Wage Garnishment Letter Template for Employees

When an individual’s wages are reduced due to a legal obligation, it’s crucial for employers to notify them in a professional and transparent manner. This process involves delivering a formal communication that outlines the necessary information and ensures compliance with applicable laws. A well-structured notification helps prevent confusion and maintains a respectful relationship between the employer and the individual.

Providing clear details about the deduction process, the amounts involved, and the timeline is essential. A properly crafted document not only addresses the legal aspects but also shows consideration for the recipient. Proper wording and format can make the difference between a smooth transition and potential misunderstandings.

Effective communication can alleviate stress, while also protecting the organization from legal issues. It’s important to ensure that the format of the communication is both legally sound and easy to understand. By using a clear structure and offering all the necessary details, employers can make the experience more manageable for everyone involved.

Understanding Payment Deduction Procedures

When a portion of an individual’s earnings is redirected to cover a financial obligation, employers must follow a structured procedure to ensure legal compliance. These procedures are essential for both the protection of the business and the rights of the individual. It is important for employers to understand how the process works, the necessary documentation, and the role they play in facilitating this process.

Legal Framework for Payment Reductions

Each jurisdiction has specific laws that govern how and when deductions can be made from an individual’s earnings. These rules are designed to protect workers from undue hardship while ensuring that the obligations are met. Employers must familiarize themselves with the legal guidelines to avoid potential disputes or violations. Ensuring that deductions are made in accordance with the law is crucial for maintaining fairness.

Steps for Implementing the Process

The process typically starts with a court order or legal agreement that specifies the amount and duration of the deduction. Once the formal directive is received, it is the employer’s responsibility to begin withholding the appropriate amount from the individual’s pay. Proper record-keeping, communication, and timely disbursement of the withheld funds are all essential aspects of this procedure. Transparency throughout the process ensures clarity for all parties involved, preventing confusion or disputes down the line.

Legal Requirements for Payment Deductions

The process of redirecting a portion of an individual’s earnings to fulfill a financial obligation is governed by strict legal standards. These regulations ensure fairness, prevent abuse, and protect the rights of the individuals involved. Understanding these legal requirements is crucial for employers to avoid legal issues and ensure that the deductions are processed correctly.

In most jurisdictions, there are specific rules regarding the maximum amount that can be withheld, the types of debts that qualify for such deductions, and the necessary documentation required to initiate the process. Employers must adhere to these laws to avoid potential lawsuits or penalties. It is also important to inform the individual of the deduction in a clear and transparent manner, complying with all notice requirements set by the law.

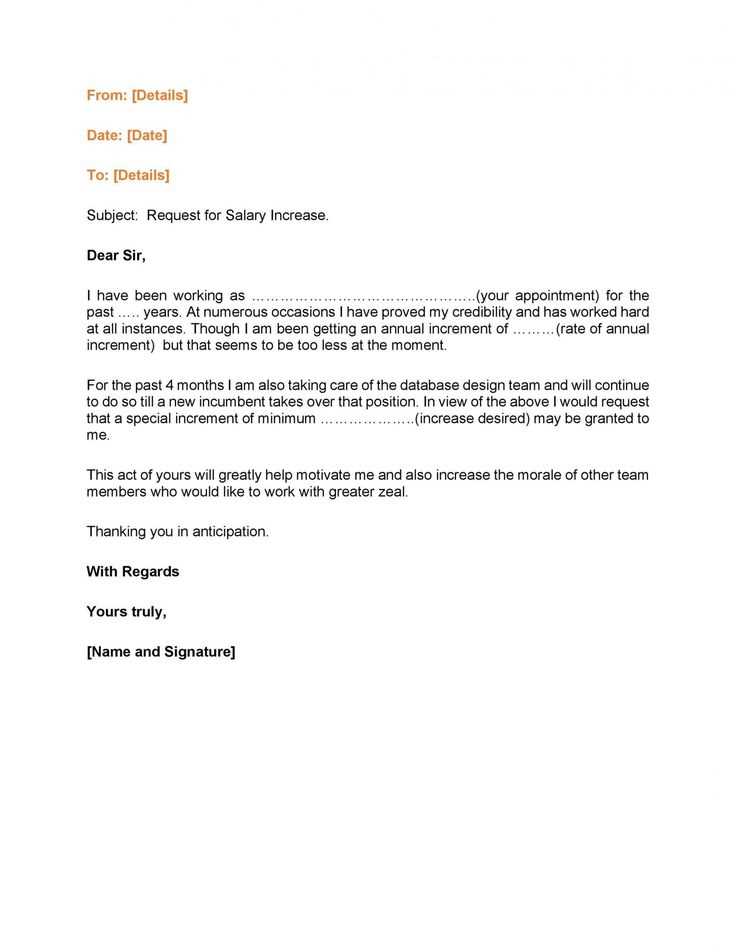

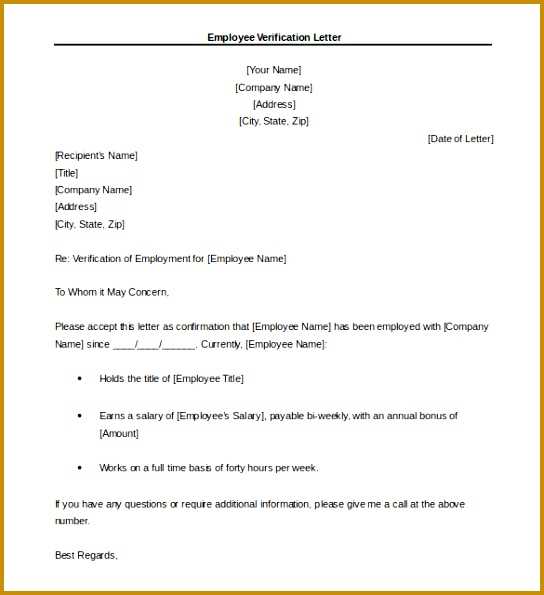

Steps to Draft an Effective Communication

Creating a well-structured communication for payment deductions involves clear, concise, and respectful language. This formal document must provide all the necessary details while adhering to legal requirements and maintaining professionalism. A carefully crafted message ensures that the recipient fully understands the situation and their rights within the process.

Include Key Information

Start by clearly stating the purpose of the communication and the reason behind the deduction. Provide specifics such as the amount, the duration, and any legal references that apply to the situation. It’s important to be transparent and ensure that the recipient can easily understand the information provided. A detailed explanation helps avoid confusion and potential disputes.

Maintain a Professional and Respectful Tone

While it’s essential to convey the seriousness of the matter, the tone should remain respectful and professional. Use language that is neutral and avoids sounding accusatory or harsh. Empathy and a sense of understanding go a long way in reducing the stress associated with such communications. Ensure that the individual is aware of their options and the support available to them, if applicable.

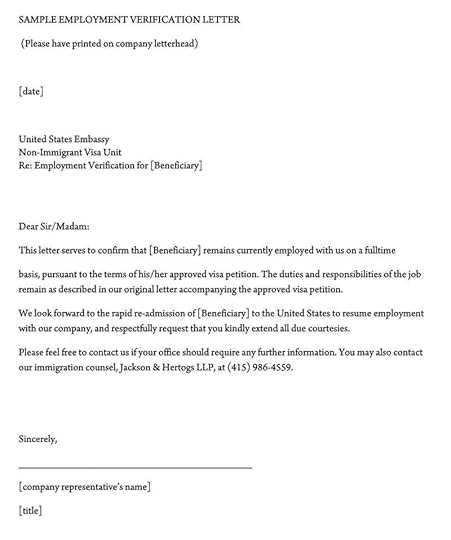

Key Elements of a Deduction Notification

An effective communication informing an individual about payment reductions must include all relevant information to ensure clarity and transparency. The notification should outline the necessary details, legal references, and the expected actions to avoid any misunderstandings or disputes. Properly including these key components is essential for maintaining both legal compliance and a respectful tone throughout the process.

Essential Information to Include

- Reason for Deduction: Clearly state the reason behind the deduction, referencing any legal orders or agreements.

- Amount and Frequency: Specify the exact amount being withheld and the duration or frequency of the deductions.

- Legal Basis: Include any relevant legal references or court orders that justify the deduction.

- Payment Timeline: Provide clear information on when the deduction will begin and any relevant deadlines.

- Contact Information: Offer a point of contact for any questions or concerns the recipient may have.

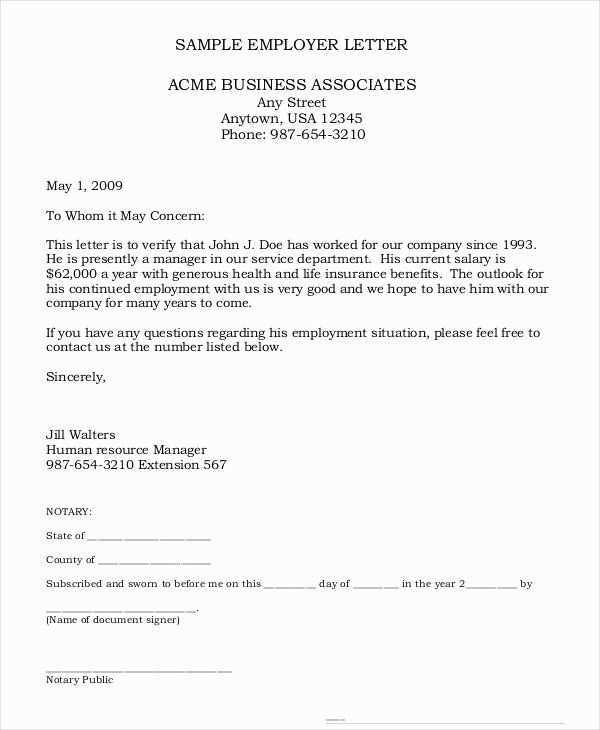

Communication Tone and Clarity

- Professional Language: Maintain a neutral, clear, and respectful tone throughout the document.

- Transparency: Ensure the individual understands the process and any rights or recourse they have.

- Clarity: Use simple language and a well-organized structure to make the document easy to follow.

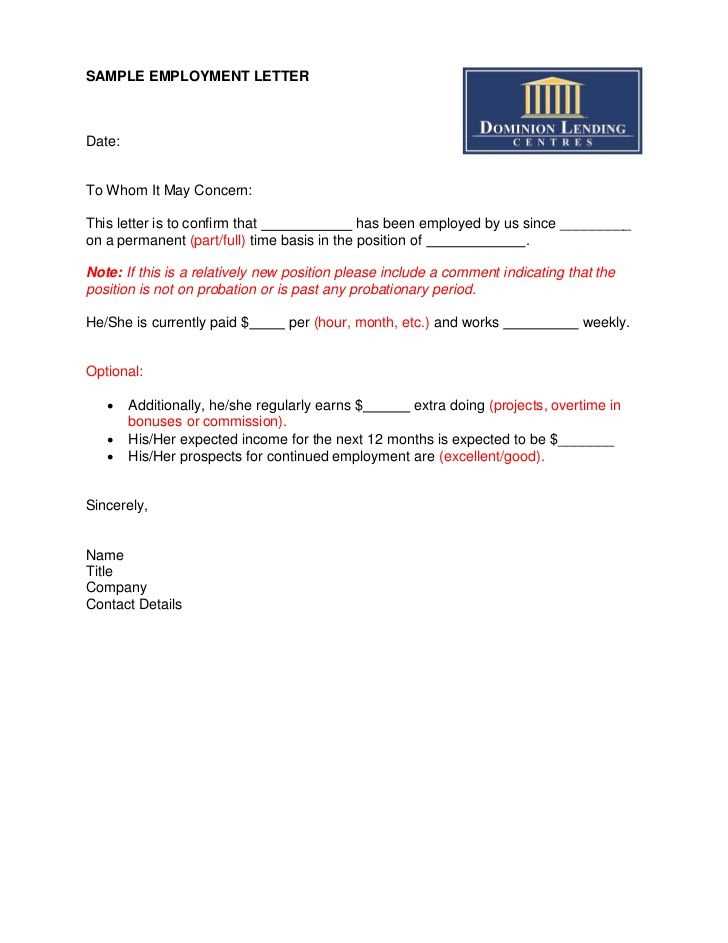

Best Practices for Employee Communication

Effective communication is key when informing individuals about any financial changes or obligations. It is important to ensure that all parties involved understand the situation and are provided with the necessary details to move forward. Following established best practices helps maintain clarity, respect, and compliance throughout the process.

| Best Practice | Description |

|---|---|

| Clear and Concise Language | Use simple, direct language to explain the situation without overwhelming the recipient with unnecessary details. |

| Timely Communication | Inform the individual as early as possible to provide them enough time to process the information and take any necessary actions. |

| Respectful Tone | Maintain a neutral and empathetic tone to avoid any undue stress and show consideration for the recipient’s circumstances. |

| Provide Contact Information | Offer a clear point of contact for any questions, allowing the recipient to address concerns or clarify details if needed. |

| Document the Communication | Keep a record of all communications to ensure transparency and to avoid future misunderstandings. |

Common Mistakes to Avoid in Communications

When drafting a formal communication regarding payment deductions, it is crucial to avoid certain errors that can lead to confusion, misunderstandings, or even legal complications. By paying attention to these common pitfalls, employers can ensure that the message is clear, respectful, and legally compliant.

Vague or Incomplete Information

One of the most frequent mistakes is providing insufficient or unclear details about the deductions. The recipient must understand the amount, frequency, and legal basis for the deductions. Failing to provide this information in a clear and precise manner can lead to confusion or even disputes. Always ensure that all relevant details are included in the communication to avoid misunderstandings.

Failure to Use a Professional Tone

Another common error is using inappropriate language or tone. While it is essential to convey the seriousness of the matter, the tone should remain respectful and neutral. Using harsh or accusatory language can create unnecessary tension and might even undermine the professional relationship. Always maintain a polite, empathetic, and professional tone in such communications to ensure a constructive dialogue.

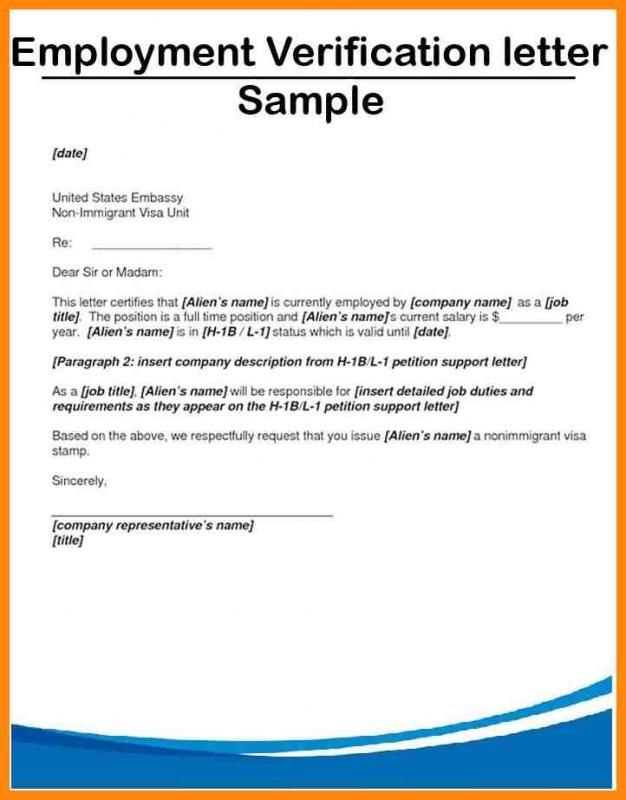

Ensuring Compliance with Employment Laws

Maintaining compliance with relevant laws is essential when making any financial adjustments that affect an individual’s income. It is crucial to adhere to legal requirements and ensure that all procedures are conducted in a fair and lawful manner. Non-compliance can lead to legal disputes, penalties, and damage to the employer-employee relationship.

- Understand Applicable Laws: Familiarize yourself with federal, state, and local laws governing payment reductions. These laws can vary depending on jurisdiction, so it is essential to stay informed about the specific regulations in place.

- Seek Legal Counsel: Before initiating any deduction processes, it is advisable to consult with a legal professional to ensure that all actions are within the bounds of the law.

- Provide Written Documentation: Always ensure that written communication about any financial deductions is clear, accurate, and legally compliant. This documentation should align with legal guidelines and provide all necessary details to the recipient.

- Monitor Changes in Legislation: Laws can evolve, and it is important to stay updated on any changes that may affect how income reductions are handled. Regularly reviewing employment law updates is crucial for ongoing compliance.

- Ensure Fairness: Ensure that all employees are treated equally under the same policies and procedures. Unfair practices or discriminatory actions can lead to legal repercussions.