Bank Account Verification Letter Template

When dealing with official matters, you may be asked to provide confirmation of your financial details. This kind of communication is essential in various situations, such as applying for loans, verifying identity, or confirming ownership. Knowing how to create an effective document for these purposes can help you avoid complications and ensure a smooth process.

Why You May Need Such Documentation

In many financial transactions, it is important to prove the legitimacy of your resources. Whether you are seeking approval for a credit line, confirming your business transactions, or complying with legal regulations, presenting formal proof of your financial status is crucial. Without proper verification, your request could be delayed or denied.

Essential Details to Include

- Your Full Name: Ensure that your name is clearly stated as it appears in your financial institution records.

- Financial Institution Information: Provide the name and address of the organization that holds your funds.

- Confirmation of Funds: Mention the type of services or products you are being verified for and include necessary numbers such as account numbers or reference codes (if applicable).

- Date: Including the date helps establish the relevancy of the document.

How to Tailor Your Document

Each request may have slightly different requirements. If you need to send this communication to a government agency, for example, be sure to follow their instructions carefully. You may need to adjust the tone or content of your message, so it fits the situation. Customizing the document ensures that all the necessary information is included and that the recipient receives what they need for a decision to be made.

Common Mistakes to Avoid

- Incorrect or Missing Information: Double-check that all details are accurate and up-to-date to avoid delays.

- Using an Unprofessional Format: Avoid using casual language or unclear structure. Keep the document formal and precise.

- Failure to Provide Proof: Be sure that any required supporting documents, such as identification or financial statements, are attached if needed.

By following these guidelines, you can create a professional and complete document that will assist in getting your financial details confirmed quickly and easily. Whether you need it for personal or business purposes, having the right format and information will save you time and hassle.

When engaging in financial matters, it is often required to confirm the existence and details of a specific financial resource. This formal document ensures that the information shared with institutions or organizations is both accurate and legitimate. The process of drafting such a document is crucial to smooth transactions and compliance with various regulations.

Why This Document Is Important

This formal piece serves to confirm that the information provided about the financial resource is accurate. It is frequently required in situations such as loans, transactions, and legal processes. The importance of this document lies in ensuring transparency and reliability between all involved parties.

Key Elements to Include

- Institution Details – Name, address, and contact information of the entity confirming the details.

- Client Information – Personal identification details of the individual involved.

- Confirmation Statement – A clear statement verifying the financial details.

- Dates – The relevant time frames for the verification process.

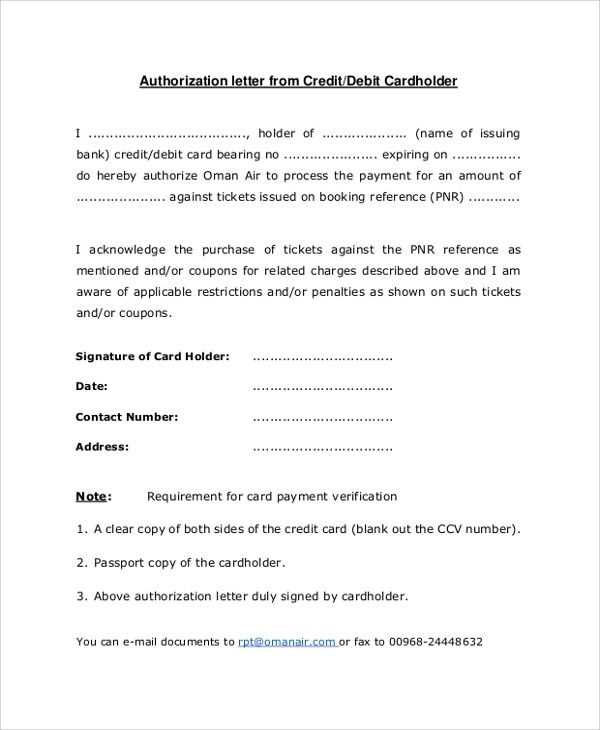

- Signature – Authorized signatures of the relevant personnel.

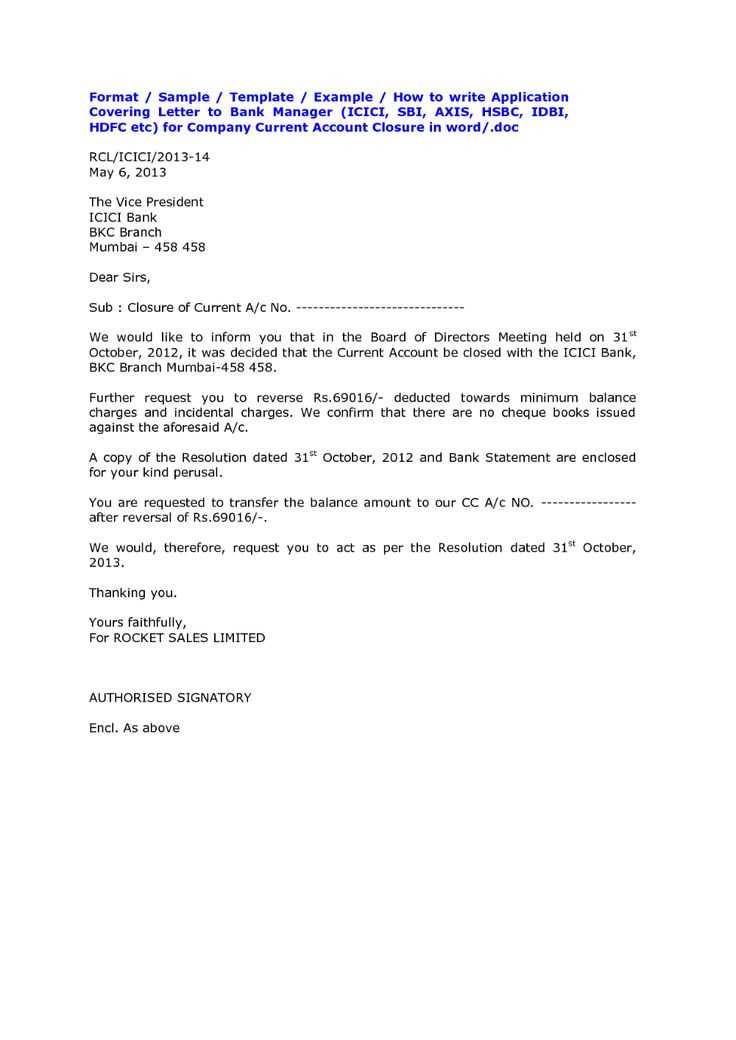

How to Customize the Document

Each instance may require slight adjustments depending on the specific needs of the transaction. Start by ensuring that the document reflects the correct details. Tailor the language used to match the level of formality needed by the institution requesting the information. It is also important to ensure that the tone remains professional and clear.

Common Mistakes to Avoid

- Incorrect Information – Ensure that all personal and institutional details are accurate to avoid delays.

- Missing Signatures – Lack of an authorized signature can render the document invalid.

- Failure to Meet Requirements – Always check the specific guidelines of the requesting party to ensure compliance.

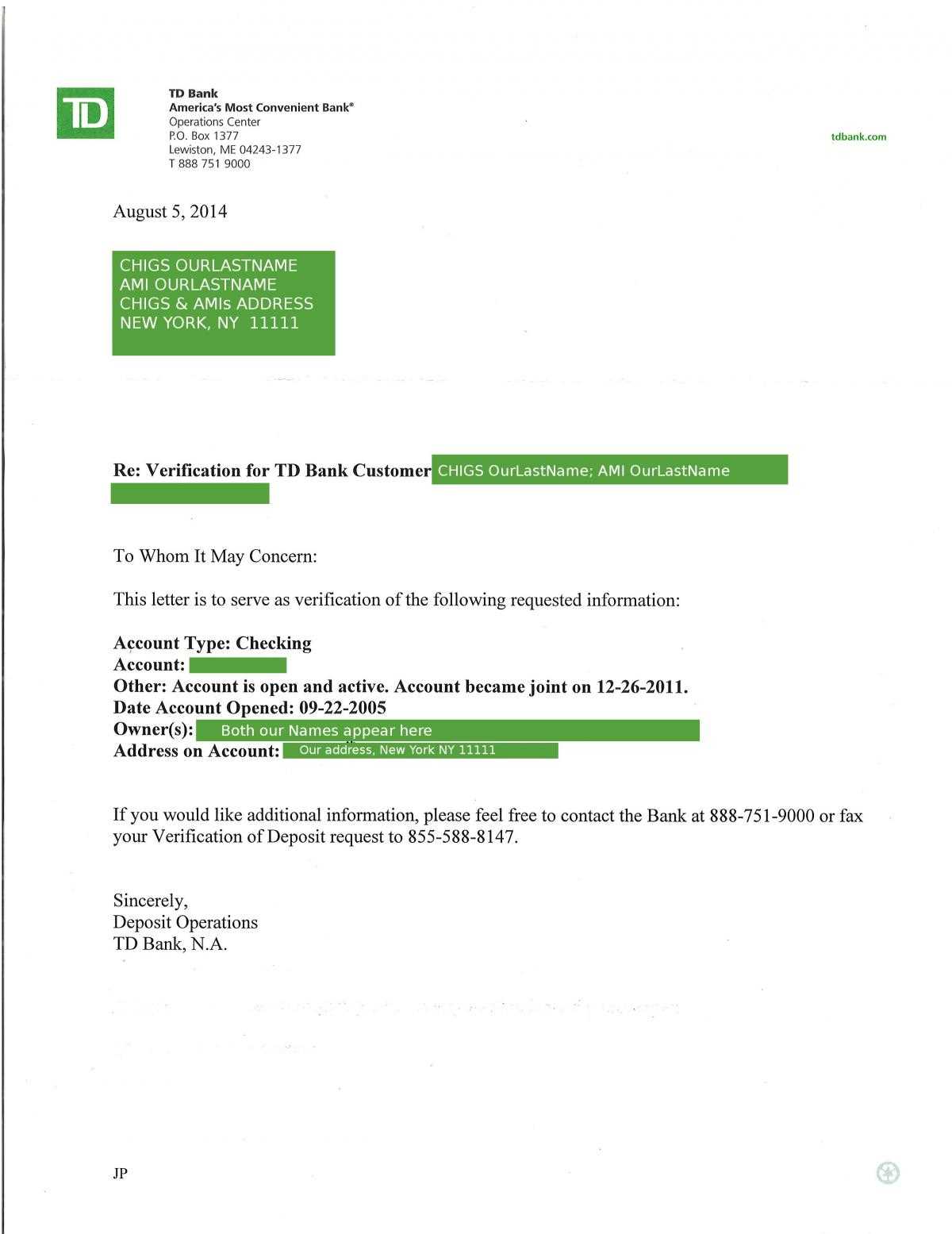

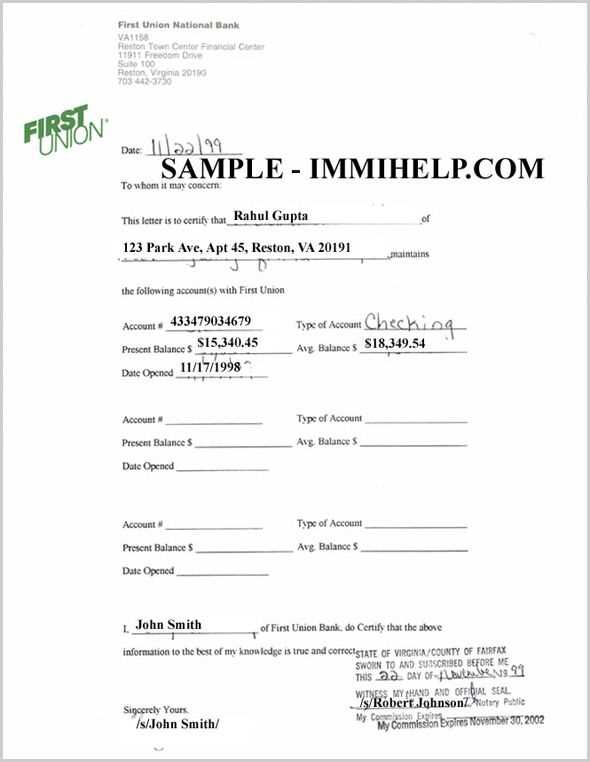

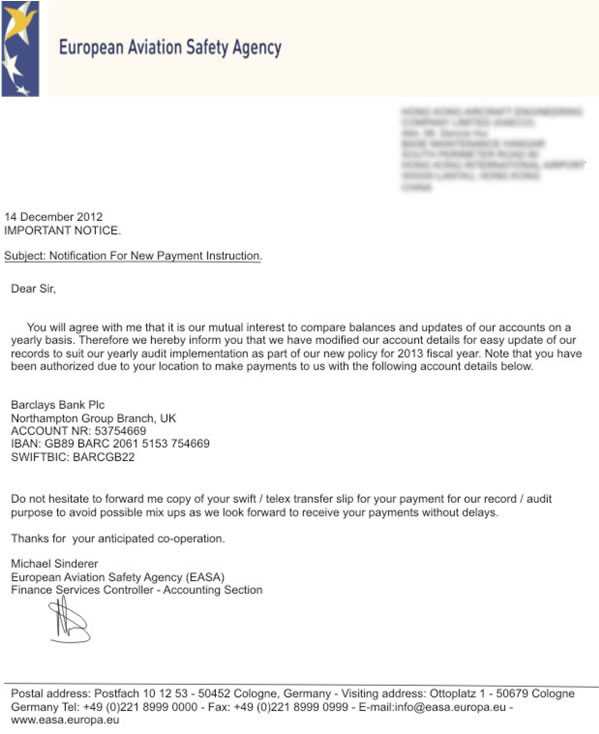

Example of a Valid Document

Here is an example of a properly formatted document. This should include all necessary elements such as accurate details, clear statements, and proper signatures. Ensuring every part is covered will make the process smoother.

How to Submit the Document

Submission methods vary by institution. Typically, this document can be submitted electronically or in hard copy. Always verify the preferred submission method to avoid delays or confusion.