Pdf printable free 609 credit dispute letter templates

If you are facing issues with inaccurate information on your credit report, a credit dispute letter is an essential tool to help resolve the matter. Using a 609 credit dispute letter template can streamline the process, saving you time and ensuring your dispute is handled correctly. These letters are designed to challenge errors and request the removal of unverified items from your credit report.

Start by identifying the specific discrepancies on your credit report. Clearly outline each error and provide supporting evidence to strengthen your case. A 609 credit dispute letter template will guide you on how to structure your letter effectively, making it easier to communicate your dispute to credit bureaus.

The beauty of using printable templates is that they are already formatted and ready to use. Simply fill in your personal details, list the disputed items, and send the letter to the credit reporting agencies. With the right template, your dispute will follow a proven format, increasing your chances of success in having erroneous entries removed.

Utilize these free templates to save on legal fees and gain more control over your credit score. Remember, it’s important to send your dispute via certified mail to ensure it is received and processed correctly.

Sure! Here’s the revised version with minimal repetition of words:

Begin by tailoring your credit dispute letter to reflect the specific issues you want to address. Clearly state the account or item in question and provide any necessary evidence, such as statements or transaction records, to support your case. Be direct but polite, focusing on factual information. Keep the tone formal and respectful to avoid any misunderstandings.

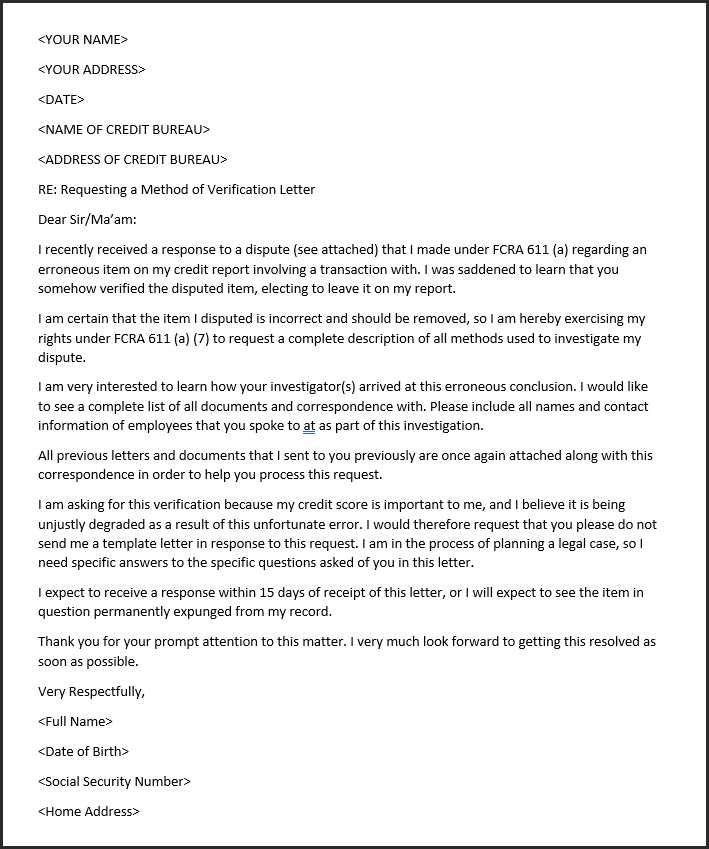

Next, ensure your contact information is up-to-date and clearly listed at the top. This helps the recipient know who they are addressing and expedites communication. Include any reference numbers that might assist the credit bureau or lender in processing your dispute more efficiently.

Then, specify the actions you are requesting. Whether you are seeking to correct an error, remove a negative mark, or clarify a transaction, make it clear. Include a deadline for a response, allowing the organization time to investigate the matter but ensuring you don’t leave the process open-ended.

Finally, conclude by reaffirming your request politely. Mention that you look forward to resolving the matter and that you are available for further clarification if needed. Be sure to sign your letter and send it through a trackable method, ensuring you have proof of submission.

- Detailed Guide to 609 Credit Dispute Letter Templates

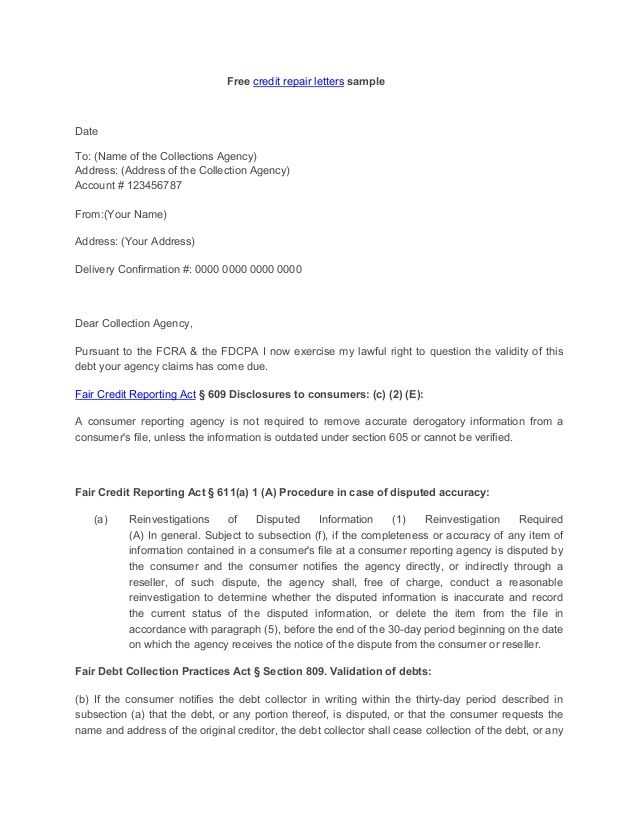

Using a 609 credit dispute letter is an effective way to challenge errors on your credit report. These letters leverage your legal rights under the Fair Credit Reporting Act (FCRA), which allows you to dispute any incorrect or outdated information with the credit bureaus.

How to Structure Your 609 Dispute Letter

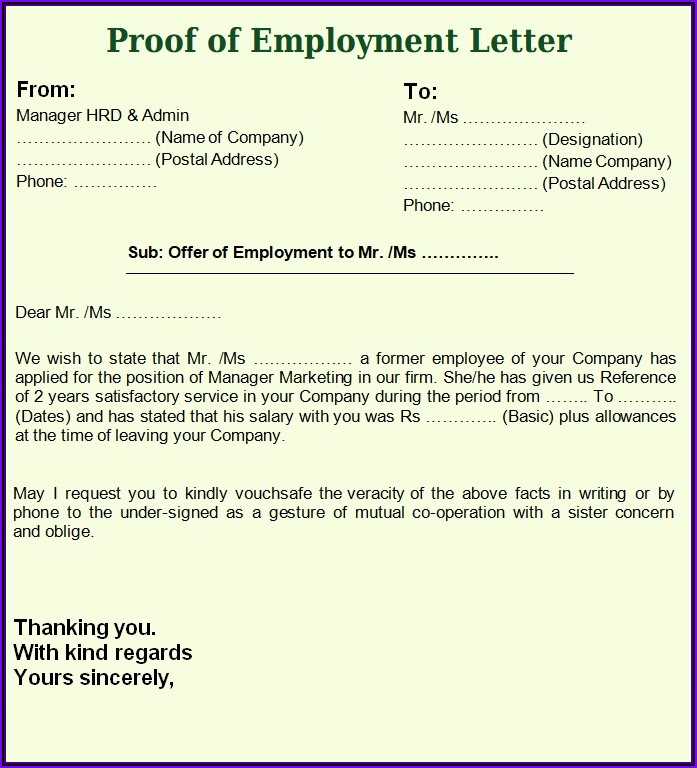

Begin by including your personal information at the top, such as your name, address, and contact number. Follow this with a clear statement outlining the specific items you are disputing, along with any supporting evidence. It’s important to highlight the discrepancies you have identified in your credit report, ensuring that you reference the exact details–such as account numbers or the inaccurate information–in a precise manner.

Tip: Always use certified mail to send your letter, which ensures proof of delivery and establishes a formal record of your dispute.

Key Elements to Include in Your Letter

- Your Contact Information: Provide your full name, address, phone number, and Social Security number for identification.

- The Credit Report Details: Clearly list the inaccurate information you’re disputing, including account numbers, dates, or other specific details.

- Your Request: State that you want the disputed information to be verified or removed based on the inaccuracies.

- Supporting Documentation: Attach any supporting evidence like bank statements, payment records, or proof of settlement that can verify your claims.

- Your Signature: Sign and date the letter to authenticate your request.

Ensure that your letter is concise but thorough, sticking only to the facts and avoiding emotional language. Keep your tone professional and polite, as the credit bureaus are required by law to investigate your dispute within 30 days.

Search trusted websites that specialize in credit repair or financial advice. Many offer free templates tailored for 609 credit disputes. Websites like Credit Karma or LegalZoom provide downloadable templates that comply with legal standards. You can also visit forums and communities, such as Reddit’s r/CRedit, where users share templates that worked for them.

Be cautious when using templates from unknown sources. Ensure that the template aligns with the Fair Credit Reporting Act (FCRA) and includes all necessary details like your identification information and the specific credit reporting errors you are disputing.

To find these templates, use search terms like “free 609 dispute letter” or “credit dispute templates.” Some websites even allow you to customize the template based on your situation, making it easier to create a letter that directly addresses your concerns.

Finally, review the templates to ensure they are up to date with any changes in credit reporting laws. If in doubt, consider consulting a professional to verify that your dispute letter is properly drafted.

Begin by addressing the credit bureau or creditor accurately. Ensure their name, title, and contact details are correctly stated at the top of the letter. This establishes credibility and ensures the right person handles the dispute.

Include specific account information that relates to the dispute. Mention the account number, the creditor’s name, and any relevant dates that will help in identifying the issue clearly. This eliminates any confusion and speeds up the process.

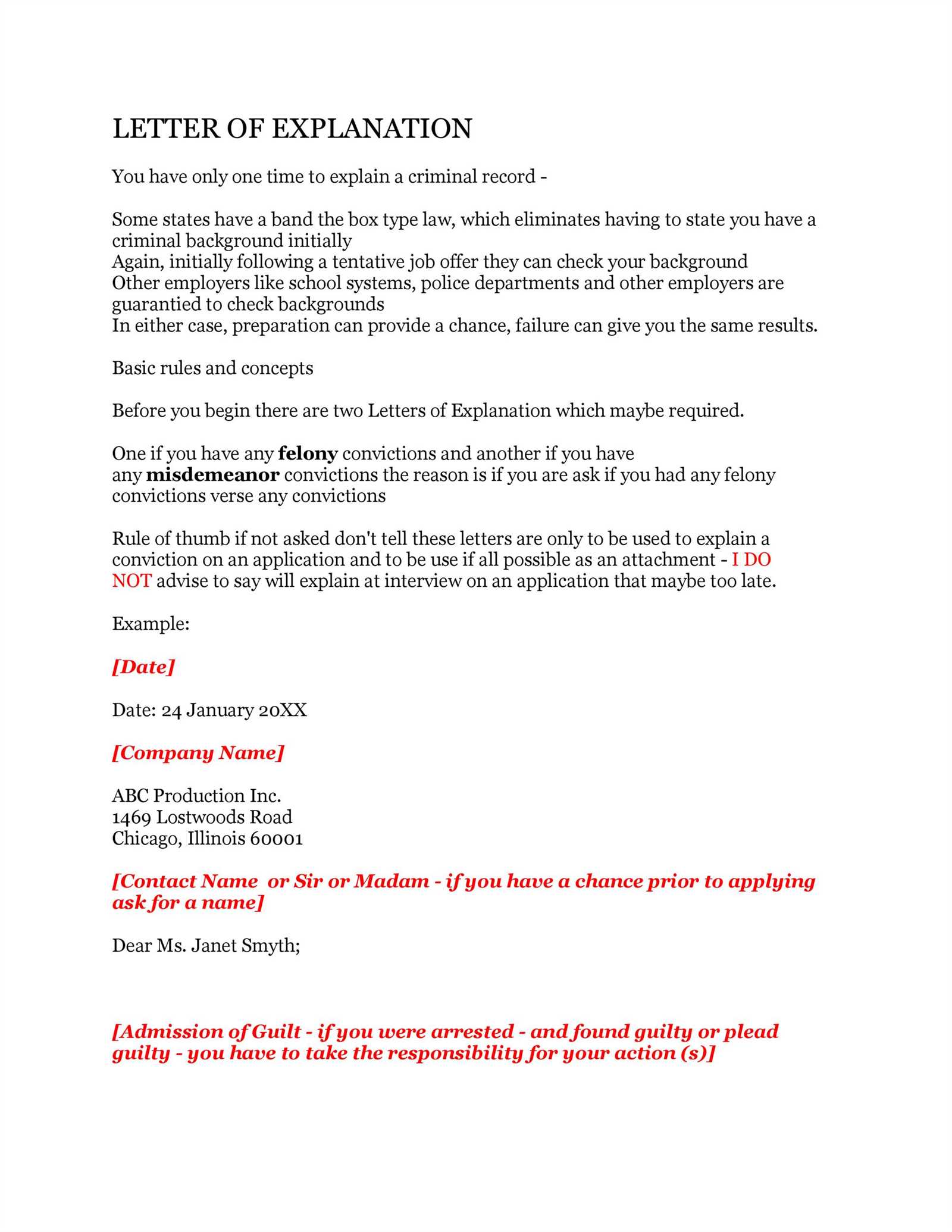

Describe the error in detail. Be concise but specific. Mention what you believe is incorrect, whether it’s an inaccurate balance, missed payments, or fraudulent activities. The clearer the issue, the easier it will be to resolve.

Attach supporting documentation, such as bank statements, payment confirmations, or legal papers, to back up your claim. This shows you have evidence to support your position, which strengthens your case.

State your request for correction or removal. Clearly explain what action you expect the creditor or credit bureau to take. Whether you want a debt removed or corrected, make sure your request is straightforward and unambiguous.

Conclude with a polite yet firm statement, reminding them of their legal obligation to investigate the dispute. Leave your contact details in case further clarification is needed.

Failing to provide accurate personal information can cause delays. Ensure all your details, such as your name, address, and Social Security number, are correct. Incorrect or missing information might result in your dispute being dismissed.

Do not send generic disputes. Tailor each 609 letter to address the specific inaccuracies in your credit report. Generic letters are less likely to get the attention needed for a resolution.

Avoid making unrealistic demands. Instead of expecting immediate results, request verification of the disputed items. The letter should be clear and reasonable, asking for proof or proper documentation to validate the items in question.

Failing to follow up can lead to your dispute being overlooked. After sending the letter, track your requests and make sure the credit bureaus respond within the required timeframe. Keep records of all communications.

| Common Mistake | Why It’s Problematic | How to Avoid It |

|---|---|---|

| Incorrect Personal Information | Can cause delays or dismissal of your dispute. | Double-check your details before submitting. |

| Generic Disputes | Reduces the chances of getting the issue resolved. | Customize your letter to each specific case. |

| Unrealistic Demands | Credit bureaus may ignore unreasonable requests. | Keep your requests clear and reasonable. |

| Failure to Follow Up | Your dispute may be left unresolved. | Track your request and follow up regularly. |

Your 609 dispute letter should clearly state the specific information needed to challenge an inaccurate item on your credit report. Include the following elements:

- Personal Identification Information – Your full name, address, date of birth, and social security number to help identify your credit file.

- Credit Report Details – Reference the exact item or account you are disputing. Include account numbers, reporting dates, and the creditor’s name for accuracy.

- Reason for Dispute – Clearly explain why the information is incorrect. Provide any supporting documentation, such as statements or receipts, that validate your claim.

- Request for Investigation – State that you request a thorough investigation into the disputed information. Mention your rights under the Fair Credit Reporting Act.

- Dispute Resolution Request – Clearly ask for the removal or correction of the inaccurate information from your credit report.

Ensure all information is accurate and concise to avoid delays in processing your dispute.

First, ensure your dispute is well-documented and clear. Collect all supporting evidence, such as account statements, letters, and relevant reports. Verify that the information you’re disputing is incorrect or outdated.

Next, identify the credit bureaus that report your credit. These typically include Experian, Equifax, and TransUnion. Each bureau may have different dispute procedures, so check their individual websites for instructions.

Once you’ve selected the correct bureau, you’ll need to complete a dispute form. Many bureaus allow online submission, which is faster than mailing a physical letter. Be concise and direct when stating your dispute. Attach any supporting documents to back up your claim.

Consider sending a certified letter if submitting by mail. This ensures your dispute is tracked and received by the bureau. Retain a copy of all correspondence for your records.

If the bureau investigates and finds your dispute valid, they will update your credit report accordingly. Monitor your credit report for any changes and request a confirmation of the update from the bureau.

In case the dispute is not resolved in your favor, you have the right to appeal the decision. Most bureaus provide an option to review your case further, often with additional information from you.

Regularly review your credit reports to catch any errors early, and dispute any inaccuracies promptly to keep your credit profile accurate.

Once you send your 609 dispute letter, it’s time to focus on how the credit bureaus respond. The key is knowing what to expect and how to act accordingly.

- Credit Bureau Acknowledgment: You should receive confirmation from the credit bureau that they’ve received your letter. They usually send this acknowledgment within a few weeks.

- Investigation Period: The credit bureau has 30 days to investigate your dispute. During this time, they will examine the information and determine if the disputed items are accurate or need to be removed.

- Results Notification: After the investigation, the credit bureau must send you a report with the results. If they find the information to be inaccurate, they will remove or correct it. If the information is verified, it will remain on your report.

- Request for Documentation: If you haven’t provided sufficient proof with your letter, the credit bureau might ask for more information. Be prepared to send additional documentation if necessary.

Staying proactive after sending your letter helps ensure a smooth response process. Monitor your credit reports and make follow-ups if you haven’t received a response within the designated time frame.

Adjustments and Customization Options

If you’re looking for a way to tailor your credit dispute letter templates, consider tweaking the sections that best fit your situation. It’s crucial to modify the personal information and specific details regarding the dispute to match the items on your credit report. Always keep the tone polite and factual while addressing the inaccuracies. Make sure to clearly state your request for correction or removal, and attach any supporting documents that strengthen your case. These steps will ensure that the dispute letter is both clear and impactful.

Let me know if you’d like further adjustments!