Credit Agency Dispute Letter Template for Effective Resolution

When incorrect information appears in your financial records, it can negatively affect your score and overall financial health. Addressing such errors is crucial to ensure your data is accurate and reflective of your true financial standing. One effective way to request corrections is by reaching out directly to the entities responsible for maintaining your information.

Understanding What Needs to Be Corrected

Before taking action, it’s important to identify what is wrong in the records. Whether it’s a mistaken payment status, outdated details, or incorrect account information, pinpointing the exact issue will make the process smoother. Review the document carefully and note discrepancies that need to be addressed.

Gather Relevant Supporting Documents

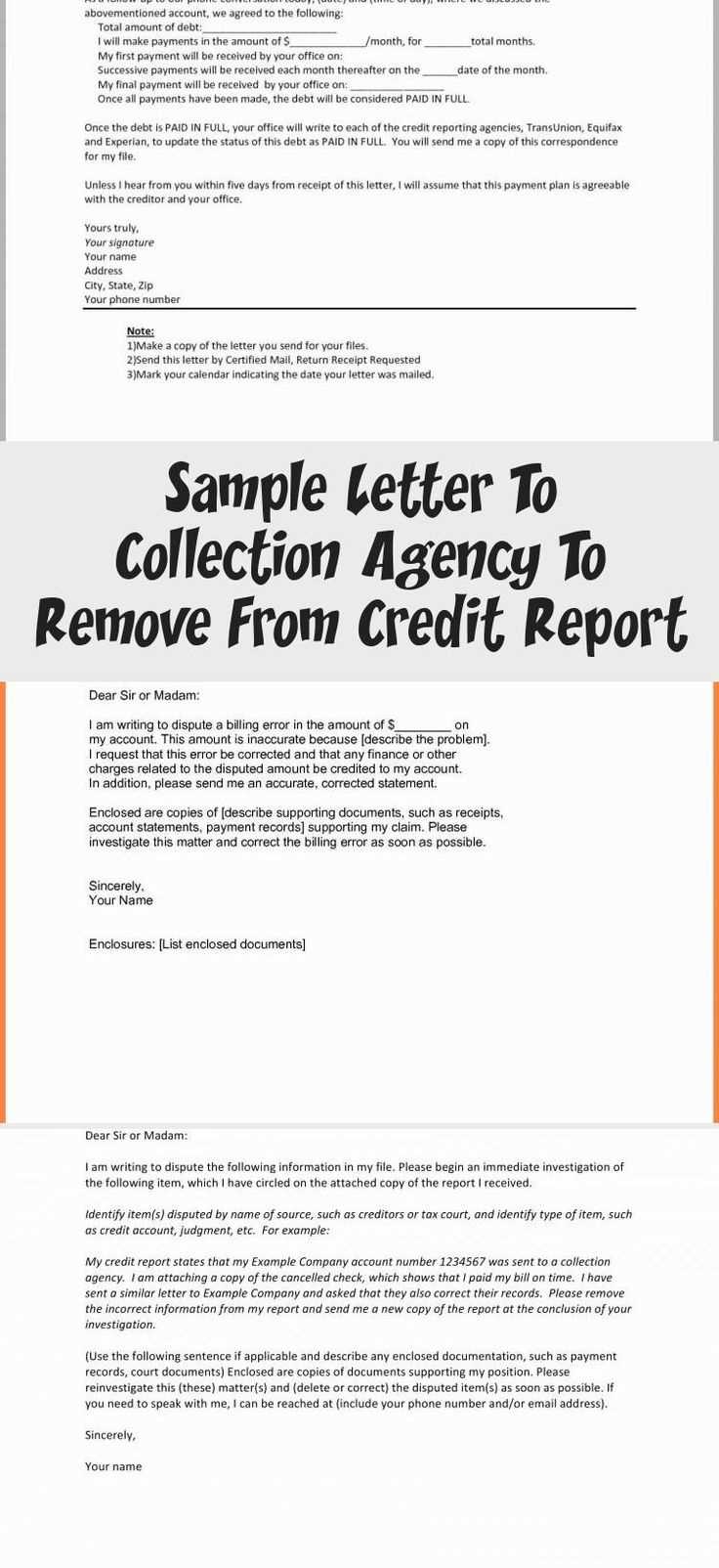

Collect any evidence that supports your claim. This could include bank statements, receipts, or previous correspondence. Having clear documentation will strengthen your case and help expedite the correction process.

Steps for Contacting the Responsible Party

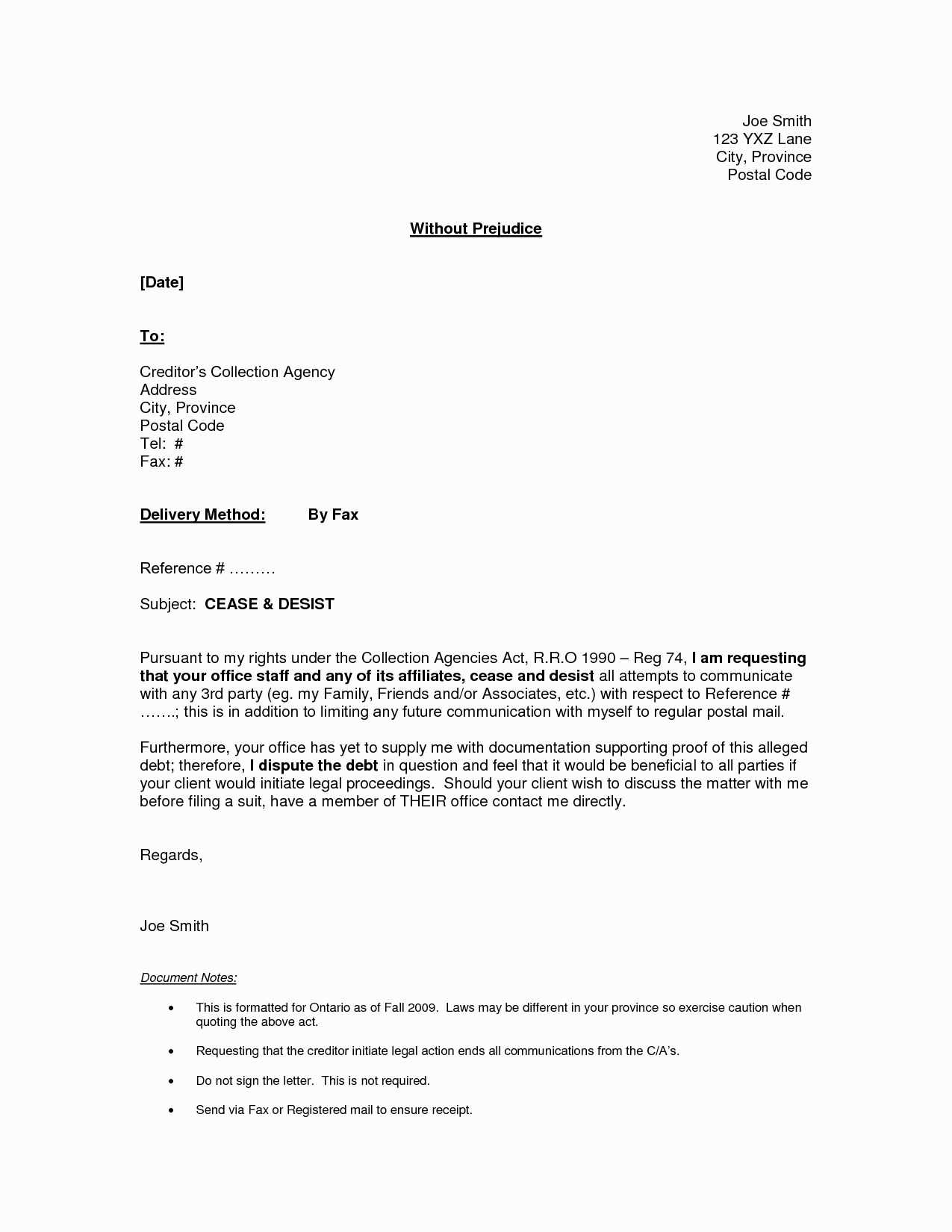

Once you’ve identified the problem and gathered your documents, it’s time to communicate with the responsible party. Be direct and precise in your request for correction, outlining the issue and including any evidence. A formal, well-structured request will increase the likelihood of a quick resolution.

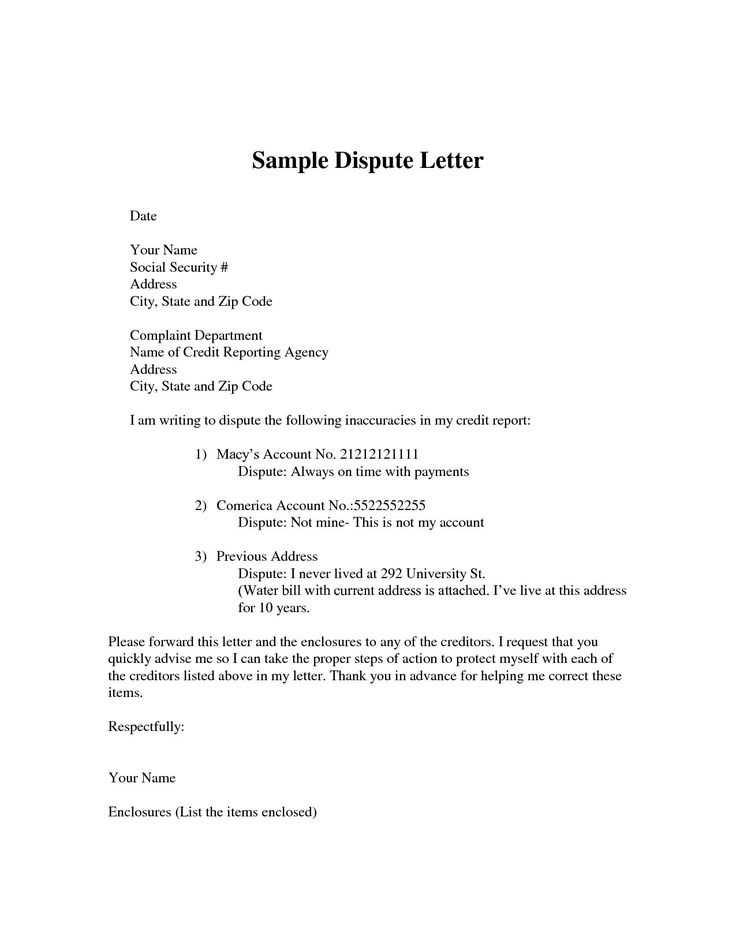

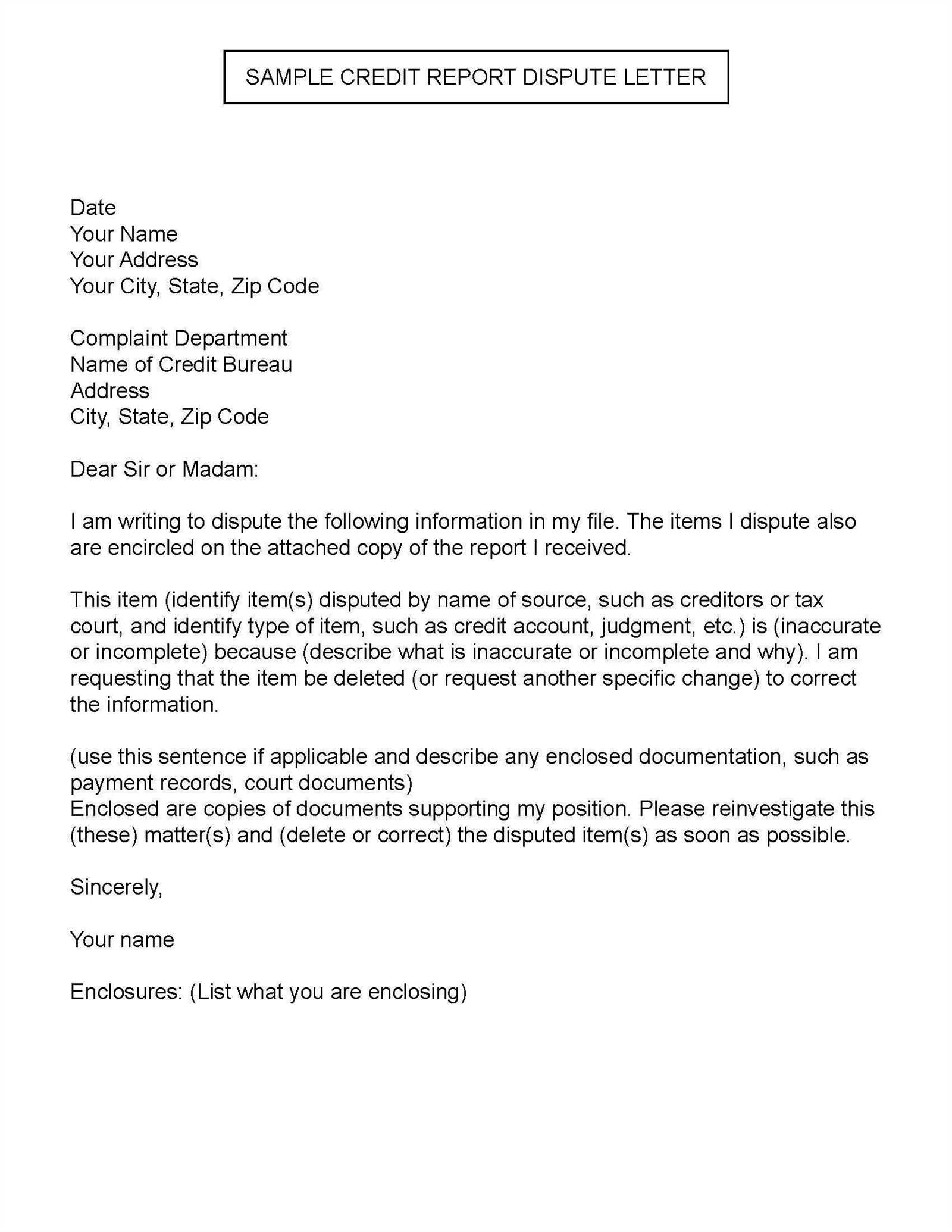

Crafting Your Request

Clearly explain the error and your request for it to be fixed. Ensure your message is professional and concise, detailing the necessary adjustments. Provide your personal information, such as account numbers, so the recipient can locate your records quickly.

Follow Up and Stay Persistent

If you don’t receive a response within a reasonable time frame, follow up with a polite reminder. Persistence can often yield better results, so don’t hesitate to reach out again if necessary.

After the Request is Made

Once the issue has been addressed, ensure the changes are reflected in your records. Review the updated documents to confirm everything is correct. If the error persists, consider exploring other options for resolution.

Monitoring Your Financial Records Regularly

To prevent future errors, make it a habit to check your financial reports regularly. This proactive approach will help you catch any discrepancies early and maintain accurate information.

Why a Formal Request is Essential for Correcting Financial Information

When inaccuracies appear in your financial history, they can lead to unfavorable outcomes, such as difficulty securing loans or higher interest rates. It is crucial to address these issues promptly and effectively. One of the most reliable methods for requesting corrections involves submitting a formal request to the relevant organization.

Understanding the Issues with Financial Records

Errors in financial records can arise from various sources, including clerical mistakes, outdated information, or misreporting by a third party. These inaccuracies can affect everything from your ability to access credit to the terms offered to you. Identifying the exact issue allows you to take appropriate action to resolve it.

How to Craft an Effective Request

To maximize your chances of success, it’s essential to clearly explain the issue and your desired outcome. A well-written request that is direct and concise will make it easier for the recipient to understand and act on your concern. Avoid ambiguous language and ensure all points are clear.

Essential Elements to Include

Your communication should be structured and professional. Be sure to include your personal details, such as account numbers or reference IDs, as well as any supporting documentation that validates your claim. Including these details helps expedite the review process.

Avoiding Common Mistakes

While crafting your request, avoid errors such as using vague language, omitting key details, or being overly aggressive. Keep the tone respectful and the request straightforward. Ensure you’ve checked for spelling and grammatical mistakes, as they can make your message seem less credible.

Steps After Submission

Once your formal request is submitted, it’s important to monitor for any updates or responses. If no reply is received within a reasonable timeframe, following up politely can help keep the matter moving forward. In the event the issue persists, consider escalating your complaint to the appropriate authority.