How to Create a Debt Letter Validation Template

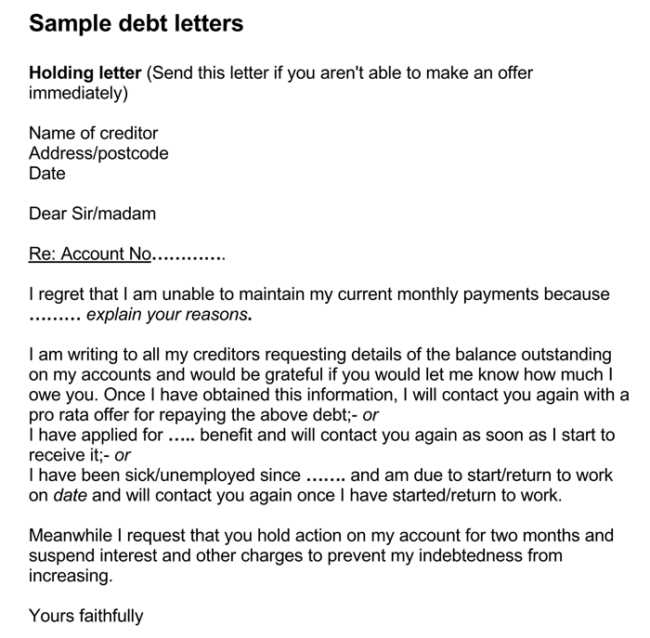

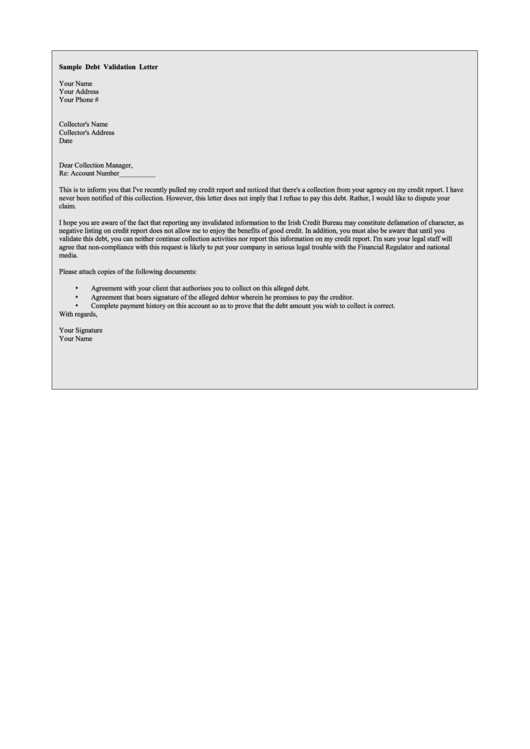

When dealing with financial disputes, it is crucial to have clear and accurate communication. Sending a properly structured document can help in resolving issues with claims effectively. It is important to ensure that all necessary information is included and formatted correctly to meet legal and procedural requirements.

Key Elements for Effective Communication

To avoid confusion, certain details must be clearly stated in any document related to financial claims. These elements include:

- Claim Information: Clearly outlining the amount in question and the origin of the claim.

- Evidence of the Claim: Attach any documents that support your stance, such as transaction records or agreements.

- Requester Information: Providing your personal or business details for proper identification.

- Clear Instructions: Offering steps for further verification or the next actions in the process.

Legal Compliance and Accuracy

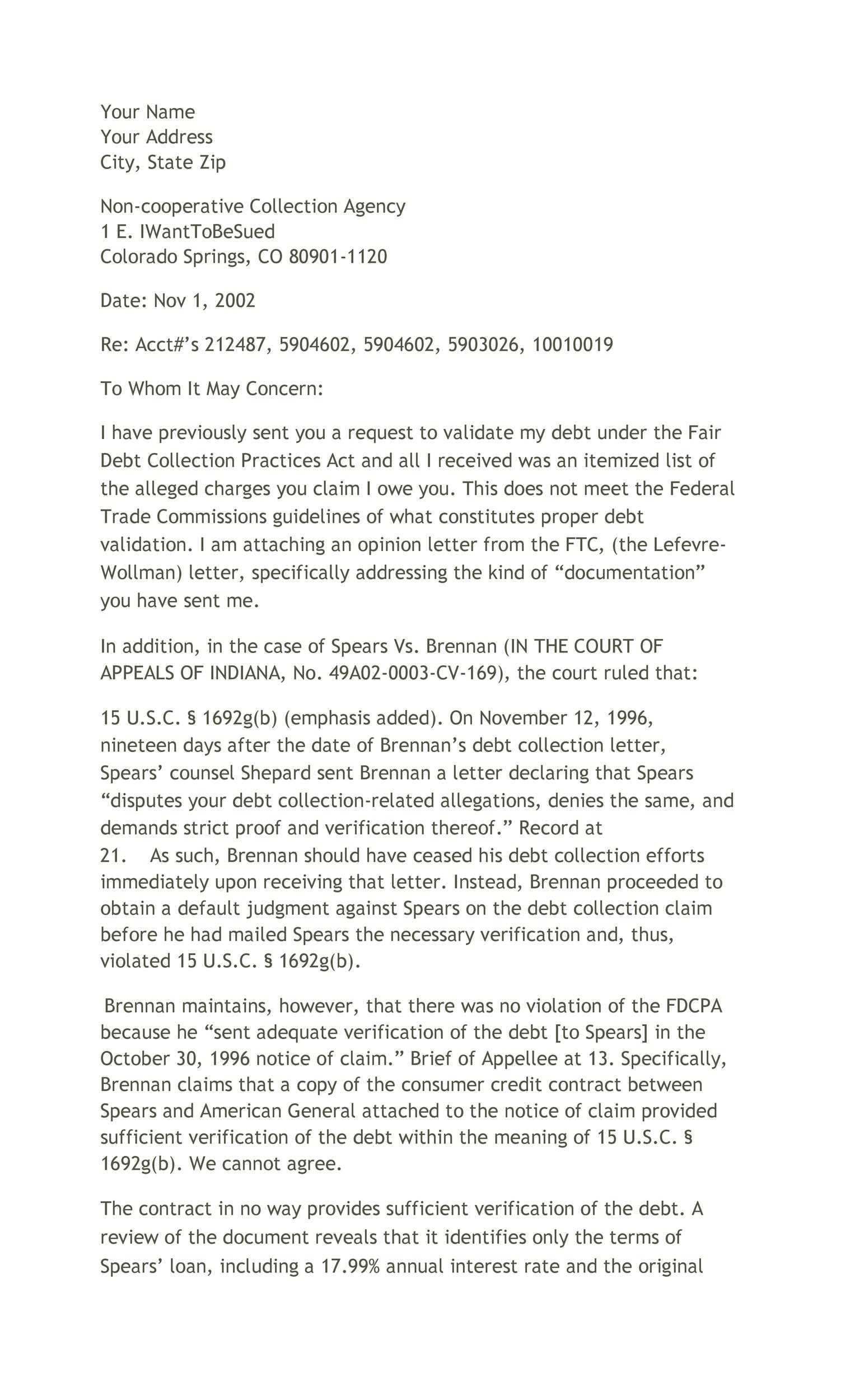

Any formal request related to financial claims should comply with relevant regulations. This helps in safeguarding your rights and ensures the other party is aware of their obligations. If any of the critical information is missing or inaccurate, it can lead to delays or even legal complications.

How to Structure the Document Correctly

The way information is organized plays a significant role in the effectiveness of the communication. A structured approach ensures clarity and minimizes any ambiguity that could arise from poorly written documents. Be concise and direct while making sure all the necessary components are included.

Common Pitfalls to Avoid

- Omitting essential details: Missing information can delay the resolution process or invalidate the claim.

- Overcomplicating language: Using overly technical or unclear terms can confuse the recipient.

- Neglecting a response deadline: Always include a clear timeframe for receiving a reply to avoid unnecessary delays.

By following these guidelines, you can ensure that your communication is both effective and legally compliant. Proper documentation helps expedite the process and supports your case should any disputes arise.

Understanding the Financial Dispute Resolution Process

When addressing financial disagreements, clear communication is essential to ensure the issue is resolved in a timely and fair manner. Crafting a well-structured document that communicates the necessary details and adheres to legal standards can facilitate a smoother resolution process.

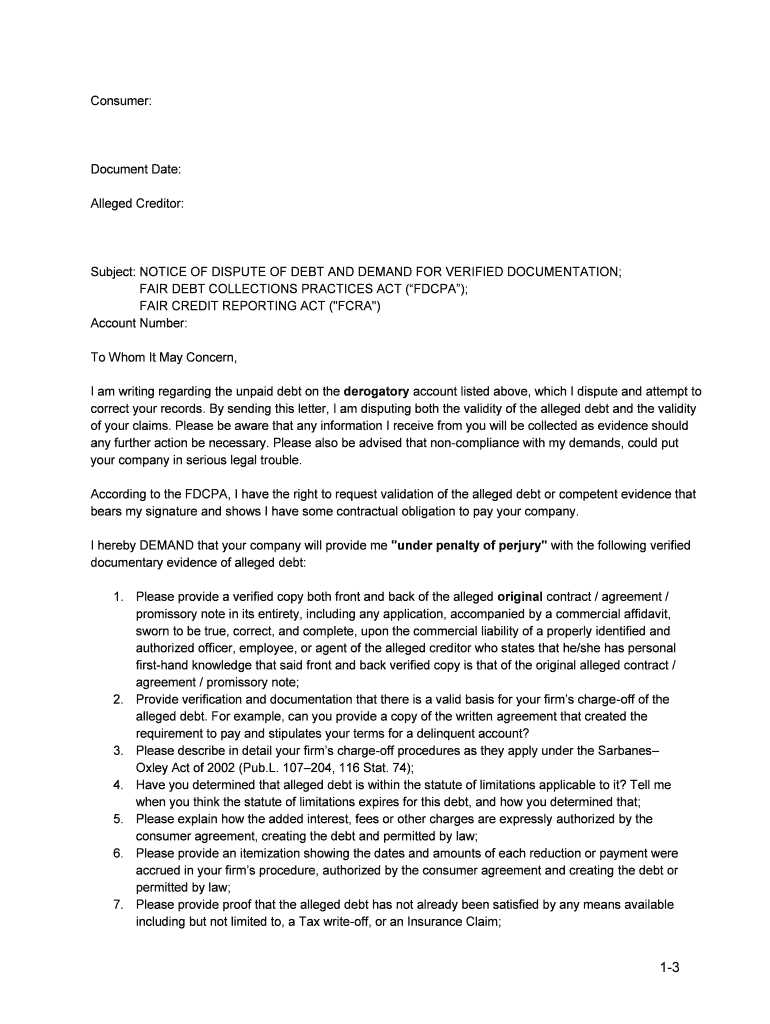

To begin, it’s important to include specific details that provide clarity about the nature of the claim, the involved parties, and any supporting documents. These elements should be clearly presented to avoid misunderstandings or delays in the review process.

What to Include in a Dispute Confirmation Request

To ensure that the request is complete and understandable, the following must be included:

- Claim Details: A breakdown of the amount owed and a description of the initial transaction or agreement.

- Supporting Documentation: Attach records such as contracts, receipts, or any relevant communication that proves the claim’s legitimacy.

- Personal Information: Include clear identification details to avoid confusion about the parties involved.

- Instructions for Next Steps: Provide a clear outline of what the recipient should do next to address or dispute the claim.

How to Confirm Information Accurately

Accurate confirmation of the details is key to preventing errors or unnecessary disputes. This involves carefully reviewing the claim and verifying that all figures and dates match with available evidence. Cross-checking the provided documents and records will ensure that all information is correct and reliable.

Legal Standards for Financial Dispute Requests

Every formal communication regarding a financial disagreement must comply with relevant laws and regulations. This guarantees that the process is fair and both parties are aware of their rights and obligations. Ensure that the document follows all legal requirements to prevent complications in the resolution process.

Common Mistakes to Avoid

Errors can significantly impact the effectiveness of your communication. Common mistakes include:

- Omitting essential details: Missing information can delay the process or invalidate the request.

- Unclear language: Ambiguity can confuse the recipient, making it harder to resolve the issue.

- Ignoring deadlines: Failing to specify a response deadline can result in unnecessary delays or lack of response.

Customizing Your Document for Better Results

Tailoring your communication ensures it meets the specific needs of each situation. Adjusting the language and format based on the nature of the claim can make the document more effective and easier to understand for the recipient.

Best Practices for Sending Requests

When submitting a financial dispute request, ensure that it is sent via a reliable method, such as certified mail, to guarantee that it is received. Always keep a copy of the request and track its delivery to ensure accountability.