Accountant Letter to Bank Template for Effective Communication

In the world of finance, communication between professionals and institutions is crucial for smooth transactions and record-keeping. Whether you are a financial consultant or a company executive, knowing how to draft a formal document for financial matters can significantly impact your business operations. This guide will provide essential insights into crafting a clear, professional document for such purposes.

Essential Components of a Financial Correspondence

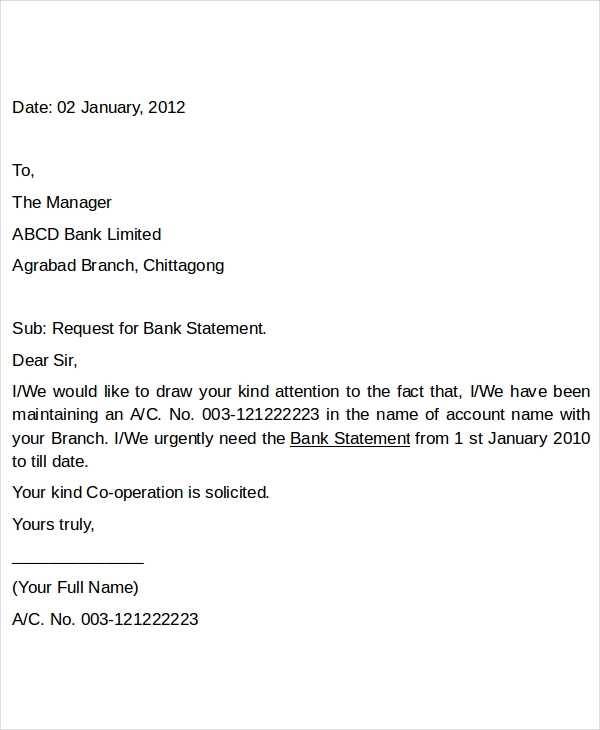

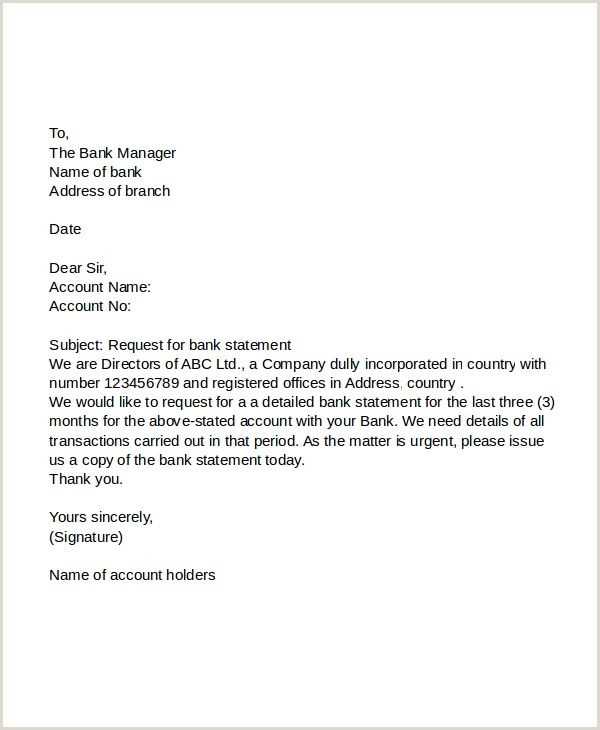

Creating a professional message to a financial entity requires attention to detail. A well-written document should contain specific information that helps establish the purpose of the communication. Key sections to include are:

- Introduction: Clearly state the reason for the correspondence.

- Details: Provide any necessary background or financial data relevant to the request.

- Conclusion: Ensure a call to action or a summary of the next steps.

Formatting for Clarity and Impact

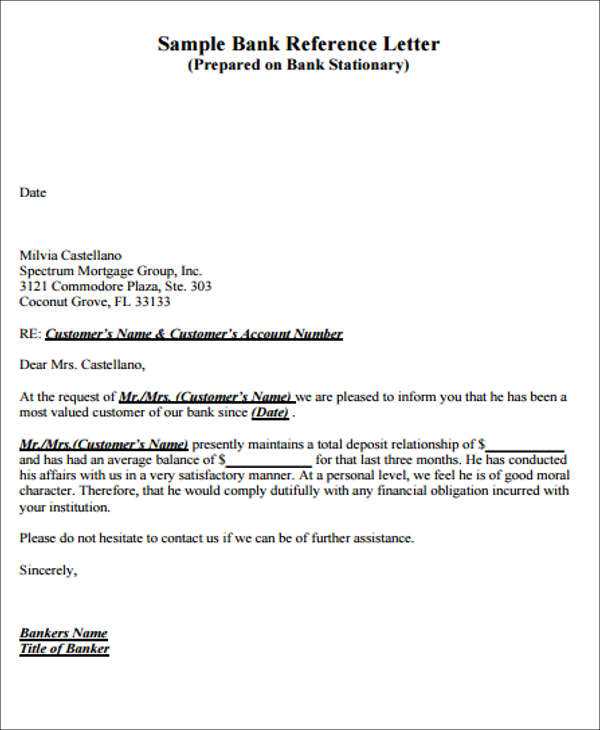

Proper formatting can make your message more effective and easier to read. Use professional fonts, a consistent layout, and adequate spacing. Bullet points or numbered lists can be helpful for presenting detailed information, such as financial figures or timelines.

Personalizing Your Message

While using a general format can save time, personalization is key to maintaining a professional relationship. Tailor the message to the specific recipient, referencing previous communications or transactions where applicable. This not only ensures clarity but also shows attentiveness to the recipient’s needs.

Common Pitfalls and How to Avoid Them

Even small errors in formal documents can lead to misunderstandings or delays. Here are some common mistakes to watch out for:

- Unclear language: Avoid jargon or overly complex sentences that may confuse the reader.

- Omission of key details: Be sure to include all relevant information so that the recipient can act on your request without needing clarification.

- Improper tone: Maintain a respectful, professional tone throughout the correspondence.

Legal Considerations for Financial Communication

It is essential to ensure that your communication complies with any relevant financial regulations. This may include privacy laws, anti-money laundering protocols, and documentation requirements. Always verify the legal framework in which you are operating to avoid potential issues down the line.

Final Thoughts on Effective Financial Communication

Crafting professional messages is a vital skill in the financial industry. By following best practices in structure, tone, and content, you can foster clear communication with financial institutions and streamline your operations. Keep these tips in mind to ensure your documents are effective, respectful, and legally compliant.

Professional Financial Communication and Its Importance

In the financial world, clear and professional communication plays a pivotal role in facilitating transactions and ensuring smooth business operations. Whether you are addressing a financial institution or another entity, conveying accurate information in a structured manner is essential for effective dealings. Understanding how to construct a formal communication piece helps you achieve clarity and professionalism in all financial interactions.

Why You Need a Formal Financial Document

In various business and financial scenarios, a formal document is necessary to request actions, confirm agreements, or clarify situations. Such communications help ensure that both parties involved are aligned, reducing the risk of misunderstandings or delays. They also serve as legal proof of communication when necessary. By having a standardized structure, you can ensure that your message is comprehensive and professional.

Key Components of Effective Financial Correspondence

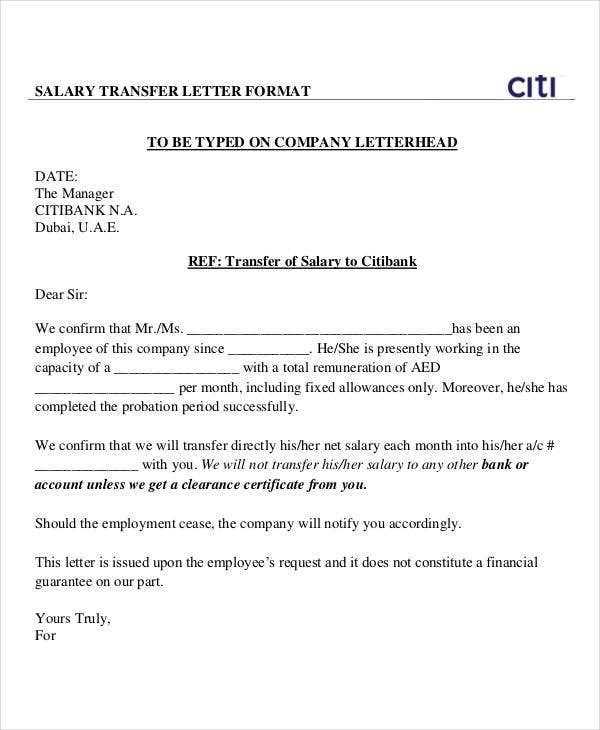

A well-organized message should include key elements to be fully understood and actionable. These include:

- Clear Purpose: Specify the reason for writing to the recipient, such as requesting services or providing financial updates.

- Relevant Details: Provide any necessary data or documents that support your request or statement.

- Formal Conclusion: End the communication with a polite and professional closing statement, summarizing the next steps or actions to be taken.

How to Personalize the Communication

While a generic format can save time, personalizing the content makes it more relevant and engaging. Tailoring the message to the recipient’s specific situation can foster better relationships and increase the likelihood of a prompt response. Mentioning previous interactions or referring to specific details shows attention to the recipient’s needs.

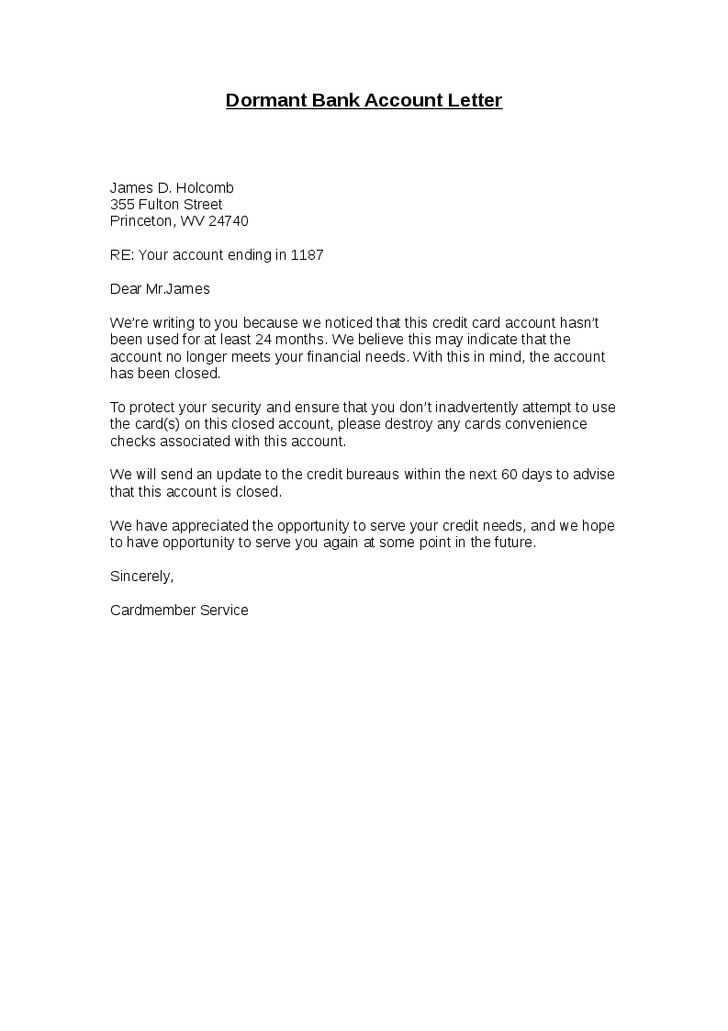

Common Errors to Avoid in Professional Correspondence

Even minor mistakes can compromise the effectiveness of your communication. Here are some common issues to watch out for:

- Vague Language: Ensure that the message is clear and direct, avoiding overly complex terminology or ambiguous phrasing.

- Lack of Key Information: Missing out on essential details can result in the recipient being unable to respond appropriately.

- Inappropriate Tone: Maintain a polite, respectful tone throughout the communication, avoiding overly casual or confrontational language.

Legal Aspects of Financial Communication

It is crucial to understand the legal implications of financial correspondence. Adhering to privacy laws, regulatory guidelines, and contractual obligations is essential to avoid any legal issues. Ensuring that the document complies with all relevant rules helps protect both parties’ interests and ensures smooth operations.

Advice for Professional Document Formatting

The layout and presentation of your financial communication can impact its effectiveness. A well-organized format improves readability and conveys professionalism. Stick to a clean, consistent structure with appropriate headings, bullet points, and proper spacing to make the document easy to follow and visually appealing.