Free Credit Repair Letter Templates for Effective Results

Restoring a positive financial profile is a key step for many individuals seeking better opportunities. There are various methods available to assist in addressing inaccurate entries or disputes on one’s financial records. Using basic resources, you can effectively manage the process of correcting these issues without complex procedures. Below, we explore useful approaches to creating professional documents that help resolve discrepancies swiftly and efficiently.

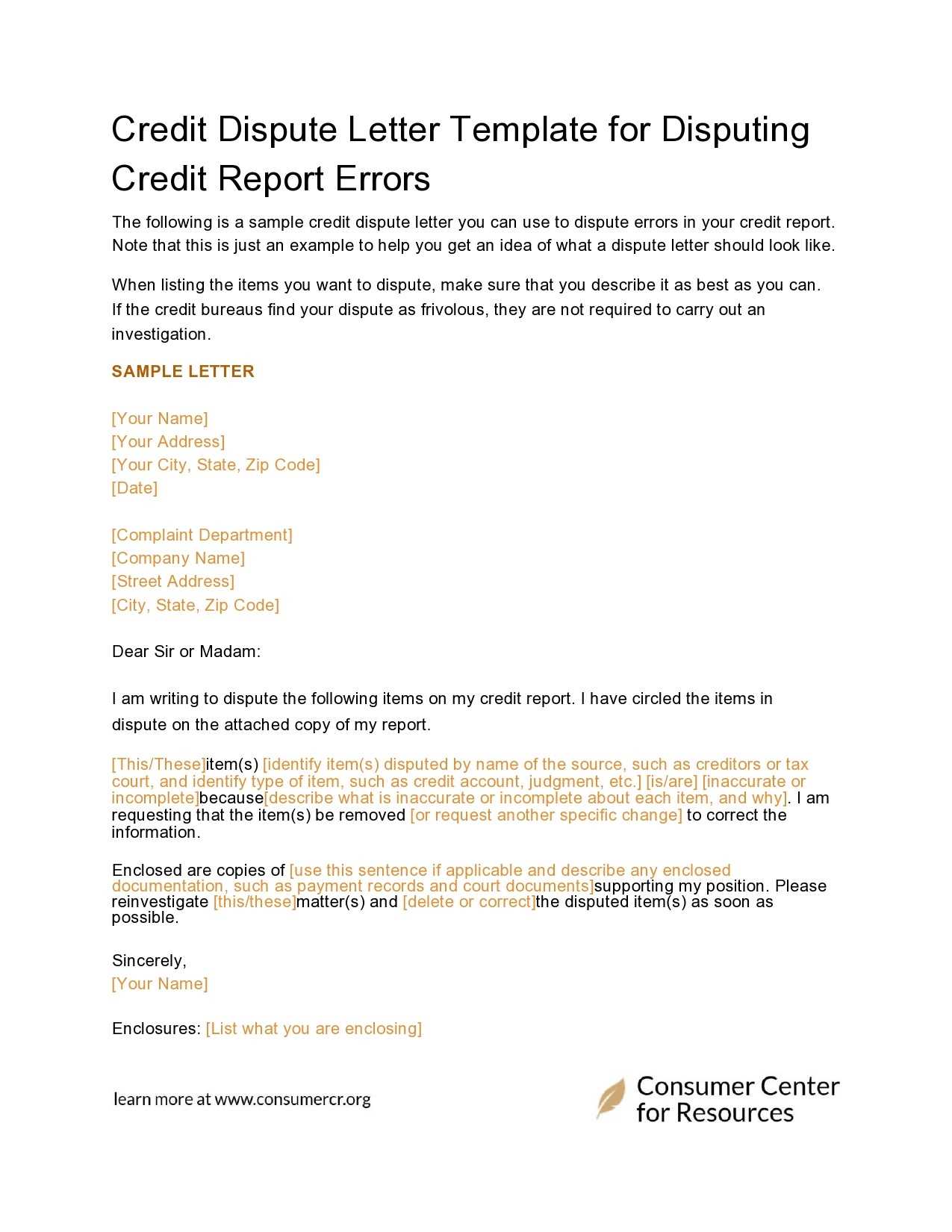

Essential Components for Crafting an Effective Document

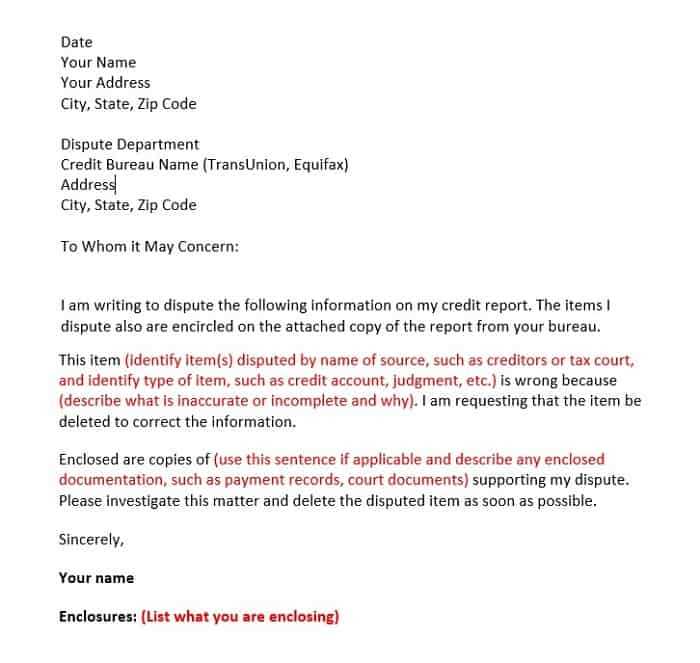

When composing a document aimed at addressing financial issues, clarity is paramount. Be sure to include the following elements to ensure your submission is comprehensive:

- Personal Information: Start by providing accurate contact details to allow easy communication.

- Discrepancy Explanation: Clearly outline the issue you are addressing and any supporting evidence or documentation.

- Request for Action: Specify the desired outcome, whether it’s a correction or further investigation.

- Professional Tone: Maintain a polite and respectful tone throughout the document to ensure it is taken seriously.

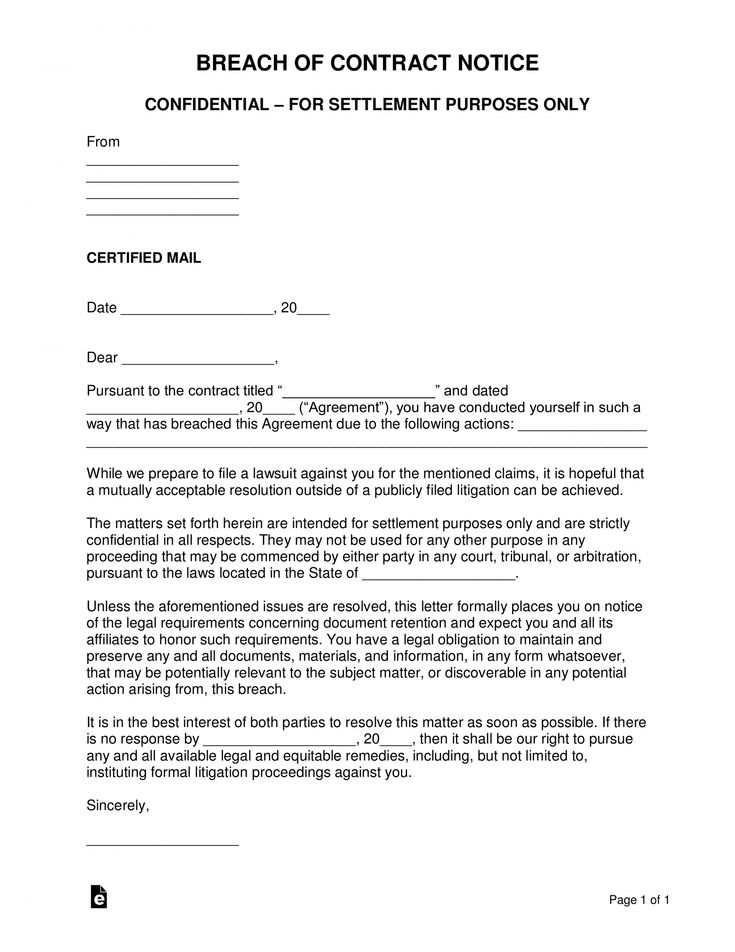

Steps to Follow for Effective Communication

When drafting the necessary correspondence, follow these steps to ensure your request is both clear and complete:

- Gather Documentation: Collect any relevant records, such as reports or transactions, to support your case.

- Draft Your Message: Keep your language direct and to the point, explaining the issue and what you seek as a resolution.

- Review for Accuracy: Before sending, double-check for errors and confirm all the necessary details are included.

- Submit Promptly: Once satisfied, send the document to the appropriate contact to expedite the process.

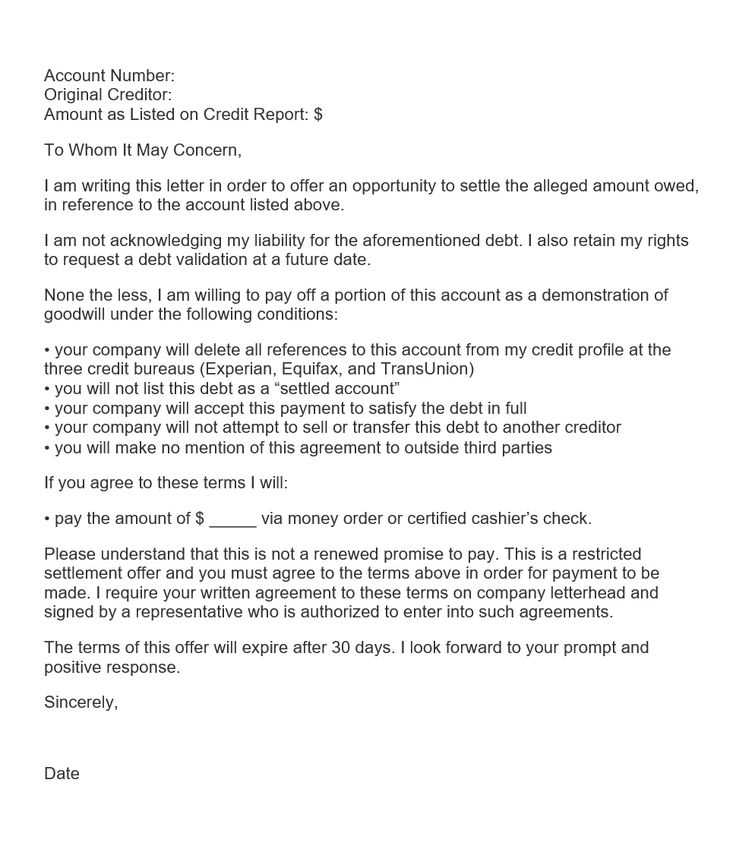

Avoiding Common Pitfalls

While preparing your document, be mindful of these frequent mistakes:

- Overly Complex Language: Keep your wording simple to avoid confusion or misinterpretation.

- Failure to Provide Proof: Without solid evidence, it may be difficult to support your claims effectively.

- Ignoring Deadlines: Ensure timely submission to ensure that issues are resolved as quickly as possible.

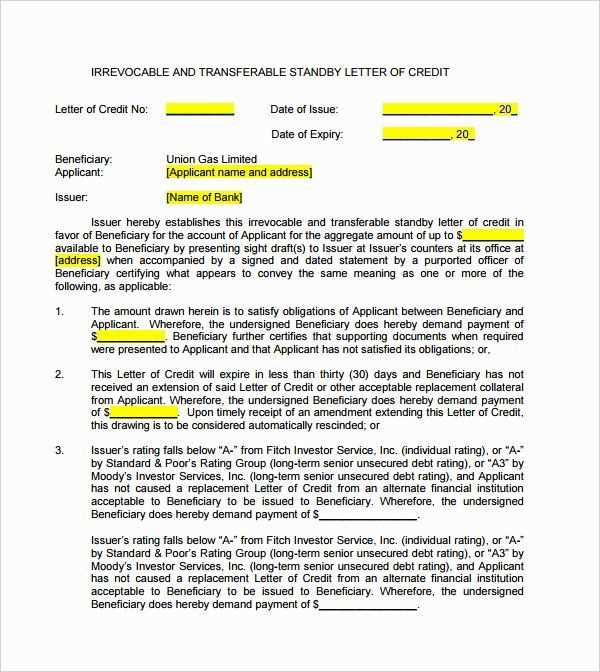

Where to Find Resources for Your Request

Various organizations and online platforms offer helpful resources to guide you through the process. By searching for reputable sites, you can access examples and samples tailored to your specific needs. These tools make it easier to navigate the often-complex process of managing financial disputes.

Improving Financial Health with Written Communication

Having the right documentation can significantly improve your financial position, especially when dealing with mistakes or discrepancies in your records. By using effective communication, you can address and resolve issues related to inaccurate information, helping you get back on track without the need for complex procedures. Below is an overview of how to construct a formal document, what to include, and how it can benefit your situation.

Why These Documents Matter

Sending a formal request to correct errors or seek clarification can have a major impact on your financial standing. A well-written document can expedite the process of removing incorrect entries, resulting in a more accurate financial profile. Whether it’s an incorrect charge, outdated information, or a misunderstanding, these requests can lead to positive outcomes.

Key Elements to Include in Your Document

To ensure your submission is clear and effective, include these essential components:

- Personal Information: Include accurate contact details for easy communication.

- Specific Issue: Clearly explain the problem you are addressing.

- Supporting Evidence: Attach any relevant documentation that supports your claim.

- Desired Resolution: Clearly state what action you expect to be taken.

By following these guidelines, you make it easier for the recipient to understand your request and take prompt action.

Avoiding Common Mistakes

While preparing your submission, be cautious of these common pitfalls:

- Ambiguity: Avoid vague language and ensure your message is clear.

- Insufficient Proof: Ensure you provide all relevant documents to back up your claims.

- Missing Deadlines: Timeliness is crucial for the process to be effective.

Where to Find Additional Resources

Many platforms offer resources that can guide you through the process, providing examples and helpful tips. By using these tools, you can ensure your communication is professional and impactful, speeding up the resolution of any financial issues.