Parent guarantee letter template

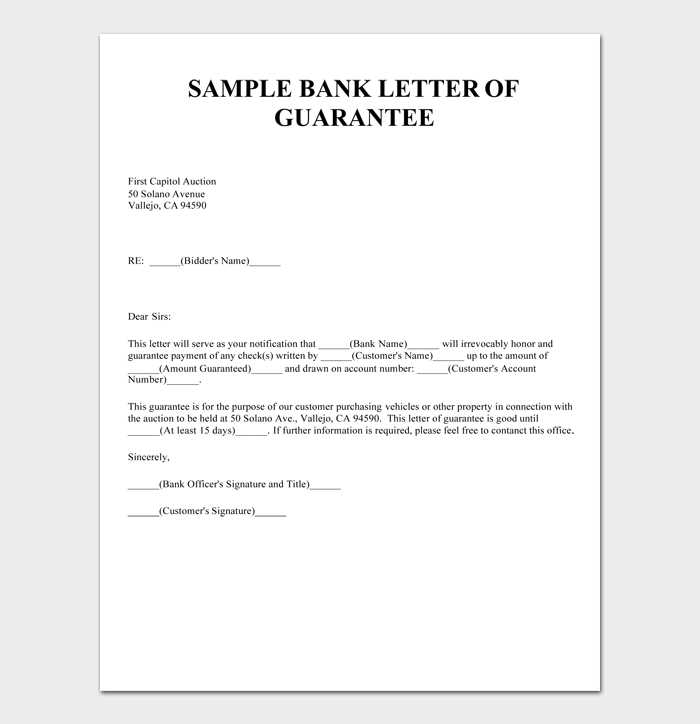

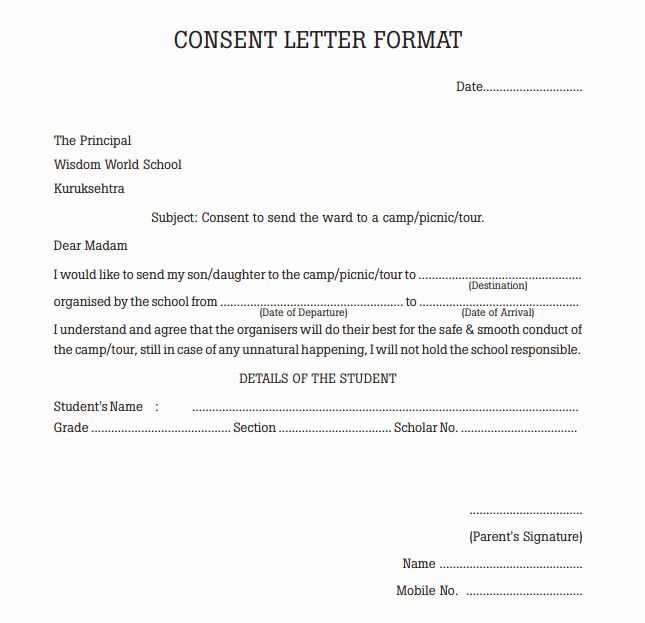

When drafting a parent guarantee letter, it’s important to be clear and concise about the responsibilities you are willing to assume. The document should clearly state that you, as the parent, will take responsibility for any debts, obligations, or actions related to your child’s financial or legal matters. This provides the necessary assurance to the recipient that you are committed to fulfilling the guarantee if required.

Start by including your full name, address, and contact details. This helps the recipient know exactly who is offering the guarantee. Be specific about the terms and conditions of the guarantee, including the duration, amount, and any conditions that may apply. Make sure to mention if the guarantee is for a loan, rental agreement, or any other obligation.

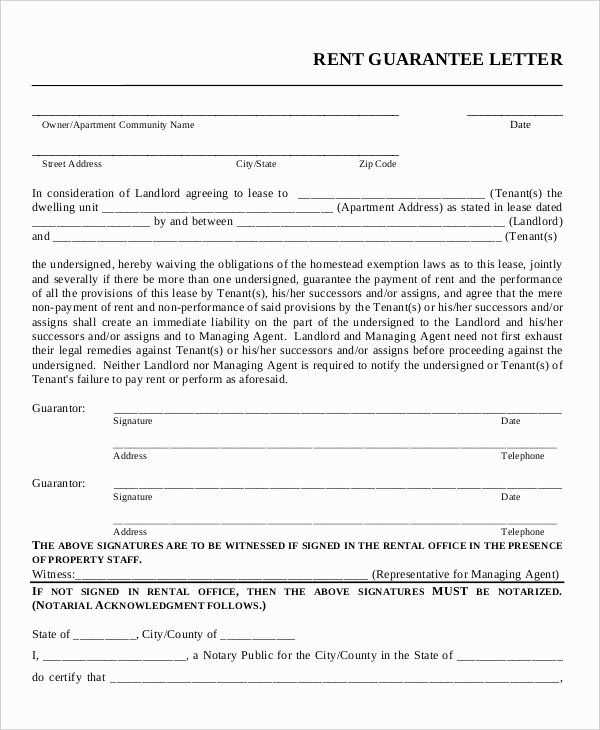

For clarity and legal security, consider having the letter signed by both the parent and the recipient, acknowledging the terms. You may also want to have it witnessed or notarized, depending on the requirement. This step ensures that the guarantee is legally binding and understood by all parties involved.

Lastly, be sure to review the letter carefully. Any vague or ambiguous language could lead to misunderstandings or disputes down the line. The clearer the terms, the easier it will be for everyone involved to uphold the agreement.

Here is the corrected version:

Make sure to begin with clear identification of the parties involved. Start by addressing the recipient directly and include the name of the parent or guardian. Then, follow up with an explicit commitment to the financial responsibility or guarantee being provided. Be clear about the specifics of the guarantee and any conditions that apply.

Key Elements to Include

- Parent’s Full Name

- Recipient’s Full Name or Organization

- Description of the financial guarantee (e.g., amount, purpose)

- Terms of agreement (duration, payments, conditions)

- Signature of the parent or guardian

- Date of agreement

Ensure the tone remains formal yet personal to show accountability. It is also crucial to include contact details in case the recipient needs further clarification or communication.

- Parent Guarantee Letter Template

When writing a parent guarantee letter, focus on clarity and precision. This letter serves as a formal assurance from a parent or guardian that they will be responsible for certain obligations, typically financial or legal, on behalf of their child. Keep the tone respectful and direct.

Key Elements to Include

Start with a formal salutation, addressing the recipient by name or title. State your full name and relationship to the individual for whom you are providing the guarantee. Clearly mention the specific responsibility being guaranteed, whether it’s a financial commitment, lease, or any other obligation. Include the exact amount or details of the guarantee, along with any relevant dates or deadlines. Conclude with a statement reaffirming your commitment, and provide contact details for further verification.

Sample Parent Guarantee Letter

Dear [Recipient’s Name],

I, [Parent’s Full Name], am the parent of [Child’s Full Name], and I am writing to guarantee [his/her] [specific obligation, e.g., rental payment] under [agreement/contract]. I understand the terms of this obligation and assure you that I will fulfill this responsibility if [child’s name] is unable to do so.

This guarantee will remain in effect until [date], or until the obligation is fully satisfied. Should you need any further details or clarification, please do not hesitate to contact me at [phone number] or [email address].

Sincerely,

[Parent’s Full Name]

A guarantee letter is a formal document used to assure a third party that certain obligations will be fulfilled. It serves as a promise from one party, usually a parent or guardian, to take responsibility for the actions or financial commitments of another party, often a child or dependent. This type of letter is commonly required in situations such as renting a property, applying for a loan, or enrolling in a program where the primary applicant may not meet the required criteria alone.

Legal and Financial Reassurance

The guarantee letter offers a sense of security to the recipient, reassuring them that the obligations will be met, even if the primary party is unable to fulfill them. This can include financial repayment, adherence to certain rules, or other commitments. By signing the letter, the guarantor legally binds themselves to cover the responsibility if necessary, protecting the recipient from potential losses or defaults.

Building Trust and Accountability

For parents or guardians, providing a guarantee letter can demonstrate their support for their child’s endeavors, whether academic or financial. It establishes a relationship of trust with the recipient, showing that the guarantor is committed to backing the agreement. This can be particularly beneficial when the child may not have the required resources or experience to handle the situation independently.

A Parent Guarantee must clearly outline the responsibilities and obligations of the guarantor. The key components to include are:

1. Identification of Parties

Clearly identify the guarantor (the parent) and the party being guaranteed. Include names, addresses, and any other relevant details to avoid ambiguity.

2. Guarantee Terms

Specify the exact scope of the guarantee. Define whether the guarantee is limited to a specific amount or covers broader obligations, such as payments or damages.

3. Duration of Guarantee

State how long the guarantee will remain valid. Whether it is a fixed period or extends under certain conditions should be made clear.

4. Conditions for Activation

Detail the conditions under which the guarantee will be enforced. Include situations where the primary party fails to fulfill their commitments.

5. Limitations of Liability

If applicable, outline any limitations on the guarantor’s liability, such as a maximum amount or specific circumstances under which they may be released from responsibility.

6. Signatures

The document must be signed by the guarantor and the party being guaranteed, ensuring legal validity.

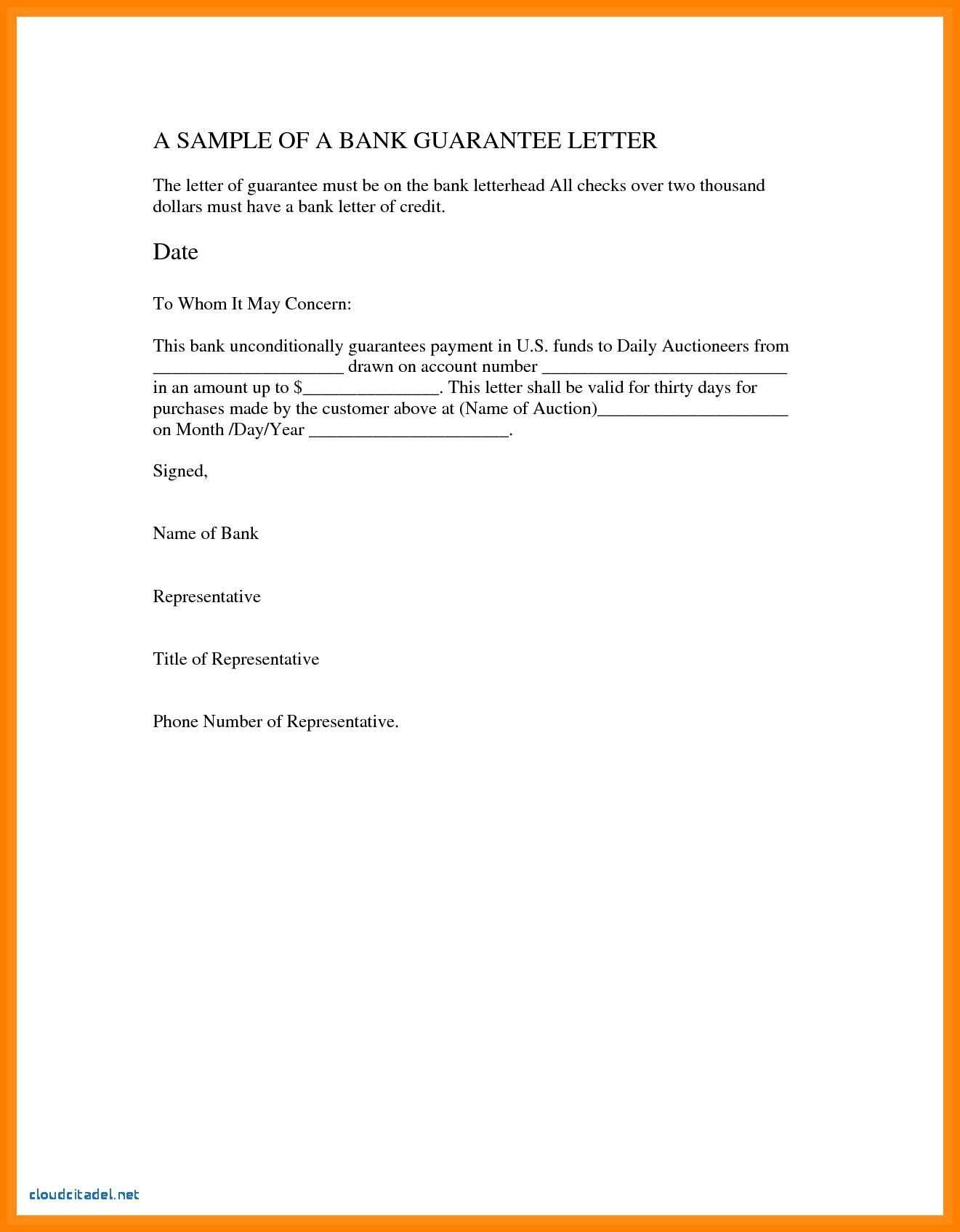

Begin by clearly stating the purpose of the guarantee. Specify that it is a commitment to support or assume responsibility for the subject in question, such as a loan, debt, or lease agreement. Include the name of the person providing the guarantee and the recipient, along with their relationship to the guarantee.

Step 1: State the Guarantee Details

In the opening paragraph, describe the nature of the guarantee. Define what is being guaranteed, the amount (if applicable), and any timeframes or deadlines involved. Ensure to clarify that the guarantor is legally responsible for fulfilling the obligation if the primary party defaults.

Step 2: Include Terms and Conditions

Specify any conditions under which the guarantee is valid. Mention circumstances in which the guarantor can be released from responsibility, if any. Also, include details about any collateral or assets related to the guarantee, if applicable.

| Key Element | Description |

|---|---|

| Guarantor’s Name | Full name of the person offering the guarantee |

| Recipient’s Name | Full name of the person or entity receiving the guarantee |

| Details of Guarantee | Nature of the commitment and any related obligations |

| Terms & Conditions | Conditions for the guarantee’s validity, and release clauses |

End the letter with a statement confirming the guarantor’s legal obligation to fulfill the guarantee if necessary. Both parties should sign the letter, and if applicable, have it witnessed or notarized to ensure its validity.

Before signing a guarantee, ensure you fully understand your obligations. A guarantee can make you financially liable if the primary borrower defaults, so review the terms carefully.

Understand the Scope of Liability

The guarantee should clearly outline your responsibilities. Ensure that the terms specify the exact amount and conditions under which your guarantee will be triggered. Ambiguities can lead to unexpected liabilities.

Seek Independent Legal Advice

Consult a legal professional to ensure you understand the potential risks. Legal counsel can help clarify terms and ensure you’re not taking on unnecessary obligations.

Confirm that the guarantee is limited to specific obligations, and check if there are clauses that might make you liable beyond the initial terms. Some guarantees can be open-ended or extend over long periods, which might not be in your best interest.

When drafting a guarantee letter, clarity and accuracy are key. Here are some common mistakes to avoid:

- Ambiguous language: Avoid using vague or unclear terms. Clearly define the scope and obligations of the guarantee.

- Incomplete information: Always include the full names, addresses, and relevant details of all parties involved.

- Missing signatures: Ensure that the letter is signed by all necessary parties. A lack of signatures may invalidate the guarantee.

- Overpromising: Stick to realistic terms. Avoid overextending guarantees or offering assurances that are beyond your control.

- Failure to specify duration: Include a clear time frame for the guarantee’s validity. Do not leave it open-ended.

- Not identifying potential risks: It’s important to outline any potential risks or conditions under which the guarantee may be voided.

- Ignoring legal requirements: Familiarize yourself with local laws to ensure that the guarantee letter complies with all applicable regulations.

If you are uncertain about the terms of a guarantee letter, it’s best to consult with a legal expert. Before signing any guarantee letter, ensure that you fully understand the obligations and potential risks involved. If the guarantee could involve significant financial consequences or long-term commitments, a lawyer can help clarify the terms and advise on any hidden risks.

Ambiguities in the Terms

If any part of the guarantee letter seems vague or open to interpretation, seek legal advice. A lawyer can help define specific terms and prevent misunderstandings that may lead to disputes later on.

Complex Legal Language

If the language used in the letter is too complex or filled with legal jargon, a legal professional can help break it down. They will ensure that the document is clear and that you are not agreeing to obligations you didn’t fully comprehend.

Consult a lawyer if you are unsure about the enforceability of the letter in your jurisdiction or if the letter involves international laws or regulations that require expert interpretation. A legal consultation can provide peace of mind and ensure you make an informed decision.

Removing Redundant Use of “Parent” in Guarantee Letters

To streamline your guarantee letter, avoid unnecessary repetition of the word “Parent.” Instead of using “Parent” before each reference, use it once at the beginning, then substitute with simpler terms or pronouns. For example, instead of saying “Parent of the student, Parent of the student will sign,” rewrite it as “The undersigned, parent of the student, will sign.” This way, the letter remains clear and direct, maintaining its professional tone without redundancy.

Additionally, refer to the guarantee letter’s signatory as “the undersigned” or “the guardian” if the context allows. This keeps the language concise and focused, while still conveying the necessary information.