Debt Demand Letter Template for Effective Debt Collection

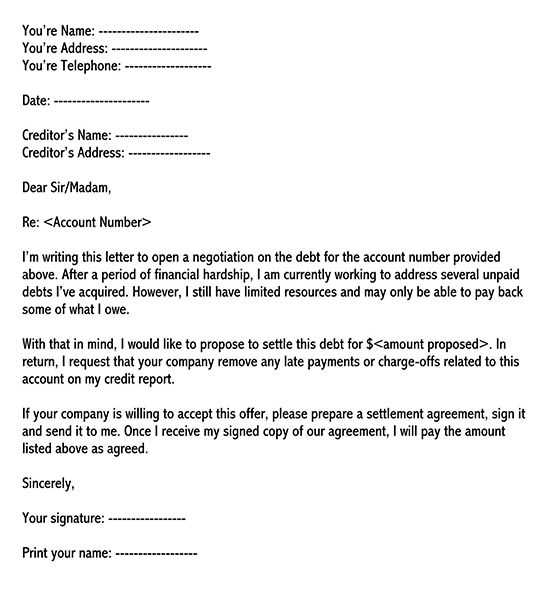

When someone fails to fulfill their financial obligation, it is essential to reach out in a clear and formal way. A structured document can be a powerful tool in requesting the owed funds. This communication serves as a professional reminder and urges the recipient to act promptly in addressing the outstanding balance.

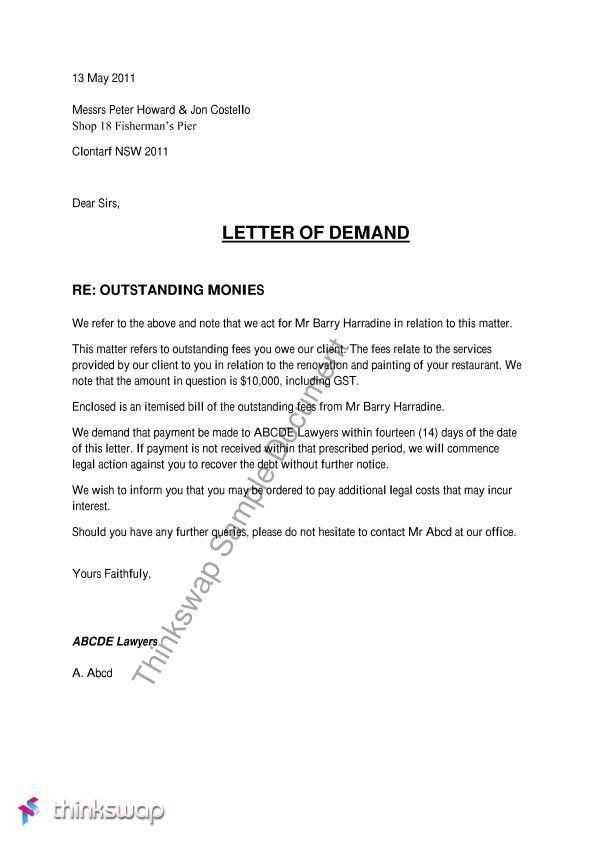

Key Information to Include

For maximum effectiveness, it is important to ensure that the message includes the following key components:

- Recipient’s Information: Always include the full name and contact details of the person or company responsible for the payment.

- Amount Due: Clearly state the total sum that needs to be paid, ensuring no confusion regarding the amount.

- Deadline for Payment: Set a clear and reasonable deadline for when the payment should be completed.

- Consequences of Non-payment: Mention the possible steps or actions that will be taken if payment is not made by the specified date.

- Preferred Payment Methods: Indicate how the payment should be made, whether it’s through bank transfer, cheque, or another method.

Creating a Structured Request

It is important that the communication is well-organized. A clear structure will make it easier for the recipient to understand the request and respond promptly. The tone should be firm but respectful, ensuring that the message is taken seriously without being overly aggressive.

When to Send the Request

Timing plays a crucial role in the success of your request. It is advisable to send the communication after the payment has been overdue for a reasonable period but before the situation escalates. A prompt action can often lead to a quicker resolution without needing further intervention.

Common Mistakes to Avoid

When drafting a formal request, be mindful of some common pitfalls:

- Ambiguity: Vague language or lack of specifics can lead to misunderstandings and delay resolution.

- Overly Harsh Tone: While being firm is necessary, being too aggressive can damage relationships and make the recipient less likely to respond positively.

- Failing to Specify Next Steps: Not clearly outlining the consequences of continued non-payment may result in a lack of urgency on the recipient’s part.

By avoiding these mistakes, you increase the likelihood of receiving payment in a timely manner, while maintaining a professional relationship with the recipient.

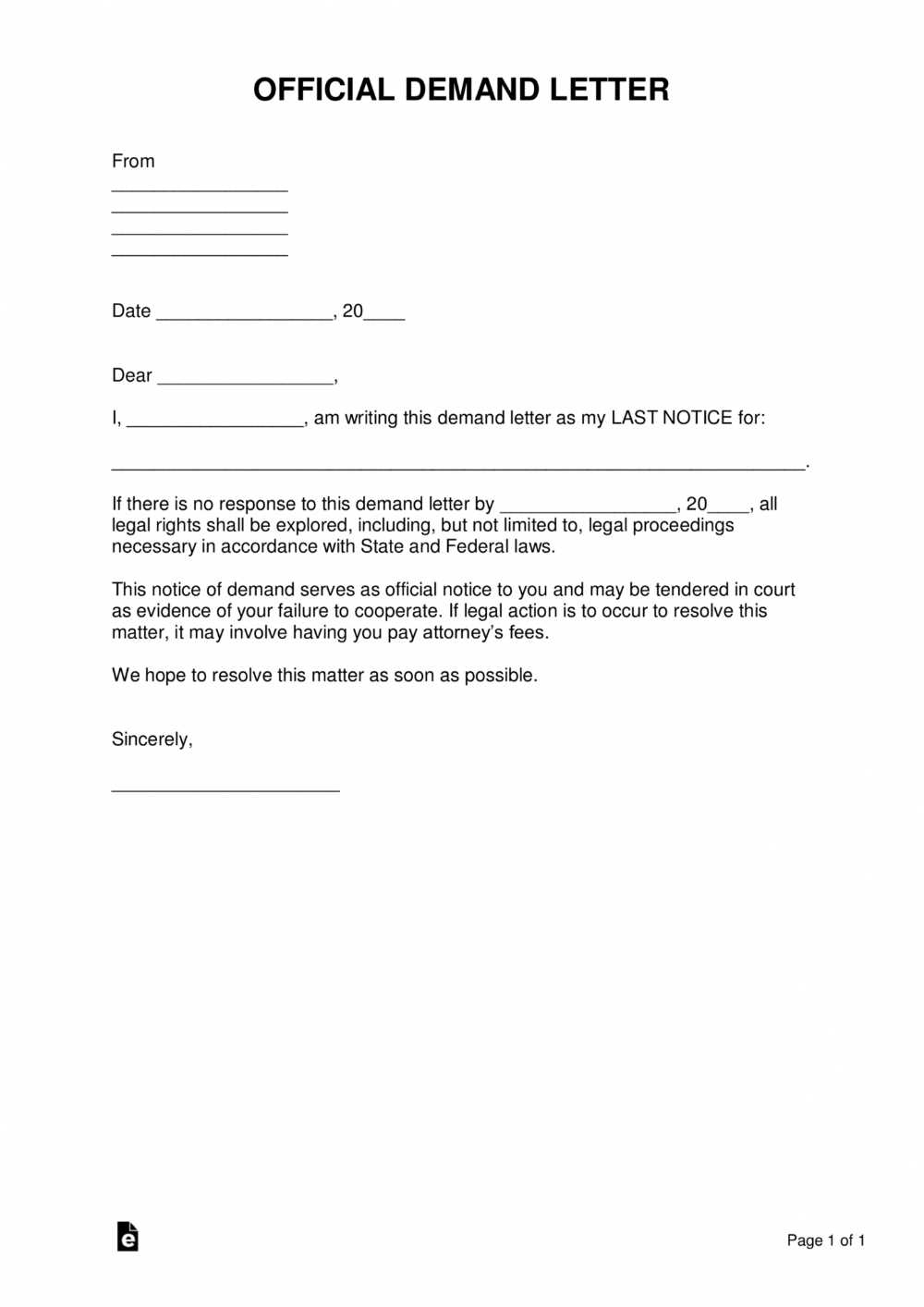

Understanding the Purpose of a Formal Request

When a financial obligation remains unpaid, it is important to take the necessary steps to formally address the situation. A structured approach helps communicate the seriousness of the issue, encouraging timely action. This form of communication is designed to serve as a reminder, urging the recipient to fulfill their payment responsibilities.

Why These Requests Are Crucial

Sending a well-crafted communication is often an essential first step in resolving an overdue payment. It provides a clear, written record of the outstanding balance and indicates your intention to pursue the matter. Without this formal notice, it may be difficult to move forward with any further legal or financial actions if necessary.

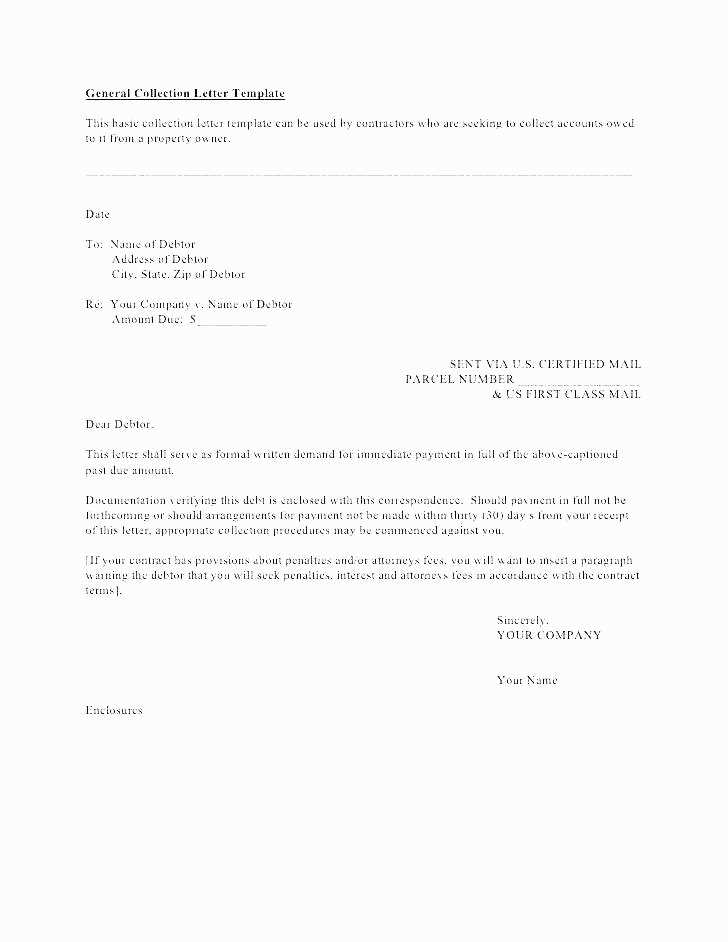

Key Components to Include in Your Document

A successful document should contain specific details that leave no room for ambiguity. Ensure that the following information is clearly presented:

- Recipient Information: Name and contact details of the individual or organization owing the payment.

- Amount Due: Precise sum that must be settled.

- Due Date: Clear deadline by which the payment should be made.

- Consequences for Non-payment: Explanation of what actions may follow if the payment is not received on time.

Important Details to Ensure Effectiveness

To ensure that your request is taken seriously, make sure all the essential components are addressed concisely. Keep your language clear, direct, and professional. Any vagueness or unnecessary information may reduce the effectiveness of your message.

How to Structure Your Request

A well-organized message is easier to understand and more likely to elicit a positive response. Start by introducing the issue and then present the required details in a logical order. Make sure to maintain a respectful tone, focusing on the resolution rather than emphasizing conflict.

Organizing Content for Better Clarity

Proper organization of your content ensures that the recipient can quickly understand the nature of the request. Use bullet points, headings, and short paragraphs to enhance readability. Avoid overloading the message with excessive detail; stick to the most important information that facilitates a resolution.

When to Send a Request for Payment

Timing plays an important role in the effectiveness of your communication. It is advisable to send your formal request once the payment has passed its due date but before taking further action. Sending it too early might be unnecessary, while waiting too long could result in further complications.

Timing and Legal Considerations for Dispatch

It’s essential to be aware of legal timelines and any regulations that may apply in your jurisdiction. Sending a formal notice at the right moment can help avoid unnecessary delays or legal issues. Additionally, make sure the recipient has enough time to respond or take the required action before you move forward with other measures.