Credit Hard Inquiry Removal Letter Template

When reviewing your financial records, you might come across some unfavorable entries that impact your score. These marks can occur due to various reasons, including mistakes or errors by creditors. Addressing these issues promptly is essential for maintaining a healthy financial profile.

In some cases, removing an inaccurate entry may be as simple as sending a formal request. This document can be a powerful tool to communicate with institutions and request adjustments if needed. Knowing how to craft an effective message can increase your chances of success and help restore your standing.

By following the right procedure and using the correct language, you can improve your financial outlook. A well-structured request ensures your concerns are taken seriously, leading to faster resolutions and a cleaner record.

What is a Credit Hard Inquiry

When you apply for a loan or a new form of credit, the lender typically checks your financial history to assess your eligibility. This review helps them determine whether you can manage additional debt responsibly. These checks, however, can sometimes impact your financial profile, especially when recorded inaccurately.

Such assessments, often seen by financial institutions as a signal of potential risk, can influence how your report appears to others. Although necessary in many situations, they may have a temporary negative effect on your rating. It’s important to know how these checks work and what they mean for your future borrowing ability.

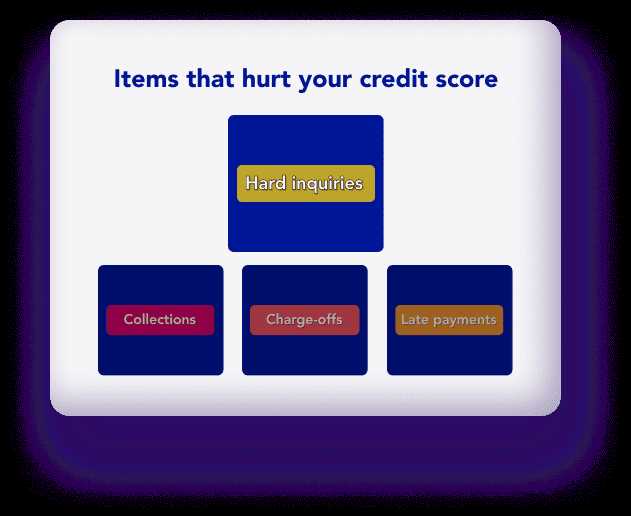

Why Hard Inquiries Affect Your Score

When a financial institution reviews your background as part of a lending decision, it may temporarily lower your standing. While this process is essential for assessing risk, it can lead to a decrease in your numerical representation of financial health, even if the application doesn’t result in a new account or debt.

The Impact on Your Financial Reputation

Each time your financial history is accessed for a potential loan or line of credit, it signals to other lenders that you’re actively seeking additional debt. Multiple requests within a short time frame can suggest to others that you’re experiencing financial strain, which could lower your perceived reliability. This can result in a higher chance of being rejected for future applications or being offered less favorable terms.

Temporary Effects and Long-Term Benefits

While these assessments might have a short-term negative effect, they can be less harmful if managed well. Responsible borrowing and maintaining a steady payment history can mitigate the long-term damage caused by these checks, as they tend to fade from view over time. It’s crucial to balance your credit activity to avoid overloading your financial profile.

How to Identify a Hard Inquiry

When reviewing your financial record, it’s important to know which actions might affect your standing. Some checks are more intrusive than others and can have an impact on your rating. Identifying these entries is the first step in understanding their potential consequences and taking appropriate action if necessary.

Here are a few key signs that indicate a more in-depth review of your financial history:

- Request for New Credit: A loan application, new credit card, or mortgage inquiry usually involves a deeper investigation into your finances.

- Visible on Your Report: These entries will appear on your report, often noted by the lender’s name and the date the check was performed.

- Effect on Your Score: These assessments can slightly lower your score, especially if there are multiple checks within a short period.

If you’re unsure whether a particular check qualifies as one that impacts your score, you can reach out to the relevant institution for clarification. Knowing what triggers a financial evaluation can help you monitor your standing more effectively.

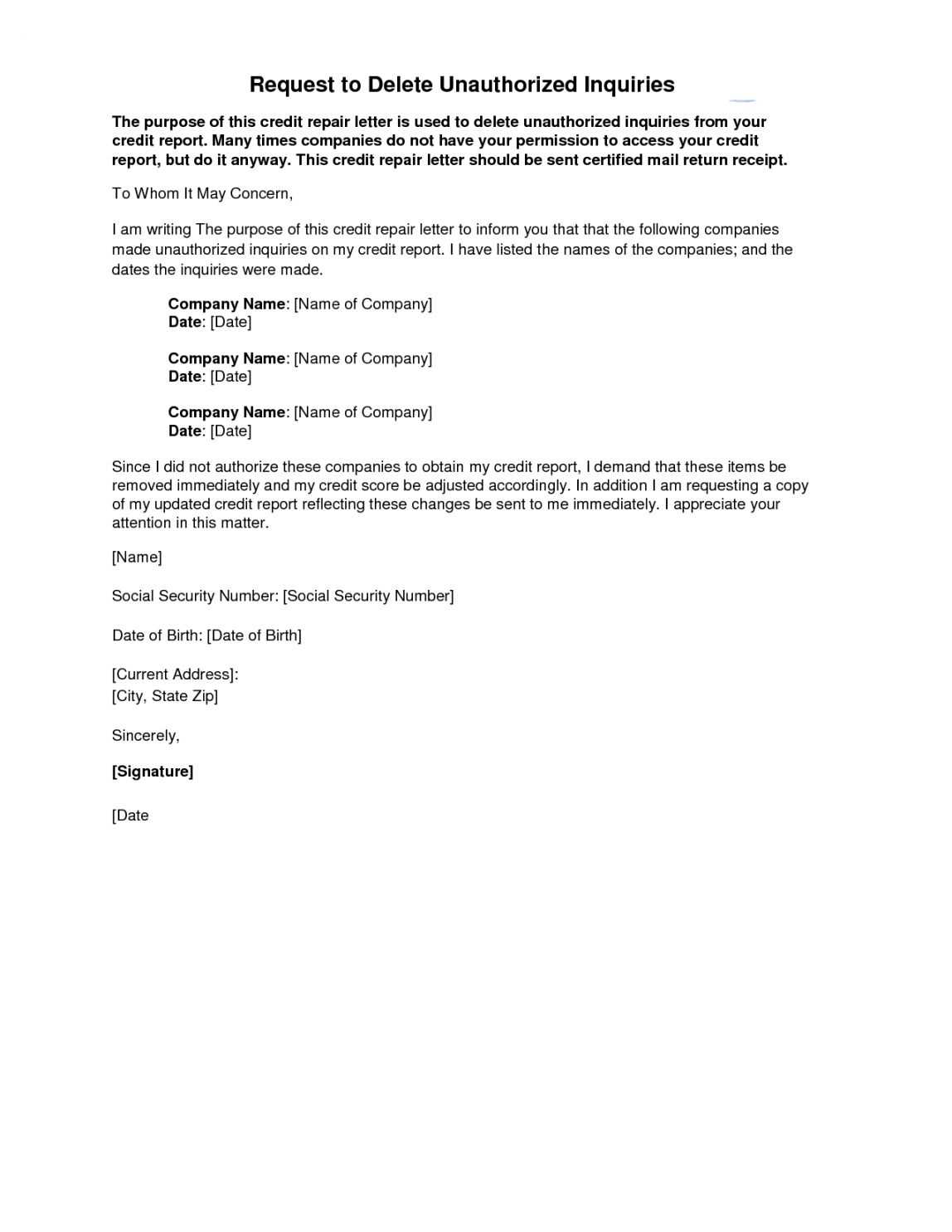

Step-by-Step Guide to Writing Your Letter

If you need to address an inaccurate or unnecessary entry in your financial history, a well-structured communication can help resolve the issue efficiently. Writing a formal request is an important step in clearing up discrepancies and ensuring your financial profile is accurate.

Follow these steps to craft a clear and effective message:

- Begin with Your Contact Information: Start by including your full name, address, phone number, and account details, so the recipient can easily identify you.

- State the Issue Clearly: Briefly explain the nature of the problem. Mention the specific entry you are disputing and why it may be incorrect or unsubstantiated.

- Provide Supporting Evidence: Attach any relevant documents, such as statements or receipts, that back up your claim.

- Request Action: Politely ask for the removal or correction of the entry and suggest a clear course of action, like reviewing your records or adjusting your standing.

- End with Your Signature: Close the letter with a respectful signature and offer your contact information for follow-up.

By following these steps, you increase the chances of your request being processed quickly and effectively. A respectful, clear, and well-supported message can go a long way in ensuring the issue is resolved in your favor.

Common Mistakes to Avoid in Letters

When crafting a formal request to address an issue in your financial record, it’s important to be mindful of certain pitfalls that can hinder the effectiveness of your communication. Avoiding common errors ensures your message is clear, respectful, and more likely to result in a favorable outcome.

Here are some common mistakes to steer clear of when composing your request:

- Being Too Vague: Provide specific details about the entry you’re disputing, including dates and account information. General complaints may not be taken seriously.

- Using Aggressive Language: Maintain a polite and professional tone throughout the message. Aggressive language can alienate the recipient and may result in a delayed or ignored response.

- Omitting Supporting Documents: Always include evidence that backs up your claim. Without proper documentation, it’s harder to convince the recipient that an error exists.

- Failing to Address the Right Person: Ensure your communication is directed to the correct department or individual handling disputes. Sending it to the wrong person can slow down the process.

- Neglecting to Follow Up: After sending your request, follow up if you don’t receive a response within a reasonable time frame. Staying proactive demonstrates your seriousness about resolving the issue.

Avoiding these mistakes can make a significant difference in the outcome of your request. Clear, respectful, and well-documented communication is key to achieving a successful resolution.

When to Follow Up on Your Request

After sending your formal communication, it’s crucial to give the recipient enough time to process your request. However, knowing when to follow up is equally important to ensure that your case is addressed in a timely manner. Following up too early may be premature, while waiting too long could lead to unnecessary delays.

Here’s a guideline to help you determine when to reach out again:

| Time Passed | Recommended Action |

|---|---|

| 1-2 Weeks | Give the recipient time to review your request and documents. Avoid following up before this period unless there was an immediate response required. |

| 3-4 Weeks | If you haven’t received any acknowledgment or update, it’s time to send a polite follow-up. Keep the tone professional and inquire about the status of your request. |

| 5-6 Weeks | If no response has been received yet, escalate the matter by contacting a supervisor or the relevant department. Mention the original date of your submission for reference. |

By following this guideline, you’ll be able to stay on top of your case while ensuring your communication remains respectful and effective throughout the process.