Letter to Close Credit Card Account Template Guide

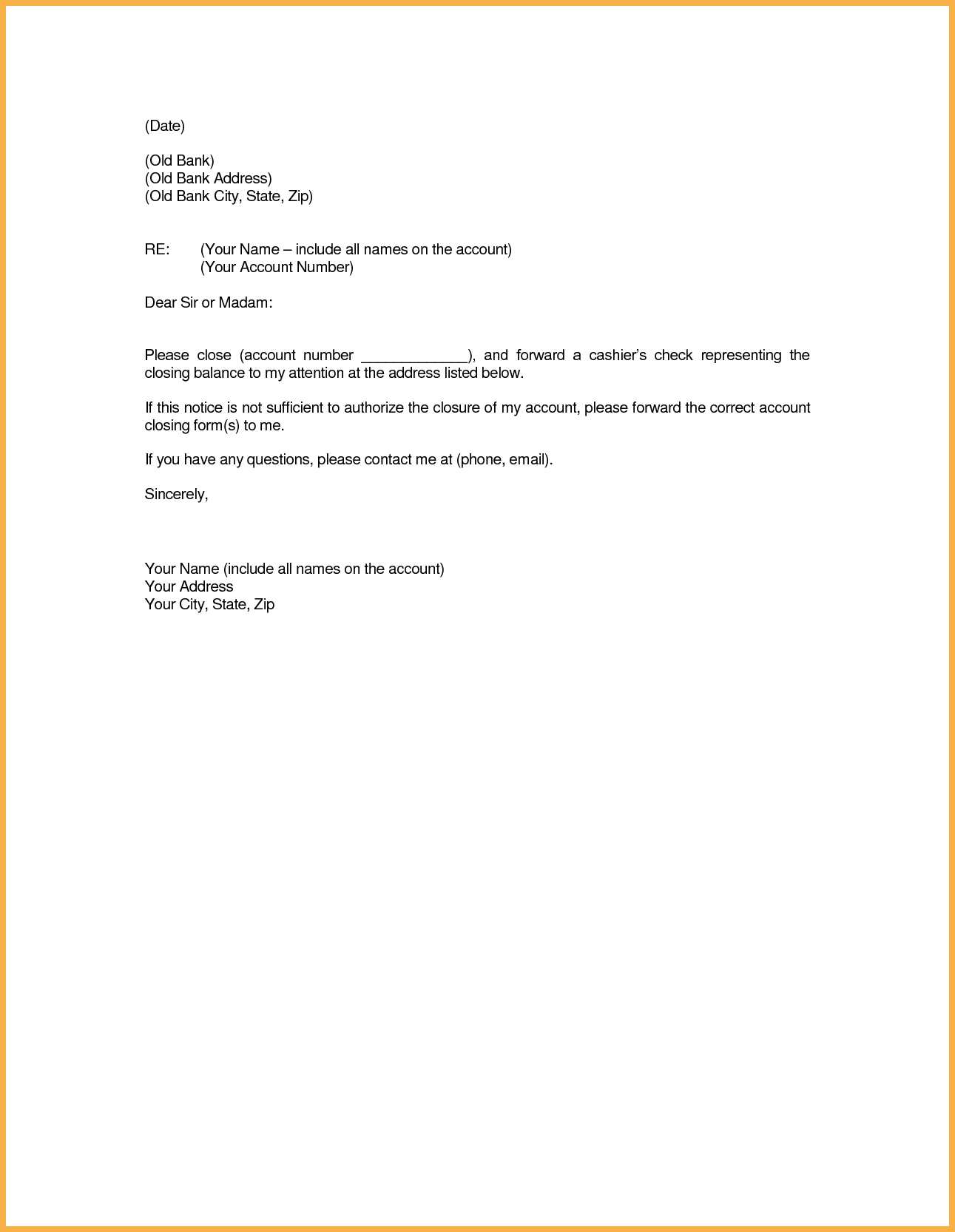

When you decide to end a financial relationship, it is important to notify the provider in a professional manner. Writing a formal request can help ensure that all necessary steps are taken for a smooth termination process. A well-crafted document can also prevent potential misunderstandings and ensure that all obligations are met before the service is fully discontinued.

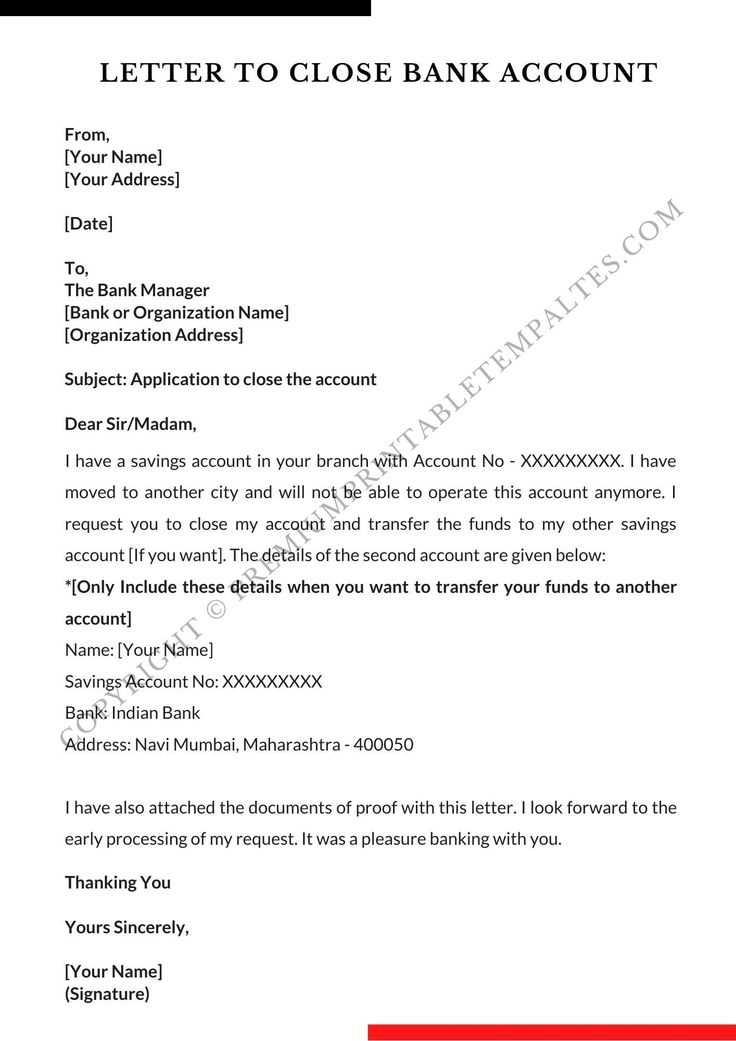

Key Elements to Include in Your Request

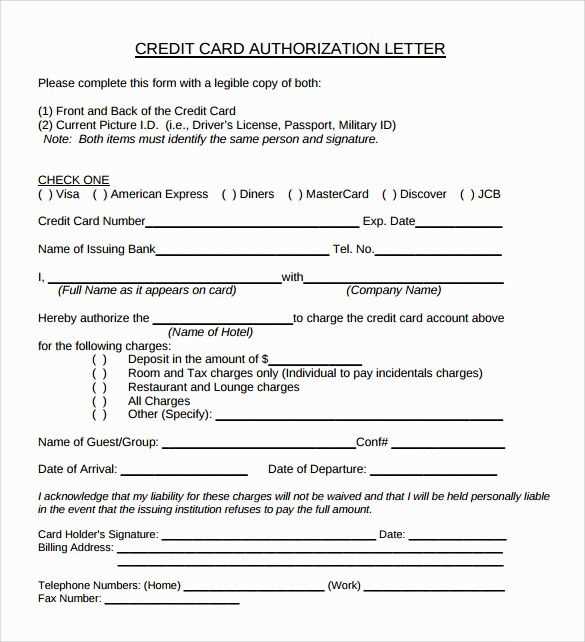

For a clear and efficient termination, it is essential to include the following details in your request:

- Your full name

- Your account number or related identifier

- The exact date of your request

- A statement expressing your intention to end the service

- A request for confirmation once the process is complete

Formatting Tips

The document should be brief yet clear. Avoid unnecessary jargon and focus on what is necessary to convey your intent. Keep the tone polite but firm, making it clear that you expect the process to be completed in a timely manner.

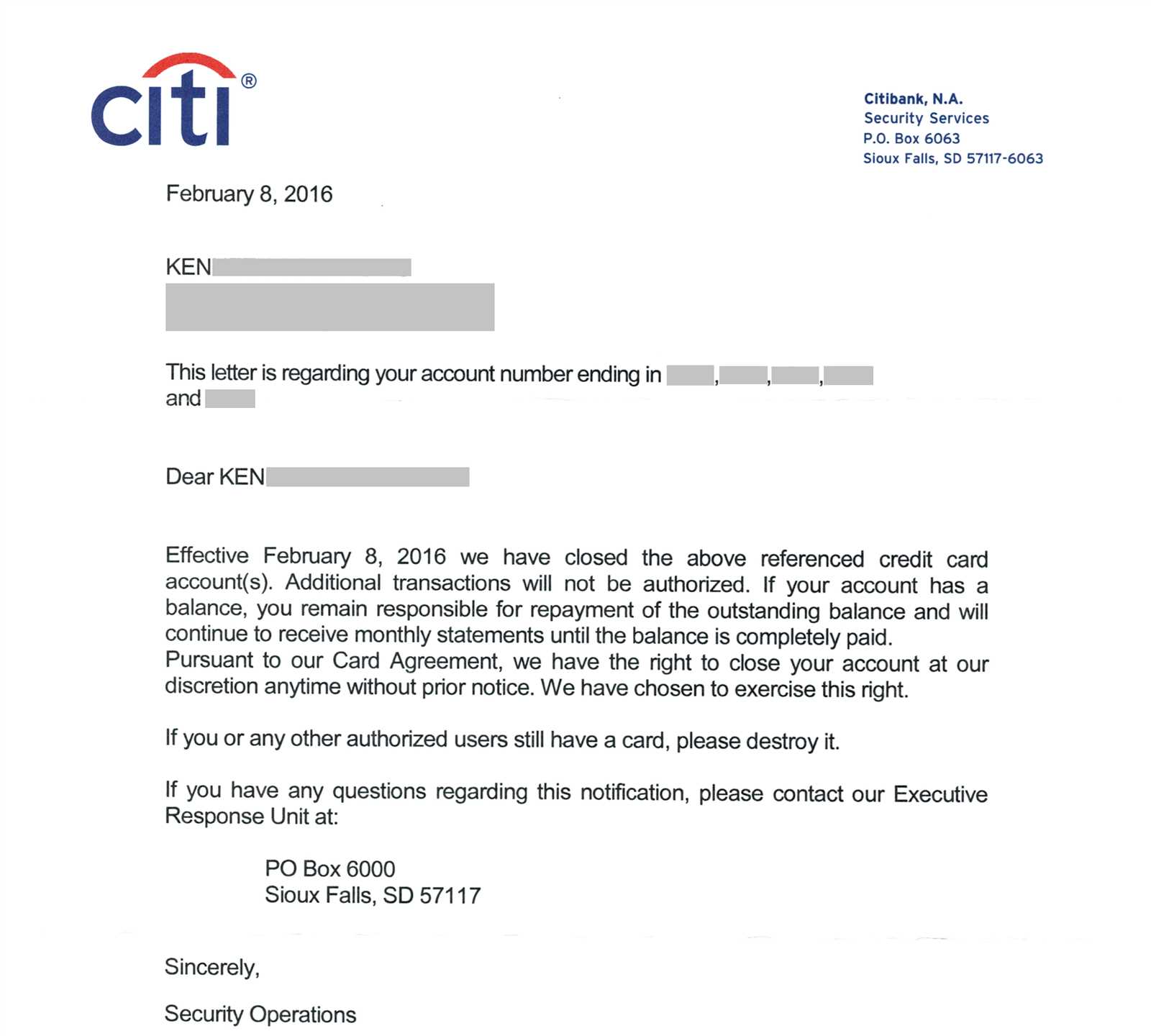

What Happens After You Send the Request?

Once you have submitted your request, you should receive confirmation from the provider. This could come in the form of a written response or an acknowledgment via email. If you do not receive confirmation within a reasonable time, it is advisable to follow up to ensure that your request is being processed.

Alternatives to Ending the Service

Before deciding to completely terminate your financial relationship, consider other options that may better suit your needs. For example, some providers may allow you to reduce the terms or adjust services to better fit your current financial situation. Exploring these alternatives could be a more beneficial solution in some cases.

Understanding the Need for a Termination Request

When you decide to end a financial service, it is essential to communicate your intention clearly and professionally. Crafting an effective request ensures that the process is smooth and that no misunderstandings occur. By following the proper steps and including the correct information, you can ensure that your request is handled efficiently and without delay.

How to Write a Clear Termination Request

Writing a termination request involves being clear, concise, and direct. The goal is to communicate your intent without confusion. Include your personal details, the reference number for the service you want to discontinue, and a direct statement indicating your desire to end the relationship. Keep the language formal and professional, and avoid adding unnecessary details that could complicate the message.

Common Mistakes to Avoid in Your Request

One common mistake is failing to include all necessary details, such as your reference number or account details, which may cause delays. Another issue is using vague language that may lead to misunderstandings about your intentions. It’s also important to ensure that your tone remains polite and respectful, as this fosters a more efficient and positive response from the provider.

Make sure your request is well-structured, clear, and polite. Double-check for any missing or incorrect information that could slow down the process. After sending the request, monitor for confirmation or follow up if necessary.

Steps to Take After Sending the Termination Request

Once your request is sent, wait for confirmation from the provider. If no acknowledgment is received within a reasonable time, follow up to ensure your request is being processed. It’s also advisable to ask for written confirmation of the termination, as this can provide peace of mind and serve as proof of your action.

Options Beyond Ending Your Financial Service

Before making a final decision to terminate a financial relationship, consider whether reducing the service terms or adjusting the plan might better fit your needs. In some cases, providers offer alternatives, such as downgrading your service or switching to a more suitable option, which could provide a better solution in the long run.