Salary Verification Letter Template for Professional Use

When an individual needs to confirm their earnings for various purposes, such as applying for loans or rental agreements, a formal document from an employer can serve as proof. This document plays a crucial role in establishing financial credibility and transparency. Understanding how to properly craft this confirmation is essential for both employers and employees.

Key Elements to Include in the Confirmation

There are several critical pieces of information that should be included in the document. These ensure that the content is clear, accurate, and sufficient for the intended use.

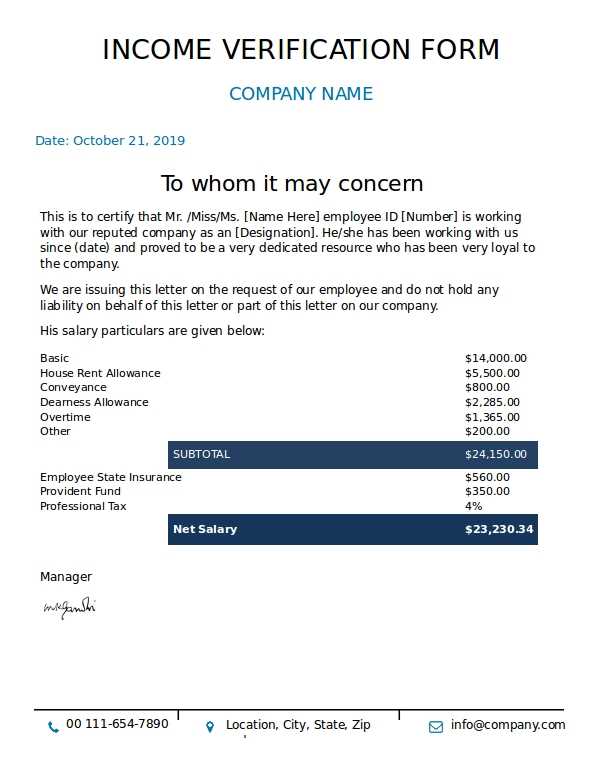

- Employer Details: The name of the company, its address, and contact information.

- Employee Information: The name, position, and employment start date of the individual.

- Income Breakdown: A description of the salary, including the amount, payment frequency, and any additional compensation such as bonuses or benefits.

- Dates Covered: The period the confirmation pertains to, typically covering the most recent payment cycle or year.

- Signature: A signature from the authorized representative of the company, along with their title and date of issuance.

Why It’s Essential for Employers and Employees

Employers need to provide this document to ensure that employees have the necessary proof of income for personal or financial matters. On the other hand, employees benefit from a clear and accurate record that can be used in various scenarios, such as securing housing or loans.

Common Mistakes to Avoid

When drafting such a confirmation, it’s important to avoid vague language or missing key details. Incomplete or unclear information can lead to misunderstandings and may not be accepted by financial institutions or other entities. Ensure the document is precise and free from errors.

How to Customize the Document

To ensure the confirmation meets the needs of the employee, employers should customize the content to reflect the specific situation. For instance, if the confirmation is intended for a mortgage application, it should highlight the employee’s stability and income consistency. Tailoring the document to the intended use will help make it more effective.

Final Thoughts on Crafting Effective Proof

Creating a formal income statement is a simple yet vital task for both employers and employees. By following the necessary steps and including all relevant information, the document can serve its purpose effectively, helping individuals meet their financial goals.

Income Confirmation Document Example

When a worker needs to validate their earnings for personal or financial purposes, a formal written statement from the employer is often required. This document ensures transparency and provides proof of income for various situations, such as loan applications or rental agreements. Understanding how to create a clear and accurate confirmation is essential for both parties involved.

Why Income Confirmation Documents Matter

These documents play a crucial role in establishing financial trustworthiness. They are often requested by institutions or landlords to assess an individual’s ability to meet financial obligations. By providing an official statement, employers help employees prove their earnings, which can be critical for securing loans, housing, or other financial agreements.

Key Details to Include in the Document

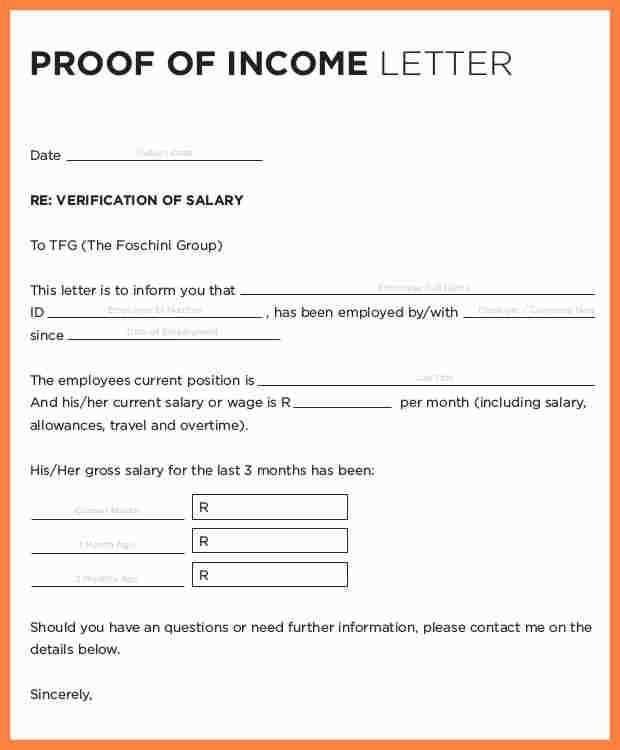

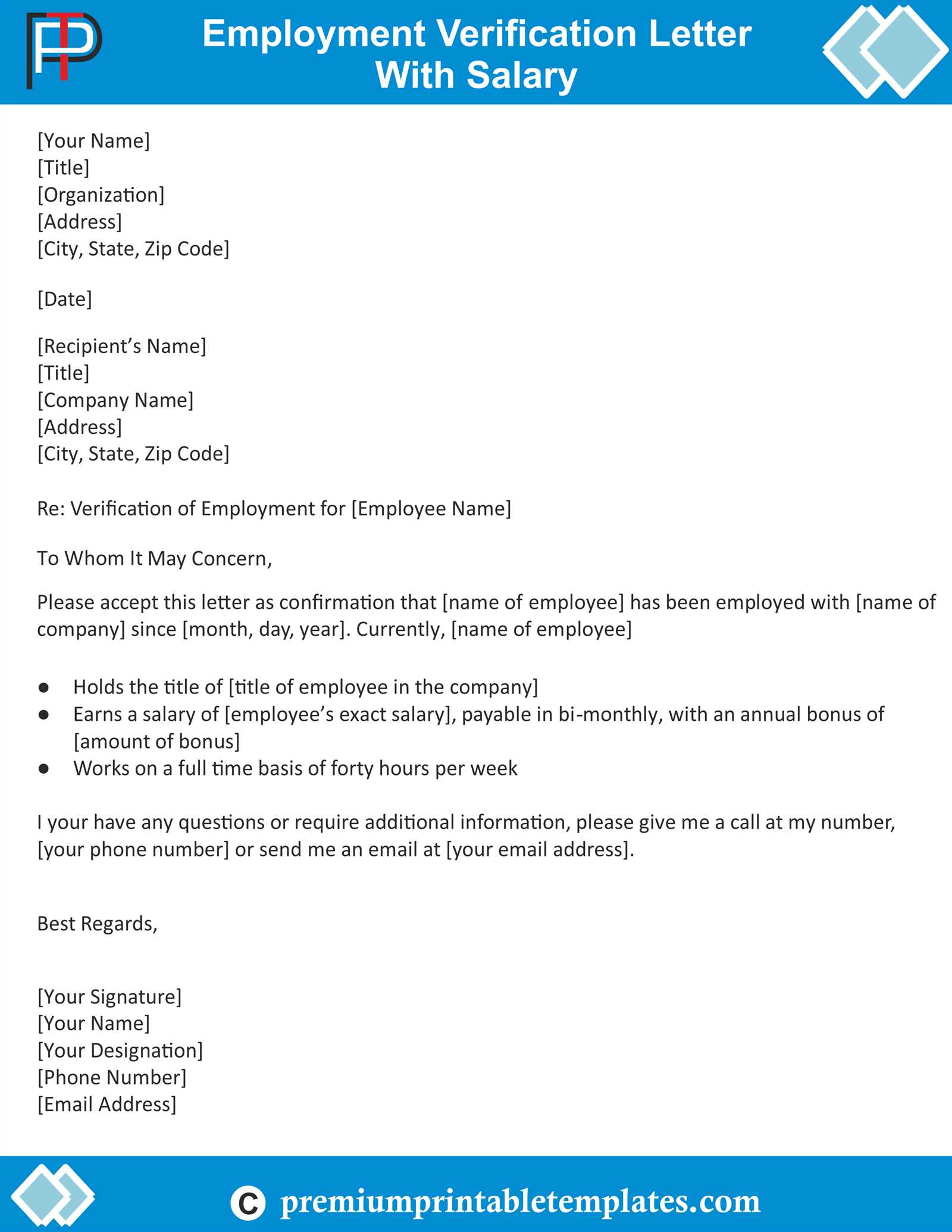

- Employer Information: The name of the company, its address, and contact details.

- Employee’s Full Name: The individual’s name, role, and tenure with the company.

- Income Breakdown: The total earnings, including base salary, bonuses, and any other financial benefits.

- Time Period: The specific period the document covers, usually the most recent pay cycle or year.

- Signature: The signature of an authorized company representative, along with their job title and the date of issuance.

How to Tailor the Confirmation Document

To make the document suitable for various purposes, such as a housing application or bank loan, employers should adjust the content to highlight specific details that may be relevant. For example, if the confirmation is needed for a mortgage, it should stress income consistency and stability. This customization helps the document meet the unique needs of the recipient.

Avoiding Common Mistakes in Income Confirmation

It’s important to avoid vague descriptions or errors in the document, as they can reduce the effectiveness of the confirmation. Ensure that all information is accurate and clear, as any discrepancies can lead to delays or rejection from institutions requesting the document. Double-check details like the employee’s role, income figures, and the time period covered.

When an Income Confirmation is Necessary

Employers may be asked to provide such a document in various situations, including loan applications, tenancy agreements, or credit approvals. It’s important to respond promptly and provide the required information to avoid delays in the employee’s process.

Best Practices for Requesting an Income Confirmation

Employees should request this document well in advance to ensure they have it when needed. Providing clear instructions to the employer regarding the purpose of the document and any specific details required can help streamline the process. Employers, in turn, should ensure that the document is clear, professional, and includes all necessary information for the intended purpose.