Demand of Payment Letter Template for Quick Payment Recovery

When it comes to securing overdue balances, clear and professional communication is essential. Without proper documentation, the process of recovering funds can become lengthy and complicated. By using well-structured correspondence, businesses can significantly increase their chances of receiving the amounts they are owed promptly.

One of the most effective ways to approach this situation is through written communication that clearly outlines the outstanding balance and sets a firm deadline for settlement. This approach ensures both parties are on the same page regarding expectations, reducing the risk of misunderstandings and potential disputes.

Using a pre-formatted document can streamline this process, allowing for faster action and less time spent drafting messages from scratch. These documents ensure all necessary details are included and help maintain a professional tone throughout the correspondence.

Understanding the Importance of Payment Requests

Clear and timely requests for outstanding amounts are essential for maintaining healthy financial operations in any business. When a client fails to meet their obligations, it is crucial to take the right steps to ensure recovery without damaging professional relationships.

Effective correspondence can significantly influence the likelihood of receiving overdue sums. Here are some reasons why these requests are so important:

- Establishes Professionalism: A well-crafted communication reinforces the company’s professionalism and commitment to financial integrity.

- Prevents Misunderstandings: It sets clear expectations regarding the amount due and the deadline for settlement, reducing the chances of confusion.

- Ensures Legal Protection: Sending formal requests creates a documented record of attempts to collect, which may be crucial in case of legal proceedings.

- Maintains Business Flow: Timely recovery of funds ensures that cash flow remains uninterrupted, allowing the business to continue operations smoothly.

When executed properly, this type of communication is not just about recouping funds; it also helps preserve trust and respect between businesses and clients. Maintaining this balance is key to long-term success.

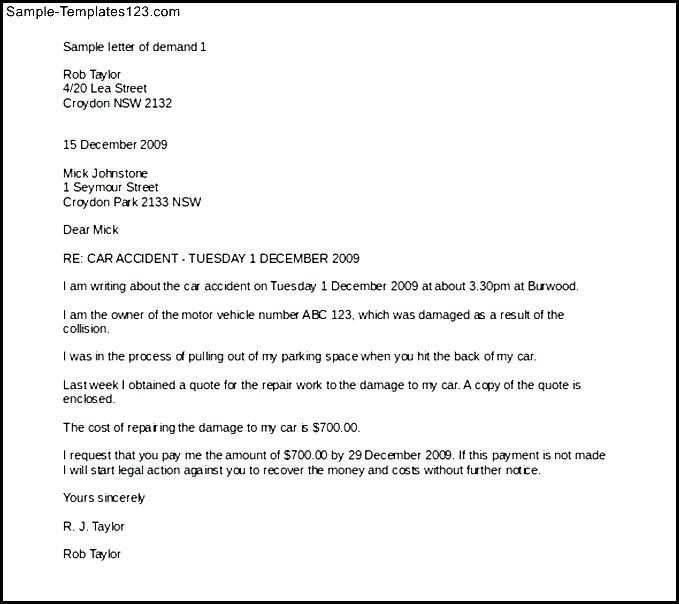

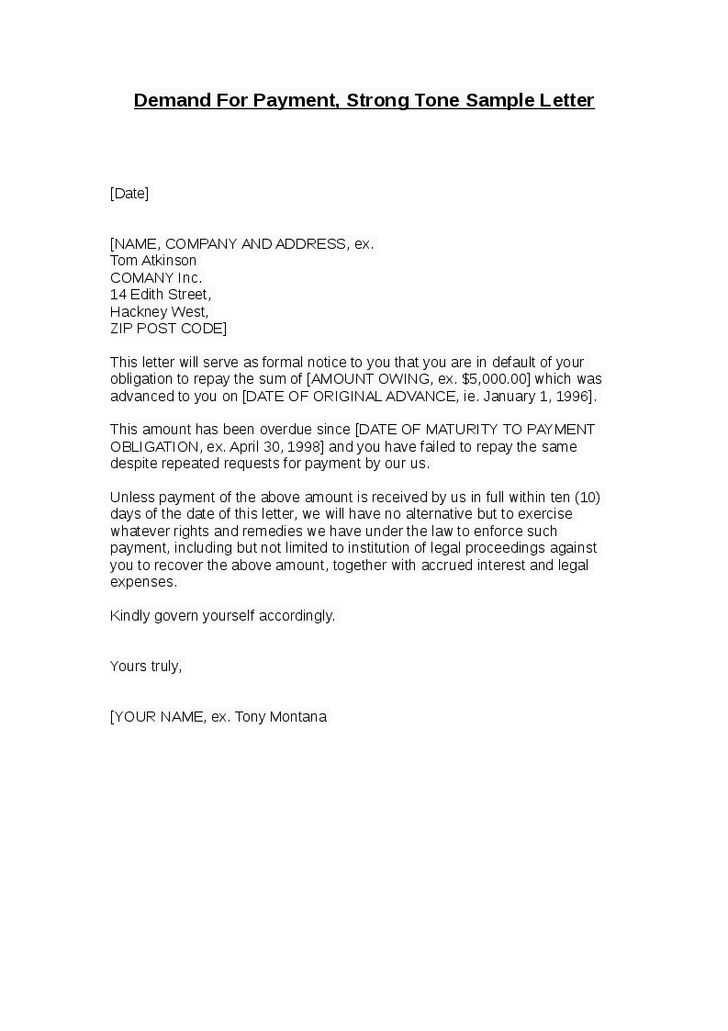

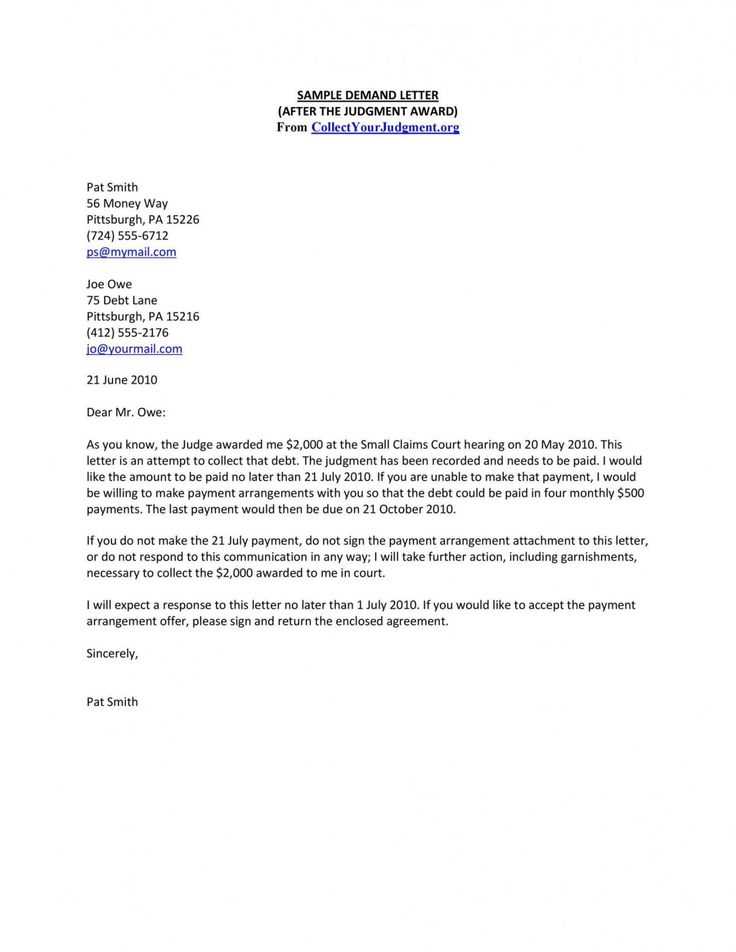

How to Write a Payment Demand Letter

When requesting overdue amounts, it’s essential to craft a message that is both clear and respectful. A well-structured communication not only helps maintain a professional tone but also increases the likelihood of a prompt response. The key is to strike a balance between being firm about the expectations and understanding that unforeseen circumstances may be at play.

Here are some crucial steps to follow when creating this type of correspondence:

- Start with the Details: Clearly mention the amount owed, the date it was due, and any previous communication or agreements related to the debt.

- State the Action Required: Be specific about what you expect the recipient to do next, whether it’s paying the full amount or contacting you to discuss a payment plan.

- Set a Deadline: Give a clear time frame for payment or resolution. Be reasonable, but firm in your expectations.

- Maintain Professional Language: Keep the tone polite and professional, even if you are frustrated. Remember, the goal is to maintain a positive working relationship.

- Include Consequences: If applicable, mention any potential actions you may take if the situation remains unresolved, such as legal steps or referral to a collection agency.

By following these guidelines, you can ensure that your request is both effective and professional, increasing the chances of a timely resolution to the issue at hand.

Key Elements of an Effective Letter

For a request to be effective, it needs to include essential information in a clear and structured way. A well-crafted document ensures that all necessary details are communicated, leaving no room for confusion. This approach not only increases the likelihood of a swift response but also sets a professional tone that reflects well on your business.

The following elements are crucial for a successful communication:

- Clear Identification: Always include the recipient’s full name and contact information, as well as your own. This ensures there is no ambiguity regarding who is involved in the situation.

- Outstanding Amount: Clearly state the amount owed. This ensures that both parties understand the exact figure in question, avoiding any potential disputes over numbers.

- Due Date: Specify the exact date by which the obligation needs to be fulfilled. This helps manage expectations and encourages timely action.

- Action Requested: Be specific about what needs to be done, whether it’s transferring funds, contacting you, or arranging an alternative resolution.

- Consequences for Non-Compliance: Include a section detailing any further steps that will be taken if the matter isn’t resolved within the given timeframe. This could involve legal action or referral to a collection agency.

By incorporating these components, you create a clear, professional, and actionable request that is more likely to yield results.

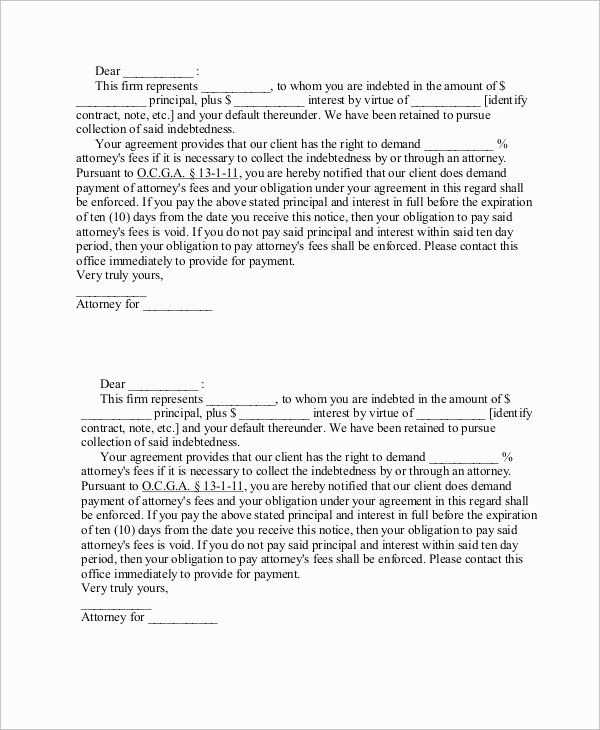

Legal Considerations for Payment Demands

When requesting overdue amounts, it’s important to understand the legal aspects involved to ensure that the process is conducted properly. By following the appropriate legal guidelines, you can avoid potential issues, protect your rights, and maintain a professional relationship with the other party.

Key Legal Aspects to Keep in Mind

Before sending a formal request, be sure to consider the following points:

| Aspect | Importance | Action Required |

|---|---|---|

| Jurisdiction | Determines where the legal process can be carried out | Identify the appropriate legal authority in your region |

| Contractual Terms | Defines the terms of the agreement | Review the contract to ensure you’re within your rights |

| Time Limits | Limits the time frame for initiating legal action | Be aware of statutory deadlines for claims |

| Documentation | Strengthens your case in legal proceedings | Keep records of all communications and agreements |

Understanding the Consequences

Familiarize yourself with the potential consequences of non-compliance. If the matter escalates, it may involve court proceedings or the engagement of collection services. Being prepared with the proper documentation and legal knowledge ensures that you are acting within the law and are in a stronger position to resolve the issue efficiently.

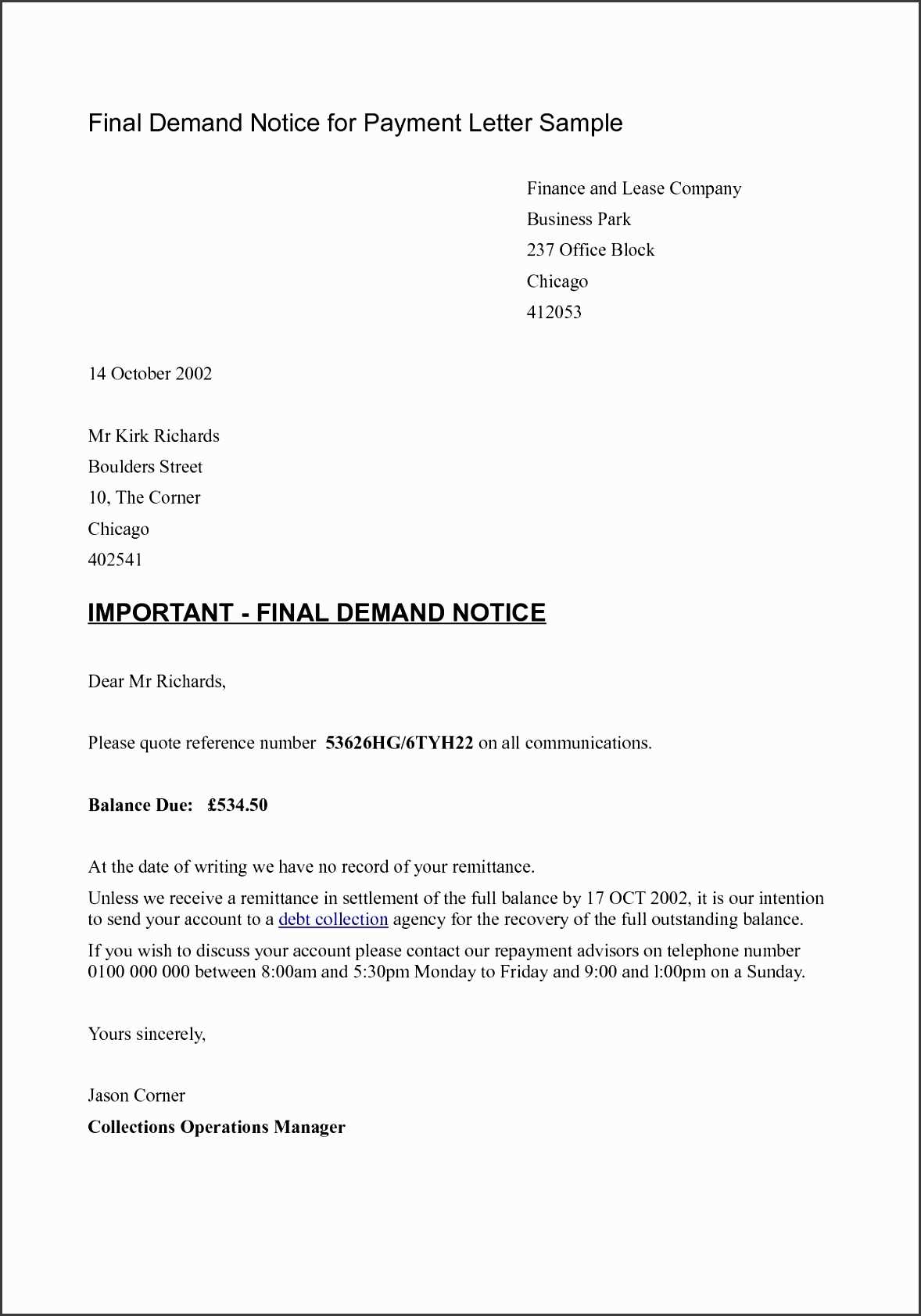

Common Mistakes to Avoid in Letters

When composing formal requests for overdue amounts, it’s essential to avoid certain pitfalls that could undermine your efforts. A poorly written or unclear message can lead to misunderstandings, delay the resolution process, and even harm professional relationships. Recognizing and steering clear of common mistakes will help ensure your communication is effective and efficient.

Here are some typical errors to watch out for:

- Lack of Clarity: Ambiguous or vague language can confuse the recipient and delay payment. Be direct and precise about the amount owed and the expectations for action.

- Overly Aggressive Tone: While it’s important to be firm, an overly hostile or demanding tone can alienate the recipient. Always maintain a professional and respectful attitude.

- Missing Key Information: Failing to include important details like the due date, specific amount, and any prior agreements can create confusion and make it harder for the recipient to act.

- Unrealistic Deadlines: Setting a deadline that is too soon may put unnecessary pressure on the recipient, while a deadline that is too far off may delay action. Aim for a reasonable time frame.

- Failure to Follow Up: Not following up after sending the request can result in the issue being overlooked. It’s important to monitor the situation and send reminders if necessary.

Avoiding these common mistakes can help you maintain a professional approach, increase the chances of timely resolution, and preserve positive relationships with clients and partners.

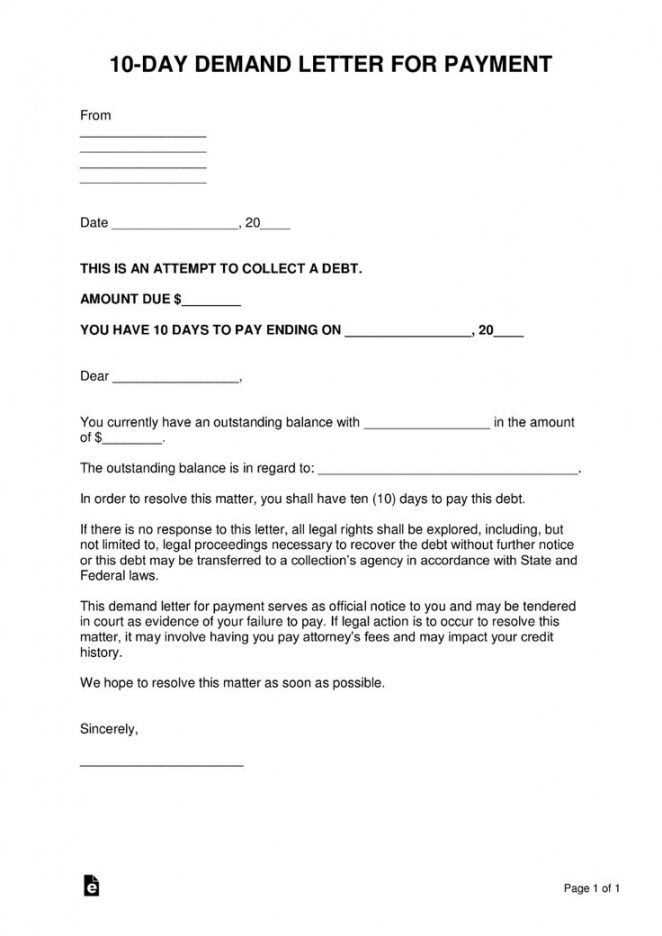

Using Templates for Faster Communication

In business, time is often of the essence, especially when dealing with overdue amounts. Using pre-structured documents can help streamline the communication process, allowing for quicker responses without sacrificing professionalism. Instead of starting from scratch each time, you can utilize a standardized format that ensures all necessary information is included while saving time and effort.

By using ready-made formats, you can:

- Save Time: Quickly input the relevant details without having to rewrite the entire message every time you need to request a resolution.

- Ensure Consistency: Maintain a uniform tone and structure across all communications, which reflects professionalism and attention to detail.

- Minimize Errors: Pre-written documents ensure that no key information is overlooked, reducing the risk of mistakes or confusion.

- Enhance Efficiency: With a well-organized format, the entire process becomes faster, from drafting the communication to sending it out.

Whether you’re dealing with a single case or numerous outstanding issues, leveraging structured formats can make the entire process smoother, allowing you to focus on other important aspects of your business.