Mortgage Loan Payoff Letter Template Guide

When closing an account or paying off a financial obligation, it’s important to formally request a statement that confirms the remaining balance. This document ensures all dues have been cleared and serves as proof of completion. It provides the necessary details to finalize the process and offer transparency for both parties involved.

Key Reasons for Requesting the Statement

Obtaining this official document is crucial for several reasons:

- Confirmation: It verifies that all remaining payments have been fully settled.

- Record keeping: Essential for your personal financial records, offering proof of settlement.

- Future Use: It may be necessary for other financial processes, such as securing a new credit agreement.

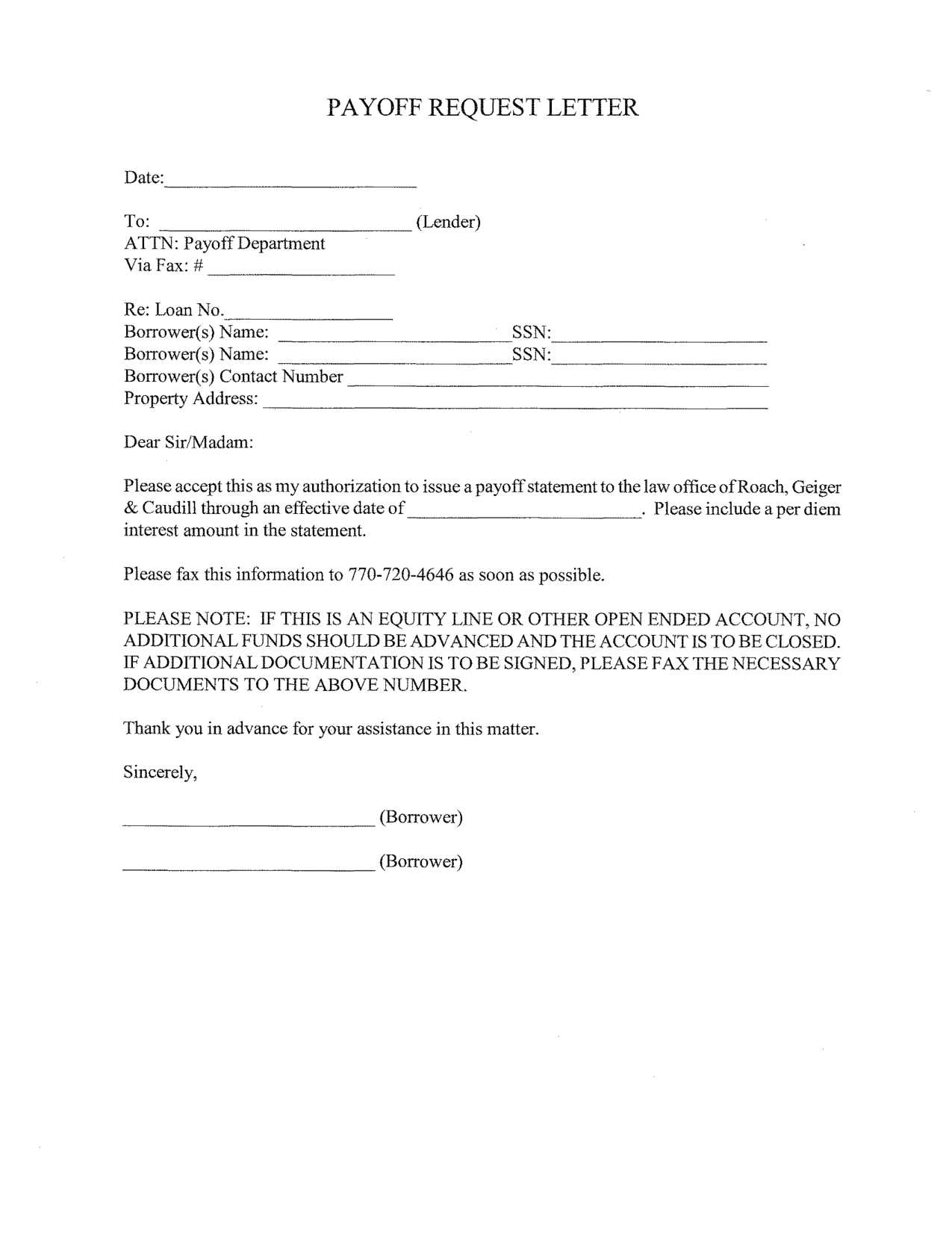

How to Request the Document

To request the final statement, follow these steps:

- Contact your financial institution or service provider.

- Provide account information and specify that you need confirmation of the cleared balance.

- Request the document in the preferred format (physical or digital).

Essential Information to Include

When making your request, be sure to include the following details to ensure accuracy:

- Account Information: Provide your account number and any other relevant identifiers.

- Full Payment Details: Specify the date of the final payment and any related transaction references.

- Contact Information: Ensure they can reach you for any further clarifications.

Avoiding Common Mistakes

Be aware of these common errors when requesting the document:

- Incomplete Details: Failing to provide necessary account or transaction information may delay the process.

- Timing: Make sure you request the statement after the full amount has been paid to avoid discrepancies.

- Format Issues: Specify if you need the document in a specific format to avoid receiving it in an inconvenient form.

Finalizing the Process

Once the document has been provided, review it thoroughly to ensure all details are correct. This serves as a final confirmation that your financial obligation has been completely settled, allowing you to proceed with confidence in any future transactions or agreements.

Understanding the Final Balance Statement

When a financial commitment is completed, it’s essential to obtain a formal document confirming the full settlement of the remaining balance. This official record provides clarity and serves as evidence that the debt has been fully paid off. Having such a statement helps ensure that both parties are in agreement, and it also protects you from any future disputes regarding the payment status.

Why the Final Document is Important

This official confirmation holds great significance for various reasons:

- Proof of Completion: It serves as concrete evidence that the balance has been fully cleared.

- Record Keeping: The document is essential for your personal financial records, offering proof of the transaction.

- Future Reference: It may be needed for new financial ventures or transactions, acting as a clean slate for your credit history.

Steps to Request the Final Statement

Requesting this document is a straightforward process. Here are the steps to follow:

- Contact the institution or service provider that handled the financial arrangement.

- Provide necessary account details to identify your transaction and request confirmation of full payment.

- Specify the format you prefer for receiving the statement, whether in paper or digital form.

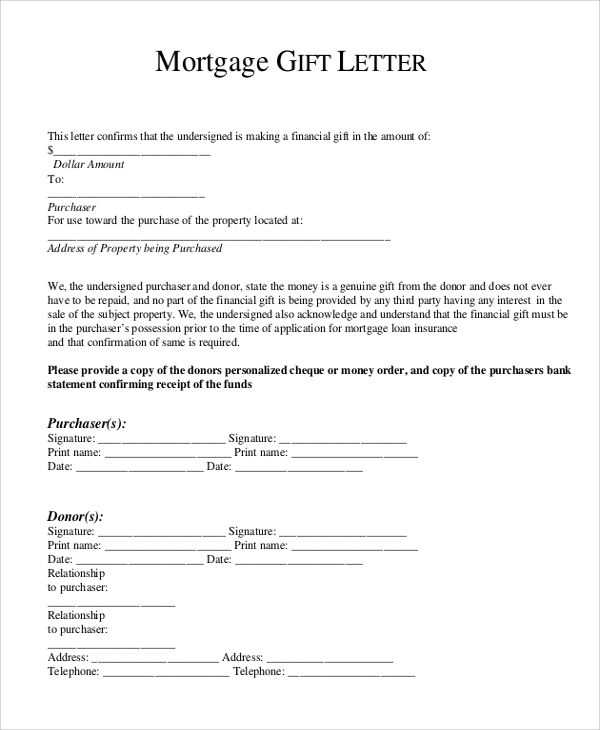

Key Information to Include in the Statement Request

To ensure a smooth process, include the following details when making your request:

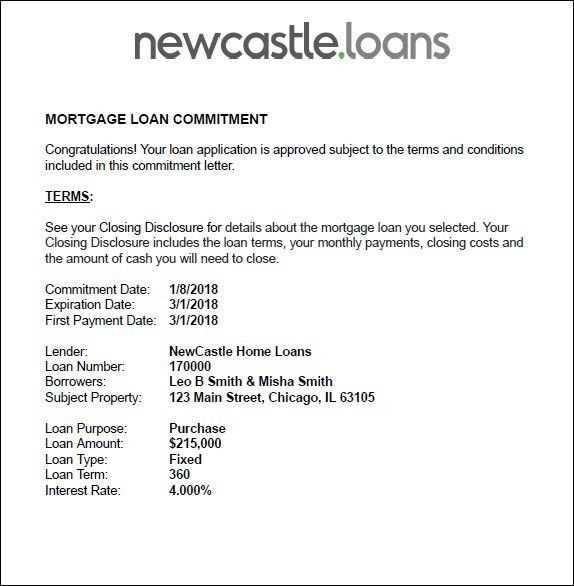

- Account Identification: Provide all necessary information related to your account, such as account numbers and customer details.

- Payment Confirmation: Specify the date and any reference numbers of the final payment made to fully settle the debt.

- Contact Details: Make sure the provider can reach you for any follow-up or clarifications.

Avoiding Common Document Errors

When requesting this confirmation, avoid these common mistakes:

- Incomplete Information: Missing details such as account number or payment references may lead to delays or errors.

- Timing Issues: Ensure the full balance has been cleared before requesting the statement to avoid any discrepancies in the document.

- Incorrect Format: Be clear about the format in which you wish to receive the statement to avoid confusion later on.

Customizing the Document for Your Needs

When you receive the confirmation, it’s important to ensure it meets your requirements. If necessary, request any additional information that may be missing or customize the format to suit your specific needs. A well-organized document will make future reference easier and help maintain clarity in your financial records.