Credit dispute letter templates equifax

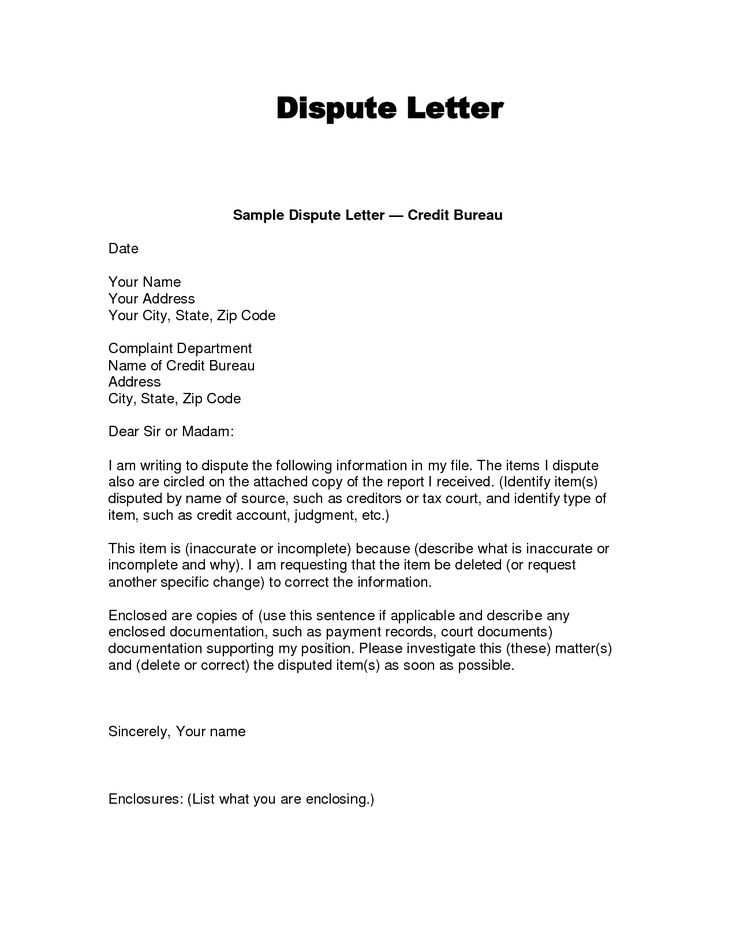

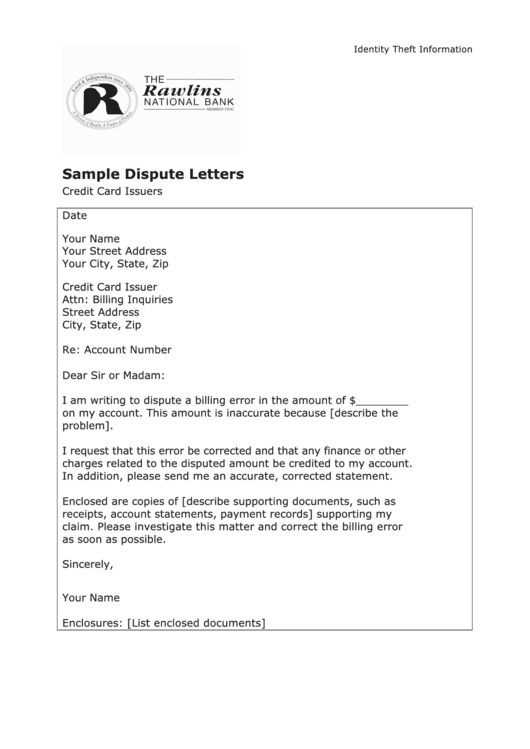

If you find discrepancies on your Equifax credit report, sending a credit dispute letter is the most direct way to address and correct those errors. A well-crafted letter can help you resolve issues efficiently and improve your credit standing. Use the following templates to create a dispute letter that gets results.

Start by clearly stating your purpose: dispute the incorrect item on your report. Reference the specific account and provide any relevant details, such as dates or amounts, to ensure clarity. Use concise language and avoid unnecessary information that might complicate the issue.

In your letter, include your full name, address, and date of birth at the top to ensure Equifax can quickly locate your records. Be specific about the error you’re disputing and request an investigation. If you have supporting documents, attach copies to strengthen your case. Close the letter by asking for a formal response within 30 days, as required by law.

Using these templates ensures you provide all necessary details, making it easier for Equifax to process your dispute and correct your credit report. A clear, straightforward approach can save you time and help you resolve any credit report inaccuracies efficiently.

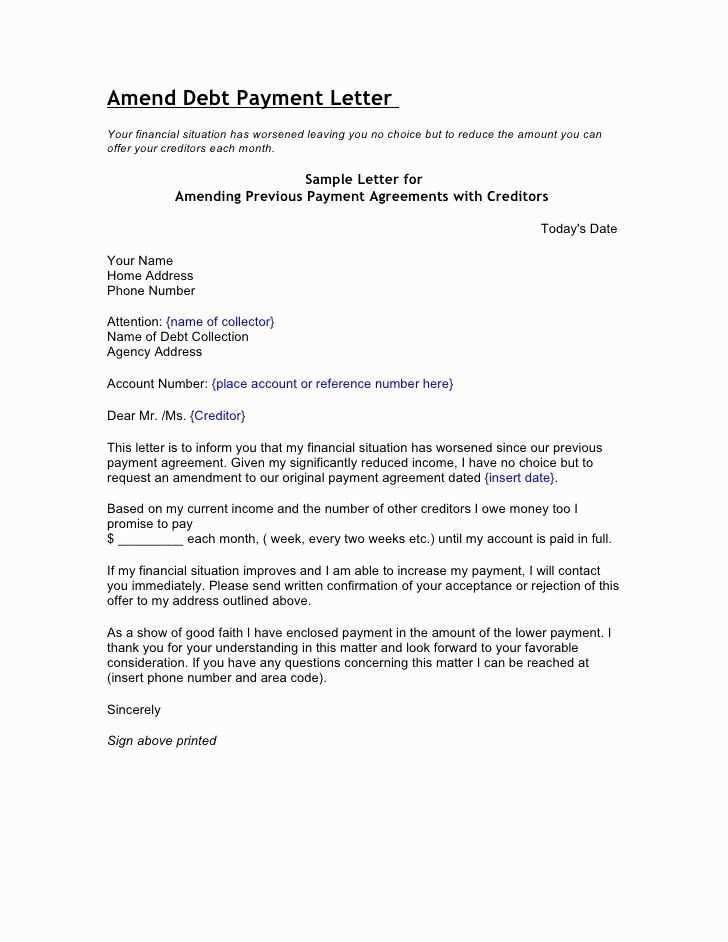

Here’s the Corrected Version:

To ensure your credit dispute letter is clear and professional, start by addressing the credit bureau directly. Use the following template as a reference:

| Section | Example Text |

|---|---|

| Header | Your Name Your Address Your City, State, Zip Code Date |

| Credit Bureau Information | Equifax P.O. Box 105873 Atlanta, GA 30348 |

| Subject | Re: Dispute of Credit Report Information |

| Body | Dear Equifax,

I am writing to dispute an item on my credit report. Upon reviewing my report, I noticed an inaccurate entry under [Account Name/Number]. This item is incorrect because [explain why it’s wrong]. Please investigate this issue and remove or correct the item as soon as possible. Enclosed are copies of supporting documents, including [list of documents]. Thank you for your attention to this matter. Please inform me of your findings and actions. |

| Closing | Sincerely, Your Name Contact Information |

Attach any necessary supporting documents like bank statements, payment confirmations, or correspondence that backs your claim. Be clear and concise in describing the issue to avoid any confusion during the investigation. Keep a copy of the letter for your records and consider sending it via certified mail for confirmation of delivery.

- Credit Dispute Letter Templates for Equifax: A Comprehensive Guide

When disputing an error on your Equifax credit report, using a well-structured dispute letter is crucial for a swift resolution. Below is a template you can use to clearly communicate the issue and request a correction. Ensure that you personalize it with your details and the specific information that is inaccurate on your report.

Template for Credit Dispute Letter

Your Name

Your Address

City, State, ZIP Code

Phone Number

Email Address

Date

Equifax Credit Bureau

Equifax Dispute Department

P.O. Box 105788

Atlanta, GA 30348

Subject: Credit Report Dispute – [Insert Discrepancy Here]

Dear Equifax Dispute Department,

I am writing to dispute an item on my credit report. I have reviewed my credit report and found the following discrepancy:

Discrepancy Details:

[Describe the item you are disputing, such as a credit account, late payment, or incorrect balance. Be sure to include account numbers, dates, and any other relevant details.]

I request that this item be investigated and corrected as soon as possible. Enclosed are copies of the supporting documents that substantiate my claim. These include [list the documents you are including, such as payment receipts, bank statements, or letters from creditors].

Please confirm receipt of this letter and keep me updated on the status of my dispute. Under the Fair Credit Reporting Act, I understand you are required to complete your investigation within 30 days of receiving this letter.

Thank you for your attention to this matter. I look forward to your prompt resolution of this issue.

Sincerely,

[Your Full Name]

Tips for Submitting Your Dispute

Before mailing your letter, verify that all the information you’re disputing is accurate and clear. Double-check the account numbers and any dates mentioned. Always send your dispute via certified mail to ensure Equifax receives it and you have a record of the submission. Additionally, keep a copy of the letter and all supporting documents for your own reference.

Equifax is required to investigate your dispute and respond within 30 days. If the issue is resolved in your favor, the incorrect information will be removed from your credit report. If not, you can ask for a reconsideration or escalate the matter to a higher authority.

Begin by gathering all the necessary documents related to the disputed item. This may include account statements, receipts, or any correspondence that supports your case. Once you have the required information, locate an Equifax credit dispute letter template. These templates are available online and can help structure your letter in a clear and concise way.

Step 1: Fill Out Your Personal Information

Start the letter by including your full name, address, date of birth, and Social Security number (or the last four digits). This information helps Equifax identify your credit file. Be sure to check for any specific instructions on the template, as some may require additional details to be included.

Step 2: Clearly Identify the Disputed Item

State the specific item you are disputing. Provide as much detail as possible, such as the creditor’s name, account number, and the reason for the dispute. The clearer your explanation, the easier it will be for Equifax to investigate the matter.

- Example: “I am disputing the charge from ABC Bank on my account (Account Number: 123456). This charge is inaccurate because I paid the balance in full on January 10, 2025.”

Step 3: Attach Supporting Documents

Include copies of any documents that support your claim. If you’re disputing a late payment, provide payment records or bank statements. If you’re challenging an account that doesn’t belong to you, attach evidence that proves your identity was compromised. These documents will strengthen your dispute.

Step 4: Sign and Send the Letter

Once you have completed the letter and attached supporting documents, sign the letter at the bottom. Mail it to Equifax’s dispute department using the address provided in the template or on Equifax’s website. Make sure to send the letter by certified mail to confirm delivery.

By following these steps and using a dispute letter template, you can submit a clear and professional dispute that will help ensure a timely response from Equifax.

Include your full name, address, and date of birth at the top of the letter to ensure Equifax can easily verify your identity. Make sure your address matches the one on your credit report for consistency. Add your Social Security Number (SSN) or the last four digits to confirm your identity securely, though this is optional for privacy reasons.

Clearly state that you are disputing specific information on your credit report. Identify the account or accounts in question with account numbers or other relevant identifiers. For each disputed item, explain why you believe it’s inaccurate or incomplete. Reference supporting documents such as receipts, bank statements, or court documents to back your claim.

Describe the incorrect information you are disputing and explain the reason behind the dispute. Whether it’s a payment error, fraudulent activity, or outdated information, provide concise, specific details to avoid confusion.

Ask Equifax to investigate the disputed information and provide a detailed report on the results of their findings. Be sure to request that any incorrect information be removed or corrected promptly.

Sign the letter at the bottom, making it clear that you are requesting a resolution. Include a statement that you expect a response within the required 30-day period, as outlined by the Fair Credit Reporting Act (FCRA).

1. Personal Information

Provide your full name, address, and Social Security Number (last four digits). This ensures that Equifax can locate your credit file quickly.

2. Identify the Disputed Item

Clearly mention the item you are disputing. Include relevant details like the account number, creditor name, and the date of the issue. Be as specific as possible to prevent confusion.

3. Include Supporting Documents

Attach any evidence supporting your claim, such as receipts, bank statements, or previous communications with the creditor. These documents validate your dispute and speed up the process.

4. Describe the Discrepancy

Write a brief, clear description of the error. Explain how it affects your credit report and why it is incorrect. Focus on the facts and avoid unnecessary details.

5. State Your Desired Outcome

Explain what you want to happen. Whether you seek a correction, removal, or an update, make sure your request is clear and direct.

6. Use Professional Language

Keep your tone respectful and professional. This approach increases the likelihood of a positive response and speeds up the resolution.

7. Proofread Before Sending

Check for any errors in your dispute letter. Ensure that all personal details, account numbers, and dates are accurate. A well-proofread letter reduces the chance of delays.

Following these steps will ensure your dispute letter is clear and organized, leading to quicker resolution of any credit report issues.

Common Mistakes to Avoid When Writing an Equifax Dispute Letter

Avoid vague or unclear language in your dispute letter. Be specific about the error you are disputing and provide clear details on why it is incorrect. Use accurate dates, amounts, and account numbers to support your claim.

1. Failing to Include Evidence

Always attach supporting documents that prove your claim, such as bank statements, receipts, or payment records. A letter without evidence is less likely to result in a successful dispute.

2. Ignoring the Credit Reporting Agency’s Guidelines

Each credit bureau, including Equifax, has specific instructions for submitting disputes. Not following their guidelines may cause delays or your dispute being rejected outright. Double-check the format and method of submission before sending your letter.

Avoid writing an overly lengthy letter. Keep it concise, focusing on the relevant facts and issues. A clear and direct letter increases your chances of receiving a timely and accurate response.

Refrain from using aggressive or emotional language. Stay professional and stick to the facts. An emotional tone can undermine your credibility and negatively impact your dispute outcome.

To dispute an error on your credit report with Equifax, you must first send a detailed dispute letter. Ensure your letter includes your personal information, a clear explanation of the mistake, and any supporting documents. Mail your dispute letter to the address provided by Equifax or submit it online via their platform.

Mailing Your Dispute Letter

If you prefer sending your dispute by mail, use certified mail with a return receipt requested. This gives you proof of delivery. Include a copy of your credit report with the disputed items clearly highlighted. Keep the original documents for your records.

Online Dispute Process

For faster processing, submit your dispute directly through Equifax’s online portal. You can access this by logging into your account on Equifax’s website. Attach scanned copies of any evidence supporting your claim, and make sure to track the status of your dispute through the site.

Tracking Progress: Once you submit your dispute, Equifax will notify you when your case is resolved, typically within 30 days. You can also check the status of your dispute by logging into your account or contacting their customer service for updates.

What to Do if Equifax Rejects Your Dispute Letter: Next Steps

If Equifax rejects your dispute letter, don’t worry–there are several steps you can take to continue resolving the issue.

- Review the Reason for Rejection: Understand the specific reason Equifax gave for rejecting your dispute. This could be due to missing documentation, insufficient evidence, or a technical issue. Correcting the identified problem is the first step in moving forward.

- Double-Check Your Information: Ensure that all personal information, account numbers, and other details are accurate and match what Equifax has on file. Discrepancies can cause delays or rejections.

- Provide Supporting Documentation: If your dispute was rejected due to a lack of evidence, gather any supporting documents such as bank statements, receipts, or letters from creditors to strengthen your case. Submit clear and legible copies of these documents.

- Submit the Dispute Again: After making necessary adjustments, submit your dispute again. Be sure to follow Equifax’s instructions carefully, including using their online dispute portal if available.

- Consider Sending a More Detailed Dispute Letter: If your initial letter wasn’t detailed enough, you can write a more specific letter outlining the dispute in detail. Clearly state what information is inaccurate and provide the exact reason for your dispute.

- Check for Errors in Equifax’s Investigation Process: If you feel that Equifax mishandled the dispute, you can file a complaint with the Consumer Financial Protection Bureau (CFPB). They may assist in resolving the issue.

- Consider Alternative Dispute Methods: If Equifax continues to reject your dispute, consider disputing directly with the creditor or lender reporting the error. They may have more flexibility in correcting the issue.

Persistence is key. By following these steps, you can increase your chances of successfully disputing any inaccuracies on your credit report.

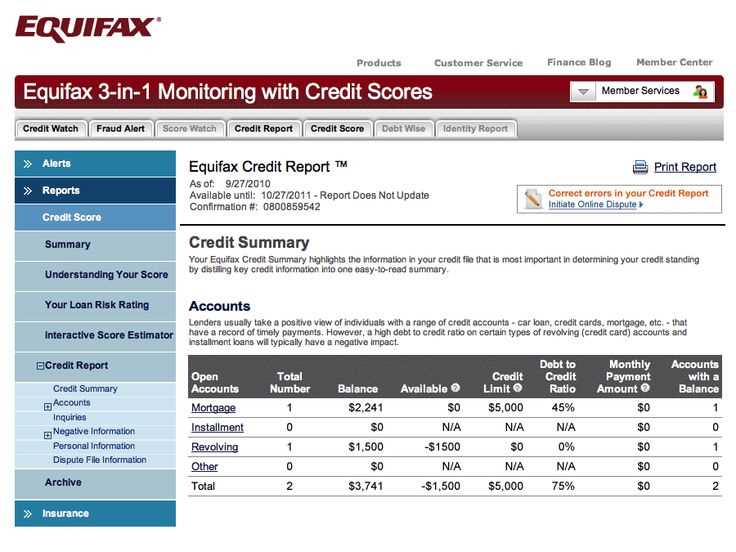

Disputing Credit Report Entries with Equifax

When you find an error on your Equifax credit report, acting swiftly can prevent further issues. The first step is to prepare a clear and concise dispute letter, which can be submitted online or by mail. In your letter, state the specific inaccuracies you’ve identified, providing any supporting documentation. Keep your language straightforward, and avoid unnecessary details to ensure your dispute is processed quickly.

Key Information to Include in Your Dispute Letter

Your dispute letter should include your full name, address, date of birth, and a brief summary of the issue. Specify the exact items on your credit report that are inaccurate. For each disputed entry, include a statement explaining why you believe it is incorrect, and attach copies of relevant documents that support your claim.

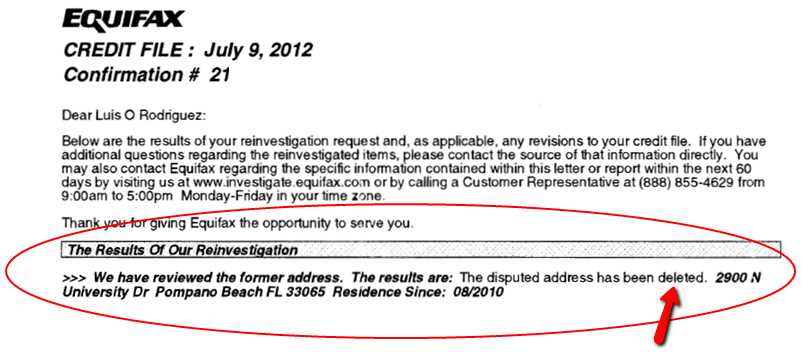

Follow-Up Actions After Submitting the Dispute

Once Equifax processes your dispute, you will receive an update regarding the status of the investigation. If the dispute is resolved in your favor, the erroneous information will be corrected on your credit report. If the dispute is not upheld, you can request a detailed explanation and may choose to escalate the issue to further review. Always keep a copy of your dispute letter for future reference.