Template for donation letter receipt

Provide a clear and concise donation receipt using a template that includes all necessary details. Start by confirming the donation amount and specifying the date of the donation. Include the name of the donor and a short description of the cause or event to which the donation was made.

Next, indicate the type of donation (monetary, goods, or services) and whether it was a one-time gift or a recurring contribution. It’s also helpful to clarify if the donor received any goods or services in exchange for their gift, as this may affect the tax-deductible status.

Conclude with a polite thank-you note and an invitation for future contributions. The tone should remain warm and appreciative, reflecting gratitude for the donor’s support. The information should be easy to read and formatted clearly for quick reference.

Here’s the revised version with reduced word repetitions:

To avoid redundancy in your donation receipt letter, focus on concise language. Begin by specifying the donation amount clearly. For example, instead of repeating the donation details multiple times, state the amount once and refer to it briefly when needed. Use alternative phrases such as ‘your contribution’ or ‘this generous gift’ to maintain clarity without overusing the word ‘donation.’ This ensures the letter remains professional, clear, and to the point.

In the body of the letter, acknowledge the donor’s impact in different terms. Instead of continually emphasizing ‘thank you,’ try varying your language with expressions like ‘We appreciate your support’ or ‘Your gift is invaluable to our mission.’ This keeps the tone fresh and engaging.

Lastly, streamline the closing by directly referring to the tax-deductible status of the donation once, rather than repeating the details. A brief sentence at the end is enough to confirm the receipt’s validity.

Template for Donation Receipt Letter

How to Format a Donation Receipt Correctly

What Information to Include in a Donation Receipt

Steps to Personalize a Receipt for Your Donors

Key Legal Requirements for Donation Receipts

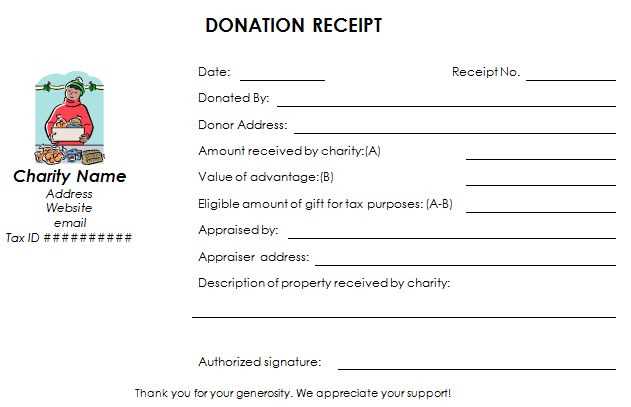

How to Acknowledge Non-Monetary Contributions in Receipts

Common Mistakes to Avoid When Creating a Donation Receipt

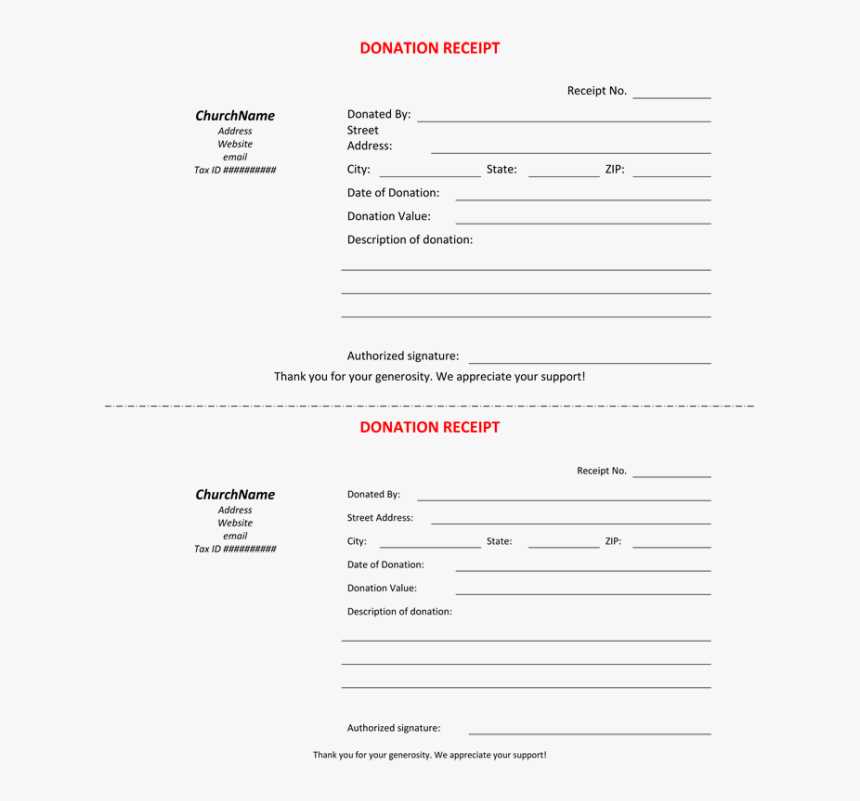

Start with the donor’s name, address, and the date of the donation. Include the nonprofit’s name and address as well. Clearly state the donation amount, and if applicable, specify whether it is a cash or non-cash donation. For non-monetary donations, provide a description of the items received, along with an estimated value, if possible. Always include a statement confirming that no goods or services were provided in exchange for the donation, or list what was received in return, such as event tickets.

Correct Format: Place the donor’s information at the top, followed by the date and nonprofit details. Use a simple, readable format, with clear headings for each section of the receipt. Ensure it is easy to follow and understand.

Important Information: Ensure the donor’s full name, donation amount, and the date are included. For non-cash donations, describe the donated items in detail. Mention the 501(c)(3) status of the organization, as it’s crucial for tax deductions. State if any goods or services were received in return for the donation.

Personalizing the Receipt: Use the donor’s first name in the salutation to make the receipt feel more personal. For recurring donors, acknowledge their continued support. If applicable, mention the specific program or project their donation helped fund, creating a direct connection between the donor and the cause.

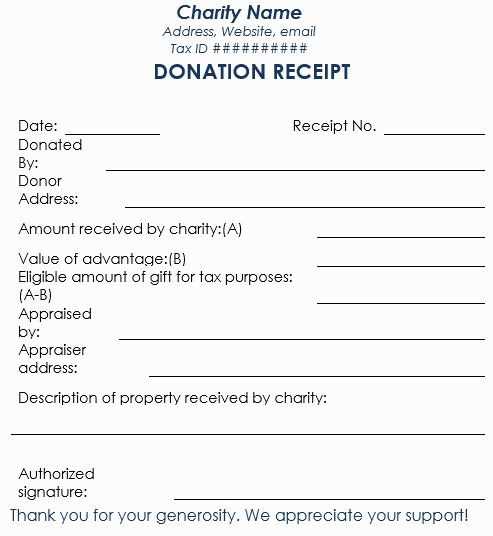

Legal Requirements: Donation receipts must include the nonprofit’s name, tax ID number, and a statement about the tax-deductible status of the contribution. If the donation exceeds $250, the receipt must also include a description of the goods or services provided in exchange, and their estimated value. For non-monetary contributions, the receipt should note that the organization did not assess the value of the donated items.

Non-Monetary Contributions: For items like clothing, furniture, or services, be sure to list what was donated, along with any appraised or estimated values. If the donor is responsible for valuing the donation, specify that the donor should consult a professional for accurate appraisals. A clear description is vital for accurate tax reporting.

Avoid These Common Mistakes: Don’t forget to include all the necessary details like the date and donation amount. Be careful not to overstate the value of non-cash donations or omit a required legal statement. Ensure the receipt is free from errors, as it can affect tax deductions for the donor. Never include vague descriptions for non-monetary items; specificity is key.