Confirmation of employment letter template for bank

To create a confirmation of employment letter for bank purposes, ensure the document is clear, concise, and includes all necessary details. This letter serves as proof of employment for individuals seeking loans or other financial services. It should verify the employee’s current status, job title, length of employment, and salary details.

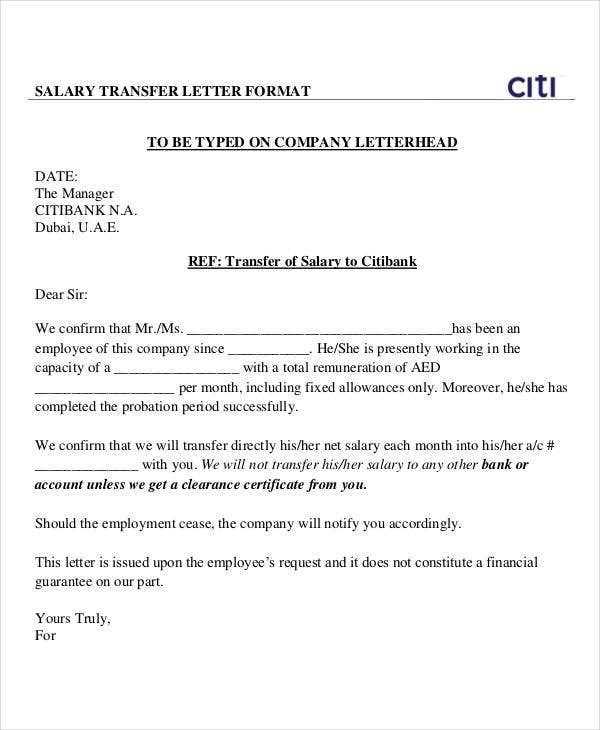

Start with the company’s official letterhead. This adds legitimacy to the document and ensures it is recognized by the bank. Begin the letter with a formal greeting, followed by a brief statement confirming the employee’s name, position, and employment duration. Include specific dates, such as the start date of employment and, if applicable, any recent promotions or position changes.

Include a section that mentions the employee’s salary or wage details. It’s important to specify whether the employee is salaried or hourly, and if relevant, include information on bonuses or commission. If the letter needs to include additional financial details, be sure to clarify this before sending it out. Conclude the letter with a formal closing, ensuring the contact information for further inquiries is available.

Here’s the revised version:

Use this format for a confirmation of employment letter. It should include all necessary details to verify the applicant’s current job status and income. Ensure the information is clear, direct, and properly formatted to meet the bank’s requirements.

- Company Letterhead: Start with the official company letterhead at the top of the letter. This ensures the authenticity of the document.

- Date: Include the current date below the letterhead.

- Recipient’s Information: Address the letter to the appropriate person at the bank, including their name, position, and bank details.

- Employee Details: Clearly state the employee’s full name, job title, and department.

- Employment Status: Confirm that the employee is currently employed with the company and outline the type of employment (e.g., full-time, part-time, contract).

- Salary Details: Provide the employee’s annual or monthly salary, specifying if it includes bonuses or commissions, and note the frequency of payments.

- Employment Start Date: Include the exact date the employee began working with the company.

- End Date (if applicable): If the employee is on a fixed-term contract, mention the end date of their employment.

- Signature and Contact Information: Conclude with the signature of an authorized company representative, along with their contact details for verification purposes.

Ensure that all provided information is accurate and consistent with the company’s records. This helps the bank process the request smoothly and without delays.

- Confirmation of Employment Letter Template for Bank

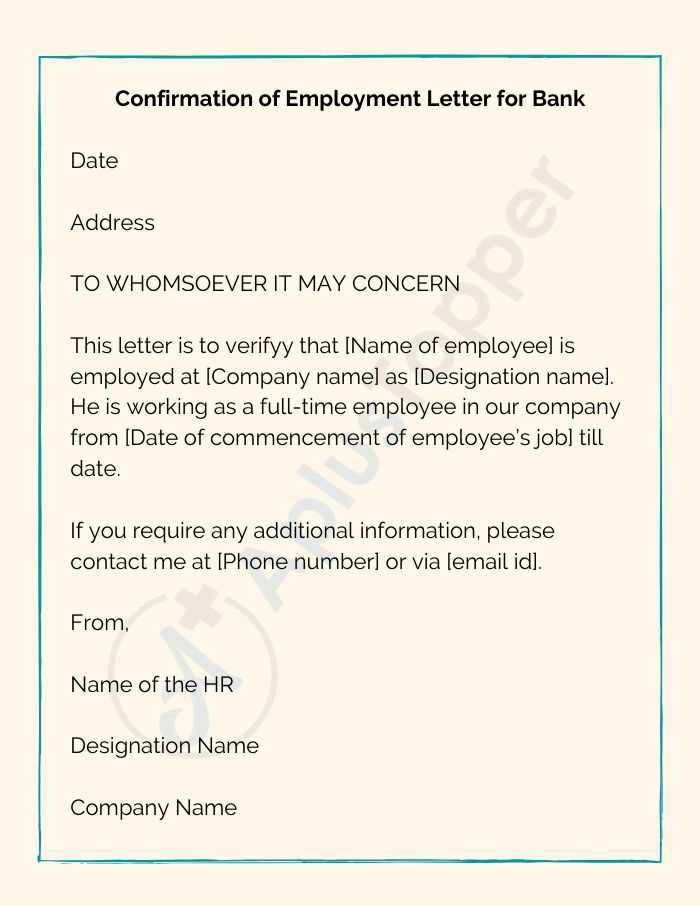

A well-structured confirmation of employment letter is essential when providing proof of employment for a bank. The letter should be clear and concise, containing key details such as the employee’s name, position, salary, and the length of employment.

Below is a simple template that you can adapt to your needs:

[Your Company Name] [Company Address] [City, State, ZIP Code] [Phone Number] [Email Address] [Date] [Bank Name] [Bank Address] [City, State, ZIP Code] Subject: Employment Confirmation for [Employee's Name] Dear Sir/Madam, This letter is to confirm that [Employee's Full Name] has been employed with [Company Name] since [Employment Start Date]. [He/She] currently holds the position of [Job Title] and works on a [Full-Time/Part-Time] basis. [Employee's Full Name] earns a monthly salary of [Salary Amount] and has a [Permanent/Contract] employment status. The employee’s role and responsibilities include [Brief description of job responsibilities, if needed]. Please feel free to contact us at [Phone Number] or [Email Address] should you need further information. Sincerely, [Your Name] [Your Job Title] [Company Name]

This letter must be signed by a company representative, such as an HR manager or supervisor. Make sure all details are accurate, as banks typically require this confirmation to process loans, credit applications, or other financial matters.

Begin the letter by clearly stating the purpose of the document. Mention that it serves as confirmation of the employee’s job status for the bank’s records.

Key Details to Include

Include the following specifics to meet most banks’ requirements:

| Information | Details |

|---|---|

| Employee’s Full Name | The complete name of the employee as listed in official records. |

| Job Title | Clearly state the employee’s role within the company. |

| Employment Status | Indicate if the employee is full-time, part-time, or temporary. |

| Start Date | Provide the employee’s start date with the company. |

| Salary/Compensation | Specify the employee’s salary or hourly wage, or note if it’s requested by the bank. |

| Company Contact | Provide a company representative’s contact details (name, phone number, email). |

Closing the Letter

End the letter by expressing your willingness to provide additional details if necessary. Sign off with a formal closing statement like “Sincerely” or “Best regards,” followed by your name, job title, and contact information.

The letter must clearly state the employee’s full name and job title to confirm their identity and role within the company.

Include the start date of employment to establish the length of time the individual has been with the organization. If applicable, mention whether they are full-time or part-time.

Provide the employee’s current salary or hourly wage, which is often a key point for banks when evaluating financial stability. Include the payment frequency, such as weekly, bi-weekly, or monthly.

State the nature of the employment, such as permanent, temporary, or contractual. This helps the bank assess the stability of the individual’s job situation.

Include any other relevant details such as bonuses, commissions, or benefits, if pertinent to the verification. If the employee has a probationary period, mention it as well.

Be sure to include the company’s contact information, including the address and phone number, so the bank can reach out for further verification if necessary.

Finally, the letter should be signed by an authorized representative of the company, such as a manager or HR officer, to ensure its authenticity.

Ensure the employment dates are accurate by cross-checking them against company records. Include both the start and end dates of employment in a clear format (e.g., MM/DD/YYYY). Be specific about whether the person was employed full-time or part-time.

For salary verification, use the exact figures from the employee’s pay stub or payroll records. Clearly state the annual or monthly salary, depending on the request. If the salary is variable, provide a range or average, and include any bonuses or commissions, if applicable. Double-check all numbers for accuracy before including them in the letter.

If needed, provide contact details for someone in your HR department to confirm the information. This helps ensure the letter’s validity and clarity for the bank or requesting party.

Common Mistakes to Avoid When Writing a Confirmation Letter

Make sure your letter is clear and direct. Avoid the following errors to ensure your confirmation letter is professional and effective.

- Using unclear language: Ambiguity can confuse the recipient. Always state the purpose of the letter clearly and provide all necessary details in a straightforward manner.

- Incorrect formatting: A messy layout can make your letter hard to read. Use standard letter formatting, with clear sections like the header, body, and closing statement. Ensure your paragraphs are properly aligned and there are no extra spaces between sections.

- Missing or wrong details: Double-check that all information, such as employment dates, positions, and any other relevant data, is accurate. Errors can lead to misunderstandings or delay the process.

- Being too vague: Avoid general statements like “the person worked here.” Provide specifics like job title, dates of employment, and responsibilities to make the letter more useful.

- Overcomplicating the language: While the letter should be professional, using overly technical or complicated terms may confuse the reader. Use simple and concise wording that gets your point across clearly.

Other Considerations

- Incorrect recipient information: Make sure to address the letter to the correct person or department. Incorrect details can delay the process or make the letter ineffective.

- Forgetting to include contact information: Always include your details in case the recipient needs to follow up with questions or clarifications.

Provide the requested supporting documents clearly and professionally to avoid delays. Follow these steps to ensure all required documents are submitted smoothly.

1. Review the Bank’s Requirements

Carefully go through the bank’s guidelines to understand what additional documents are necessary. Typically, they might request proof of identity, income statements, or tax records. Ensure you are aware of the exact specifications.

2. Gather Supporting Documents

Collect documents that verify the details in your employment letter. This might include pay slips, tax returns, or a recent bank statement. Ensure these documents are up to date and clearly legible.

3. Verify the Documents’ Authenticity

Double-check that all documents are original or certified copies. Banks may request verification of the documents you submit, so authenticity is important.

4. Ensure Document Consistency

Make sure that all the information in the employment letter matches the data in your additional documents. Discrepancies can raise red flags and delay processing.

5. Submit Documents in the Correct Format

If submitting documents electronically, follow the bank’s guidelines regarding formats (e.g., PDF, JPG). If submitting physical copies, make sure they are neatly organized and legible.

6. Confirm the Submission

After submitting, confirm with the bank that all documents were received successfully. If possible, request a confirmation email to have a record of your submission.

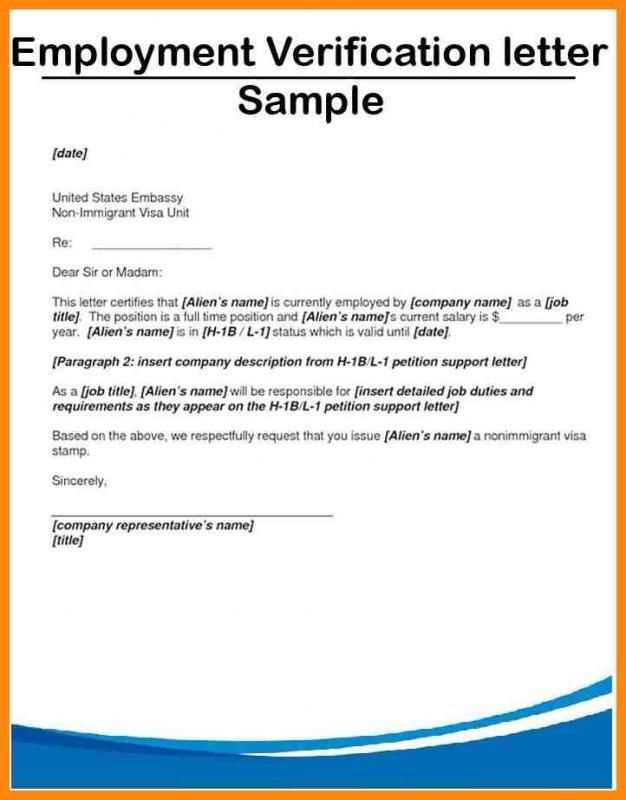

How to Tailor the Confirmation Letter to Different Bank Needs

Customize the letter based on the bank’s specific requirements. If the bank is asking for proof of employment for a loan application, focus on job stability, income verification, and tenure. Include the employee’s job title, department, and salary information clearly. Avoid unnecessary details that could clutter the purpose of the letter.

For Loan Applications

Ensure the letter outlines the employee’s employment status, salary range, and tenure with the company. A bank will be interested in verifying that the individual has a steady income and is unlikely to leave the job soon. If requested, attach a pay stub or bank statement to reinforce the details provided in the confirmation letter.

For Mortgage Applications

For mortgage loans, the bank might require more detailed information. In addition to job title and salary, include the employee’s length of employment, any bonuses, or additional compensation that affects total income. Highlight the reliability of the employee’s work history and mention any long-term contracts or permanent positions.

Each bank has different criteria. Always verify exactly what they need and adjust the tone and details of the confirmation letter accordingly. The more specific and accurate the information, the smoother the approval process will be.

Employment Verification for Bank Use

When writing an employment verification for bank purposes, avoid redundancy by streamlining key information. Start with the employee’s full name, position, and employment status. Mention the start date and the expected duration of employment if applicable. Instead of repeating terms like “letter” or “employment”, focus on providing clear details in a concise manner.

Key Details to Include

Make sure to confirm the job title, work hours, and salary or wage details. These elements are often required by financial institutions to assess the individual’s financial stability. Keep your tone formal but straightforward, sticking to facts rather than interpretations.

Final Considerations

Always include your contact information for verification purposes. Avoid unnecessary phrases that may cause the document to appear cluttered. Clarity and precision help the bank process the request efficiently.