Insurance claim demand letter template

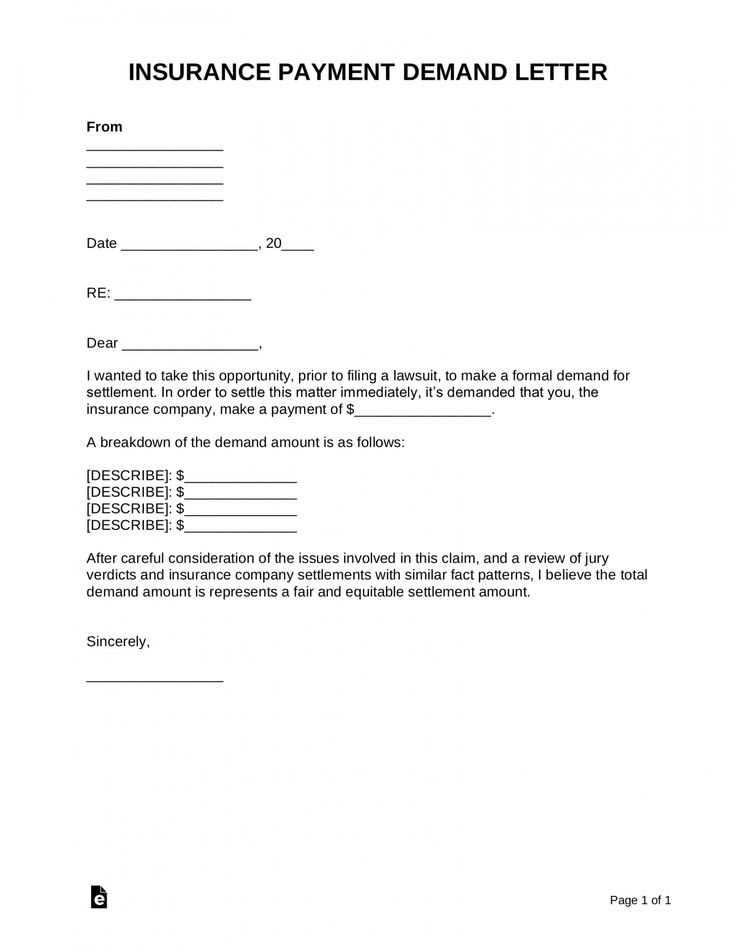

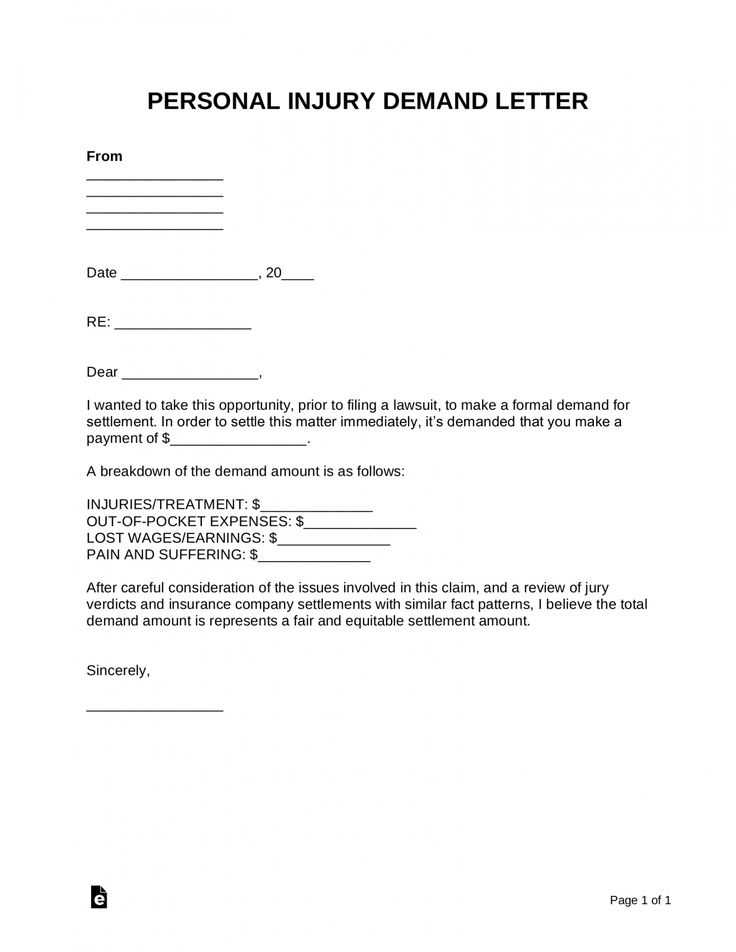

To start, ensure that your letter is clear and direct. Provide all the necessary details regarding your claim, including your policy number, the incident date, and a summary of the damages or losses sustained. It’s critical to state the specific amount you’re requesting for compensation and the reasons behind your demand.

Next, keep the tone respectful yet firm. Be sure to explain how the situation has affected you and why you believe the compensation is warranted. Provide any supporting documentation, such as photos, repair estimates, or medical bills, to strengthen your claim.

Lastly, include a deadline for the insurance company to respond. A reasonable time frame of 15-30 days is typical. Clearly state the consequences of not receiving a response within that period, such as pursuing legal action or escalating the matter. This shows your seriousness in seeking a resolution.

Sure! Here’s the modified version:

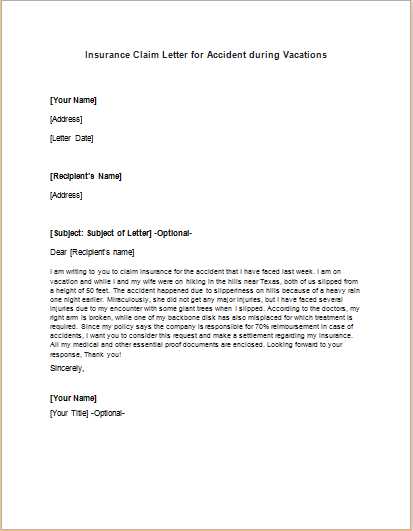

To begin, ensure you address the insurance company directly in the letter, including their official name and contact information. Specify your claim number clearly at the top, so the recipient can easily locate your file. Keep the tone formal yet concise, focusing on the key details relevant to your claim.

Outline the incident briefly, including dates and any supporting evidence such as photographs, police reports, or receipts. Clearly state the amount you are claiming, and break down the costs if necessary. If you’ve already paid for any repairs or medical expenses, mention those as well, attaching the receipts as proof.

Conclude by requesting a response within a reasonable time frame. Make sure to include your contact details so the insurer can reach you with ease. Always keep a copy of the letter for your records and track any correspondence you receive after sending the claim letter.

Insurance Claim Demand Letter Template

How to Structure Your Claim Letter

Key Details to Include in the Letter

Common Errors to Avoid When Writing

How to Calculate the Claim Amount

How to Address Adjusters Effectively

Steps to Take After Sending the Letter

Begin by clearly identifying yourself and the incident. Start with your name, contact details, policy number, and a brief description of the event that caused the claim. Outline the damages and losses you are seeking compensation for. Be specific about dates, times, and locations to avoid any ambiguity.

Key Details to Include in the Letter

Always include the policy number, details of the incident, and any supporting documentation such as photos, receipts, and repair estimates. Mention any previous conversations with the insurance company or adjusters. List the amount you are requesting based on your damages and losses. Provide a clear timeline for when you expect a response.

Common Errors to Avoid When Writing

Don’t leave out any essential details that could strengthen your claim. Avoid being vague or overly emotional, as this can reduce the effectiveness of your letter. Refrain from using ambiguous language and ensure the claim amount is calculated accurately to prevent delays or rejections. Double-check your contact information to avoid confusion.

When calculating the claim amount, include an itemized breakdown of all costs, including repair estimates, medical bills, or lost wages. Ensure that the calculations are realistic and well-documented to increase the chances of approval. Always align the amount with the terms specified in your insurance policy.

Address your letter to the appropriate adjuster by name, if possible, and maintain a professional tone throughout. Be polite, but assertive. Make sure to reference any prior communications and ask for a timely response. This shows you are serious about resolving the claim.

After sending the letter, follow up to confirm receipt and inquire about the next steps. Keep detailed records of all correspondence and make sure to send any additional documents they request promptly. Stay proactive, but patient, throughout the claims process.