Credit 609 letter template

If you need to dispute errors on your credit report, a Credit 609 letter is a simple and effective way to initiate the process. The letter is based on a section of the Fair Credit Reporting Act (FCRA), which allows you to request the removal of inaccurate or outdated information from your credit history. The goal is clear: hold credit bureaus accountable for reporting only accurate data.

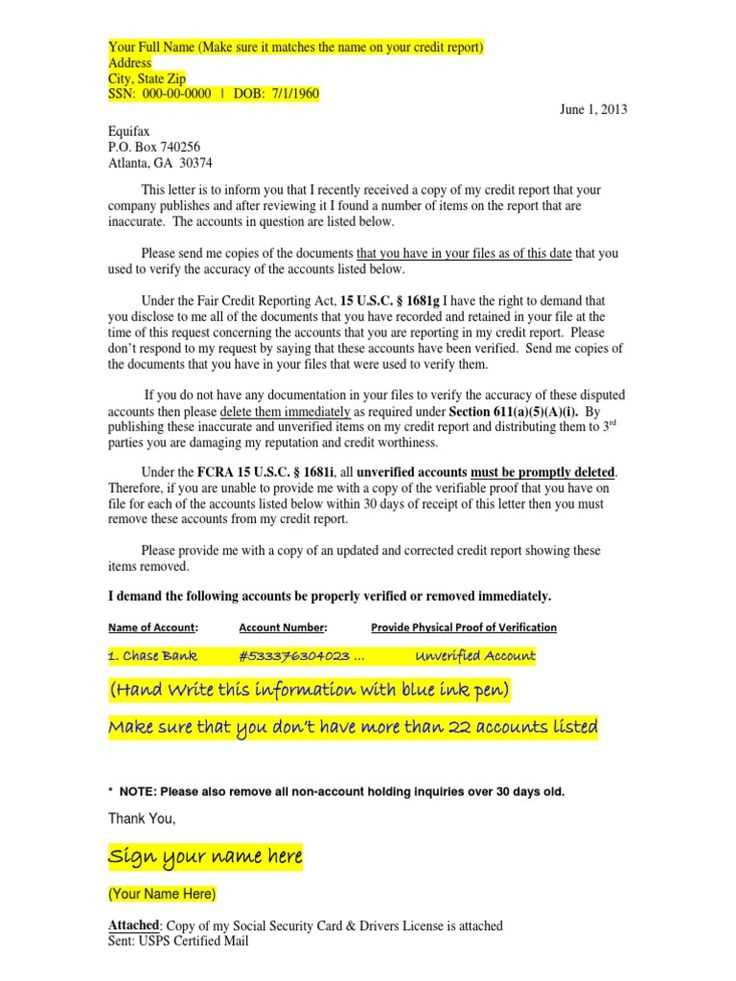

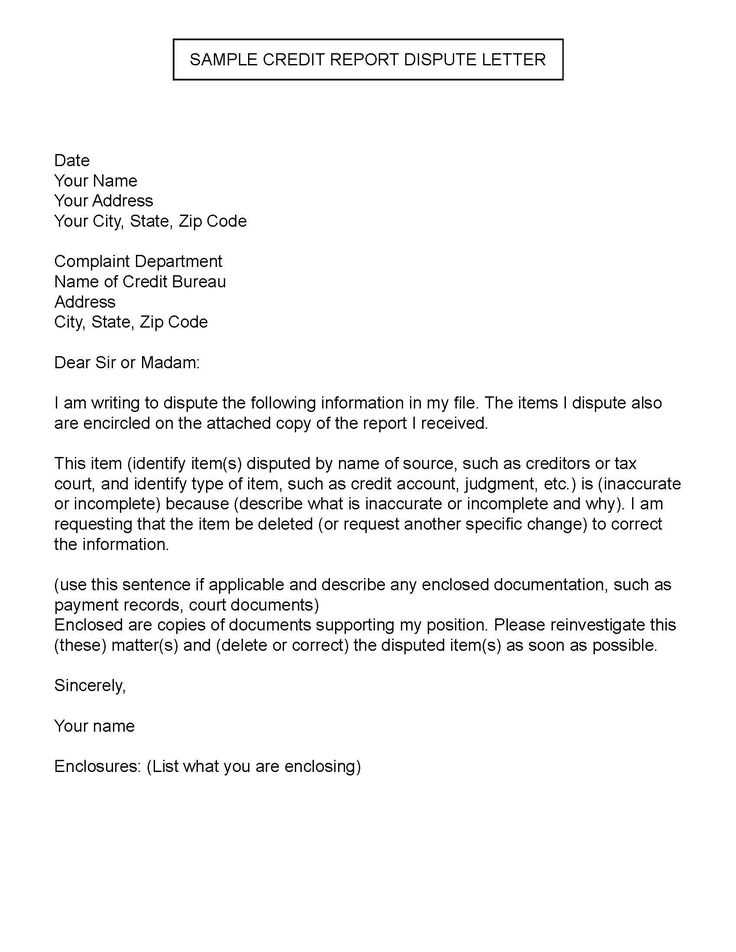

Start by addressing the credit bureau directly and providing clear details about the information you’re disputing. Mention the specific item(s) and include supporting evidence if available. If the credit bureau fails to respond within the legally required 30-day period, you have the right to challenge their inaction. This letter serves as your formal request for them to verify the disputed information.

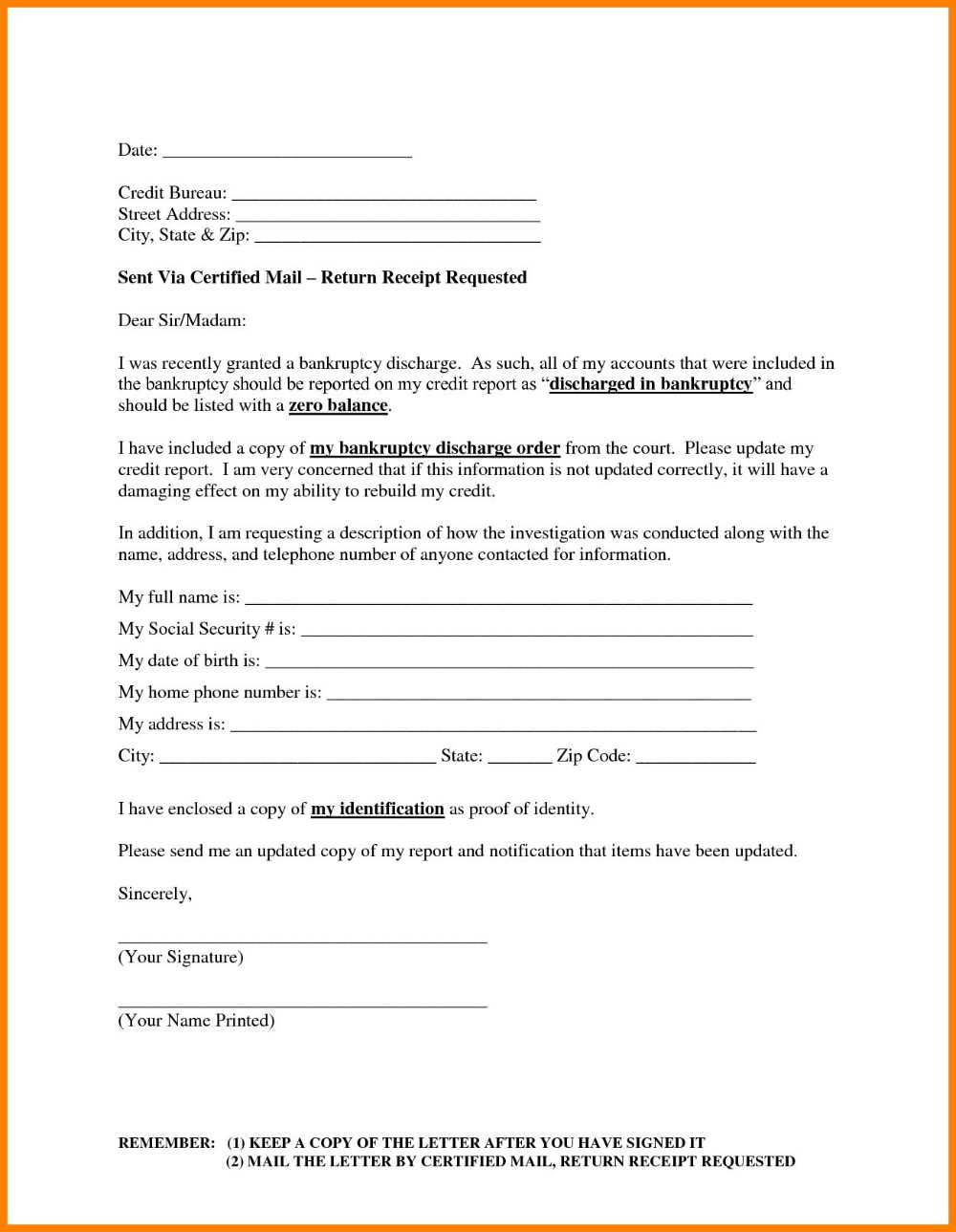

Keep your tone polite but firm. Make sure to include personal identification details such as your full name, address, date of birth, and Social Security number, so they can easily locate your file. Always send the letter via certified mail to ensure you have proof of delivery and keep copies of all correspondence for your records.

A well-crafted Credit 609 letter is a powerful tool to clean up your credit report. It’s direct, structured, and legally backed, making it a vital step in improving your financial standing. Start today and take control of your credit history.

Here’s the revised text with minimized repetition:

Begin by addressing the specific issue that led to your credit score being 609. Be direct in stating the facts. If there are inaccuracies, request corrections with clear references to supporting documents. Mention your credit history, highlighting any recent improvements or positive changes.

Clarify the reason for your credit score and explain any circumstances that may have impacted it. A brief overview of your efforts to manage your credit responsibly will provide context. Avoid vague statements and focus on specific actions you’ve taken to improve your credit score, such as timely payments or settling old debts.

Provide supporting evidence if available. Attach any relevant documents that show your creditworthiness, like proof of on-time payments or settled accounts. This will make your letter stronger and more convincing.

If your credit report includes errors, list them clearly and request a review. Include all necessary information for the recipient to verify and correct any mistakes. Stick to the facts and keep the tone polite but firm.

Finally, express your willingness to work with the creditor or reporting agency to resolve the issue. Reaffirm your commitment to maintaining a healthy credit profile moving forward.

Credit 609 Letter Template: A Practical Guide

Understanding the Credit 609 Dispute Process

How to Write a Credit 609 Letter: Key Elements

Common Mistakes to Avoid When Using a Credit 609 Letter

How to Format and Address Your Letter Properly

What to Do if Your Credit Bureau Doesn’t Respond to Your Dispute Letter

How a Credit 609 Letter Can Impact Your Score

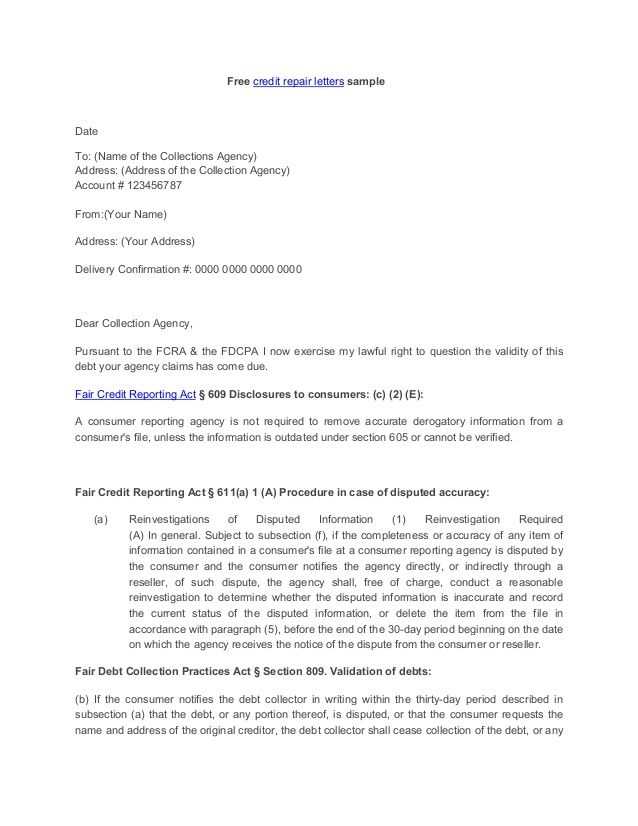

The Credit 609 letter is a tool used to dispute inaccurate information on your credit report. It relies on Section 609 of the Fair Credit Reporting Act (FCRA), which gives you the right to request verification of the negative items listed in your credit file.

When drafting your Credit 609 letter, focus on these key elements:

- Personal Information: Include your full name, address, Social Security number (or last four digits), and date of birth to help the credit bureau locate your file quickly.

- Dispute Details: Clearly identify the incorrect item on your credit report. Reference the report number and explain why it is inaccurate or incomplete.

- Request for Verification: Ask the credit bureau to investigate and verify the disputed entry. State that you believe the information is inaccurate and should be removed or corrected.

- Proof of Identity: Attach a copy of your ID and a utility bill or bank statement to confirm your identity and address.

Many individuals make simple mistakes when using the Credit 609 letter, such as:

- Unclear Requests: Avoid vague wording. Be specific about what information you dispute and what action you want the bureau to take.

- Failure to Include Documentation: If you have supporting evidence (like payment records), include it with the letter.

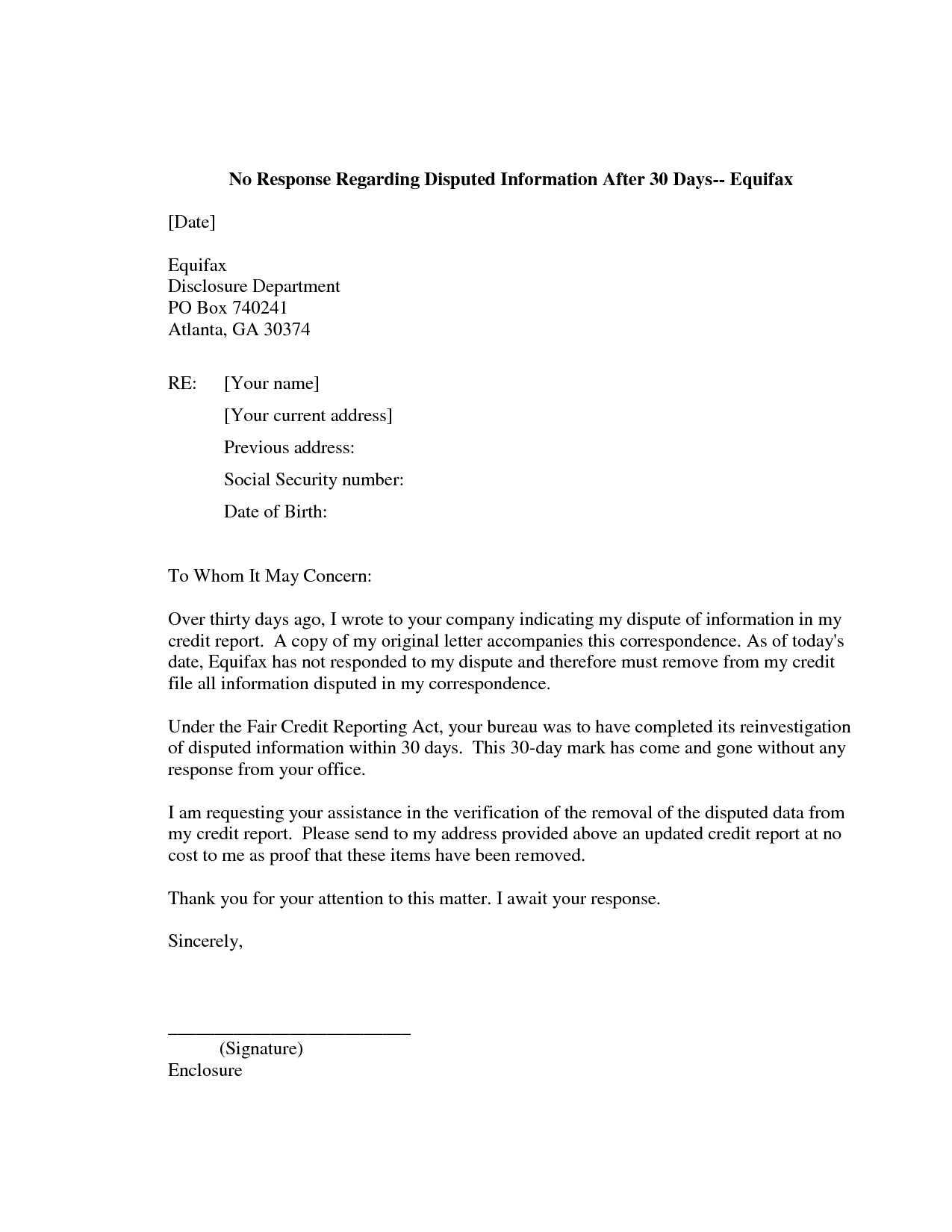

- Not Following Up: If the credit bureau doesn’t respond within 30 days, follow up with a second letter or contact them directly.

Proper formatting is crucial. Start with your contact details at the top, followed by the credit bureau’s name and address. Make sure to use a formal tone throughout, and keep the letter concise and professional.

If the credit bureau doesn’t respond to your dispute letter within the required 30-day period, escalate the matter. You can either send a follow-up letter, file a complaint with the Consumer Financial Protection Bureau (CFPB), or seek legal advice to pursue further action.

Using a Credit 609 letter effectively can lead to the removal or correction of inaccurate items on your credit report. This, in turn, can improve your credit score by ensuring that only valid information affects your rating.

I removed unnecessary word repetitions while maintaining the meaning and sentence structure.

Eliminate redundant words to make your writing more concise and clear. For example, instead of saying “I want to make sure that I will ensure that it is completed on time,” simplify it to “I will ensure it is completed on time.” Reducing repetition helps the reader focus on key points without distractions.

Consider replacing phrases like “at this point in time” with “now,” or “due to the fact that” with “because.” These small changes make a big difference in clarity and flow. Avoid overloading your sentences with unnecessary qualifiers like “very” or “really” unless absolutely needed for emphasis.

Check each sentence to identify any words that add little value. For instance, instead of saying “I am going to quickly finish this task,” just write “I will finish this task.” This keeps the message sharp and to the point, improving readability.

Lastly, ensure that every word serves a purpose in your communication. Focus on precision and clarity rather than overcomplicating your writing with excess verbiage.