Free 609 Dispute Letter Template for Credit Report Errors

When errors appear on your financial records, taking quick action is crucial to correcting them. With the right approach, you can resolve discrepancies and work towards a better financial future. In this section, we’ll explore a helpful method to address such issues and take control of your credit history.

Understanding the Process

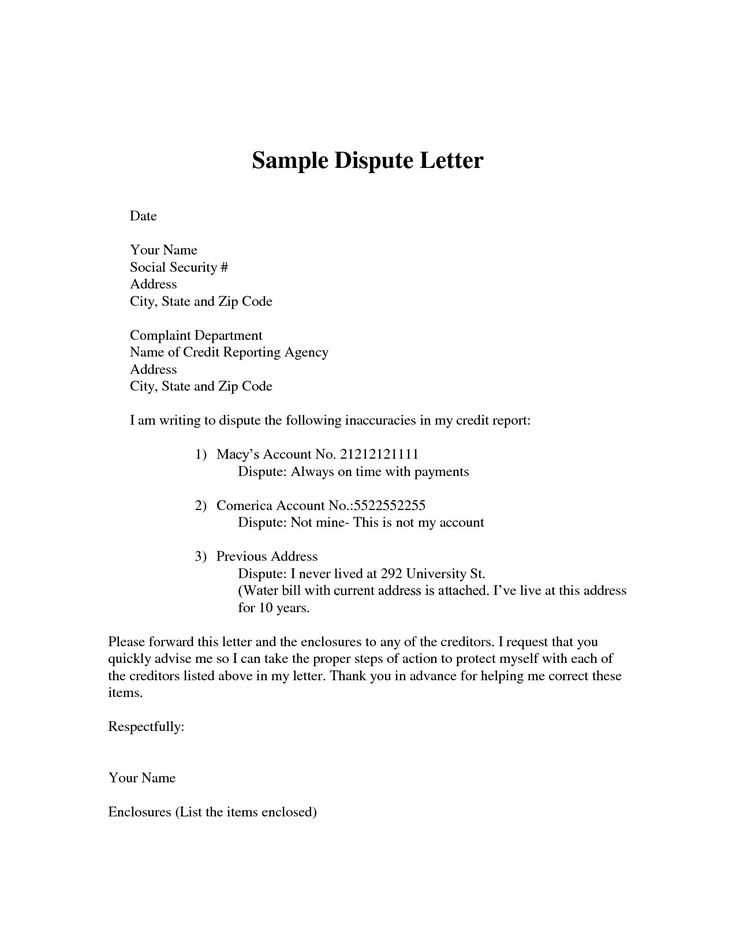

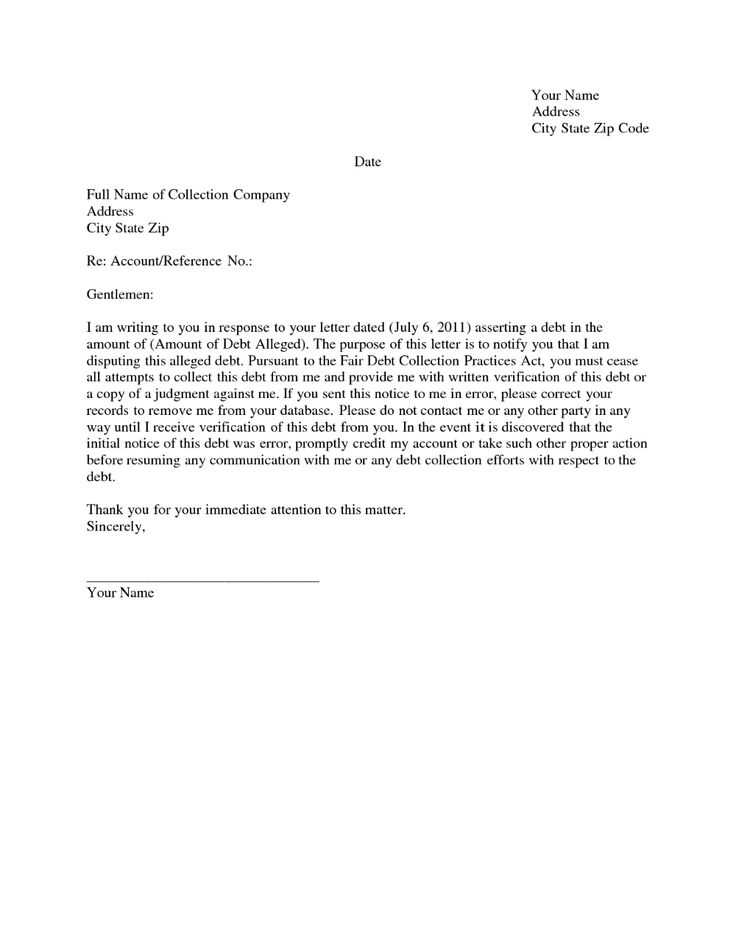

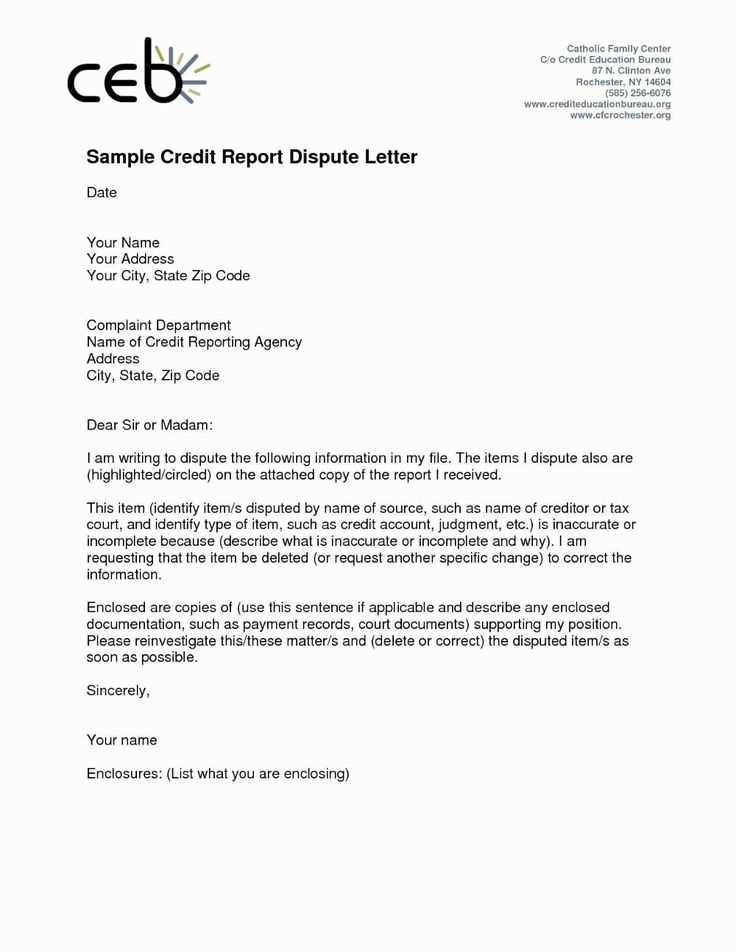

Addressing mistakes on your financial report begins with clearly identifying what needs to be corrected. You should carefully review each item, ensuring all the information is accurate. Once you’ve identified the discrepancies, the next step involves formally challenging those items to be reviewed by the reporting agency.

Why It’s Important to Act

Taking prompt action helps protect your credit standing. Errors, even small ones, can have a negative impact on your financial health, influencing decisions like loan approvals or interest rates. Therefore, correcting them as soon as possible can improve your chances of maintaining a good credit score.

Effective Methods for Communicating with Agencies

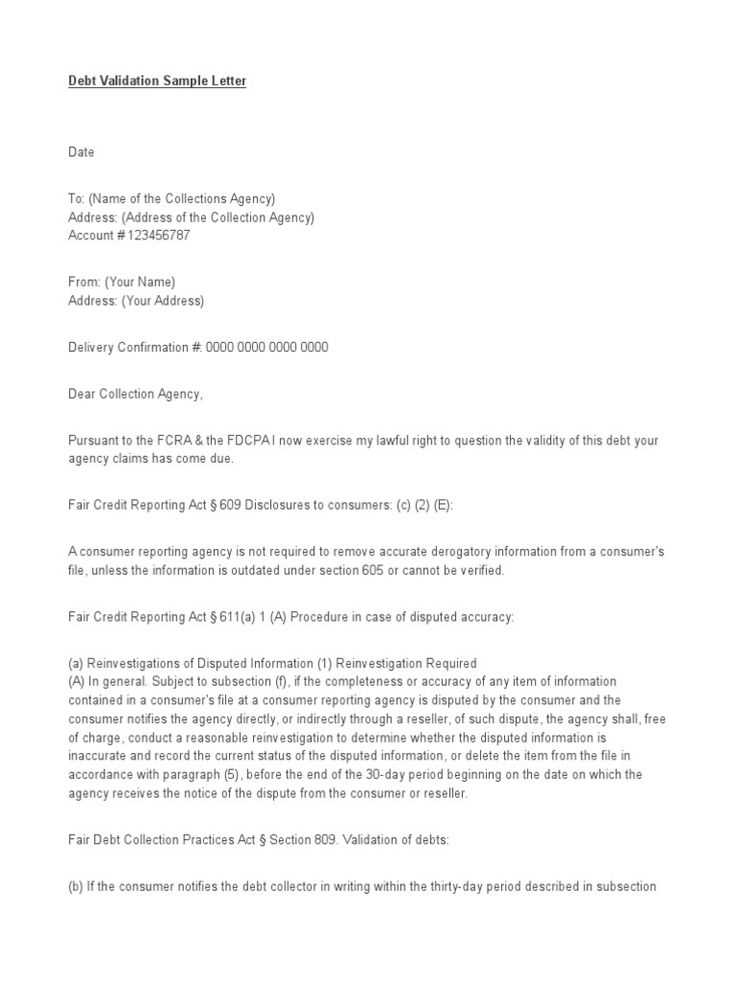

To ensure your challenge is taken seriously, it’s essential to follow a formal process. Write a detailed message explaining the error, including all necessary information to support your case. Providing clear and precise details can increase your chances of a successful resolution.

Helpful Tips for Crafting Your Message

- Be clear and concise: State the exact error and provide evidence that supports your claim.

- Be professional: Avoid emotional language, and keep the tone neutral and factual.

- Include personal details: Ensure the agency has all the information they need to verify your identity.

Why Using a Standard Approach Helps

Using a structured method helps ensure all necessary information is included and that your communication is professional. This can streamline the process and increase the chances of a timely and favorable outcome.

Where to Find Resources

Various online platforms offer guides and resources to help you draft the necessary documents. These resources can assist you in creating a clear and effective message, saving time and effort. It’s important to choose reliable sources that provide up-to-date and accurate advice.

Final Steps to Take

After sending your challenge, it’s essential to follow up. Keep track of the responses and ensure that all corrections are made. If the issue is not resolved to your satisfaction, you may need to escalate the matter or consider further action to ensure your financial records reflect accurate information.

Understanding the Process of Correcting Credit Report Issues

When errors appear on your financial record, it is crucial to understand how to properly address and resolve them. This involves following a specific set of steps to ensure that inaccuracies are recognized and corrected by the relevant agencies. With the right approach, you can effectively manage your financial history and improve your overall standing.

How to Use a Structured Approach for Resolution

To resolve any discrepancies in your financial profile, it is important to communicate clearly with the credit agencies. Begin by identifying the exact errors, gathering any supporting documents, and submitting a formal request for review. This process ensures that your case is heard and given proper attention.

Advantages of Using a Formal Request Format

Using a well-established method to address inaccuracies offers several advantages. It helps to keep the process organized, ensures you don’t miss key details, and increases the likelihood of a timely resolution. Furthermore, a standard approach makes it easier for agencies to process your request and take the necessary actions.

However, some common mistakes can hinder the resolution process. It is essential to avoid vague language, unclear documentation, or leaving out important details. Double-checking your submission can prevent delays and help you achieve a more favorable outcome.

Once your issues are resolved, taking steps to strengthen your financial profile is essential. Regularly monitoring your records, paying bills on time, and avoiding unnecessary debt are vital to maintaining and improving your credit score over time.

Finding Reliable Resources for Assistance

There are various platforms where you can access reliable resources to help with the correction process. These resources provide step-by-step guidance to ensure your request is comprehensive and professionally crafted. Make sure to select trusted sources that offer accurate and updated information to help you navigate the process successfully.