Debt dispute letter template free

Use a debt dispute letter to clearly and professionally challenge any debt that you believe is incorrect. A well-written letter can help resolve misunderstandings, clarify discrepancies, and protect your credit score. Follow the structure provided in this free template to ensure you communicate your concerns effectively.

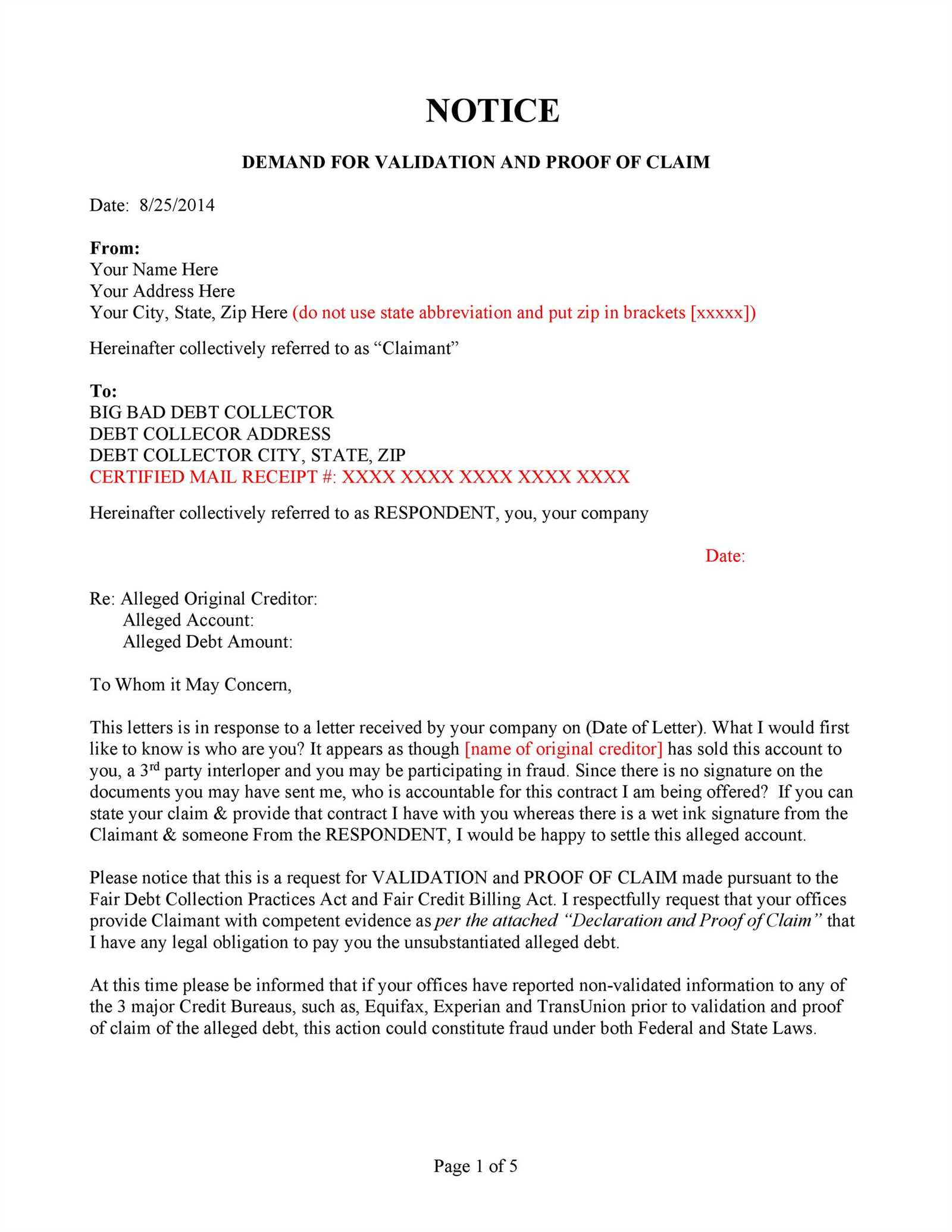

Start by addressing the creditor directly and outlining your reason for disputing the debt. Include key details such as the account number, amount in question, and any relevant dates. Be concise but thorough in explaining why you believe the debt is inaccurate.

Next, make a formal request for the creditor to provide verification of the debt. This could include a copy of the original agreement, transaction records, or other proof of the debt’s legitimacy. Be sure to set a reasonable deadline for their response, such as 30 days, to keep the process moving forward.

Note: Always keep a copy of the letter for your records, and send it via a traceable method, such as certified mail, to ensure you have proof of communication. The letter serves as an official notice of your dispute and sets the stage for resolving the matter swiftly.

Here’s the corrected version:

When writing a debt dispute letter, focus on clarity and accuracy. Start with a concise statement of your position regarding the debt, stating that you dispute the amount or the validity of the debt. Provide any supporting documentation that could strengthen your case. A clear structure helps ensure the reader understands your dispute at a glance.

Structure of the Debt Dispute Letter

| Section | Description |

|---|---|

| Introduction | State that you are disputing the debt and provide basic details such as the creditor’s name, the amount in question, and the account number. |

| Details of the Dispute | Explain why you believe the debt is incorrect. Include any discrepancies you have found in the billing, or if you believe the debt has already been paid. |

| Supporting Evidence | Attach any documents that support your claims, such as payment receipts, bank statements, or previous correspondence. |

| Conclusion | Request a formal review of the dispute and state your preferred resolution, whether it’s the removal of the debt from your records or other actions. |

Use clear language and avoid unnecessary legal jargon. It’s crucial to remain professional and respectful throughout the letter, as this can help facilitate a quicker resolution. Always keep a copy of the letter and any responses for your records.

- Debt Dispute Letter Template Free

When you need to dispute a debt, using a clear and concise letter can help resolve the issue quickly. Below is a debt dispute letter template you can use for free. It includes all the necessary details to help you formally dispute any inaccuracies in your debt record.

Debt Dispute Letter Template

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Phone Number]

[Email Address]

[Date]

[Creditor’s Name]

[Creditor’s Address]

[City, State, ZIP Code]

Dear [Creditor’s Name],

I am writing to formally dispute the debt listed under my name on your records. I believe the amount of [disputed debt amount] is inaccurate for the following reasons:

- Details of why the debt is being disputed (incorrect amount, fraudulent activity, etc.)

- Any documentation or evidence you have to support your dispute (bank statements, payment receipts, etc.)

As per the Fair Debt Collection Practices Act, I request that you investigate this matter and provide me with verification of this debt. If you cannot provide verification, I request that you remove this debt from my records immediately.

If necessary, I am prepared to take further steps to resolve this issue. Please respond within 30 days of receiving this letter, as required by law.

Sincerely,

[Your Name]

Enclosures:

[List of documents or evidence enclosed with the letter]

This template provides a strong foundation to dispute any debt inaccurately listed in your name. Adjust the details according to your specific case for the best results. Ensure that you keep copies of all correspondence for your records.

Begin your debt dispute letter with accurate details to avoid any confusion. Clearly state the account number associated with the debt. Include the full name of the creditor or debt collection agency as listed on your records. Mention the amount in question and the date of the original debt, as well as any dispute that has occurred. Be precise and concise with your wording.

For example, start by writing: “I am writing to dispute the following debt listed on my account: [Account Number], with [Creditor’s Name], in the amount of [Amount]. The date of the alleged debt is [Date].”

This ensures the recipient knows exactly what debt you’re referring to and helps avoid delays in addressing your dispute.

Include a copy of the original bill or statement that shows the debt in question. If the debt is not yours or the amount is incorrect, highlight the discrepancies clearly. Attach any supporting documents like contracts, receipts, or emails that provide evidence supporting your claim. If you’ve made payments already, include proof such as bank statements or receipts. If the dispute involves a specific service or product, include related records, like delivery confirmations or warranties. Include your correspondence history with the creditor, as it shows your efforts to resolve the issue. Lastly, always make sure to provide your contact details so they can respond to your letter quickly.

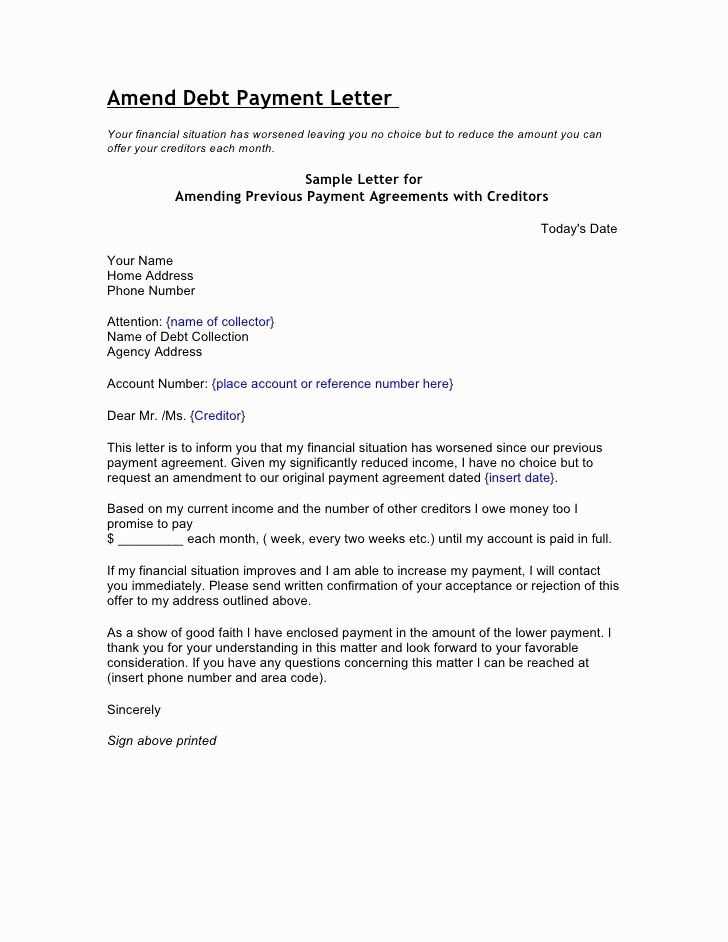

Maintain a clear and respectful tone in your dispute letter. It’s key to express your disagreement without sounding hostile or overly emotional. Keep your language formal but polite, ensuring you come across as reasonable and open to resolving the issue. Avoid inflammatory or accusatory language that could escalate the situation.

Be Direct and Precise

State your case concisely. Focus on the facts and be specific about what’s wrong, whether it’s an incorrect charge or an unresolved payment. This clarity will help avoid misunderstandings and allow the recipient to quickly grasp the issue at hand.

Avoid Defensiveness

Avoid defending your actions in an overly apologetic manner. Your goal is to highlight the mistake, not justify your position excessively. Being defensive can weaken your case or make the recipient feel attacked. Instead, focus on the facts and what needs to be corrected.

If you notice mistakes or inaccuracies in a debt statement, take action immediately to avoid potential complications. First, carefully review all the details in the statement, including the amounts, dates, and account information. Highlight the specific areas where discrepancies appear.

Next, draft a clear and concise letter to the creditor or collection agency. In your letter, directly state the incorrect information and provide evidence to support your claim. Attach relevant documents, such as payment receipts, bank statements, or prior correspondence, that prove your position.

Use polite and professional language throughout. Start by explaining the issue, specifying the erroneous details, and offering corrections. For example, if the balance is incorrect, mention the exact amount you believe is accurate. Be specific and reference dates, transaction numbers, or other identifiers to strengthen your case.

If applicable, request that the creditor provide you with any evidence supporting their claims. This helps clarify any misunderstandings and provides both sides with a better understanding of the issue.

Once you’ve written your letter, send it via a reliable method, such as certified mail, to ensure there’s a record of your communication. Keep a copy of both the letter and any supporting documents for your records. If you do not receive a response within a reasonable time frame, follow up politely.

Taking these steps promptly can help resolve disputes efficiently and prevent further complications with your debt.

Use simple and clear language throughout your letter. Avoid complex sentences or unnecessary jargon. Break down your message into easy-to-understand points to avoid confusion.

- Use bullet points or numbered lists to outline key information. This helps the reader focus on each important detail without feeling overwhelmed.

- Keep paragraphs short and focused on one topic. A single idea per paragraph makes it easier to follow.

- Include clear headings or subheadings for sections, such as “Amount Due” or “Action Required.” This helps the reader quickly locate relevant information.

- Write in a straightforward, professional tone, but be firm and direct about the issue. Avoid emotional or aggressive language.

- Use a legible font and keep the text size readable. Ensure there’s enough spacing between lines and paragraphs to prevent a cramped appearance.

- Be specific with dates, amounts, and any other relevant details. Avoid vague terms like “soon” or “soon enough” that leave room for interpretation.

Clear formatting not only makes your letter more readable but also increases the chances of getting a response in your favor.

Once you’ve sent your debt dispute letter, follow up to ensure it was received. Check if you can track delivery through a service like certified mail or email confirmation. If you haven’t heard back within a reasonable time, follow up with a polite inquiry. Document all your communications–this helps protect you if further action is necessary.

If you receive a response, review it carefully. Assess if the dispute is resolved or if further negotiation is needed. Keep copies of all correspondence for your records. In case the debt collector doesn’t respond or refuses to resolve the issue, consider escalating the matter by filing a complaint with consumer protection agencies or seeking legal advice.

Maintain a professional tone throughout all interactions. This can help preserve your rights while showing that you are serious about resolving the matter. If the dispute progresses to a legal stage, having thorough documentation will support your case.

How to Respond to a Debt Dispute Letter

When you receive a debt dispute letter, it’s crucial to handle it promptly and correctly. Responding to it can prevent further complications, including legal action. Below are the steps to take after receiving such a letter.

1. Review the Dispute Letter

- Carefully examine the details of the debt. Ensure the amount, creditor, and other information are correct.

- If any of the details are inaccurate, be prepared to provide evidence showing why the debt is disputed.

- Take note of the date by which you must respond to avoid legal or financial repercussions.

2. Prepare Your Response

- Write a formal response acknowledging receipt of the dispute letter.

- If you believe the debt is valid, explain why and provide any supporting documentation that confirms your obligation.

- If you believe the debt is incorrect or doesn’t belong to you, state the reasons clearly and include any proof of your claim.

3. Send Your Response

- Send your response by certified mail or another trackable service to ensure the creditor receives it.

- Keep a copy of your response for your records in case the issue escalates.

Addressing the debt dispute promptly can help resolve the matter efficiently. Be clear, concise, and well-documented in your response to avoid any confusion or delays.