Corporation Tax Penalty Appeal Letter Template Guide

When facing an imposed financial charge from a governmental body, businesses often have the option to contest it. This process allows organizations to present their case, request reconsideration, and potentially reduce or eliminate the imposed fine. A well-structured written document is an essential part of this process, helping to effectively communicate the reasons for challenging the decision.

Understanding the Process

The first step in contesting an imposed fee involves gathering all necessary information. This includes understanding the reason for the fine, the rules that apply, and any deadlines for submitting requests for reconsideration. Being thorough and clear about the situation can increase the chances of a favorable outcome.

Key Points to Include

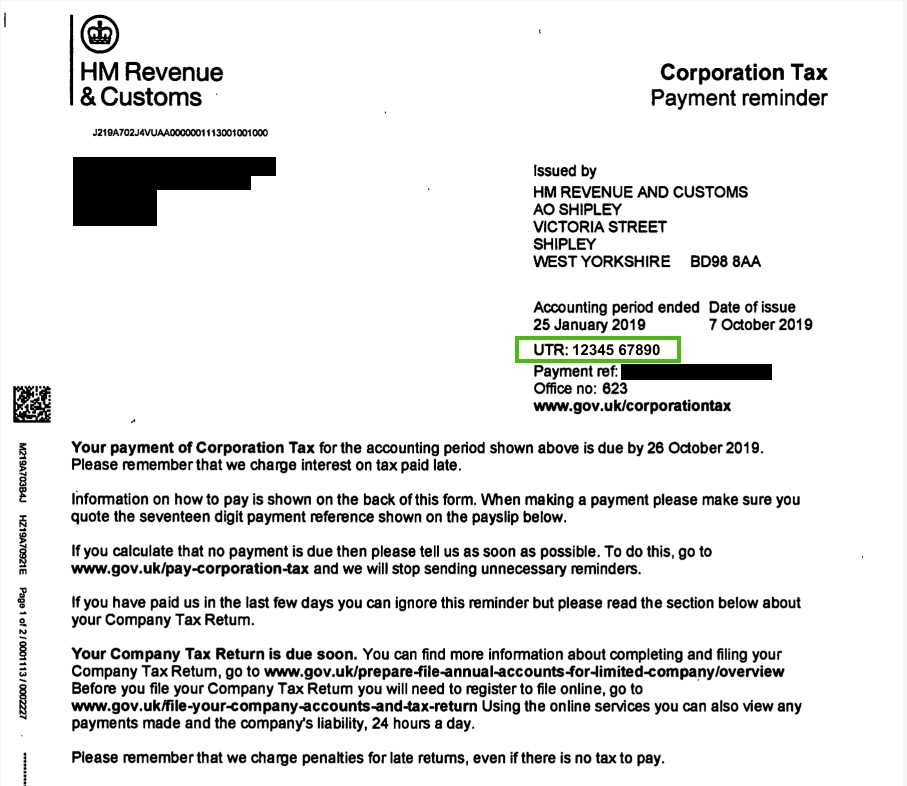

- Details of the Fine: Mention the charge, its amount, and any relevant reference numbers.

- Justification for Reconsideration: Provide clear reasons why the fine is unjust or should be reduced.

- Supporting Evidence: Attach any documents that support your position, such as financial records or correspondence.

- Desired Outcome: Clearly state what resolution you are seeking, whether it’s a reduction or complete removal of the fine.

Structuring Your Request

It is important to maintain a professional tone in your written request. Avoid emotional language or aggressive phrasing. A well-organized structure enhances readability and increases the likelihood that the request will be taken seriously. Use the following structure as a guideline:

- Introduction: Briefly introduce the situation and the charge in question.

- Body: Explain why the fine should be reconsidered and provide all relevant facts and supporting evidence.

- Conclusion: Clearly state the outcome you are requesting and express your willingness to cooperate further if necessary.

Final Considerations

After submitting your request, be patient and wait for a response. In some cases, further documentation may be required. If the result is not in your favor, you may have the option to escalate the issue or seek legal advice. Regardless of the outcome, following the process carefully can help demonstrate your commitment to complying with regulations while protecting your business’s interests.

How to Challenge a Financial Charge Effectively

When a business faces an imposed financial charge from authorities, they have the option to present a formal request for reconsideration. This process involves drafting a clear and structured communication that outlines reasons for disputing the fine and provides necessary documentation to support the claim. Crafting such a document is crucial to achieving a favorable outcome and reducing or removing the charge.

Understanding Financial Fines for Businesses

Businesses may encounter fines for various reasons, ranging from missed deadlines to administrative errors. Understanding the basis for the fine and the relevant rules is essential to formulate a strong case. Knowing the process of contesting the fine will help businesses navigate the complexities of resolving the issue.

Key Elements to Include in Your Request

To ensure your request is clear and persuasive, include the following key elements:

- Reference Information: Include the fine reference number, amount, and the date it was issued.

- Clear Explanation: State why the charge is unjust or should be reconsidered, whether due to mitigating circumstances or errors.

- Supporting Evidence: Attach any relevant documentation, such as financial statements, contracts, or previous correspondence that supports your case.

- Desired Resolution: Clearly state the outcome you seek, whether it’s a reduction, waiver, or reconsideration of the fine.

Steps to Contest a Fine

To contest the fine, first review the official guidelines for challenging such charges. Then, prepare a detailed and well-organized request. Ensure all deadlines are met and that the communication is sent through the appropriate channels. Once submitted, allow time for review and be ready to provide additional information if necessary.

Common Mistakes to Avoid

When submitting your request, avoid these common errors:

- Failure to Include Necessary Details: Omitting key reference numbers or evidence can weaken your case.

- Excessive Emotional Tone: Keep your language professional and factual rather than overly emotional or confrontational.

- Missing Deadlines: Ensure that you submit the request on time to avoid automatic rejection.

How to Communicate Effectively with Authorities

Maintaining a polite, professional, and clear tone when communicating with government agencies is critical. Be concise, respectful, and stick to the facts. It’s important to respond promptly to any follow-up requests or clarifications to demonstrate your commitment to resolving the matter.

Next Steps After Submission

After submitting your request, allow time for the authorities to process it. If you do not receive a response within the expected timeframe, follow up politely. If the outcome is not favorable, explore further options such as appealing to a higher authority or seeking legal advice to ensure your business’s rights are protected.