Council Tax Band Appeal Letter Template Guide

If you believe that your property’s valuation is incorrect, it’s possible to request a review of the decision. This process is important for ensuring that you are being charged fairly based on your property’s true worth. While the process can seem complex, having the right approach can make all the difference.

Writing an effective communication to request a reassessment requires clarity and the right information. It’s essential to present your case in a way that is both logical and persuasive. Knowing how to structure your message and what details to include can significantly improve your chances of success.

Understanding the essential components of a well-crafted request is key to making your case strong. This includes having clear reasoning and supporting evidence for why the current valuation is inaccurate. With the right information, you can ensure that your submission is as effective as possible.

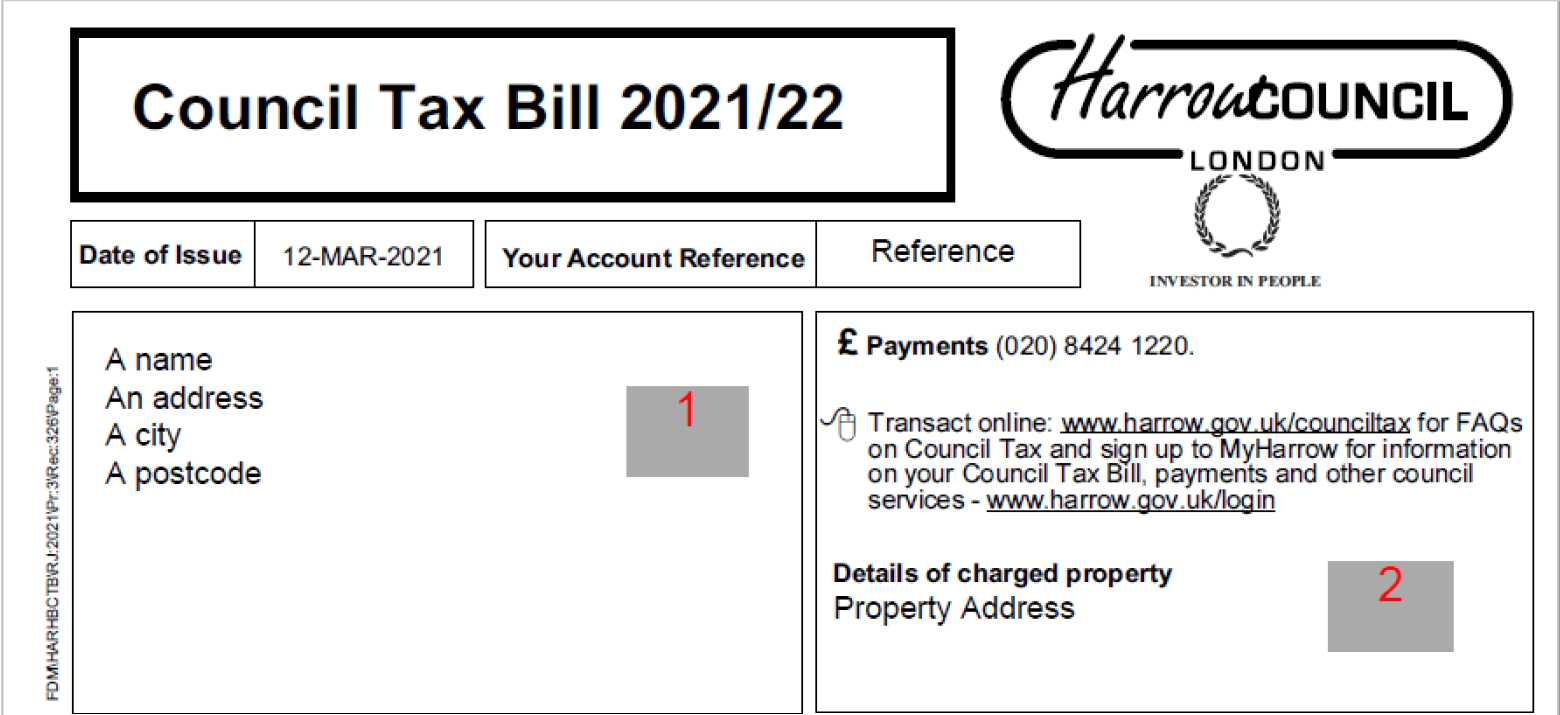

Understanding the Property Valuation System

In many regions, properties are assigned a value that influences the amount homeowners are required to contribute towards local services. These assessments are based on various factors such as the size, location, and condition of the property. The assigned value determines how much you will pay, and understanding how this process works is crucial for anyone seeking to verify or challenge the assessment.

The system typically works by grouping properties into different categories based on their estimated value. These categories are then used to calculate the contribution that each homeowner must make. However, not all properties are placed in the correct group initially, which may result in overcharging. Understanding how properties are assessed can help in identifying discrepancies in your current valuation.

Key factors that influence the assessment include:

- Size of the property

- Location and its amenities

- Age and condition of the building

- Market trends in the area

Once the valuation is done, it’s important to be aware of the categories or ranges that properties fall into. While these categories are generally accurate, they can sometimes be based on outdated or incorrect data. This is where reviewing the assigned classification becomes important, especially if there are signs that your property has been misclassified.

Why You Might Need to Challenge Your Property Assessment

Occasionally, a property valuation may not reflect the true market value or condition of your home, leading to an unfair financial burden. If you believe that the current evaluation does not align with the value of your property, it is crucial to take action and request a reassessment. This process can help correct any errors and ensure that you’re only paying what is truly owed.

Common Reasons for Discrepancies

There are several reasons why your property might be incorrectly valued. These include:

- Outdated data or comparisons to similar properties

- Errors in the property’s description or classification

- Changes in the local property market that have not been reflected

- Recent renovations or improvements that add value

When to Consider Taking Action

If you notice any of the above factors affecting your current evaluation, it might be time to formally challenge it. Overcharging based on an inaccurate assessment can result in paying more than your fair share. Ensuring that your property is correctly valued is not just about reducing costs; it’s about achieving a fair and transparent assessment process.

Key Information for Your Challenge

When requesting a reassessment of your property’s valuation, providing the right details is crucial to building a strong case. Clear and accurate information helps to support your argument and increases the likelihood of a successful outcome. Ensuring that you include all relevant facts can help demonstrate why the current valuation is incorrect.

The following details are essential to include:

- Property description: Provide a detailed account of your home, including its size, condition, and unique features that may affect its value.

- Comparable properties: Research similar properties in your area to show how their valuation compares to yours. This helps to highlight discrepancies.

- Recent market trends: Include data on any changes in property values within your local area, especially if prices have significantly dropped or risen.

- Supporting documents: Attach any relevant documents, such as property appraisals, survey reports, or photographs that support your claims.

By presenting this information clearly and thoroughly, you will be able to demonstrate that your current assessment is not reflective of the true value of your property. Proper documentation is key to ensuring that your challenge is taken seriously and reviewed fairly.

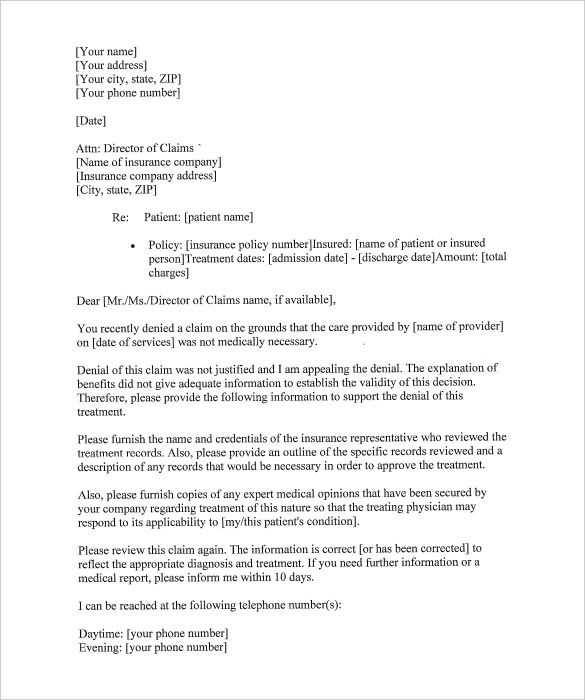

How to Structure Your Request Effectively

To maximize the chances of your request being considered and acted upon, it’s important to organize your message in a clear and logical manner. The structure should guide the reader through the key points of your case, making it easy for them to understand why your property’s evaluation should be revisited. A well-organized communication ensures that nothing important is left out and that your argument is presented persuasively.

Introduction: State Your Purpose

Begin by clearly stating the purpose of your communication. Introduce yourself, provide your property details, and explain that you are requesting a review of the valuation. Be concise but informative, outlining the reason for your challenge without going into excessive detail.

Supporting Information: Present Your Case

Next, present the key facts that support your request. This could include information about similar properties in your area, recent market changes, or details about your property that may have been overlooked. Organize these points logically and provide any evidence or documents that help strengthen your case.

Finish by summarizing your request and expressing your expectation for a prompt review. Make sure to provide contact information and indicate your willingness to offer additional details if needed.

Common Mistakes to Avoid in Challenges

When requesting a reassessment of your property’s valuation, it’s easy to make mistakes that can weaken your case. Avoiding common errors will help ensure your request is clear, well-supported, and taken seriously. Knowing what pitfalls to watch for can make the process smoother and increase your chances of a successful outcome.

Failing to Provide Sufficient Evidence

One of the most common mistakes is not including enough supporting documentation. Without proper evidence, your request may seem unsubstantiated. Make sure to include clear comparisons, photographs, or appraisal reports that demonstrate your property’s actual value.

Using Vague or Unclear Language

Being too vague in your explanation can confuse the reviewer and lead to a rejected request. Always be precise and concise when outlining your points. Avoid using general terms and focus on specific issues that can be backed by data.

| Common Mistake | How to Avoid It |

|---|---|

| Insufficient evidence | Include detailed comparisons, reports, and photographs to support your claims. |

| Vague explanations | Be clear and specific, providing concrete examples and facts. |

| Ignoring deadlines | Check the deadlines and ensure your request is submitted on time. |

By avoiding these common errors, your request will be more effective and stand a higher chance of receiving a favorable review.

Submitting Your Challenge: What to Expect

Once you’ve completed your request for reassessment, it’s important to understand what happens next in the process. Knowing what to expect can help you stay organized and manage your expectations. While the process may take some time, understanding the steps involved will keep you informed and prepared for any actions you may need to take.

Initial Review and Confirmation

After submitting your request, the first step typically involves an acknowledgment from the relevant authority. They may confirm that they have received your submission and provide you with an estimated timeline for when you can expect a response. This initial review may involve a basic check to ensure that your submission includes all necessary information.

Further Assessment and Outcome

The next phase involves a detailed evaluation of your request. The reviewing body will assess the evidence you’ve provided and compare it to other similar properties in your area. Depending on the complexity of your case, this may take some time. Once the assessment is complete, you will be informed of the decision, and if successful, the property’s valuation may be adjusted.

Throughout this process, it’s important to remain patient and responsive. If further information is needed, providing it promptly can help speed up the process.