International Letter of Credit Template Overview

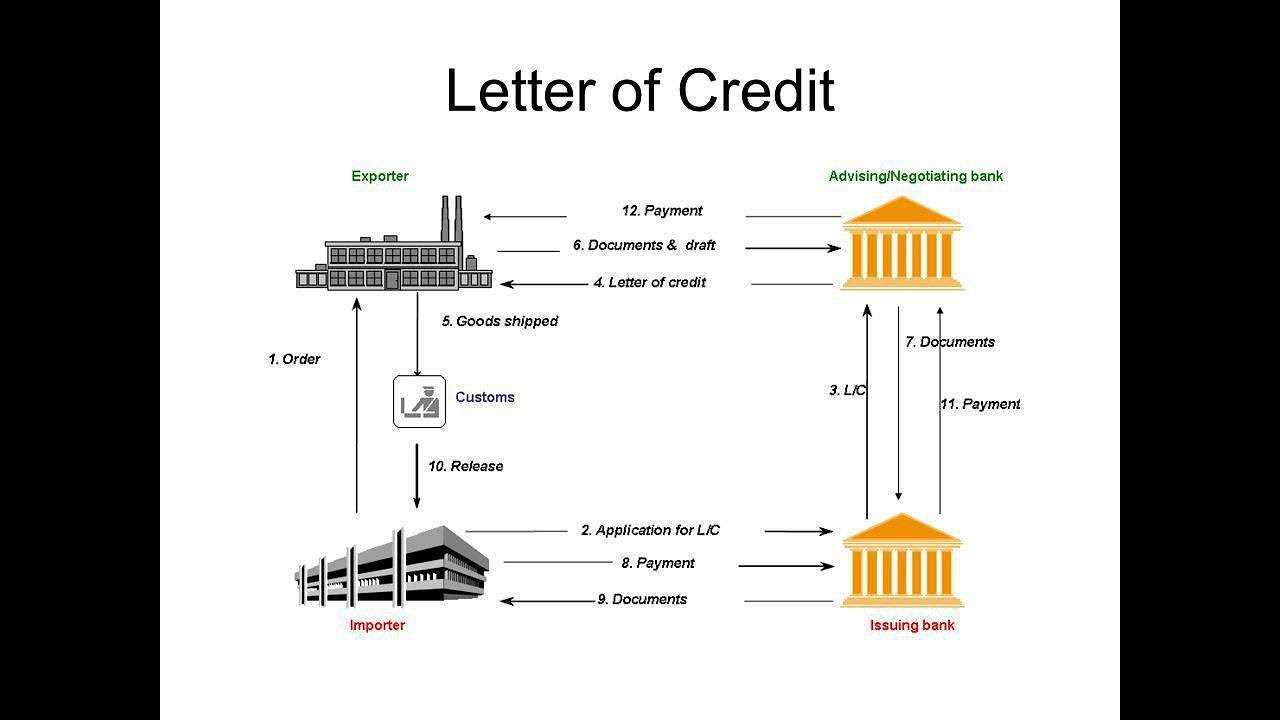

In global commerce, businesses often rely on formalized documents to ensure payment security and build trust between parties. These written agreements help mitigate risks and set clear terms for transactions, especially when parties are located in different parts of the world. This process involves outlining conditions under which payments are guaranteed upon fulfilling certain criteria.

Key Components of a Secure Financial Agreement

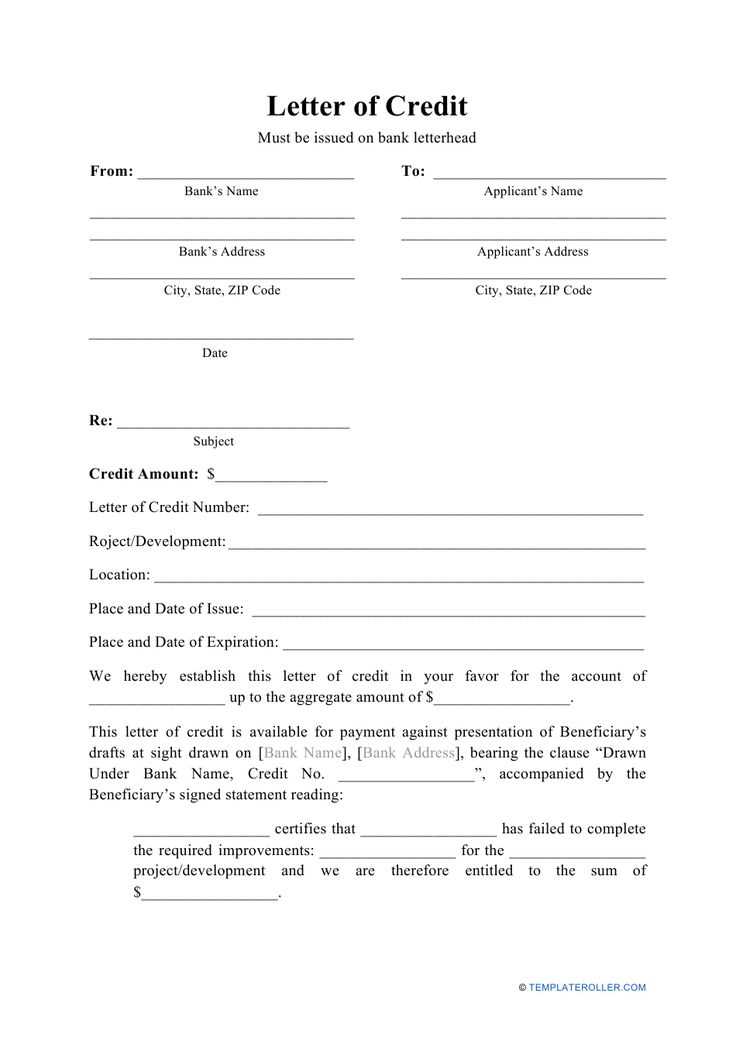

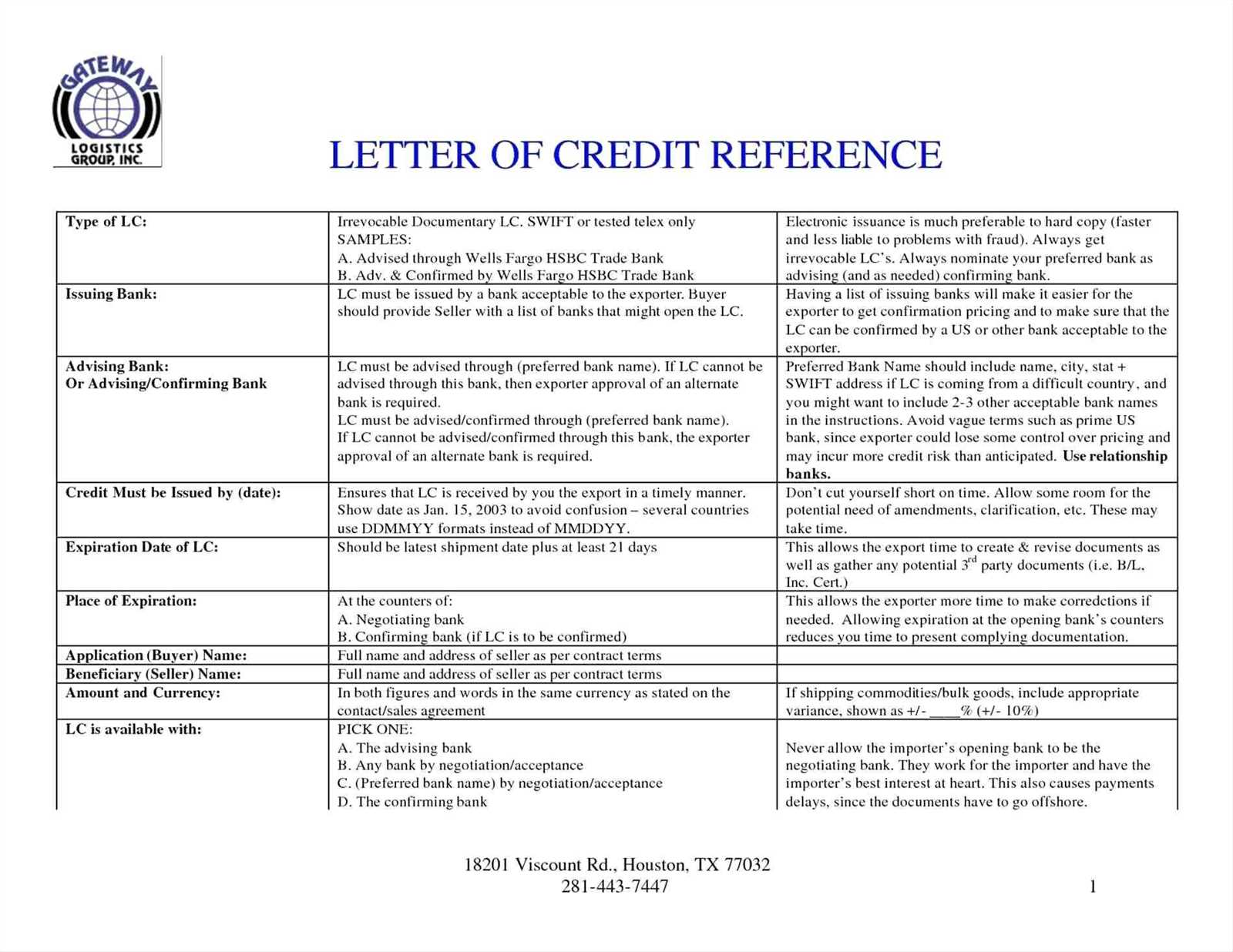

These documents typically contain several crucial elements that define the rights and obligations of the involved parties. Understanding these components is essential for anyone looking to engage in secure global transactions.

- Parties Involved – Identifies the buyer, seller, and the financial institutions facilitating the process.

- Payment Terms – Specifies when and how the funds will be transferred, usually upon meeting agreed conditions.

- Conditions for Release – Details what documents or actions are required to trigger the payment.

- Expiration Date – Indicates the time frame within which the conditions must be fulfilled.

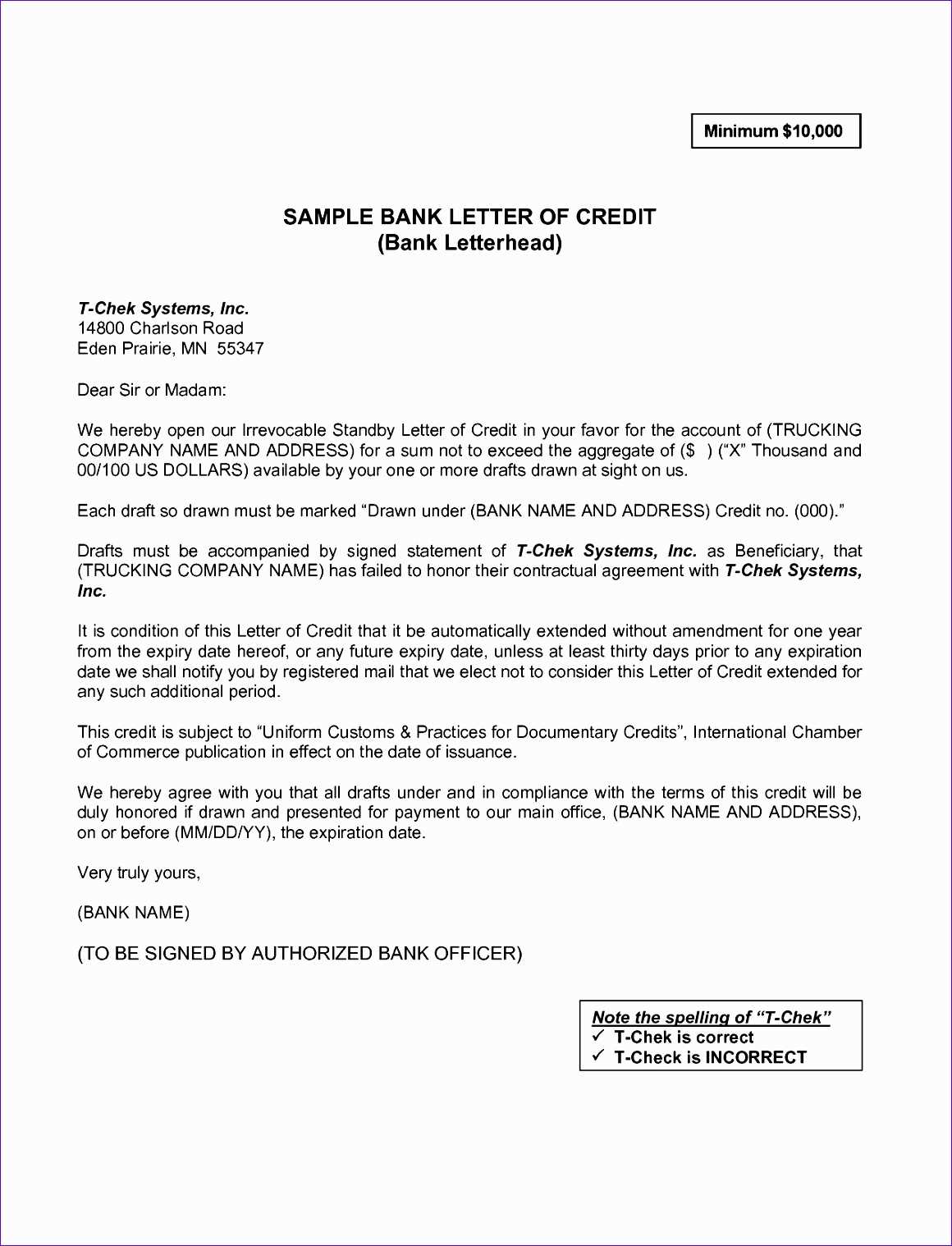

How to Draft an Effective Agreement

When drafting such documents, it is crucial to ensure clarity and precision in outlining the agreed terms. Misunderstandings can lead to costly disputes. Here are a few key tips:

- Use clear and concise language to avoid ambiguity.

- Ensure that all terms are fair and balanced for both parties.

- Consult legal experts to ensure compliance with relevant international regulations.

Benefits of Secure Financial Agreements

These agreements offer numerous advantages, making them a popular choice for cross-border business transactions. Some of the main benefits include:

- Security – Reduces the risk of non-payment by ensuring that funds are only released once specific conditions are met.

- Trust – Establishes confidence between parties, especially when dealing with unfamiliar partners or high-value transactions.

- Efficiency – Streamlines international trade by setting clear, enforceable conditions.

Alternatives to Financial Agreements

While these documents provide a secure method for managing international transactions, there are other ways to facilitate global business exchanges. Alternatives include direct bank transfers, escrow services, and trade insurance. However, these options may not always offer the same level of protection or clarity as formalized agreements.

Understanding Secure Payment Documents and Their Use in Global Trade

In the world of global commerce, businesses often engage in agreements that ensure the safe transfer of funds between buyers and sellers. These written instruments act as guarantees, providing confidence to both parties that the terms of the transaction will be met. Such agreements are vital for international trade, reducing risks and fostering trust across borders.

The essential components of these agreements include clear definitions of the involved parties, payment conditions, required documentation, and deadlines. These elements are structured to safeguard both the buyer and the seller by ensuring that obligations are fulfilled before funds are exchanged.

Advantages of Using Secure Payment Documents

One of the main advantages of utilizing these formalized agreements is the protection they provide. Both buyers and sellers are assured that the payment will only be made when predefined conditions are met, offering security for both sides. This reduces the chances of disputes and encourages smoother international transactions.

How to Create an Effective Payment Guarantee

Creating an effective agreement requires careful attention to detail. It is important to outline the exact terms and conditions in a clear and precise manner. Inadequate or vague language can lead to misunderstandings and complications down the line. Engaging legal professionals to help draft such documents ensures compliance with international standards and best practices.

Common Mistakes in Payment Agreement Usage

Despite their benefits, mistakes can occur when handling these agreements. Some common errors include failing to clearly define terms, overlooking required documentation, and not specifying timelines for action. These oversights can result in payment delays or disputes, undermining the purpose of the agreement.

Legal Considerations in Global Transactions

Understanding the legal framework surrounding these agreements is critical for ensuring their enforceability. Different countries may have varying regulations that affect how these documents are implemented. It is crucial to stay informed about the legal implications and ensure all parties are compliant with relevant laws to avoid any potential legal issues.

Alternative Payment Methods in International Commerce

While these payment guarantees are a popular choice, businesses also have other options available to facilitate international trade. Alternatives include direct wire transfers, online payment platforms, and escrow services. However, these methods may not always provide the same level of security or formal structure as written payment agreements, making them less ideal for high-value transactions.