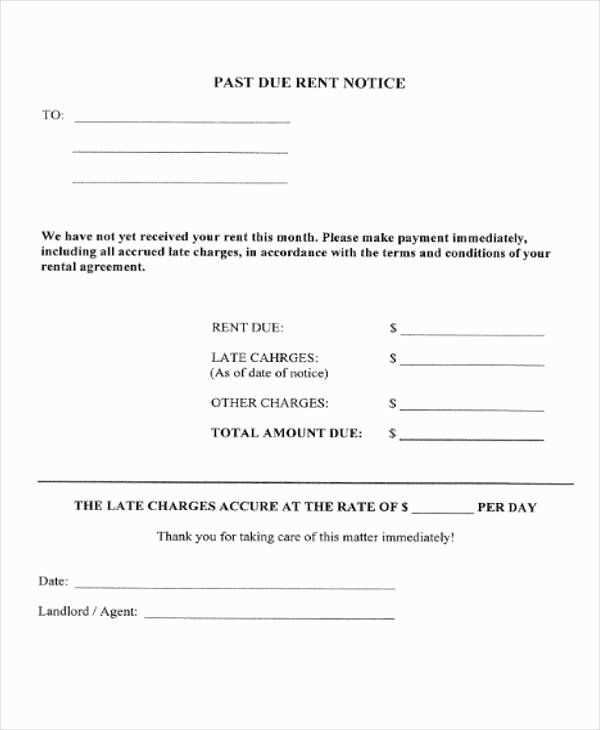

- Clarity: Be specific about the amount owed and the time frame for action.

- Politeness: Maintain a respectful and understanding tone to avoid confrontation.

- Details: Provide clear instructions on how to settle the balance and any consequences for non-payment.

- Professionalism: Ensure that the language used is formal and businesslike.

Tips for Effective Communication

- Start with gratitude: Acknowledge the client’s previous business to maintain goodwill.

- Be concise: Keep the message brief and to the point, focusing on the key issue.

- Follow up: If there’s no response, send a polite reminder to reinforce the urgency.

By incorporating these elements and tips, you ensure that your communication is both professional and effective in encouraging prompt action while preserving strong business relationships.

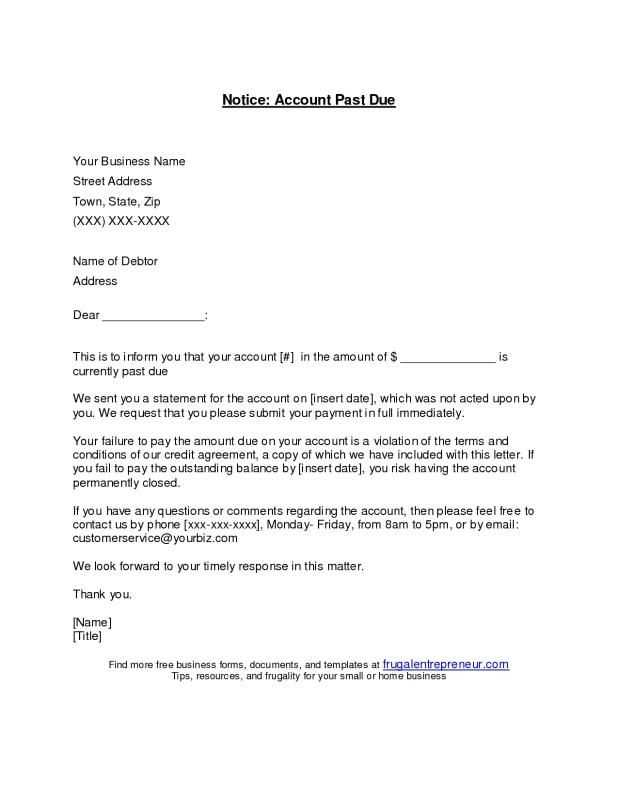

Essential Elements for Clear Communication

To effectively request overdue amounts, clear and concise communication is crucial. A well-structured message ensures that the recipient understands the situation and the required actions. When crafting a reminder, it is important to include specific details that leave no room for confusion and encourage timely resolution of the matter.

Key Components for Clarity

- Clear Identification: Start by clearly identifying the amount owed, the services or products involved, and the date of the original transaction.

- Specific Instructions: Clearly outline the steps the recipient needs to take in order to settle the outstanding balance.

- Professional Tone: Use formal and respectful language throughout the message to maintain a positive relationship.

- Timelines: Include a clear deadline for when the matter should be resolved, along with any consequences for non-compliance.

Strategies for Effective Communication

- Be Direct: Avoid unnecessary information and get straight to the point.

- Maintain Politeness: Even when addressing a financial issue, it’s important to remain courteous and professional.

- Provide Contact Information: Offer a way for the recipient to reach out if they have questions or need assistance in completing the transaction.

By including these elements, your communication will be clear, professional, and effective, ultimately leading to better outcomes and maintaining strong business relationships.

How to Politely Request Overdue Payments

When asking for outstanding funds, the tone of your communication is key to maintaining a positive relationship with the recipient. While the issue at hand is financial, a respectful and polite approach can help encourage action without creating unnecessary tension. The goal is to remind the recipient of their obligation while ensuring they feel comfortable addressing the matter promptly.

Here are some steps to take when crafting a polite request:

| Step | Action |

|---|---|

| 1 | Start with a courteous greeting and express appreciation for their business. |

| 2 | Politely remind them of the outstanding balance and the agreed-upon terms. |

| 3 | Offer assistance in case there are any issues with processing the transaction. |

| 4 | Set a clear deadline for resolving the matter, with a gentle reminder of potential consequences if not addressed. |

| 5 | End with an invitation for them to reach out if they need further clarification. |

By following these steps, you can effectively request overdue amounts in a way that encourages a positive response and maintains professionalism throughout the process.

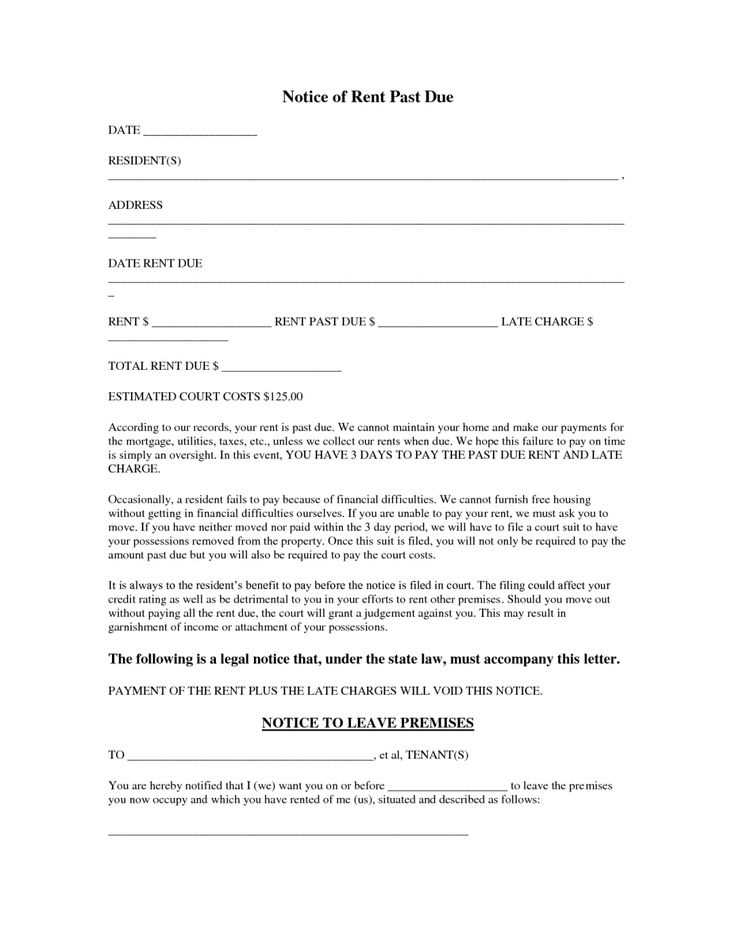

Structuring Your Payment Request Letter

When drafting a formal request for overdue amounts, it’s essential to ensure that the structure of your message is logical and easy to follow. A well-organized message helps the recipient quickly understand the issue and take the necessary steps to resolve it. Proper structure not only improves clarity but also conveys professionalism, making it more likely that the recipient will respond promptly.

Here are some key components to include in your request:

- Introduction: Start with a polite greeting and a brief acknowledgment of the recipient’s past business or collaboration.

- Clear Explanation: State the outstanding amount and provide specific details about the transaction, including dates and relevant terms.

- Request for Action: Politely but clearly ask the recipient to settle the balance by a specific date.

- Offer Assistance: Include an option for the recipient to contact you if there are any issues or questions regarding the transaction.

- Closing: Finish with a polite thank you and an invitation to get in touch if needed.

By organizing your message with these components, you can ensure that your request is clear, respectful, and likely to prompt a timely response from the recipient.

Tips for Maintaining Professional Tone

When addressing financial matters, maintaining a professional tone is essential to ensure that your communication is both effective and respectful. A well-balanced tone fosters a sense of professionalism and encourages a positive response from the recipient. Striking the right balance can prevent misunderstandings and ensure that your message is taken seriously while preserving a positive relationship.

Here are some valuable tips to keep in mind when crafting your communication:

- Be Polite and Courteous: Use respectful language and avoid any phrasing that could be interpreted as confrontational or aggressive. Always begin with a polite greeting and end with gratitude.

- Use Clear and Neutral Language: Stick to neutral, clear, and factual language. Avoid emotional or overly strong words that could create tension.

- Avoid Threatening Phrases: Refrain from using ultimatums or threats. Instead, focus on providing a constructive solution or timeline for resolution.

- Be Concise and Direct: While it’s important to be polite, it’s also crucial to get to the point quickly. Long-winded messages can dilute the effectiveness of your communication.

- Empathize with the Recipient: Acknowledge any difficulties the recipient might be facing. Offering flexibility or assistance can foster goodwill and show understanding.

By following these guidelines, you will ensure that your communication is professional, polite, and effective, helping to maintain strong business relationships and encouraging prompt resolution of the issue at hand.

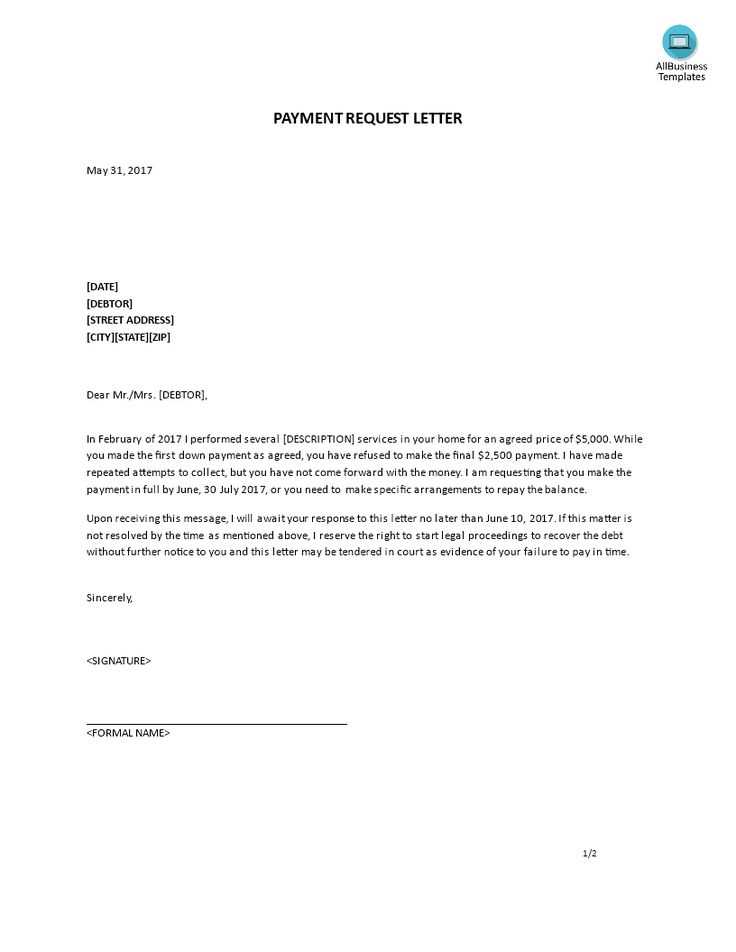

Customizing Letters for Different Situations

Not all situations call for the same approach when requesting overdue funds. Adapting your message to fit the specific context and the relationship with the recipient can greatly improve the chances of a positive outcome. Whether the delay is due to a misunderstanding, financial hardship, or simple oversight, tailoring your communication will help ensure it is both effective and appropriate.

Understanding the Context

The first step in customizing your message is understanding the situation at hand. Consider factors like the recipient’s previous history with your business, the length of the delay, and whether they have encountered any challenges that might have affected their ability to fulfill the obligation. Adjust your tone and the level of urgency based on these details.

Adapting the Tone and Approach

In some cases, a gentle reminder may suffice, while in others, a firmer request may be necessary. If the recipient is a long-time partner, for example, a polite and empathetic approach might be more effective. On the other hand, if the situation is more critical, you might need to be more direct while still maintaining professionalism.

By considering these factors and adjusting your message accordingly, you can improve the likelihood of resolving the issue promptly while maintaining good business relationships.

Legal Implications of Payment Requests

When requesting outstanding amounts from clients or customers, it’s crucial to understand the potential legal implications involved. Failure to adhere to proper procedures or making certain types of demands could expose businesses to legal challenges. Ensuring compliance with relevant laws and regulations is essential to avoid disputes and protect your rights as a creditor.

Understanding the Legal Framework

In many jurisdictions, there are specific laws governing the collection of unpaid debts. These laws dictate how and when funds can be requested, as well as what actions can be taken if payment is not made. It is important to familiarize yourself with these laws to avoid taking illegal or unethical steps, such as making threats or using aggressive tactics to enforce payment.

What You Can and Cannot Do

While requesting outstanding amounts is your right, it is essential to do so within the boundaries of the law. For instance, harassment, threats, or public shaming are prohibited in many legal systems. It’s important to maintain a professional approach that adheres to legal norms, ensuring that any communication is respectful, clear, and accurate.

By staying informed and compliant with applicable regulations, businesses can minimize legal risks and foster smoother relationships with their customers, ultimately ensuring better financial outcomes without the need for legal intervention.