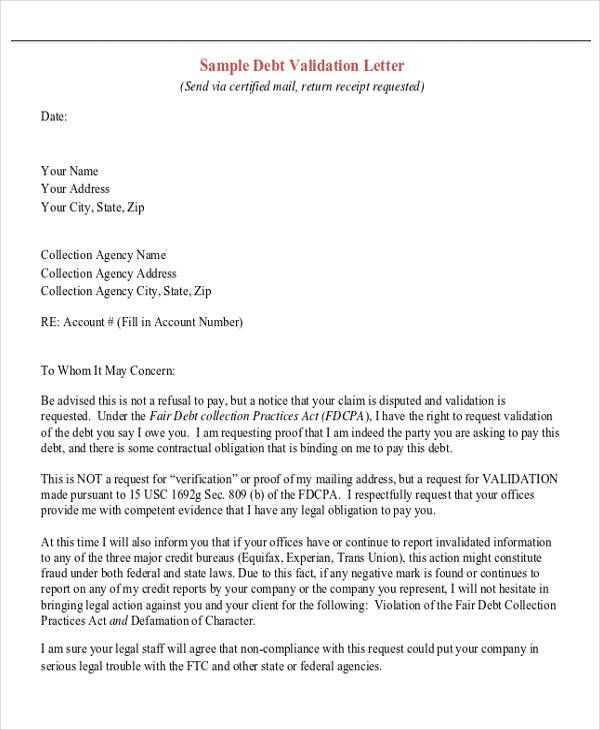

Collection Validation Letter Template for Debt Disputes

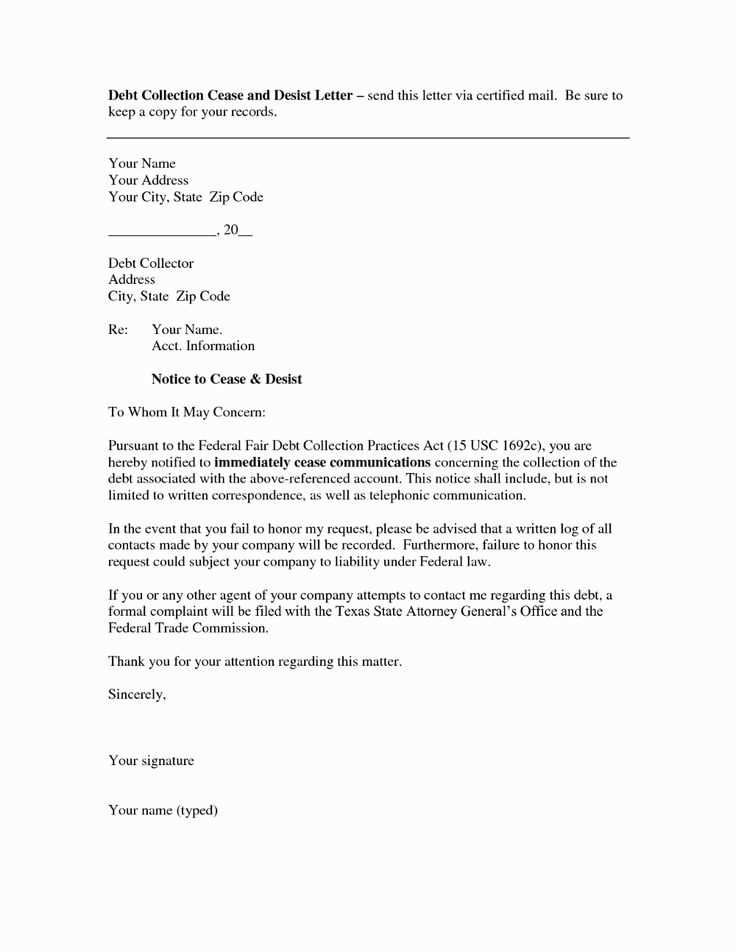

When dealing with disputed financial obligations, it is crucial to formally request verification from the creditor. This process ensures that the debt is valid and that you are being asked to repay the correct amount. A well-constructed document serves as a formal approach to protect your rights and clarify any potential mistakes or misunderstandings.

Key Details to Include in the Request

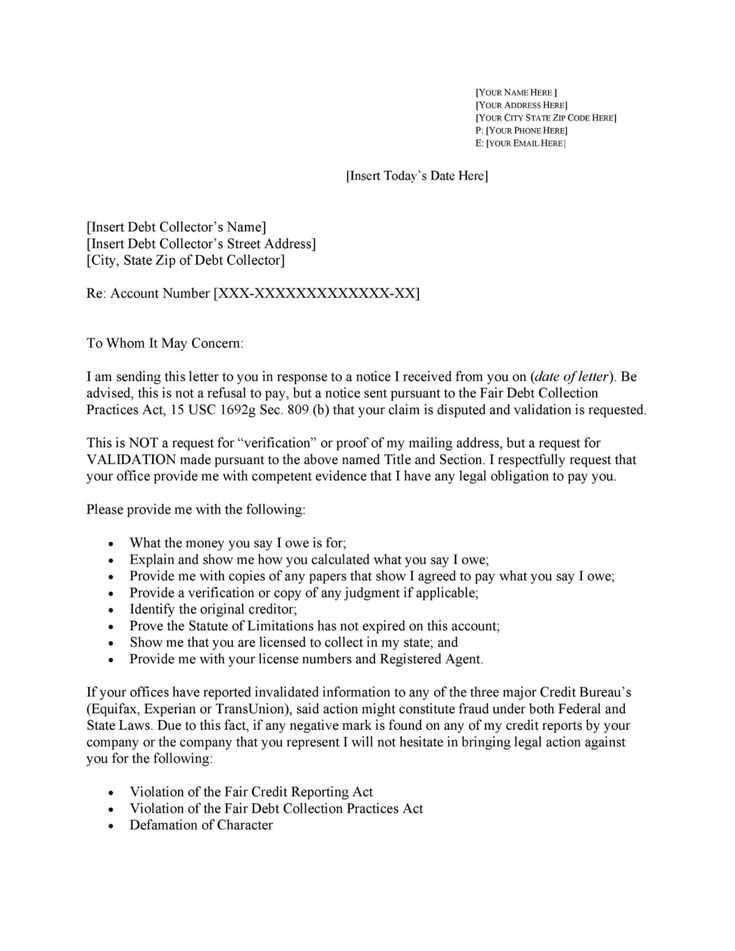

To craft an effective request, certain key components should be present. These elements ensure that your document meets legal requirements and facilitates clear communication with the creditor.

- Creditor Information: Include the full name, address, and contact details of the entity you are addressing.

- Debt Information: Clearly state the amount in question, along with relevant account or reference numbers.

- Your Information: Provide your full name, address, and any identifying account or customer numbers linked to the debt.

- Request for Verification: Explicitly ask for proof of the debt, including original documentation and any supporting evidence.

How to Personalize the Form for Your Situation

Tailoring the request to your specific circumstances is important. Customize the document to reflect the exact nature of your dispute and be sure to adjust the tone depending on the situation. Be clear, concise, and professional in your wording to maintain the formality of the communication.

Avoiding Common Mistakes

While creating this formal request, avoid common errors that could lead to unnecessary delays or complications. Ensure that the document is free from any ambiguous or unclear language, and double-check for spelling and numerical mistakes. Inaccuracies in the debt details could complicate the verification process.

When to Send the Request

The timing of your request is crucial to the dispute process. Make sure to send it promptly after discovering a discrepancy or upon receiving a communication from the creditor. Keeping a record of your correspondence will help in case of further legal action.

Legal Rights and Protection

It’s essential to be aware of your rights during this process. You have the right to challenge inaccurate debt claims and ask for proof before making any payments. Familiarize yourself with consumer protection laws to better navigate this situation.

Overview of Debt Dispute Request Process

When facing a questionable financial obligation, it’s essential to formally ask for verification from the creditor. This official request helps ensure that the amount you are being asked to repay is accurate and substantiated. Crafting a clear and professional document is the first step in protecting your rights and clarifying any potential mistakes made by the creditor.

Importance of a Debt Dispute Request

A well-structured request serves as an important safeguard in cases of debt disputes. It not only ensures that you are being asked to repay a legitimate obligation, but also helps maintain a formal and documented communication trail that could be valuable if the matter escalates.

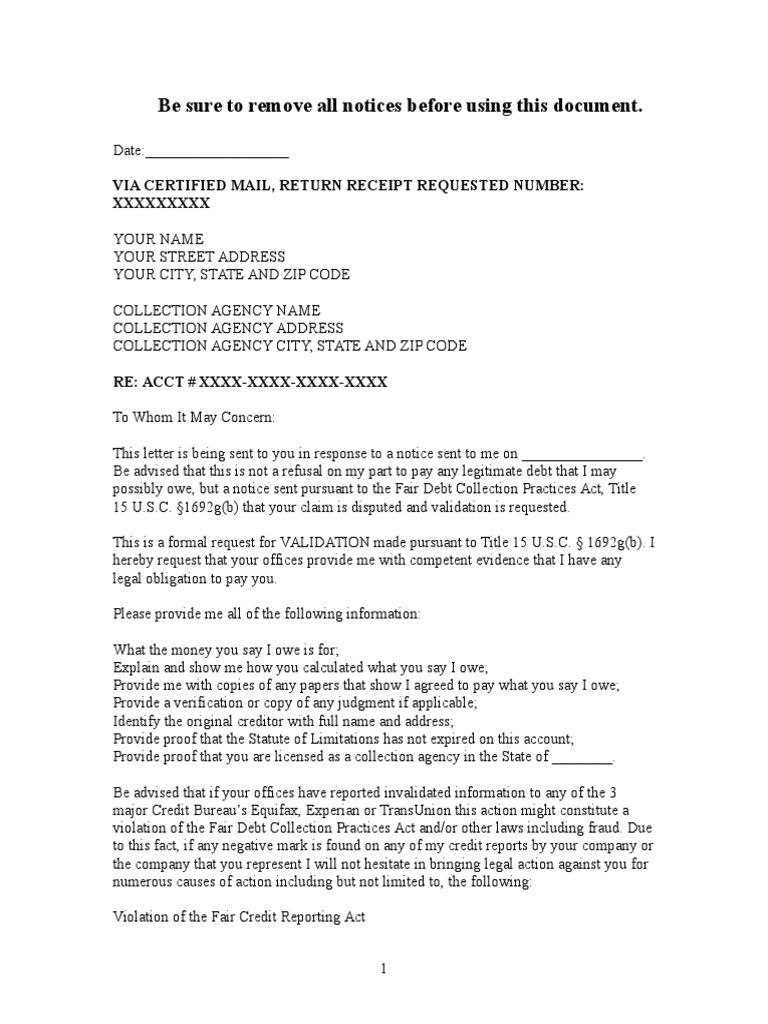

Essential Information to Include in the Document

To ensure the request is effective, several key details should be included:

- Creditor’s Details: Full name, address, and contact information of the party you are addressing.

- Debt Information: The specific amount of money in question, along with any associated account or reference numbers.

- Your Details: Your full name, address, and relevant account numbers tied to the debt.

- Request for Evidence: A direct request for proof of the debt, asking for documentation or other evidence of the obligation’s legitimacy.

How to Tailor Your Form for the Situation

Adapting the request to your specific situation is vital for clarity. Customize it to fit the exact nature of the dispute, adjusting the tone depending on the circumstances. Be precise and professional in your language to avoid confusion or unnecessary delays in the process.

Common Errors to Avoid

While drafting the request, make sure to avoid common mistakes that could weaken your position. Double-check the details of the debt, ensuring there are no errors in the amount or reference numbers. Keep the language clear and direct, as ambiguity can lead to unnecessary back-and-forth or misinterpretation.

Timing of Your Request

It’s important to act quickly after identifying a possible issue with a debt claim. Sending the request soon after receiving a notice or discovering discrepancies can help resolve the matter swiftly. Be sure to keep a record of the correspondence for future reference or legal action if needed.

Legal Rights in Debt Disputes

Understanding your legal rights is essential in this process. As a debtor, you have the right to request proof of any debt that you are being asked to repay. Familiarize yourself with the relevant consumer protection laws to ensure that you are not held responsible for erroneous claims.