Money owed demand letter template

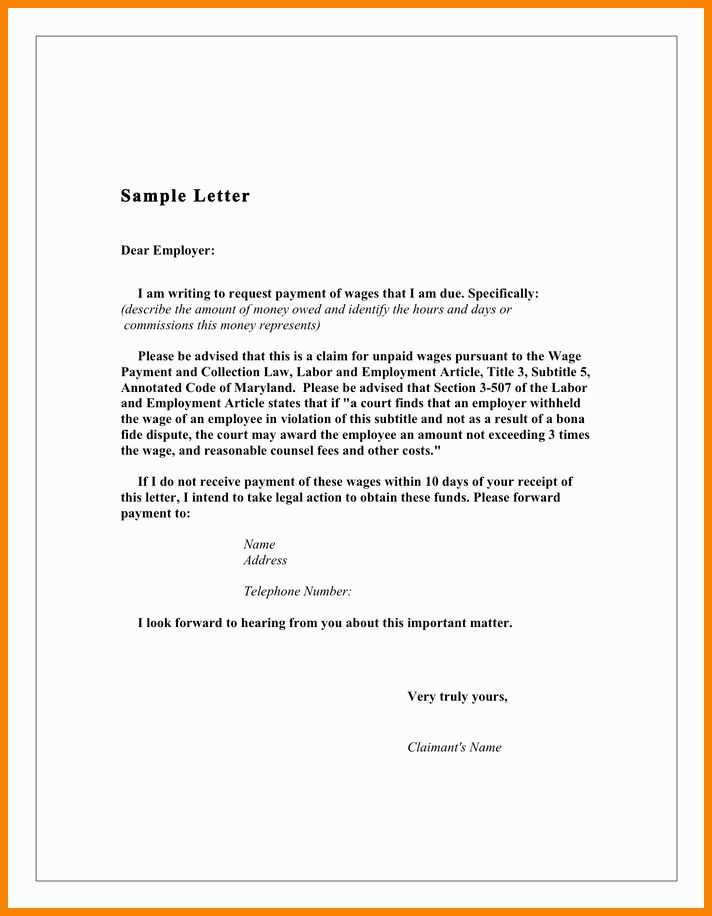

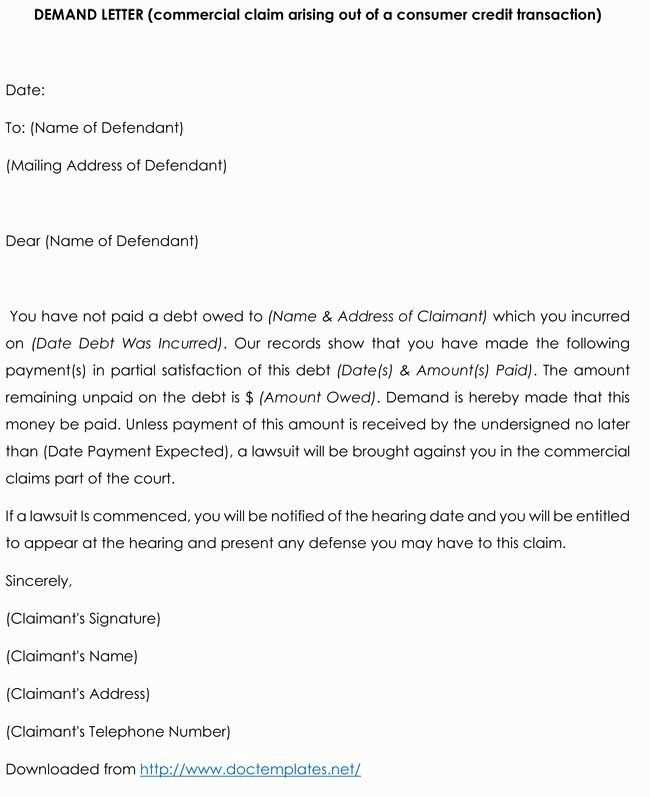

When you need to request payment from someone who owes you money, crafting a clear and firm demand letter is a critical step. A well-structured letter can prompt the debtor to take action without the need for further legal steps. Be direct in your communication, stating the amount owed, the due date, and the consequences of non-payment.

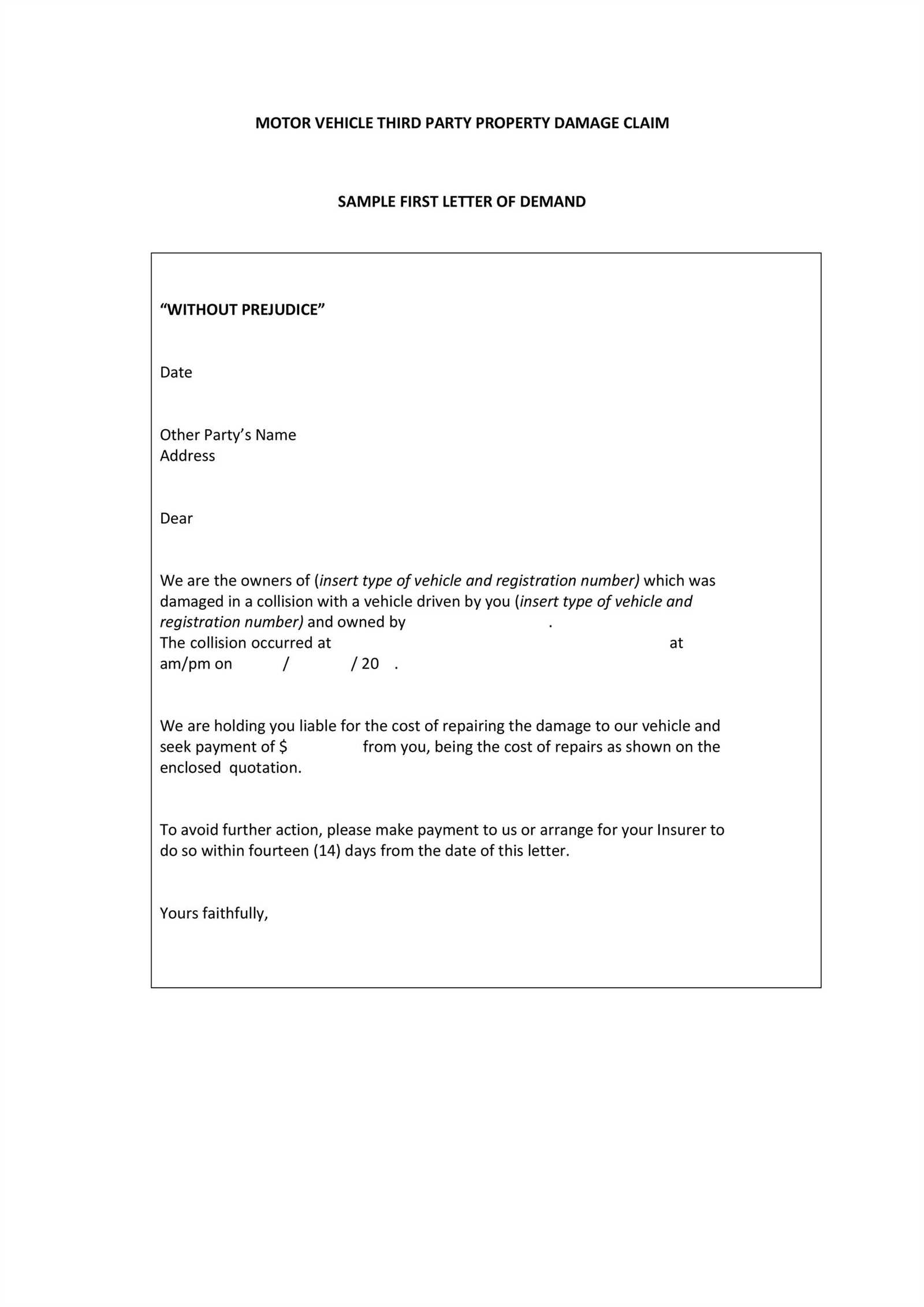

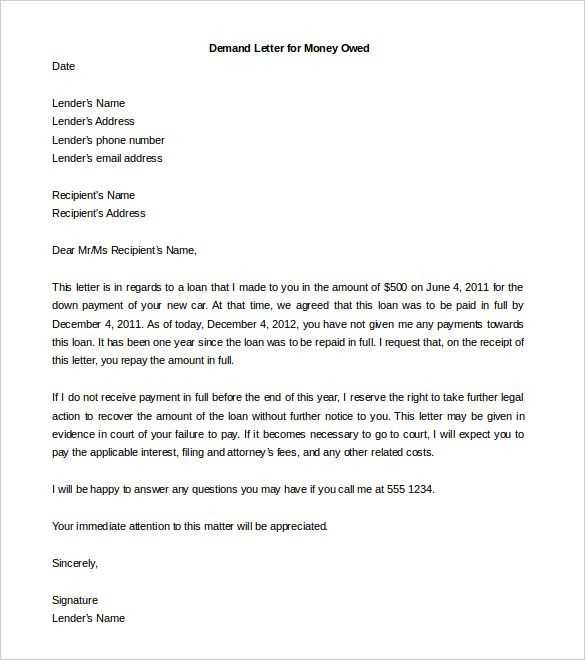

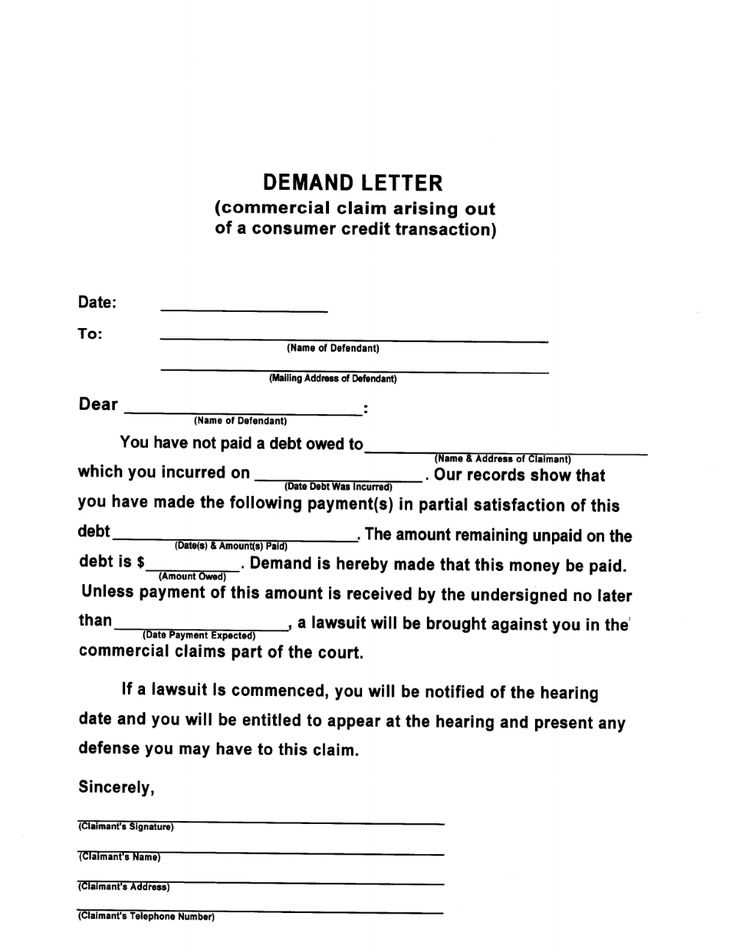

Start with clarity: Open your letter with a clear statement of the amount the debtor owes and any outstanding details. Include the original payment terms, referencing the specific agreement or invoice to avoid confusion. This makes your expectations transparent and leaves no room for ambiguity.

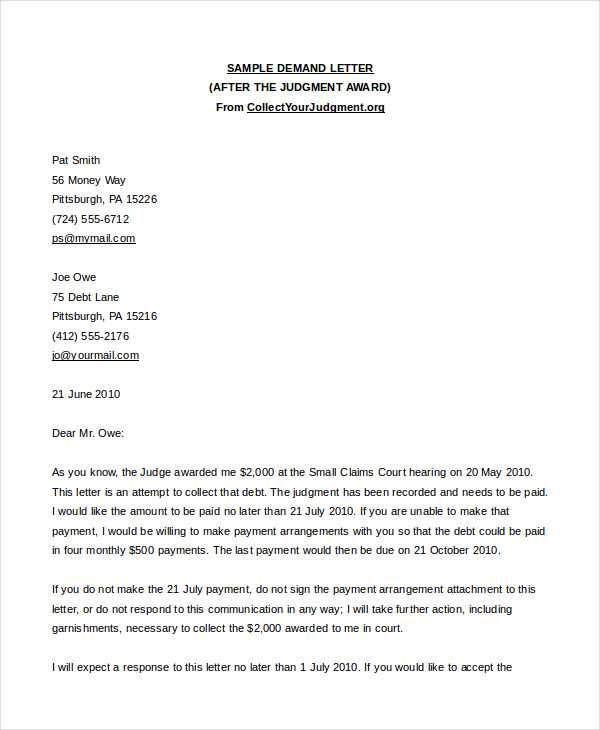

Outline consequences: Explain the next steps if the debt remains unpaid, such as legal action or hiring a collection agency. Be firm but professional–there’s no need to resort to threats, but make it clear that you are serious about receiving payment.

Provide a deadline: Set a specific date by which payment should be made. This reinforces the urgency of the situation and encourages the debtor to act swiftly. If they miss this deadline, remind them of the consequences outlined in the letter.

Offer payment options: Suggest how the debtor can pay, whether through bank transfer, check, or another method. Make it as easy as possible for them to settle the debt to avoid delays.

By following this approach, you can create a money owed demand letter that is clear, firm, and effective in prompting payment.

Here’s the revised version:

Make sure to include the full details of the debt, including the amount owed and any previous payment agreements. Be clear about the due date for payment and include a statement that outlines the next steps in case the payment isn’t made. The letter should be direct but courteous, ensuring it’s both professional and firm.

Start by specifying the exact amount owed, including any interest or late fees that may have accrued. Clearly state that this is a demand for immediate payment and provide a specific deadline, typically 7–10 days, for the debt to be settled.

Additionally, you can offer a payment plan if appropriate, outlining clear terms for installment payments. If the debt remains unpaid after the deadline, state your intention to pursue legal action or use collection services.

End the letter with a reminder of the consequences for non-payment, ensuring that the tone remains polite but firm throughout. This approach helps maintain professionalism while asserting your right to payment.

Money Owed Demand Letter Template

How to Structure a Debt Demand Letter

Key Information to Include in Your Request Letter

Setting a Realistic Payment Deadline

Language to Use in a Letter to Maintain Professionalism

What to Do if the Debt Is Not Settled After the Letter

Common Mistakes to Avoid When Writing a Demand for Payment Letter

Begin with a clear subject line, such as “Final Notice for Payment Due.” In the opening paragraph, state the amount owed and the specific date the debt was due. Be direct, but polite, and make sure the tone remains professional. Clearly identify the debtor and the agreement or service that led to the debt.

Provide a detailed breakdown of the debt. Include the original invoice, payment terms, and any interest or fees that may have accumulated. This helps prevent confusion and gives the recipient all the necessary information to process the payment.

Next, set a realistic payment deadline. A reasonable timeframe–typically between 7 to 14 days–gives the debtor time to settle the debt while emphasizing the urgency. Make it clear that failure to pay within this timeframe will result in further action, such as legal proceedings or collection agency involvement.

In maintaining professionalism, avoid aggressive or emotional language. Keep the tone firm but respectful. Phrases like “Please remit payment” or “We request full payment by” convey urgency without sounding confrontational.

If payment is not made after the letter, consider escalating the matter. The next steps could include contacting a collection agency or pursuing legal action. State in your letter that these actions will be taken if the debt remains unresolved.

Avoid common mistakes such as not providing enough detail about the debt or being unclear about the payment terms. Also, refrain from threatening language or giving the impression that you are unsure about your rights. Be concise and avoid unnecessary content that might distract from the main message.