Repayment Overpayment Letter Template for Employees

In any organization, managing financial transactions with precision is crucial. Sometimes, errors can occur when processing wages, resulting in payments that exceed what is owed to a worker. Addressing this issue professionally and clearly is essential for maintaining trust and a positive relationship between the company and its staff.

When such discrepancies arise, it’s important to communicate the situation effectively. A well-structured document can ensure that both parties understand the mistake and agree on the steps to resolve the situation. This type of communication should remain courteous and precise, offering solutions that minimize any potential confusion or frustration.

In this article, we will explore how to craft an effective communication for situations where a financial adjustment is needed. We’ll discuss the necessary components, tone, and best practices to ensure clarity and mutual understanding.

Understanding Salary Discrepancies and Its Consequences

In many cases, a company may inadvertently provide more funds to a worker than intended. These discrepancies can arise from various factors, such as clerical errors, incorrect calculations, or system malfunctions. Understanding the implications of these mistakes is important to ensure fair treatment while maintaining financial integrity.

Financial Impact on the Organization

When discrepancies occur, it is crucial for the organization to address them quickly. Prolonged overpayments can lead to unnecessary financial strain on the company. The longer the issue remains unresolved, the more challenging it becomes to rectify, especially if there are complications regarding budgets or accounting records.

Potential Strain on Professional Relationships

While mistakes happen, failing to communicate effectively about these errors can damage the professional bond between the organization and its workforce. Clear and respectful dialogue is key to minimizing any negative impact on morale or trust. It is essential to approach the situation delicately and ensure that all involved parties understand the steps toward resolution.

| Impact | Potential Outcome |

|---|---|

| Financial Loss | Reduced company resources for other expenses |

| Employee Frustration | Decreased morale and potential dissatisfaction |

| Legal Ramifications | Possible legal disputes or claims |

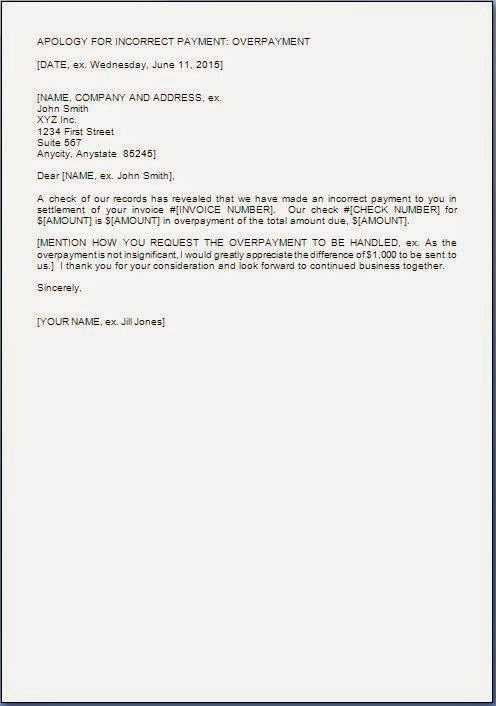

Key Elements of a Financial Adjustment Communication

When a discrepancy occurs in the financial compensation, it’s essential to address the issue in writing. A clear, formal document helps both parties understand the situation and outlines the necessary actions to resolve the matter. Effective communication ensures that the process is transparent, professional, and minimizes any confusion.

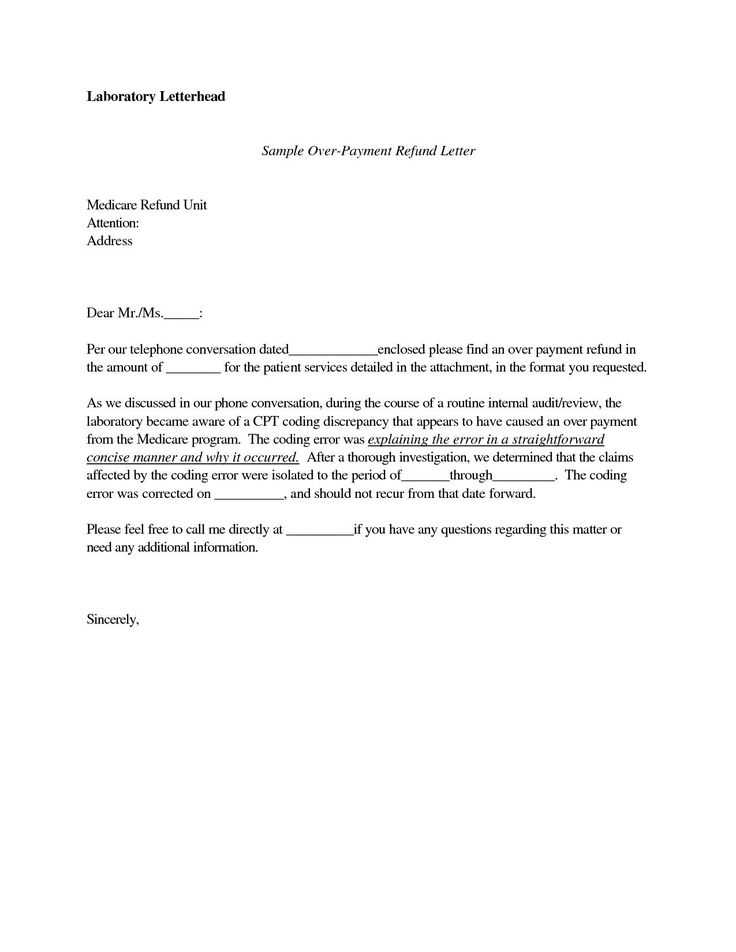

Clear Explanation of the Situation

The document should begin with a straightforward explanation of the error, outlining how the excess funds were disbursed. Providing a brief yet precise description of the cause–whether it was a calculation mistake or a system issue–will help the recipient understand the context and nature of the problem.

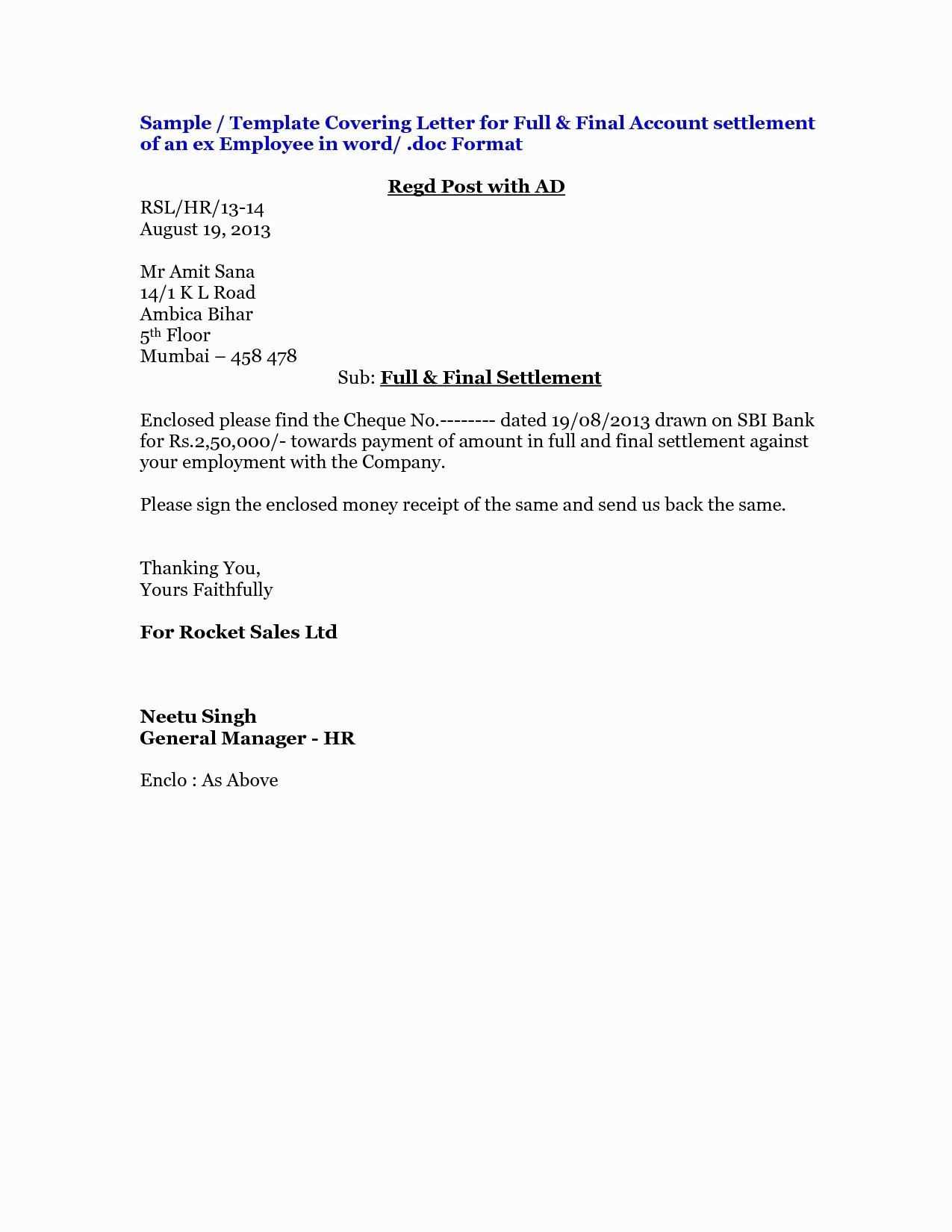

Proposed Solution and Next Steps

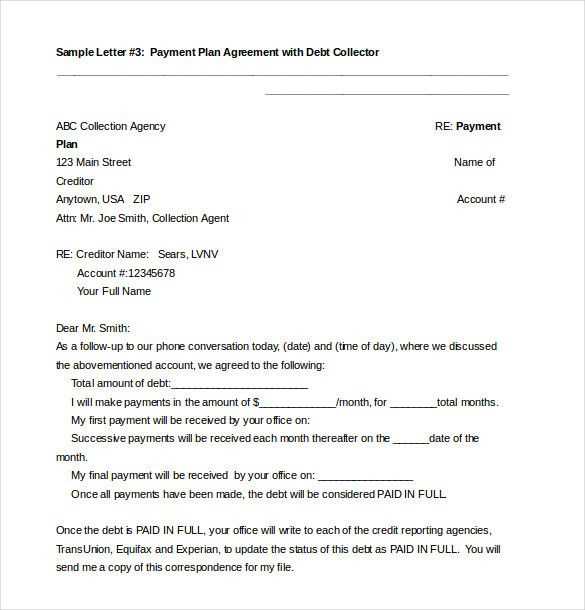

Once the issue is explained, it’s crucial to detail the steps the organization intends to take to rectify the situation. This may include specifying the amount to be recovered, the proposed timeline for resolution, and any options available to the recipient, such as installment plans if applicable. Ensuring a fair and reasonable approach is key to maintaining goodwill.

Steps to Draft a Financial Adjustment Request

When addressing an error in funds distributed to an individual, it is essential to approach the situation with clarity and professionalism. A well-crafted request ensures that both parties are informed of the issue and can work together toward a fair resolution. Below are the key steps involved in creating an effective communication to resolve the situation.

1. Begin with a Clear Introduction

Start by introducing the reason for the document. Briefly state that a financial discrepancy has been identified and that this communication aims to resolve the matter. It is important to be straightforward without being confrontational, ensuring the recipient understands the purpose of the document immediately.

2. Provide Detailed Information and Explanation

Once the introduction is complete, provide specific details about the error. This could include the amount involved, the nature of the mistake, and the timeline in which it occurred. Be transparent about how the error happened, whether it was a clerical mistake, system malfunction, or another cause. The more accurate and detailed the information, the easier it will be for the recipient to understand the situation.

Example: “We have noticed an error in the funds transferred to you for the pay period of January 2025. The amount disbursed was $500 more than what was due, due to a calculation issue.”

3. Suggest a Solution and Request Action

After presenting the facts, explain how you intend to resolve the issue. Clearly outline the next steps, such as the amount to be adjusted or returned, and propose a timeline for this to occur. Offering options, such as installment payments, may help to facilitate a smoother process.

Example: “To rectify this, we request that the excess funds of $500 be returned by the 10th of February. We can arrange an installment plan if necessary, with monthly payments of $100 over the next five months.”

Best Practices for Communicating Salary Discrepancies

When addressing a situation involving incorrect funds provided to an individual, it’s essential to maintain clear and professional communication. Handling such matters delicately ensures the issue is resolved promptly without causing unnecessary tension. Here are several best practices to follow when communicating these situations.

- Be Transparent and Honest: Clearly explain the nature of the error and how it occurred. Providing accurate details helps build trust and reduces any confusion.

- Use a Professional Tone: Even if the situation may seem uncomfortable, always maintain a polite and professional tone. Keep the communication neutral to avoid unnecessary conflict.

- Be Timely: Address the issue as soon as possible. The longer the discrepancy remains unaddressed, the more complicated it may become to resolve.

- Offer a Solution: Propose a clear path forward, such as how the funds will be adjusted, the repayment options, or a timeline for resolution. Be flexible if the recipient needs alternatives.

- Provide Documentation: Include relevant financial records, if necessary, to support your claims. This helps clarify the situation and makes the process more transparent.

By following these best practices, both parties can reach a fair agreement, maintaining a strong professional relationship while resolving the issue efficiently.

Legal Considerations in Financial Adjustment Communications

When addressing a situation where an individual has received more funds than intended, it is essential to consider legal requirements to ensure that the process is fair and compliant with the law. Mishandling such matters can lead to disputes or even legal action, making it crucial to understand the legal framework that governs such financial adjustments.

Understanding Legal Rights and Obligations

Both the organization and the individual involved have legal rights and responsibilities in these situations. In many jurisdictions, employers are legally entitled to request the return of funds paid in error. However, it is essential to ensure that any request for repayment complies with local labor laws, including requirements for notice periods, payment terms, and the method of recovery.

Contractual Agreements and Terms

In addition to statutory laws, employment contracts often outline the procedures for handling financial discrepancies. It is important to refer to the terms agreed upon in the contract when addressing such matters. Any communication regarding the return of funds should be consistent with the agreed-upon terms to avoid breaching the contract or creating unnecessary legal complications.

How to Handle Disagreements with Staff

In situations where there is a disagreement regarding a financial issue, it is important to approach the matter with sensitivity and understanding. Disputes may arise when there is confusion or dissatisfaction, and addressing these issues thoughtfully can prevent escalation and maintain a positive working relationship.

1. Listen Actively and Remain Open

One of the most crucial steps in resolving any dispute is to listen to the other party’s concerns without interruption. Allow them to express their point of view fully and ensure they feel heard. Being empathetic and open to their perspective can go a long way in fostering trust and cooperation.

2. Offer Clear Explanations and Solutions

Once you have listened to the individual’s concerns, provide a clear and concise explanation of the situation. If a mistake was made, acknowledge it and offer a transparent solution. Ensure that any proposed resolution is fair, reasonable, and in line with company policies. It’s important to remain calm and professional, even if the discussion becomes tense.

Example: “I understand your concern about the discrepancy in the funds received. The error was caused by a system issue, and we’re happy to discuss how we can resolve it with minimal inconvenience to you.”

By addressing the issue in a calm and transparent manner, you can ensure that both sides reach a fair understanding and maintain a professional relationship moving forward.