Certificate of creditable coverage letter template

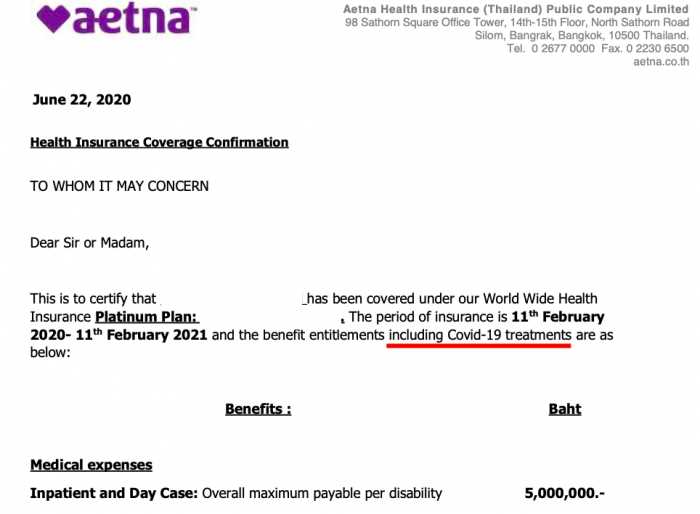

For employers or health insurance providers needing to create a Certificate of Creditable Coverage letter, it’s important to include key details to ensure the letter serves its purpose. This letter confirms the period during which an individual was covered by health insurance, which can be crucial for avoiding penalties related to the Affordable Care Act (ACA) or for switching between plans.

A simple, clear format is effective. Begin by stating the individual’s name, policy number, and the start and end dates of coverage. Follow this with the name of the insurance company, as well as a confirmation that the individual’s coverage was “creditable,” meaning it meets the standards set by the ACA.

In the body of the letter, include any necessary contact details for questions or verification, and always ensure that the letter is signed by a company representative with the authority to provide such confirmation. This document must be accurate, as it might be required for verification of eligibility for a special enrollment period or for penalty exemptions under the ACA.

Keep the language clear and direct, avoiding unnecessary jargon. A well-structured letter helps avoid confusion and ensures that the recipient understands the coverage details without ambiguity.

Got it! Do you need help with something specific about sewing machine repair?

- Certificate of Creditable Coverage Letter Template

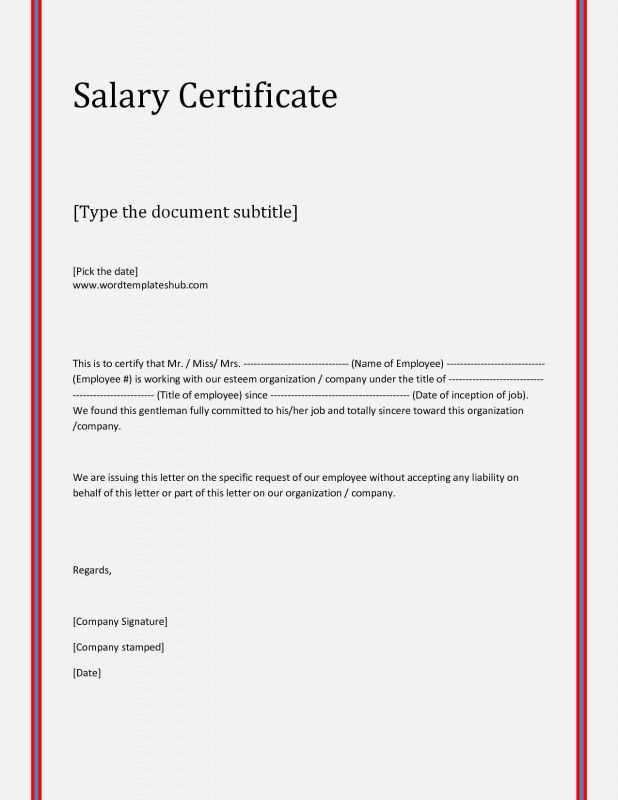

To create a clear and accurate Certificate of Creditable Coverage letter, follow this template to ensure all necessary details are included:

- Header: Start with the name of the insurance provider, along with the address, contact details, and date of the letter.

- Introduction: Begin by addressing the recipient with their name and title. Clearly state that the letter serves as a Certificate of Creditable Coverage. For example: “This letter verifies that you, [Recipient’s Full Name], were covered under our health insurance plan from [Start Date] to [End Date].”

- Policy Details: Include the type of coverage (e.g., individual, family), policy number, and plan type. Be specific with dates to ensure clarity on the period of coverage.

- Employer Information (if applicable): If the coverage was employer-sponsored, mention the employer’s name and provide contact details for further inquiries.

- Statement of Creditable Coverage: Clearly state that the coverage meets the minimum required standards. For example: “This coverage qualifies as creditable coverage under [applicable legislation], and it meets the requirements for avoiding late enrollment penalties under Medicare.”

- Signature: End with the signature of the authorized person, including their name, title, and the date of signature. Ensure there is a space for the signature if printed.

Ensure all sections are filled accurately. Double-check dates, coverage details, and contact information to prevent any issues with future claims or Medicare enrollment. A well-structured letter helps recipients avoid unnecessary penalties or complications related to their health coverage status.

A Certificate of Creditable Coverage (CCC) is a document that verifies the period during which an individual had health insurance coverage. This certificate shows that a person was covered under a group health plan or other health insurance before enrolling in a new health insurance plan, including a new employer’s plan or a Medicare plan. The purpose of the CCC is to help individuals avoid gaps in their healthcare coverage when switching insurance plans.

The primary function of this document is to provide proof that a person has had continuous health coverage. This helps with the calculation of pre-existing condition exclusions and to ensure that no penalties are applied for late enrollment in a new health insurance plan. For example, when someone transitions from an employer’s health plan to Medicare, the CCC can prevent penalties related to late enrollment in Medicare Part B.

Why Is It Important?

The Certificate of Creditable Coverage ensures that the transition between health insurance plans is seamless and without penalties. For those transitioning to Medicare, it helps avoid the late enrollment penalties that can arise if someone waits too long to sign up. It also protects individuals from being considered “uninsured” for periods when they were actually covered. Therefore, it is crucial for maintaining health insurance continuity and ensuring there are no delays in care due to gaps in coverage.

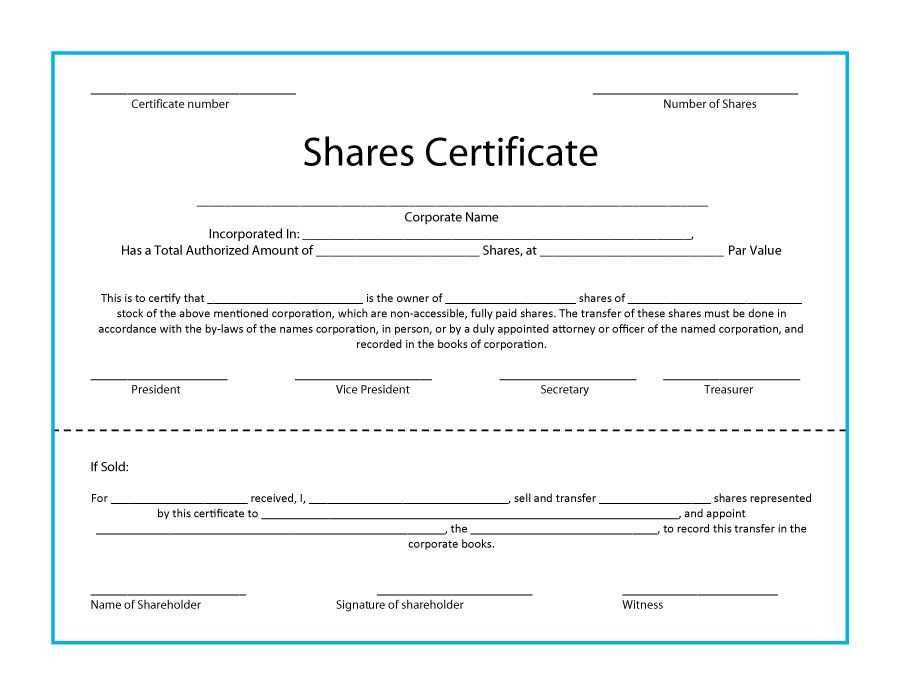

Provide the insurance provider’s name, policy number, and the coverage dates to clarify the exact period when the insurance was active. This ensures that both parties are aligned on the details of the coverage period.

Clearly state the type of coverage provided, whether it’s medical, dental, or vision insurance. This helps the recipient quickly understand the scope of the insurance.

Include the names of covered individuals. This ensures transparency about who was protected under the policy during the specified period.

Provide the group number or individual identification number associated with the coverage. This is essential for tracking and referencing the policy in future communications.

Be sure to indicate whether there were any gaps in coverage or if the policy was continuous. This helps the recipient to understand if there were any interruptions in the coverage period.

Clearly outline the start and end dates of the coverage. This ensures there’s no ambiguity about the duration of coverage for any of the insured individuals.

| Information | Description |

|---|---|

| Insurance Provider Name | Include the name of the company offering the coverage. |

| Policy Number | Include the unique identifier for the insurance policy. |

| Coverage Dates | Specify the start and end dates of the coverage period. |

| Type of Coverage | Clarify if the coverage is for medical, dental, vision, etc. |

| Covered Individuals | List all individuals covered by the policy. |

| Group/ID Number | Provide the group number or ID associated with the policy. |

| Coverage Gaps | Note any gaps in coverage if applicable. |

Begin by gathering all necessary information, such as your personal details, the coverage period, and the insurance provider’s contact information. This ensures that you have accurate data at hand for each section of the form.

Next, enter your full name and address in the designated fields. Double-check your information for accuracy to avoid any mistakes. It’s important that your details match the records from your insurance provider.

For the coverage period, include the exact start and end dates of your coverage. Be precise with the dates as any discrepancies could delay processing or verification.

When filling in the insurance provider’s name, ensure it matches the official name listed in your policy documents. Include the provider’s contact number and address, as these details might be needed for follow-up verification.

Some certificates require you to list specific types of coverage, such as medical, dental, or vision. Be sure to indicate the coverage type that applies to your plan during the reporting period.

In the “Sign and Date” section, provide your signature and the date you complete the form. This confirms that the information you have provided is accurate and truthful. If the certificate needs to be notarized, follow the additional instructions for notarization.

Review the entire form for any errors or omissions before submitting it. Accuracy is key, as any incomplete or incorrect information could lead to delays or issues with your health coverage records.

One of the biggest mistakes is providing incomplete or unclear coverage details. Be specific about the period of coverage, including the start and end dates. Make sure to include the name of the insurer, the type of coverage, and any specific policy numbers. Failure to include this information can lead to confusion and delays in processing claims or enrollment.

1. Inaccurate Information

Double-check all facts. Incorrect policy numbers or coverage dates are a frequent source of errors. Mistakes in names, addresses, or plan details can cause the letter to be rejected. Always verify the data before finalizing the document.

2. Missing Signatures

Without an authorized signature, the letter lacks validity. Make sure the document is signed by the correct representative, whether it be an employer, insurer, or administrator. This is often overlooked, yet it is essential for confirming the authenticity of the letter.

3. Unclear Formatting

Unorganized or unclear formatting can make the letter difficult to read or understand. Use a simple, clean layout with distinct sections for coverage details, dates, and the contact information of the issuer. Use bullet points or tables to separate key information.

| Key Detail | Common Mistake |

|---|---|

| Coverage Dates | Not providing specific start and end dates |

| Insurance Information | Incorrect policy numbers or insurer details |

| Signature | Forgetting to include an authorized signature |

Avoid these common pitfalls to ensure that your coverage letter is accurate, clear, and complete. This can prevent delays and ensure that the recipient can process the letter efficiently.

Submit your Certificate of Creditable Coverage promptly to ensure continuous health insurance coverage. Follow these steps to make the process smooth and efficient.

1. Review the Submission Guidelines

Before sending your certificate, check the specific requirements provided by your insurance provider. This may include the format, additional documents, or a specific submission method (online, by mail, etc.).

2. Gather Supporting Documents

If required, attach any necessary supporting documentation, such as proof of previous insurance or relevant personal information. Double-check that all documents are up-to-date and complete.

3. Choose the Submission Method

- Online Portal: Log into your provider’s website and upload the certificate in the designated section. You may receive a confirmation email once the submission is successful.

- Mail: If mailing the certificate, ensure you use a reliable service (e.g., certified mail) to track delivery. Include a cover letter if needed, and address it to the correct department.

- Fax: Some providers accept faxed copies. Ensure the fax is clear and legible before sending.

4. Confirm Receipt

After submitting, confirm receipt with your provider. Follow up with a call or email to ensure that the certificate was processed successfully. Keep a copy of all correspondence for your records.

If your Certificate of Creditable Coverage is incorrect or missing, take the following steps to address the issue:

- Contact your health insurance provider immediately to report the error or missing certificate. Be ready to provide personal details, policy numbers, and the period of coverage you believe should be included.

- If your insurer can’t resolve the issue right away, ask for a specific timeline for when you can expect to receive a corrected certificate or a replacement. Keep a record of all communication.

- If your insurer refuses to issue the correct document or fails to provide a satisfactory solution, file a complaint with your state’s insurance department. This will escalate the issue and may prompt further action.

- If you have been without insurance coverage for a period, check if you are eligible for alternative documentation that can serve as proof of coverage, such as pay stubs or other official documents from your employer.

In case you are unable to resolve the problem directly with your insurer, contacting a legal professional or an insurance advocate might help you understand your rights and obligations in this situation.

To create a clear and informative Certificate of Creditable Coverage letter, ensure the document includes the necessary information about the individual’s health coverage period. Start by listing the name of the individual covered, along with the name of the insurance provider. Then, specify the dates of coverage, outlining both the start and end dates. If the coverage was continuous, make sure to mention it explicitly. If there were any gaps in coverage, list the dates of those gaps. Be sure to add the reason for any interruptions, such as changes in employment or other relevant circumstances.

Include a statement that verifies the coverage meets the required standards for creditable coverage as defined by the regulations. This helps the recipient understand how their previous coverage applies to future health plans, particularly when transitioning to new insurance providers. Finally, conclude with the contact information of the issuing entity in case the recipient has further questions or needs additional documentation.