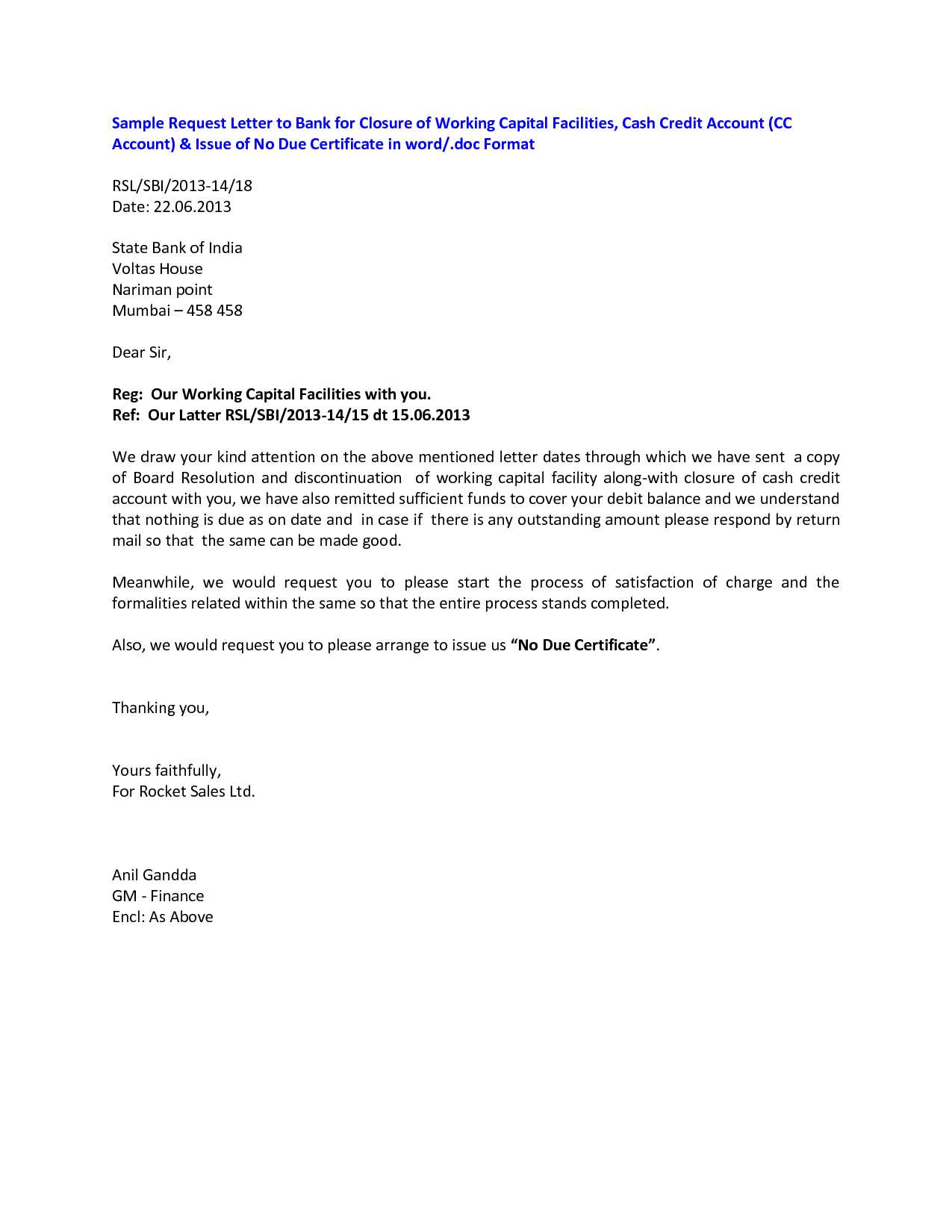

Letter to close a bank account template

When closing a bank account, it’s important to address the matter clearly and professionally. A well-written letter ensures the process goes smoothly, confirming your request and providing necessary details to avoid any confusion. Below is a simple, direct template you can use to close your bank account.

Start by clearly stating your intention to close the account. Include the account number, your full name, and address details for verification purposes. Ensure that you’ve settled all outstanding transactions or fees before sending the letter to avoid complications.

Once the bank processes your request, ask for written confirmation of the account closure. This confirms that no further charges or activity will occur, protecting you from any potential errors down the line. Below is a template you can adapt to suit your specific needs:

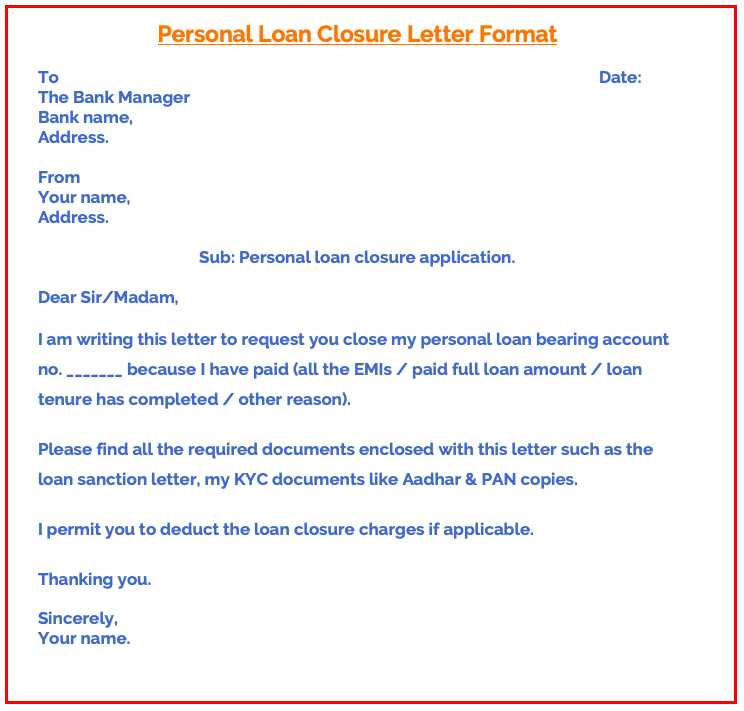

Template:

Dear [Bank Name],

I am writing to request the closure of my account with your bank. Please find the account details below:

Account Number: [Your Account Number]

Account Holder: [Your Full Name]

Address: [Your Address]

I would like to confirm that all transactions and pending charges have been settled. Please close the account and provide written confirmation once this has been completed. I would appreciate it if you could send me a final statement, as well as confirmation of account closure to my address listed above.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

This template keeps things simple and ensures all necessary steps are taken for a smooth account closure process.

Here’s the revised version with minimal repetition:

To close your bank account, start by writing a formal letter to your bank. Ensure you include your account details and a clear request for account closure. Begin with your full name, address, and contact information. State your account number and type, then explicitly ask the bank to close the account. Make sure to mention if you would like any remaining balance transferred to another account. Include a request for confirmation once the account has been closed. Sign the letter and send it via mail or any method your bank requires.

Be concise, polite, and direct. Double-check your account balance and ensure there are no pending transactions before sending the letter. Include any identification or paperwork the bank may request for verification. After submission, track the progress and keep a copy of your communication for reference.

- Letter to Close a Bank Account Template

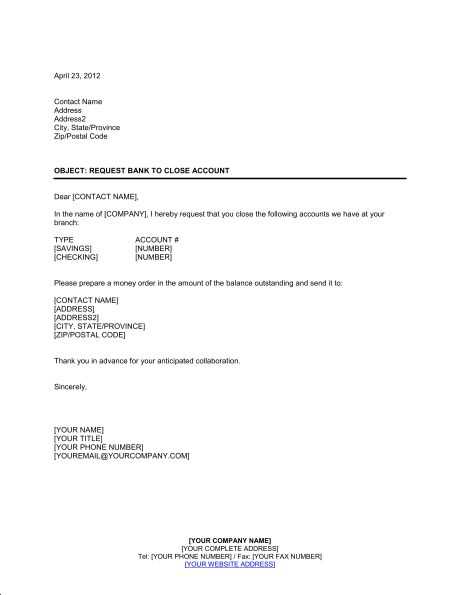

To close your bank account, you need to submit a formal letter to your bank. Make sure to provide clear and accurate details in your request. Below is a simple template to guide you through this process:

Bank Account Closure Request Letter

Date: [Insert Date]

To,

[Bank Name]

[Bank Address]

[City, Postal Code]

Subject: Request for Closure of My Bank Account

Dear Sir/Madam,

I am writing to formally request the closure of my bank account with your institution. The details of my account are as follows:

- Account Holder Name: [Your Full Name]

- Account Number: [Your Account Number]

- Branch: [Your Branch Name]

- Type of Account: [Savings/Checking]

Kindly close my account and process the closure at your earliest convenience. I would appreciate it if you could transfer any remaining balance to the following account:

- Account Name: [Your Name]

- Account Number: [New Account Number]

- Bank Name: [New Bank Name]

Additionally, please provide a confirmation of the closure of the account and any further steps I need to follow. If any documents are required from my end, please let me know.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Full Name]

[Your Contact Information]

By following this template, you can ensure a smooth and straightforward process when closing your account.

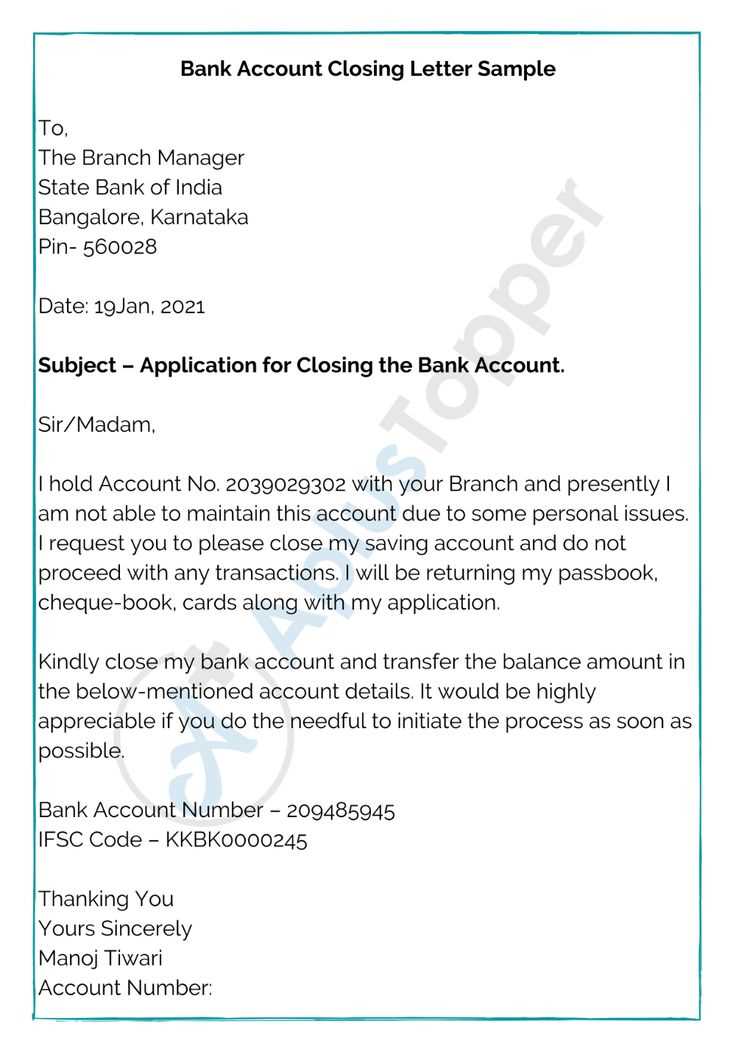

Start by addressing the letter to the correct department of the bank. Include the name of the bank, and use a formal salutation such as “Dear Sir/Madam” or the specific person if you know their name. It’s important to ensure the letter reaches the right office for processing.

Include Your Account Information

Clearly state your account details, including the account number, type (e.g., checking or savings), and your full name. This information will help the bank quickly locate your account and proceed with the closure request.

State Your Request Clearly

Express your intention to close the account in simple terms. Mention that you would like to close the account and request written confirmation once the closure is complete. If applicable, you can specify a reason for the closure, but it is not mandatory.

For example, “I would like to formally request the closure of my [account type] account with the number [account number]. Please confirm the closure in writing and provide any necessary information about the remaining balance or steps I need to take.”

Address Remaining Balance or Pending Transactions

If there is an outstanding balance or pending transactions, mention how you would like to handle them. Provide instructions for transferring the remaining balance to another account or ask for a cheque if necessary.

For instance, “Please transfer the remaining balance of $[amount] to my other account [account number], or issue a cheque for the remaining amount.”

Close with a Polite Request

End the letter politely by thanking the bank for their assistance. Include a contact number or email for any follow-up communication and ensure the bank has all necessary information to proceed efficiently.

Example closing: “Thank you for your prompt attention to this matter. Please contact me at [phone number] or [email address] if you need any further information.”

Sign the letter at the end with your full name, and don’t forget to keep a copy of the letter for your records. Once completed, submit the letter to the bank through your preferred method, whether by mail or in person.

Key Information to Include in Your Account Closure Request

Provide the exact account number. It is essential to make sure that the bank can locate the correct account for closure. Without the account number, the process may face delays.

Include your full name and address as they appear on the account. This helps the bank verify your identity and ensures they close the right account.

Clearly state your request to close the account. Avoid any ambiguity, and specify the account type–checking, savings, or other.

Details of Outstanding Transactions

Address any pending transactions or unresolved issues. If you have any balance remaining, mention whether you want it refunded or transferred to another account.

Reason for Closure (Optional)

While not mandatory, you may include a brief reason for closing the account. Some banks may appreciate the feedback, but it won’t affect the closure process.

How to Address the Letter: Correct Bank Contact Information

Make sure to find and use the correct contact details for your bank to avoid delays or confusion. Contact information may vary depending on your location or branch. Here’s how to get it right:

- Check the bank’s website for an official address or the “Contact Us” section.

- If you are closing your account with a specific branch, address the letter to the branch manager or the appropriate department.

- For larger banks, you can direct the letter to the customer service department or a centralized account closure team.

- Include the bank’s official address, including the branch or post office code, to ensure proper routing.

Where to Find Contact Information

- Bank statements: Your recent statements will often list a customer service address or contact information for account-related matters.

- Online banking: Most banks provide contact details through their secure online platforms.

- Phone support: Call the bank’s support line and ask for the appropriate address or department for account closures.

Always double-check the address before sending your letter. Using outdated or incorrect contact information can cause delays in processing your request.

If there are pending transactions or remaining balances, wait for them to process before closing your account. Pending transactions may take a few days to clear, depending on the type of transaction. Check your account regularly to ensure all pending activities have been completed.

If there is a positive balance, transfer it to another account or request a withdrawal. You may need to wait for the bank to finalize any processing before you can withdraw or transfer funds. If you are unsure about any pending transactions, contact the bank to clarify the status and expected time for completion.

If you have any automatic payments or subscriptions linked to the account, update them with your new banking information before closing the account. This will prevent missed payments or disruptions.

In case of any disputes related to pending transactions, it’s best to resolve them before proceeding with account closure to avoid complications later.

If you are ready to close your bank account, use this sample template to ensure that all necessary information is included. Customize the details according to your situation to make the process smooth and clear for the bank.

Bank Account Closure Letter Template

Below is a simple, effective letter format that you can use to formally request the closure of your bank account.

| Subject | Request for Bank Account Closure |

|---|---|

| Recipient | Bank Manager, [Bank Name] |

| Date | [Insert Date] |

| Account Holder | [Your Full Name] |

| Account Number | [Your Account Number] |

Dear [Bank Manager’s Name],

I am writing to request the closure of my bank account with your institution. Below are the details of the account:

| Account Name: [Your Full Name] |

| Account Number: [Your Account Number] |

| Account Type: [Type of Account] |

Please process the closure of my account and transfer any remaining balance to the following account:

| Recipient Bank Name | [Recipient Bank Name] |

|---|---|

| Recipient Account Number | [Recipient Account Number] |

| Account Holder’s Name | [Recipient’s Name] |

I would appreciate your confirmation of the account closure once it has been completed. Please send me a final statement of the account balance and details of the closure process. Thank you for your assistance.

Sincerely,

[Your Full Name]

Additional Information

Make sure to check with your bank about any outstanding fees or balances. If necessary, you may want to follow up with them to ensure the closure process is completed and that your final statement is received promptly.

Don’t close your account without checking if there are any pending transactions. Ensure all checks, automatic payments, or subscriptions are cleared before closing the account. Leaving pending transactions can cause complications and fees.

Failing to Withdraw Your Funds

Before closing your account, withdraw all remaining funds. If you forget this step, the bank may charge additional fees for an inactive account, or you may face delays in receiving your money later. Transferring the balance to another account is a simple way to avoid this issue.

Not Getting Written Confirmation

Always ask for written confirmation when you close your account. This serves as proof that your account has been closed, protecting you from any future misunderstandings or incorrect charges.

Don’t forget to destroy any old checks and debit cards tied to the closed account. This reduces the risk of identity theft and prevents any accidental transactions. Safely dispose of these items after the account is closed.

How to Close Your Bank Account

Follow these steps to close your bank account effectively:

- Ensure all pending transactions are cleared. This includes pending deposits, automatic payments, and checks that haven’t been cashed.

- Transfer your funds. Make sure to move your balance to another account to avoid complications.

- Review your account for any outstanding fees or charges. Settle them before closing the account.

- Contact your bank to request account closure. You can do this online, by phone, or in person. Ask for written confirmation once the closure is complete.

- Destroy any checks and debit cards linked to the account. This will prevent future use of the account.

- Monitor your account for any unexpected activity after closure. Keep an eye on statements for a few months to ensure no fees or unauthorized transactions appear.

By following these steps, you can successfully close your account without facing unwanted issues later.