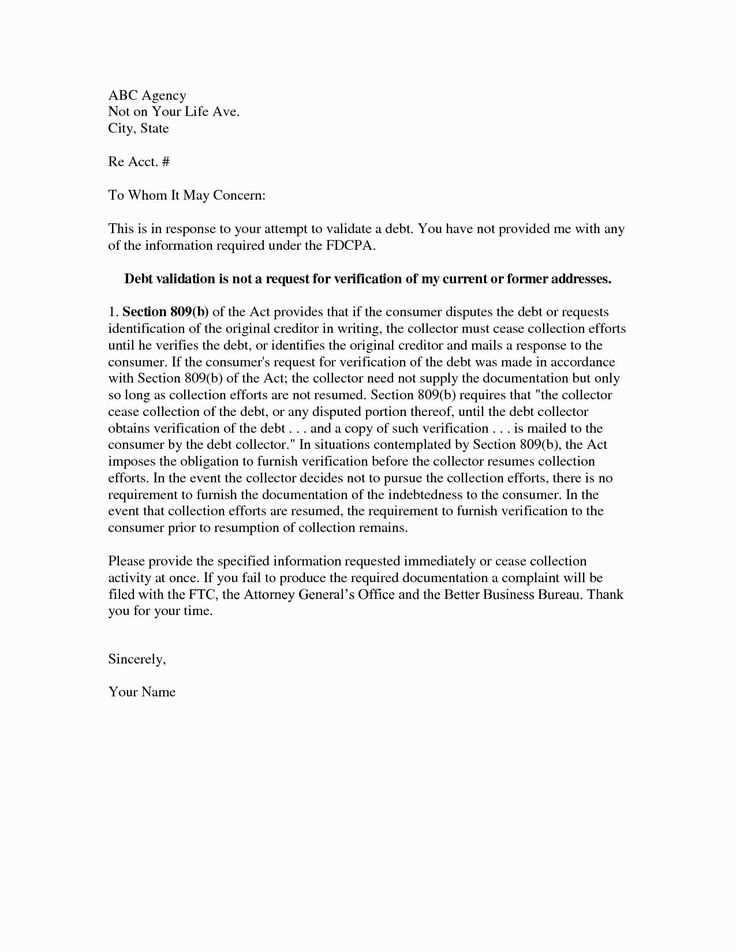

Credit Validation Letter Template for Financial Disputes

When facing financial disagreements, it’s essential to have a structured way to address and clarify issues. A properly drafted response document ensures clear communication and can help resolve misunderstandings efficiently. This type of correspondence is often needed when disputing claims made by financial institutions or creditors. Understanding the process and knowing how to structure your response can make all the difference.

Why Having a Structured Response is Crucial

Disputing financial matters requires clear, formal communication. A well-crafted document not only serves to challenge inaccuracies but also protects your rights. It helps establish your position and provides an official record of your claims. Using a prepared format can streamline the process, ensuring that all relevant details are included.

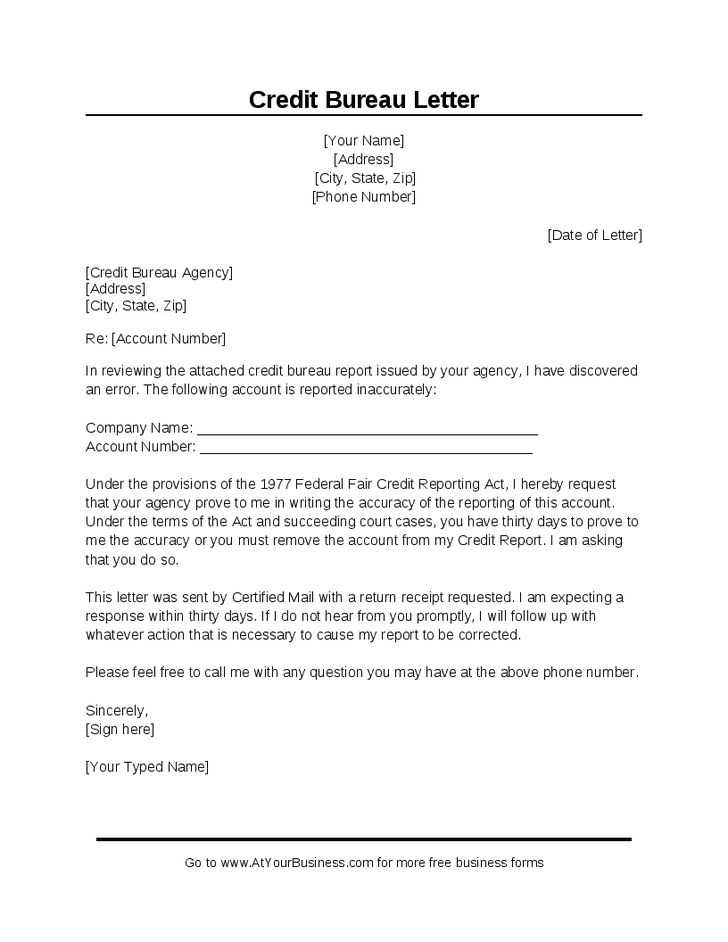

Essential Information to Include

- Identification details: Ensure all parties involved are clearly identified, including account numbers and names.

- Specific concerns: Highlight the exact items or statements that are being disputed.

- Supporting evidence: Attach any relevant documents that support your position.

How to Draft a Clear Response

Begin with a concise introduction, stating the purpose of your document. Then, systematically address each point of contention. It’s important to be factual and polite, avoiding emotional language. Be sure to request a clear resolution and provide your contact information for follow-up.

Common Mistakes to Avoid

- Being vague: Always be specific about what is being disputed.

- Excessive detail: Focus on the facts that are most important for resolving the issue.

- Ignoring deadlines: Responding promptly is key to maintaining the validity of your dispute.

Final Thoughts

By following a clear structure and including all necessary information, you improve the chances of resolving financial issues swiftly. A well-prepared document not only aids in dispute resolution but also helps maintain a professional relationship with the other party.

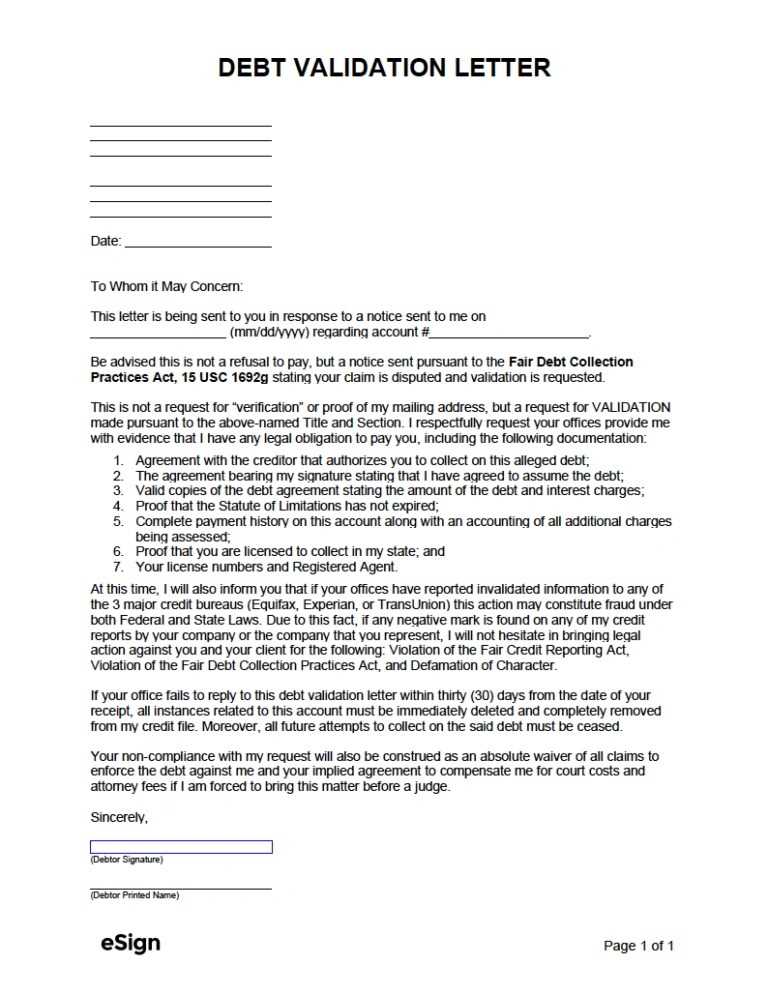

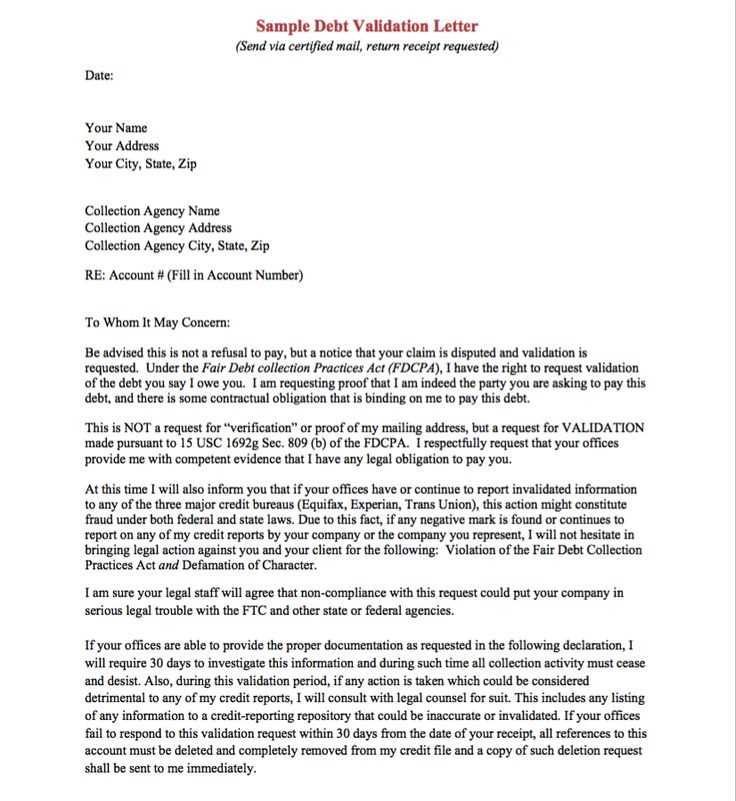

What is a Dispute Response Document

In financial matters, it’s crucial to have a formal approach when contesting claims or charges. A well-structured document serves as an official communication tool that can be used to clarify any discrepancies or challenges. It provides the necessary details to dispute a claim, ensuring that the process remains clear and organized.

Why a Structured Approach is Essential

Using a predefined format for your response not only saves time but also ensures consistency in addressing the matter. It allows you to focus on the key issues without missing important information. A clear, professional response increases the likelihood of resolving the matter efficiently and reduces the chances of further confusion or delays.

Key Information to Include in Your Document

Ensure that you include all relevant details to support your position. These should cover the specifics of the disputed issue, your personal identification, any account or transaction references, and any supporting evidence. This helps to make your case stronger and facilitates quicker resolution.

How to Prepare Your Response Effectively

Start by clearly stating the reason for your communication. Address each disputed item one by one, providing clear explanations and any necessary documentation. Be sure to remain professional and factual, avoiding overly emotional language that could detract from your argument.

Avoiding Common Pitfalls

Common mistakes include failing to provide clear, precise details or submitting incomplete information. Make sure your document is error-free and contains all the necessary facts to avoid unnecessary back-and-forth. Additionally, always check for deadlines to ensure your response is timely.

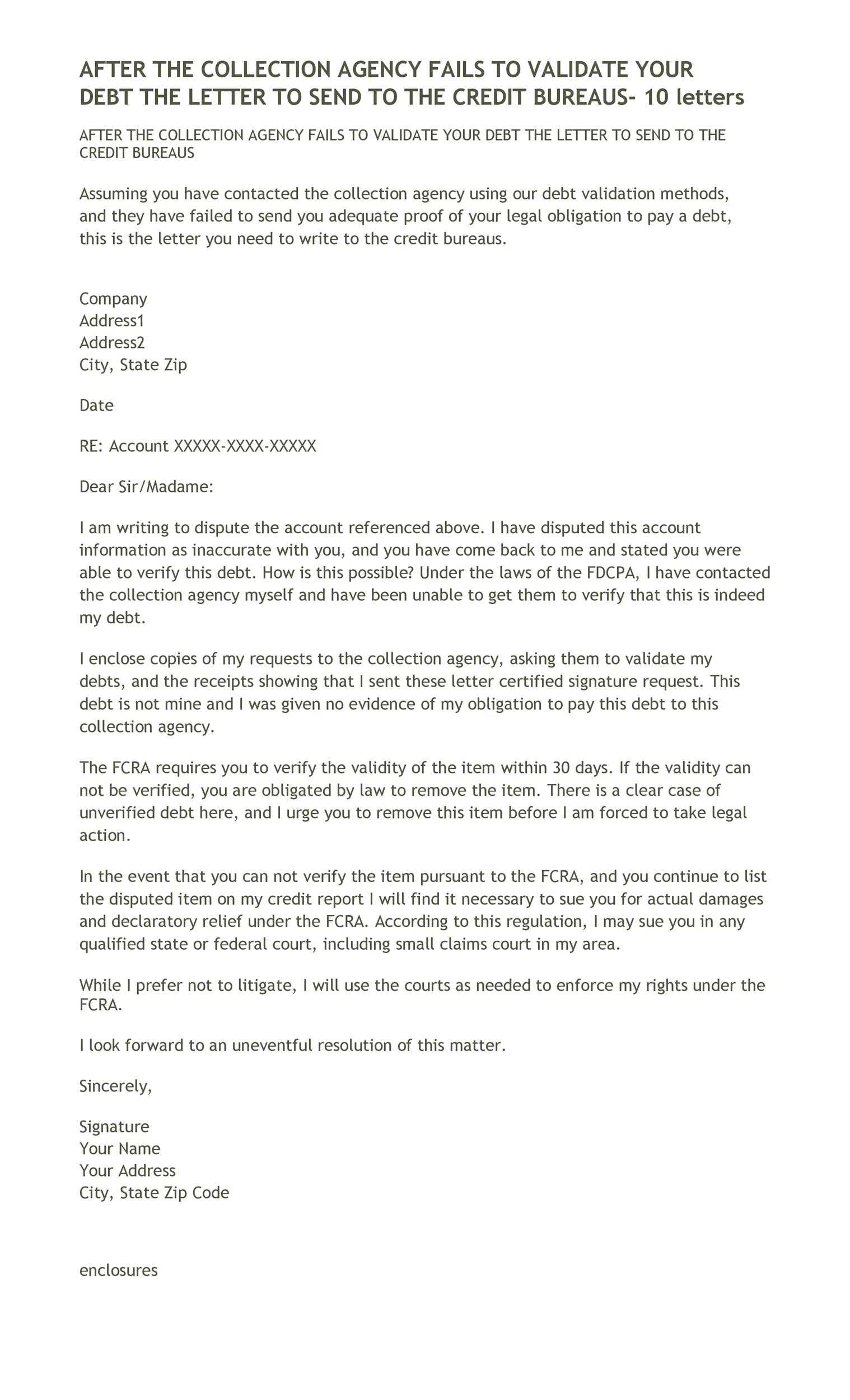

Legal Considerations in Dispute Response Documents

It’s important to be aware of the legal framework when crafting your response. Understanding your rights and obligations under the relevant laws can help you ensure that your document is compliant and effective. By including the right information and following proper procedures, you can strengthen your case and avoid potential legal issues.