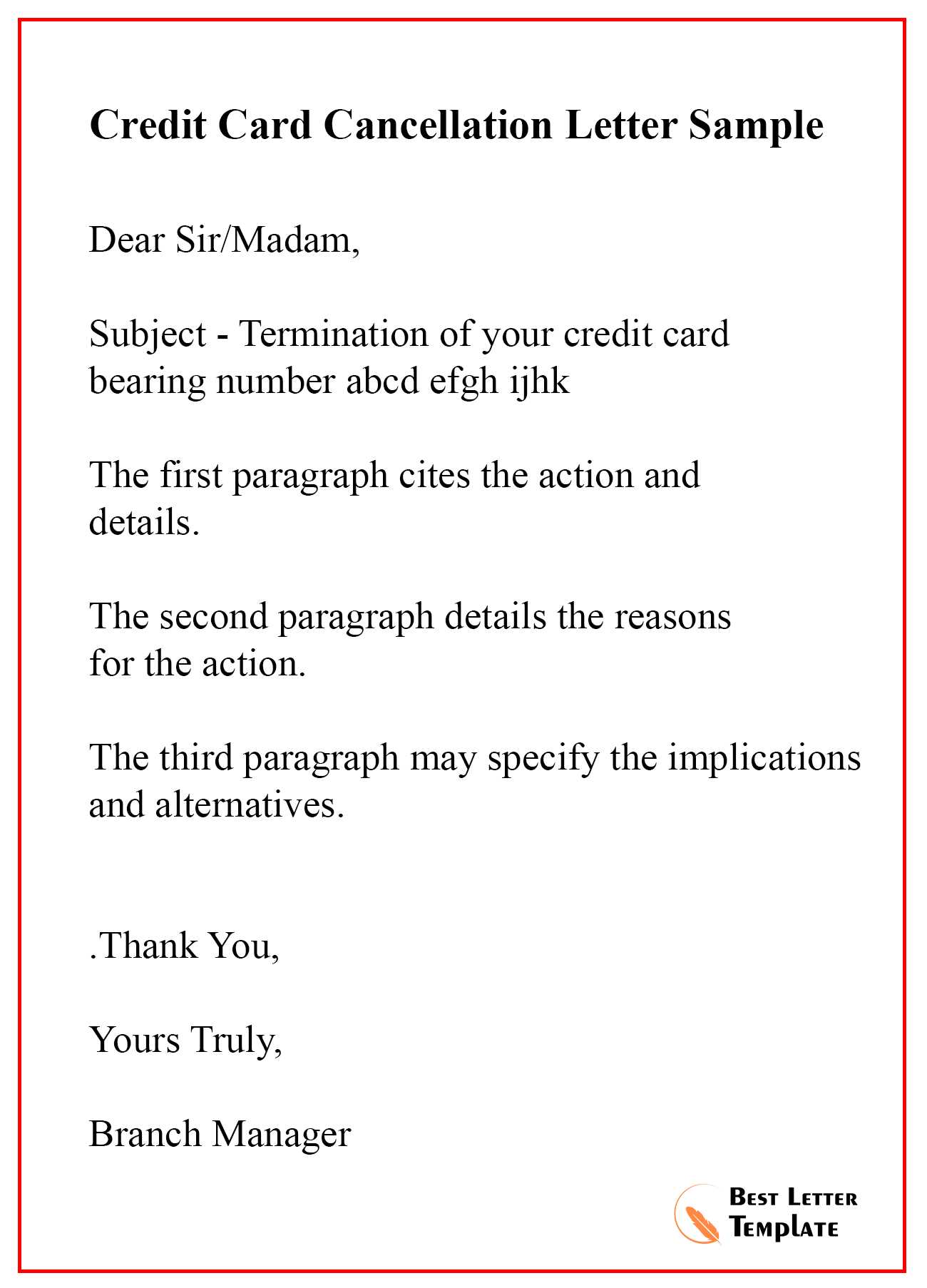

Letter Template to Cancel Your Credit Card

When managing your finances, there may come a time when you need to end a particular account. Whether due to high fees, poor service, or simply no longer needing the account, it’s important to approach the process thoughtfully and professionally. Properly ending a financial relationship can help avoid future complications and ensure that all obligations are settled.

Knowing how to communicate your decision clearly is key in this process. A well-crafted message can ensure a smooth transition, leaving no room for misunderstandings. By outlining your intentions in a concise and respectful manner, you are more likely to receive a prompt response.

In the following sections, we will explore the necessary steps, best practices, and tips for successfully wrapping up your account. With the right approach, you can close your account with confidence and ease.

How to Effectively End Your Financial Account

Closing a financial account can be a straightforward task when done properly. It is important to approach the process with clarity and organization to ensure everything is handled smoothly. The goal is to avoid any unexpected charges or complications that could arise later. Here are key steps to ensure a hassle-free closure.

1. Review Your Account Balance

Before making any final decisions, ensure that all outstanding balances are paid off. This will prevent any fees from accumulating after the account is terminated. Be sure to:

- Check for any unpaid bills or charges

- Ensure your balance is at zero

- Verify there are no pending transactions

2. Contact Customer Support

Reach out to the institution managing your account. Often, they will provide specific instructions on how to proceed. During the conversation, be clear about your intention to close the account and ask for confirmation that all steps are followed correctly.

- Request confirmation in writing

- Inquire about any potential fees

- Ask if there are any necessary forms to fill out

By carefully following these steps, you can ensure the account is properly closed and avoid any future issues with financial institutions.

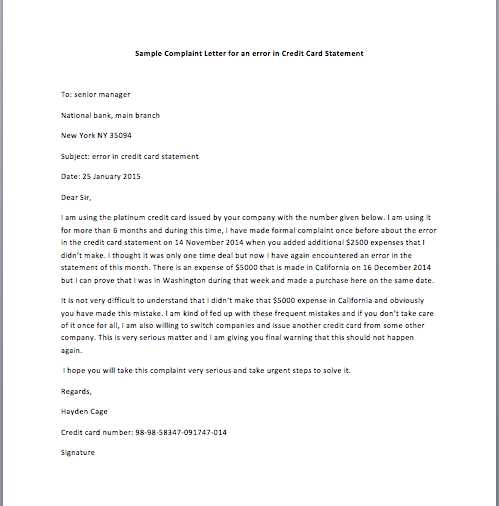

Understanding the Need to Close Your Account

There are several reasons why individuals may decide to end their financial relationships with a provider. Whether due to dissatisfaction with services, excessive fees, or no longer needing the account, it is essential to evaluate your situation carefully. Understanding the implications of such a decision is key to ensuring that it is the right choice for your financial well-being.

Some of the most common motivations include:

| Reason | Implication |

|---|---|

| High Fees | Unnecessary costs that can be avoided by switching providers or terminating the account. |

| Low Usage | Not using the account often can lead to wasteful spending or loss of benefits. |

| Poor Customer Service | Unresolved issues or frustration with support can push individuals to end their relationship. |

| Fraudulent Activities | Protecting yourself from possible misuse or unauthorized charges can be a valid reason for account termination. |

By understanding these motivations, you can make an informed decision about whether closing your account is the best move for you.

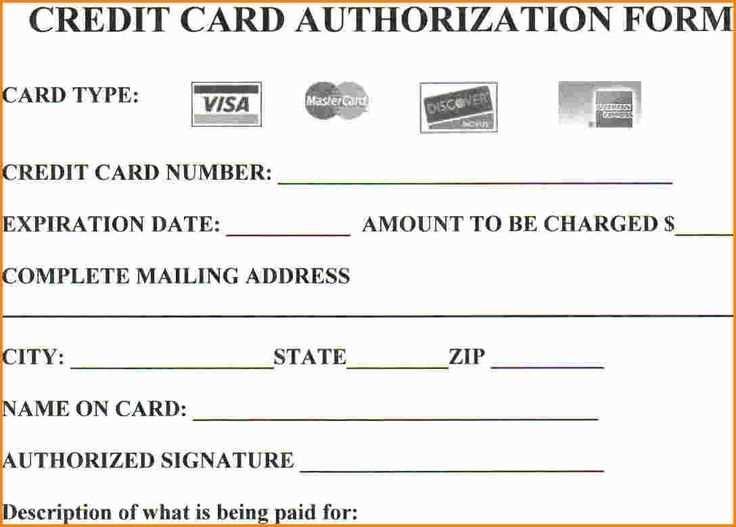

Key Information to Include in the Request

When formally requesting to close a financial account, it is crucial to provide all necessary details to ensure the process is handled correctly. A clear and precise request will help avoid delays or misunderstandings. Make sure to include specific information that will assist the provider in identifying and processing your request efficiently.

1. Personal Identification Details

It is important to include relevant personal information that allows the institution to verify your identity. This will ensure there are no issues with processing your request.

- Full name

- Account number

- Address and contact information

2. Request Confirmation and Action

Clearly state your intention to close the account and request confirmation of the closure. Additionally, inquire about any final steps or documentation required to complete the process.

- State the account termination request explicitly

- Ask for written confirmation of closure

- Inquire about any pending actions on your part

By ensuring these key details are included, you can facilitate a smooth and efficient process when ending your financial relationship with a provider.

Tips for Writing a Professional Account Termination Request

When requesting to end your financial account, it’s important to communicate in a clear and professional manner. A well-structured message will not only help ensure the process goes smoothly but also maintain a positive relationship with the institution. Below are some tips to help you craft a formal and effective request.

- Be Clear and Concise: Avoid unnecessary details or emotional language. Focus on the key points and express your intention clearly.

- Stay Polite and Professional: Use a respectful tone. Even if you’re dissatisfied with the service, maintaining professionalism can lead to a more positive outcome.

- Provide Necessary Details: Include all relevant account information, such as your full name, account number, and contact details to make identification easier for the provider.

- Request Confirmation: Ask for written confirmation that your request has been processed. This ensures you have a record of the termination.

- Check for Any Outstanding Balances: Ensure that any dues are settled before making the request to avoid complications.

By following these tips, you can create a professional and efficient request that will help you successfully close your account with minimal hassle.

What to Do After Sending the Request

Once you have submitted your request to close the financial account, there are several important steps to follow to ensure that the process is completed without any issues. It is essential to stay proactive and follow up to confirm that the closure is handled correctly and promptly. Here are the key actions to take after submitting your request.

1. Monitor Your Account

After sending the request, keep an eye on your account for any changes. Make sure there are no further transactions or hidden fees being charged. It’s important to ensure everything is settled before the account is officially closed.

- Check for any new charges or activity

- Confirm that the balance is zero

- Verify that the account is no longer accessible for transactions

2. Follow Up for Confirmation

If you haven’t received confirmation of the account closure within the expected time frame, don’t hesitate to follow up. Contact the provider to ensure that your request is being processed and request any documentation that proves the closure has been finalized.

- Request written confirmation of closure

- Ask if any final steps are required on your end

- Ensure the account is officially closed with no further obligations

By staying vigilant and following up, you can ensure that your account is closed properly and avoid any unexpected issues down the line.

Common Mistakes to Avoid When Closing an Account

Ending a financial relationship requires careful attention to detail to avoid complications. Many individuals make simple mistakes that can lead to delays or even financial repercussions. Understanding these pitfalls will help ensure the process is smooth and efficient.

1. Ignoring the Terms and Conditions

Before initiating the termination, make sure to review the terms of your agreement. Not being aware of any penalties or specific requirements for ending the relationship could result in unnecessary fees or setbacks.

- Check for cancellation fees

- Verify if there are any minimum balance requirements

- Understand the notice period, if any

2. Failing to Settle the Balance

One of the most common mistakes is forgetting to clear any outstanding balances before requesting closure. Failing to do so could result in additional charges or prevent the account from being properly closed.

- Ensure there are no pending payments or dues

- Double-check for any accrued interest or fees

- Verify that all payments are processed before submission

Avoiding these mistakes will streamline the process and help you close your account without unnecessary complications.

Alternatives to Closing Your Account

While closing a financial account may seem like the best solution in some cases, there are alternative options to consider before making a final decision. Depending on your circumstances, you may find that other actions can provide the same benefits without going through the formal termination process.

1. Reduce the Account’s Credit Limit

If you’re concerned about overspending but still want to keep the account active, reducing the available limit can help minimize the risk. This option allows you to retain the account for emergencies or future use without the temptation of excessive spending.

- Request a lower limit to control spending

- Avoid making impulse purchases with a reduced limit

- Retain the account for occasional use or emergencies

2. Request a Temporary Suspension

If you’re facing temporary financial hardship but do not want to close the account entirely, consider requesting a suspension. Many institutions offer the option to pause account activity without permanently closing it. This can provide relief while you work on improving your financial situation.

- Ask the provider for a temporary suspension period

- Keep the account open without worrying about activity

- Reassess your needs after the suspension ends

Exploring these alternatives allows you to manage your account more effectively without the need for immediate closure.