Credit Denial Letter Template for Clear Communication

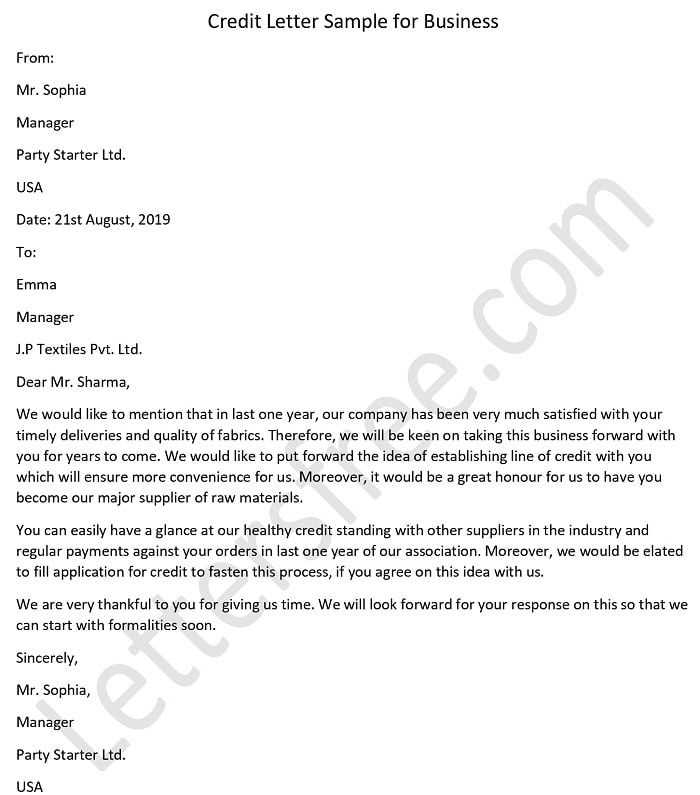

When informing an individual or organization about an unfavorable financial decision, it’s crucial to maintain professionalism and clarity. The way you communicate can significantly impact how the message is received and understood. A well-structured notification not only conveys the necessary information but also helps to preserve a positive relationship, even in challenging situations.

Clear communication is essential, ensuring the recipient understands the reasoning behind the decision without feeling misunderstood or mistreated. This kind of correspondence often involves sensitive topics, making it all the more important to approach it with the right tone and format.

By crafting an effective response, you can guide the reader through the decision while offering them the opportunity to seek further clarification if needed. The right approach can also serve as a way to maintain trust, offering transparency and respect in your dealings.

htmlEdit

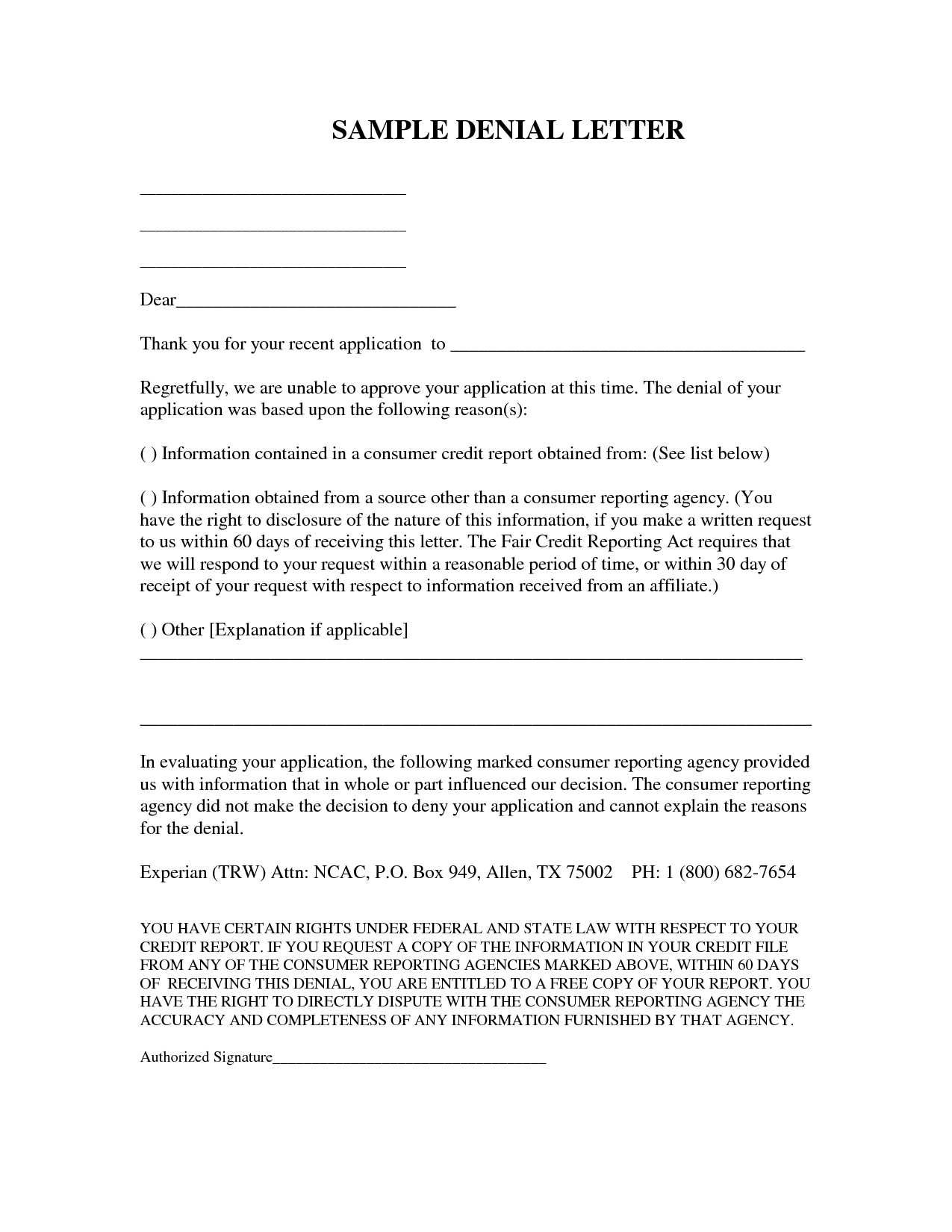

Key Elements to Include in Your Letter

When communicating a decision to decline a request, it’s essential to ensure that your message is clear, professional, and respectful. The structure of the response should provide the necessary details while maintaining a tone that is considerate of the recipient’s situation. Understanding what specific information to include will help convey the decision effectively and minimize confusion.

Essential Information to Outline

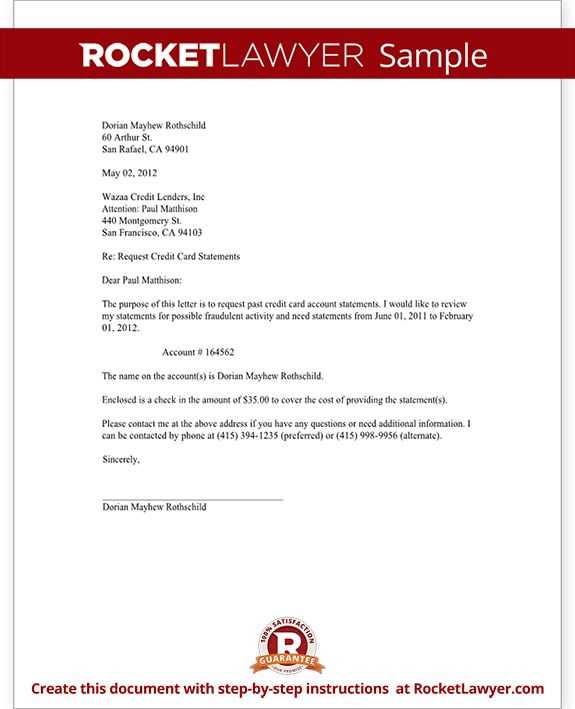

Begin by stating the decision in a straightforward manner, making sure to offer the recipient an understanding of the rationale behind the choice. Providing this context helps to clarify the situation and may reduce any frustration the recipient may feel. Make sure to include any relevant details that led to the outcome, such as requirements not being met or financial limitations.

Considerate Closing Remarks

Conclude the correspondence with a courteous and professional closing. Offering resources for potential next steps, such as suggestions for improving future applications, can soften the impact of the decision. In addition, consider expressing willingness to revisit the matter if circumstances change, leaving the door open for future communication.

htmlEdit

How to Craft a Professional Tone

Maintaining a respectful and clear tone is crucial when conveying an unfavorable decision. The manner in which the message is delivered can significantly impact how the recipient perceives the communication. A professional tone ensures that the recipient understands the outcome while feeling respected and valued, even in challenging situations.

Key Approaches to Maintain Professionalism

- Be Direct, Yet Courteous: Clearly state the decision without ambiguity while ensuring your phrasing remains polite and considerate.

- Use Neutral Language: Avoid emotional or biased expressions that could create tension. Focus on factual and objective reasons for the decision.

- Maintain Empathy: Acknowledge the potential disappointment of the recipient and show understanding of their situation.

Best Practices for Closing Your Message

- Offer Support: Suggest potential actions the recipient can take moving forward, such as exploring other options or improving qualifications.

- Keep the Door Open: If appropriate, indicate that the decision can be revisited under different circumstances, fostering goodwill for future interactions.

htmlEdit

Common Mistakes to Avoid in Credit Denials

When informing someone of a rejected request, it’s important to ensure that the communication is clear, respectful, and helpful. Missteps in how the decision is conveyed can lead to confusion, frustration, and a negative experience for the recipient. Being mindful of potential pitfalls can help ensure the message is delivered appropriately and professionally.

- Vague Explanations: Failing to provide specific reasons for the decision can leave the recipient feeling unsure or dissatisfied. Always offer clear, relevant information.

- Unnecessary Harshness: A tone that is overly blunt or discouraging can damage relationships. It’s important to maintain a balance between firmness and empathy.

- Failing to Offer Next Steps: Not providing guidance on how the recipient can improve or reapply might leave them frustrated and without direction. Suggesting ways to enhance future applications is valuable.

- Delayed Response: Delays in responding to the request can create unnecessary anxiety. Timely communication is essential to maintaining trust.

htmlEdit

Legal Considerations in Credit Denial Letters

When informing an individual of a decision to reject their request, it is essential to adhere to legal requirements to ensure fairness and compliance with relevant regulations. Failing to meet these standards can lead to disputes or legal challenges. Understanding key legal obligations can help prevent risks and ensure transparency in the communication process.

- Disclosure of Reasons: In many jurisdictions, it is mandatory to provide the applicant with a clear explanation of why the decision was made. This allows the individual to understand the reasoning behind the outcome and, if applicable, address any issues.

- Adherence to Anti-Discrimination Laws: Ensure that the rejection is not based on discriminatory factors, such as race, gender, or age. Legal protections exist to prevent such biases from influencing decisions.

- Compliance with Privacy Regulations: Safeguard any personal or sensitive data shared by the applicant. It’s crucial to handle this information in accordance with privacy laws and regulations.

- Notification Timelines: Legal standards often require that the recipient be notified within a certain time frame. Delays in communication could be a violation of the applicant’s rights.

htmlEdit

Tips for Handling Customer Reactions

Responding effectively to a customer’s reaction after delivering an unfavorable decision is crucial for maintaining a positive relationship. Customers may express frustration, confusion, or disappointment, so it’s important to address their concerns with empathy and professionalism. The approach you take can influence the future of your relationship with them.

Key Strategies for Managing Responses

In order to maintain a constructive conversation, it’s essential to remain calm, listen actively, and provide solutions where possible. Here are some best practices for handling customer reactions:

| Customer Reaction | Recommended Response |

|---|---|

| Frustration | Stay calm and acknowledge their feelings. Offer explanations in a respectful manner and provide alternative solutions if possible. |

| Confusion | Clarify any points of confusion and provide additional information to help the customer understand the reasoning behind the decision. |

| Disappointment | Express empathy and regret, then offer guidance for potential improvements or actions they can take moving forward. |

Maintaining Professionalism Throughout the Process

Regardless of the reaction, always ensure that your tone remains respectful and professional. This will help preserve trust and leave the door open for future interactions.