How to Create a Cancel EIN Letter Template

In some cases, businesses may need to officially end the use of their assigned identification number. This process involves drafting a formal document to notify the relevant authorities. Such a step may be necessary when a company has ceased operations, is no longer in need of a tax ID, or has undergone changes that render the number obsolete. Crafting this communication correctly ensures the smooth closure of business affairs.

Key Points to Include

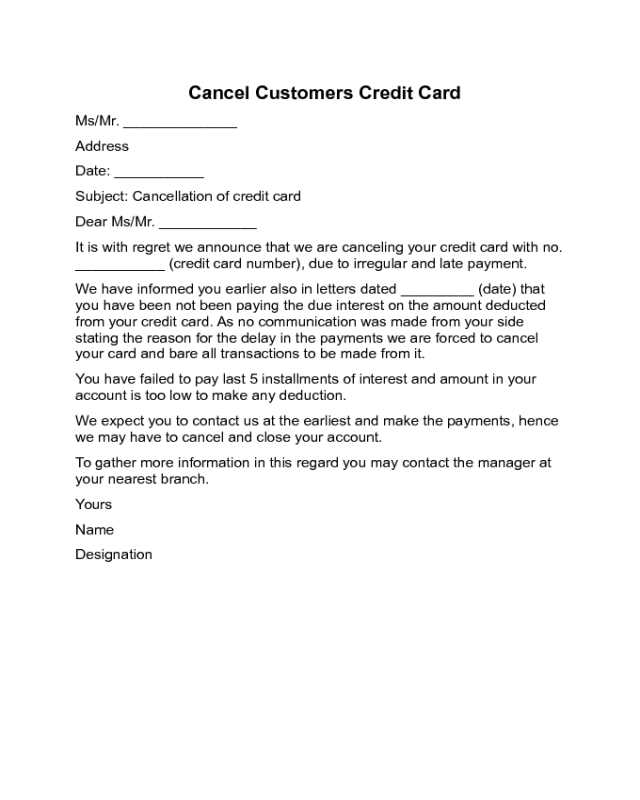

When preparing the necessary communication, it is important to include several key details to ensure it is processed without delay:

- Business Name and Address: Clearly state the full name and contact address of the company.

- Identification Number: Include the number that needs to be deactivated.

- Reason for Discontinuation: Briefly explain why the number is no longer needed.

- Official Signature: Sign the document to authenticate your request.

When to Submit the Request

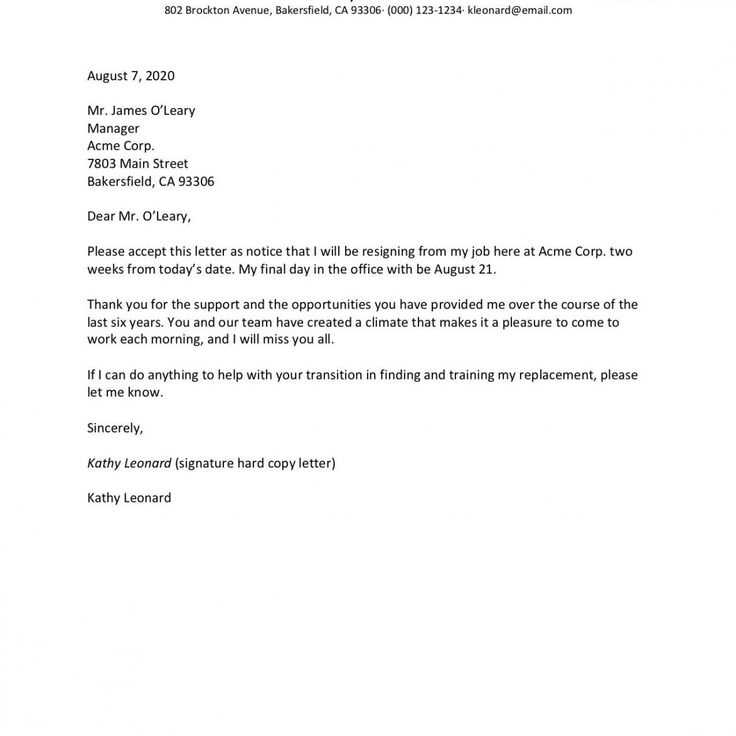

It is best to submit this request when the decision to stop using the number is final. Doing so ensures that all legal and tax obligations are addressed in a timely manner. Ideally, submit the request after the company has ceased operations or when a new identification number has been obtained if needed.

Potential Issues to Avoid

While drafting the document, make sure not to overlook any required information or use ambiguous language. Avoid mistakes such as:

- Providing incorrect business details.

- Failing to mention the reason for discontinuation.

- Not following the correct submission procedure as outlined by authorities.

After Submission

Once the request has been sent, it may take some time for processing. Be prepared to wait for confirmation or any additional instructions. In some cases, further documentation or clarification may be needed. Ensure you keep a copy of your submission for future reference.

Why You Need to Terminate Your Business Identification Number

When a business no longer requires its assigned tax identification number, it is essential to formally notify the authorities to close the account. This process ensures that the company is no longer responsible for any ongoing filings, taxes, or reporting associated with the identification number. Properly completing this task protects both the company and the authorities from confusion or administrative errors in the future.

How to Properly Format Your Request

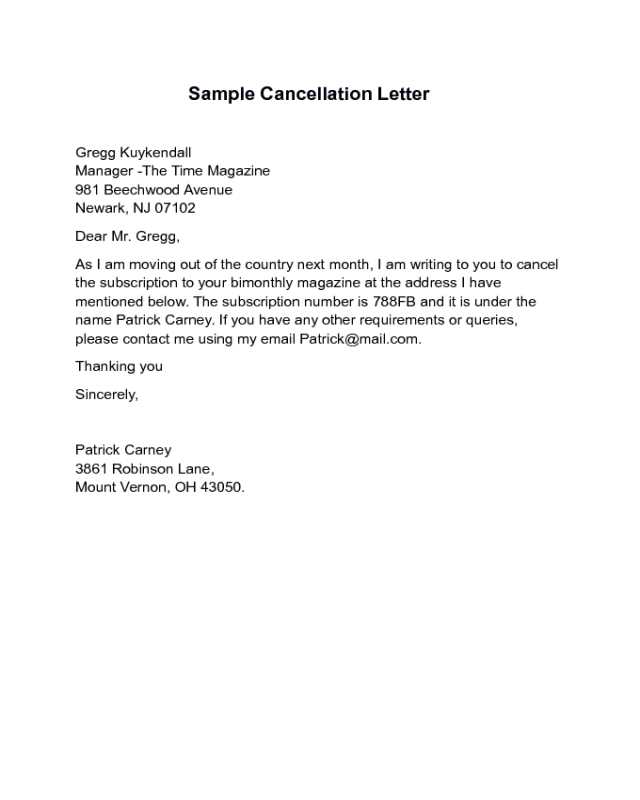

Structuring the communication correctly is crucial for efficient processing. A clear and organized request should contain specific details about the company and the reason for discontinuation. Make sure to follow the official guidelines provided by the tax authorities to avoid delays. The request should be concise yet comprehensive, ensuring that all necessary information is included in an easily readable format.

Critical Information to Include in the Submission

For the request to be processed smoothly, ensure that the following details are included:

- Business Name and Address: Include the full legal name of the business and its address.

- Identification Number: Provide the tax ID number that is being deactivated.

- Reason for Termination: Clearly state why the identification number is no longer needed.

- Signature and Contact Information: The document must be signed and include the appropriate contact details for follow-up.

Common Mistakes to Avoid

Errors in the request can lead to delays or complications. Some of the most common mistakes include:

- Missing or incorrect business details.

- Failure to provide a valid reason for discontinuation.

- Incomplete or inaccurate submission forms.

To avoid these issues, double-check your submission before sending it to the authorities.

When to Submit the Request

Timing is important. The request should be made once it is certain that the number is no longer required. Submitting it too early could lead to complications if the number is still in use for certain transactions or filings.

Once the request is made, you will need to wait for confirmation from the relevant authorities. This may take some time, depending on their processing procedures. Ensure that you keep a copy of the request and any communication from the authorities for your records.