Confirmation of Salary Letter Template for Employers

In various professional and personal situations, individuals may be required to provide proof of their earnings. This is often necessary for securing loans, renting property, or verifying employment status for various purposes. A properly structured document can serve as reliable evidence of a person’s income history and employment details.

Employers typically issue these statements, which can be essential for both employees and external parties needing accurate income information. The format of these documents should be clear, concise, and contain specific details to ensure their validity. A well-written statement can make all the difference in professional and financial matters.

When creating such a document, it is important to follow a standard structure, ensuring all relevant data is included. This guide will explore the key elements needed and how to craft an effective income verification form. With the right approach, the process can be straightforward and beneficial for both parties involved.

Many situations require individuals to verify their earnings or job status for various purposes, such as applying for loans, renting a property, or completing government paperwork. In these cases, a formal document proving employment and income is often requested. This type of verification serves as official proof for external parties, providing them with accurate and trustworthy details.

Employers play a vital role in issuing these statements, as they are the source of the information regarding an individual’s job and compensation. The need for such documents arises from a variety of practical and legal reasons, ensuring that individuals can provide reliable information when needed. Understanding why and when these documents are required helps both employees and employers prepare and respond efficiently.

Furthermore, in an increasingly regulated environment, this documentation helps maintain transparency in financial and professional dealings. The clarity and accuracy of these forms protect both the person requesting the information and the one providing it, ensuring the integrity of the verification process.

Key Details to Include in a Document

When creating an official statement about an individual’s employment and earnings, it is essential to ensure that certain information is included to make the document both clear and credible. These details will not only validate the document but also provide the recipient with the necessary data to make informed decisions. Each section of the document plays an important role in confirming the individual’s job status and compensation.

Essential Information for Accuracy

The following details should be included to ensure the document’s effectiveness and correctness:

| Detail | Description |

|---|---|

| Employee Name | Full name of the individual whose income is being verified. |

| Position | Job title or role within the company. |

| Employment Duration | The start date and, if applicable, the end date of employment. |

| Income Information | The employee’s pay, including the type of compensation (e.g., hourly, salaried). |

| Employer Information | The name and contact details of the company issuing the document. |

Formatting the Information

Besides including the essential details, the layout of the document is equally important. A clean and structured presentation makes the data easier to read and helps prevent misunderstandings. It is crucial to avoid any unnecessary jargon and stick to the most relevant facts, presented in a concise manner.

When drafting a document to validate an individual’s job and earnings, the structure is as important as the content itself. A clear, well-organized format ensures that all necessary information is easy to find and understand. The structure should allow for quick verification of key details, ensuring both the employee and the requesting party can trust the accuracy of the document.

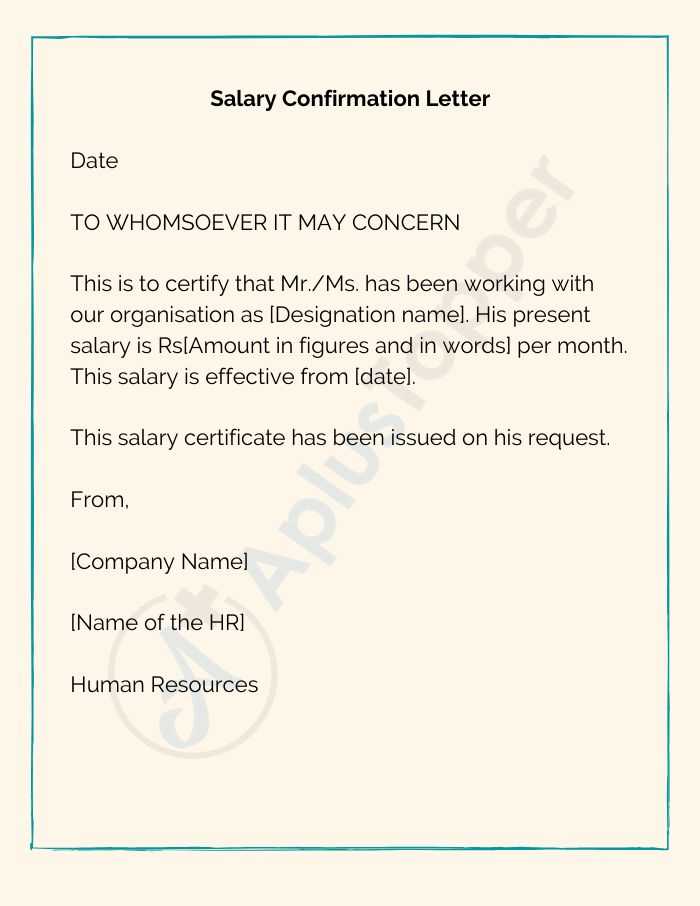

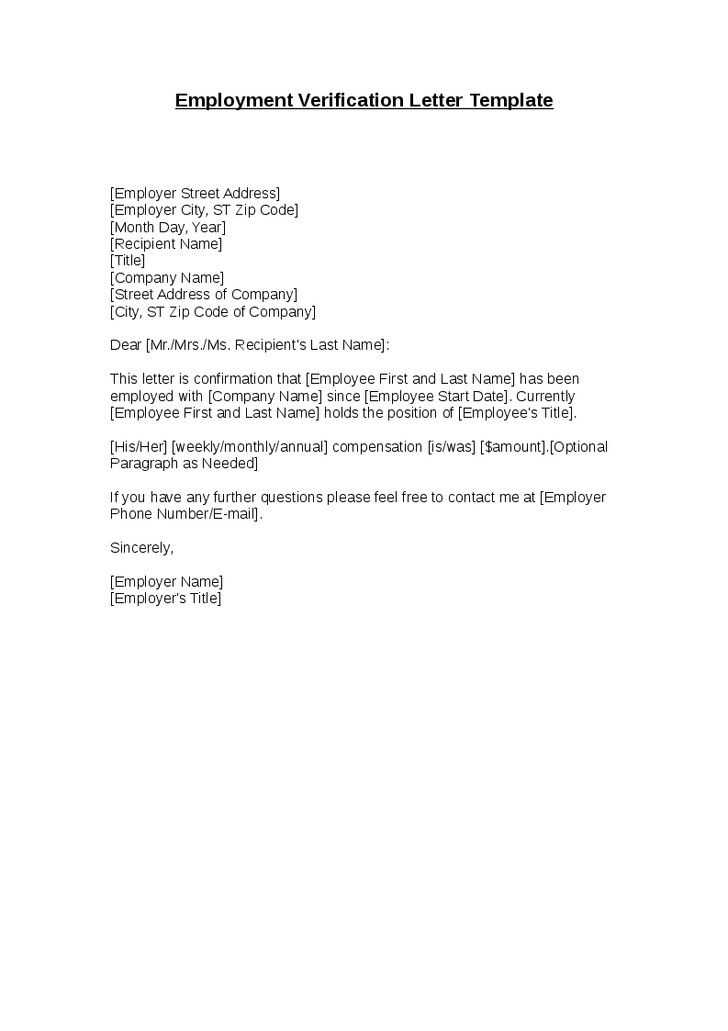

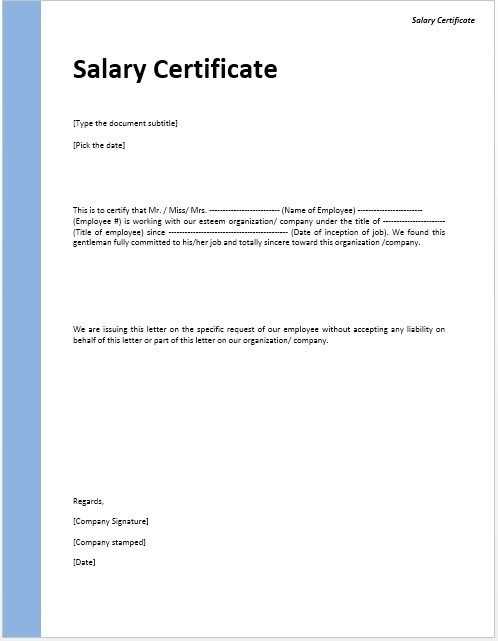

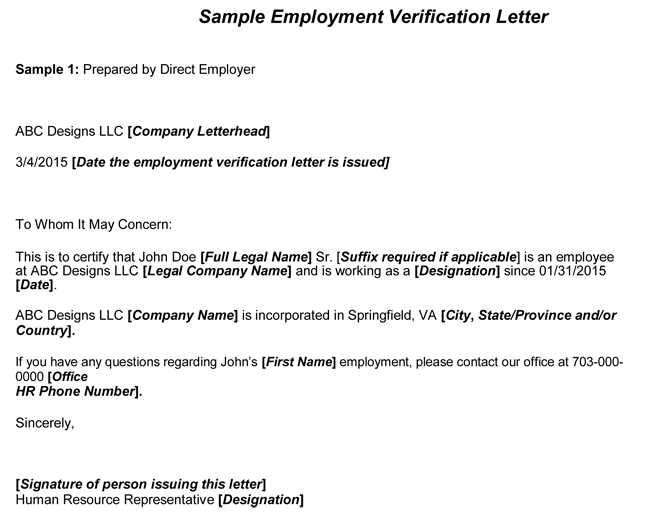

It is crucial to begin with an introductory statement that clearly outlines the purpose of the document. This should be followed by the main body of information, providing specific details about the employee’s position, compensation, and employment period. Concluding the document with a formal closing helps maintain professionalism and reinforces the validity of the statement.

Key Sections to Include:

- Introduction: State the intent of the document and identify the employee being verified.

- Job and Employment Details: Provide the individual’s role, dates of employment, and basic job description.

- Income Information: Clearly outline the compensation details, including any bonuses or additional earnings.

- Employer Details: Include the employer’s name, contact information, and any relevant signatures.

By following this structure, the document will meet both the legal requirements and the expectations of the requesting party, making it an efficient tool for confirming employment and compensation.

Steps for Creating a Pay Statement

Creating a formal document to verify an individual’s earnings involves a series of steps to ensure accuracy and professionalism. It is essential to follow a clear process, starting from gathering the necessary information to structuring the final document. Each step should be carefully executed to meet the needs of both the employee and the recipient requesting the proof of income.

Below are the key steps to follow when creating an income verification document:

- Gather Employee Information: Start by collecting essential details, including the employee’s full name, job title, and employment dates.

- Verify Income Details: Ensure that the income figures, including base pay, bonuses, and any other compensation, are accurate and up to date.

- Format the Document: Structure the information logically. Use headings, bullet points, and clear paragraphs to make the document easy to read.

- Include Employer Information: Provide the name, position, and contact details of the person issuing the document, along with the company’s official details.

- Review and Finalize: Double-check all details for accuracy and completeness. Make any necessary corrections before finalizing the document.

Following these steps will ensure that the document is both comprehensive and professional, meeting the requirements of the requesting party while protecting the integrity of the information provided.

There are various situations where an organization may need to provide an official document to verify an employee’s job details and compensation. These documents serve as formal proof for external parties and help facilitate various financial or legal processes. Employers are responsible for issuing these confirmations when requested, ensuring that all information is accurate and up to date.

Common Scenarios for Issuing Documents

Companies typically provide such documents in the following situations:

- Loan Applications: Employees may need proof of income when applying for personal or home loans.

- Rental Agreements: Landlords may request verification of income before renting out properties.

- Visa or Immigration Processes: Government authorities may require income verification as part of a visa application or work permit process.

- Tax Purposes: Official verification is often needed to confirm earnings for tax filing or auditing purposes.

- Employment Verification for Other Employers: Prospective employers may ask for income details when conducting background checks.

Employer’s Role in Document Issuance

It is important that employers adhere to company policies and legal standards when issuing these documents. Ensuring confidentiality and compliance with labor laws is essential to maintain professionalism and protect both the employee’s and employer’s interests. These statements should be clear, concise, and include all necessary details to avoid confusion or delays in the verification process.

Avoiding Common Errors in Salary Statements

When creating a document to verify an individual’s job and earnings, accuracy is crucial. Small mistakes or omissions can lead to confusion, delays, or even legal issues. It’s essential to be aware of common errors that can undermine the reliability of the statement and take steps to avoid them. A well-crafted document not only serves its purpose but also reflects the professionalism of both the employee and the employer.

Some of the most frequent mistakes to avoid include:

- Incorrect Personal Details: Ensure the employee’s name, job title, and other personal information are accurate. Even minor errors in this section can affect the credibility of the document.

- Missing Income Information: Failing to include complete pay details, such as base salary, bonuses, or other forms of compensation, can render the document incomplete.

- Inconsistent Dates: Double-check the dates of employment and the period being verified. Incorrect or unclear dates may create confusion.

- Unclear Formatting: Avoid cluttered or hard-to-read layouts. A clean, organized structure makes the document more professional and easier to understand.

- Omitting Employer Details: Always include the employer’s contact information and signature when applicable. This ensures the document is legitimate and can be verified if needed.

By paying close attention to these details, employers can ensure their verification documents are both accurate and effective, avoiding potential issues that may arise from poorly drafted statements.