Commercial lease letter of intent template

Creating a commercial lease letter of intent (LOI) can simplify the leasing process for both landlords and tenants. The LOI serves as an outline of the basic terms and conditions that will govern the lease agreement, providing a clear framework before drafting the final contract. It establishes mutual understanding and helps avoid misunderstandings later on.

Ensure that the LOI includes key details like the rental price, lease duration, property description, and any specific terms such as maintenance responsibilities or allowed modifications. Having these basics clearly defined in the LOI sets the stage for a smoother negotiation and saves time in the formal lease drafting process.

Include clauses about potential rent increases, security deposits, and termination options to protect both parties. Highlighting these factors early can prevent surprises and facilitate transparent communication. While an LOI is not a binding contract, it provides clarity and demonstrates the intent of both parties to proceed with the lease agreement.

Remember to review the document thoroughly before sending it. A well-written LOI reflects professionalism and helps build trust between landlord and tenant. With this template, you can streamline the leasing process and ensure all important terms are discussed and agreed upon upfront.

Here is the revised text without repetition:

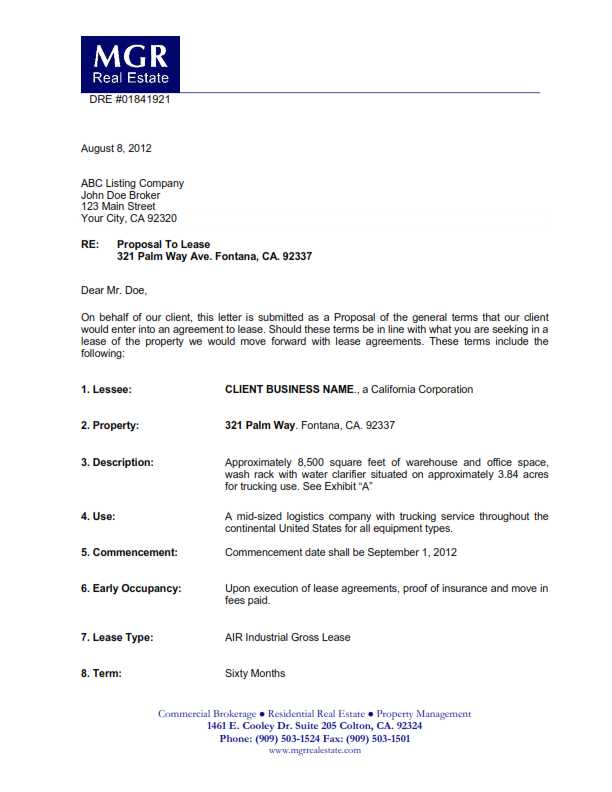

To create a clear and professional commercial lease letter of intent (LOI), focus on specific terms without redundancy. Start by stating the intent to lease and outline the property details, such as address, square footage, and lease duration. Include the rental rate, payment frequency, and escalation clauses to ensure both parties are aligned on financial terms. Specify any tenant improvements or modifications to the property and include responsibilities for maintenance and repairs.

Lease Terms and Conditions

Clearly define the lease term, start date, and any renewal options. Ensure that the rent increase structure is defined, whether it is based on a fixed amount or tied to a market index. Outline the security deposit amount and conditions for its return. It is also necessary to mention insurance and indemnity requirements for both parties.

Additional Provisions

Include any special provisions such as parking, signage rights, or exclusivity clauses. If the tenant has specific needs or requests for the space, include them here. Make sure all contingencies are addressed, such as zoning compliance or landlord’s approval for tenant alterations.

Finish the LOI by stating the expected timeline for finalizing the lease agreement and any required legal reviews. Both parties should sign the letter to confirm their understanding of the key points, although it does not constitute a binding lease until formally executed.

- Commercial Lease Letter of Intent Template

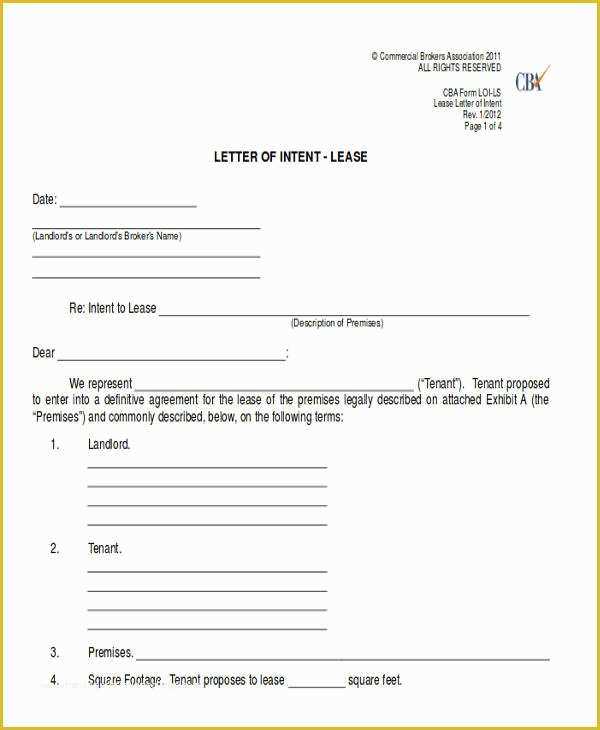

A Commercial Lease Letter of Intent (LOI) sets the foundation for negotiations between a landlord and tenant. It outlines the key terms of the lease agreement before both parties finalize the details. Here is a template to guide you through drafting an LOI:

Basic Structure of a Commercial Lease Letter of Intent

1. Introduction: Begin by identifying the parties involved: the landlord and the tenant. Include their legal names and addresses. Clearly state the intent of the letter– to outline the preliminary terms of a commercial lease.

2. Property Description: Provide a brief description of the property, including the address and any distinguishing features. Specify the space that the tenant intends to lease (e.g., square footage, floor number).

3. Lease Term: Indicate the proposed lease duration (e.g., five years) and mention whether there are options for renewal. If applicable, include any termination clauses or break options.

4. Rent and Payment Terms: Outline the proposed rent amount, payment frequency, and any rent escalation clauses. Include details about security deposits and any additional costs, such as utilities or maintenance fees.

Key Provisions to Address

5. Use of Premises: State the intended use of the leased property (e.g., retail, office). This helps prevent disputes over misuse of space.

6. Condition of Premises: Clarify the current condition of the property and whether the landlord or tenant will be responsible for any improvements or repairs before moving in.

7. Exclusivity Clause: If necessary, include a provision preventing the landlord from leasing space to direct competitors within the same property.

8. Signage: Discuss any permissions or limitations on placing signage on the property, including size, placement, and costs.

By addressing these points, the LOI will provide a clear framework for further negotiations, helping both parties move forward with confidence.

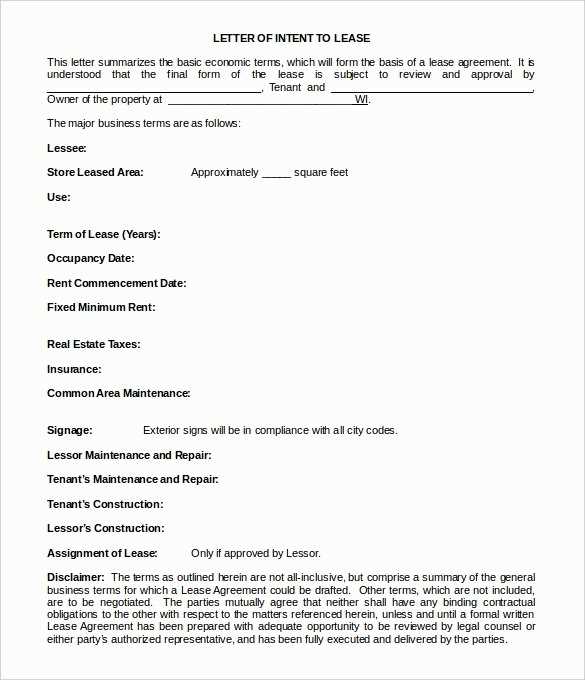

A well-structured commercial lease letter includes several key elements that ensure clarity and prevent misunderstandings. Below are the most important components:

| Component | Description |

|---|---|

| Introduction | Clearly state the intention to enter into a lease agreement, specifying the parties involved (landlord and tenant). |

| Premises Description | Include a detailed description of the leased property, including its address, size, and any relevant features. |

| Lease Term | Specify the length of the lease, including start and end dates, and any renewal or termination options. |

| Rental Terms | Outline the agreed-upon rental amount, payment schedule, and method of payment (e.g., monthly or annually). |

| Security Deposit | State the amount of the security deposit, conditions for its return, and any deductions that may apply. |

| Use of Property | Specify the permitted use of the premises and any restrictions on modifications or subleasing. |

| Maintenance Responsibilities | Define the responsibilities of both parties for maintaining and repairing the property. |

| Signatures | Include spaces for both the landlord and tenant to sign, indicating their agreement to the terms. |

Each of these components plays a role in making sure the lease agreement is clear, actionable, and mutually agreeable. Ensure all parties review and understand these terms before moving forward.

Be clear and specific when outlining the terms and conditions in the letter. Clearly state the lease duration, rental amount, payment frequency, and any adjustments or increases. Mention any security deposits, maintenance responsibilities, and modifications to the premises. Use precise language to define each party’s obligations, such as who will cover utilities, taxes, or insurance. If there are any limitations or restrictions on use, outline them here as well. Avoid vague terms that could lead to confusion later.

Rental Amount and Payment Terms

Define the rent clearly, specifying the exact amount, payment schedule, and any applicable late fees. If rent increases over time, outline the schedule or percentage of increase. Include provisions for rent payment methods, whether by check, bank transfer, or other means, and indicate the due date for each payment cycle.

Tenant and Landlord Responsibilities

Identify both the landlord’s and tenant’s duties, including maintenance and repair obligations. Specify which party is responsible for maintaining specific areas of the property, such as HVAC systems, plumbing, and structural repairs. If there are restrictions on modifications to the property, such as painting or remodeling, make those clear to avoid disputes later on.

Specify the exact amount of rent, the frequency of payments, and the payment method in the lease agreement. Outline whether the rent is fixed or subject to adjustments over time, and define the specific conditions under which rent increases may occur, such as after a set period or tied to inflation rates. This avoids ambiguity and ensures both parties understand the financial terms.

Clarify who is responsible for additional costs, such as utilities, maintenance, or property taxes. If these costs are to be paid separately from the rent, indicate whether they are flat fees or variable charges. Include a breakdown of these expenses, or reference an appendix where details can be found.

Define the due date for rent payments, and establish a grace period if applicable. Include penalties or late fees for missed payments, as well as a process for handling payment disputes. Clear timelines and consequences for non-payment reduce the likelihood of misunderstandings or delays.

If rent escalation clauses are included, describe the method of calculation in detail. This could involve specific formulas, annual percentage increases, or changes based on market rates. Transparency here helps prevent disputes over future rent adjustments.

Lastly, determine the terms for security deposits. Specify the amount, the conditions under which it may be withheld, and the procedure for its return at the end of the lease. This protects both landlord and tenant interests while ensuring a smooth financial transition at the lease’s conclusion.

Make sure to include key legal points that outline your rights and responsibilities clearly. Below are some important items to address in your commercial lease letter of intent.

- Parties Involved: Clearly state the full legal names of both the landlord and tenant, along with any affiliated entities. This avoids ambiguity regarding the parties entering the lease agreement.

- Lease Term: Specify the duration of the lease, including the start and end dates. Also, include any renewal options and the procedures for exercising them.

- Rent Payment Structure: Detail the base rent, payment schedule, and any additional costs such as property taxes, maintenance fees, or utilities. Be clear on how rent increases will be handled, if applicable.

- Security Deposit: Include the amount of the security deposit required and the conditions under which it will be returned or withheld. Specify any interest that may accrue on the deposit during the lease term.

- Tenant Improvements: If the tenant is allowed to make improvements to the property, outline the approval process, responsibility for costs, and whether these improvements become property of the landlord.

- Termination Clauses: Specify conditions under which either party can terminate the lease early, such as breach of contract or failure to meet agreed-upon terms. Detail any penalties or notice requirements for early termination.

- Dispute Resolution: Include provisions for resolving disputes, whether through mediation, arbitration, or litigation. It’s essential to set expectations for how conflicts will be managed.

- Compliance with Laws: Both parties should agree to comply with all applicable local, state, and federal laws during the term of the lease. This may include zoning laws, safety regulations, or accessibility requirements.

- Insurance and Liability: Specify insurance requirements for both parties, including liability, property, and casualty coverage. Outline who will be responsible for damages and any indemnification provisions.

Addressing these items will help set a clear framework for negotiations, minimize potential conflicts, and protect both parties’ interests as the lease agreement progresses.

Be clear on your goals. Outline the key negotiation points before starting, focusing on what’s non-negotiable and where there’s flexibility. Be ready to adjust based on the landlord’s stance while maintaining clear priorities.

- Rent Structure: Clearly define the rent amount, frequency, and any escalations. Specify whether rent will increase annually or based on specific terms (such as CPI, cost of living, or market rates). This helps avoid surprises later.

- Length of Lease: Be specific about the lease term. A longer lease may give you more security, but it’s important to consider flexibility for expansion or downsizing. Define any options for renewal, extensions, or early termination.

- Maintenance and Repairs: Clearly assign responsibilities for property maintenance, repairs, and inspections. Specify who covers the costs of structural repairs, and whether the landlord will be responsible for any upkeep of the space.

- Contingencies: Add provisions that allow you to back out or renegotiate if certain conditions are not met. For instance, you might want a contingency if the property fails inspection or if zoning approvals are not granted. These clauses provide a safety net if issues arise.

- Lease Flexibility: Negotiate terms that allow for adjustments as your business grows or changes. This can include rights of first refusal, expansion options, or the ability to sublease or assign the lease to another party.

- Security Deposit: Define the security deposit amount and conditions for its return. Ensure that the terms are clear to prevent disputes at the end of the lease term.

Keep communication open and direct during negotiations. Document all agreed-upon points and contingencies to avoid misunderstandings. Ensure both parties clearly understand their obligations under the terms before moving forward.

Begin by clearly outlining the terms of the lease to avoid any misunderstandings later. Confirm the rental amount, lease term, renewal options, and any contingencies or conditions. Double-check the dates for possession and commencement, as well as maintenance responsibilities.

Clarify Lease Conditions

Specify who is responsible for repairs and maintenance. Indicate the terms for property taxes, utilities, and insurance. Make sure the permitted use of the property is clearly defined, including any restrictions on business operations.

Include All Negotiated Points

List any special clauses agreed upon during the negotiation, such as rent abatement periods, tenant improvement allowances, or options for additional space. These should be incorporated to reflect the final deal accurately.

Verify that the letter is signed by both parties before submitting it to move forward with the lease process. Ensure all contact details are up-to-date for any required follow-up.

By being thorough in these areas, you can finalize the letter efficiently and reduce the risk of disputes during the lease term.

Commercial Lease Letter of Intent (LOI) Template

Be clear and direct in your Letter of Intent (LOI) to avoid misunderstandings later. Begin with the key terms like rent, lease duration, and responsibilities. Outline the proposed rental rate, payment schedule, and any adjustments or increases over time. Specify the lease term length and renewal options. Include tenant and landlord obligations such as maintenance, utilities, and insurance. Make sure the LOI addresses the condition of the property upon occupancy.

Key Components to Include

Incorporate these elements for a more thorough LOI:

- Rental Amount and Payment Terms: Clearly state the base rent and payment frequency (monthly, quarterly, etc.), and how payments are to be made.

- Lease Term: Define the initial lease duration and any options for extension, including terms for rent increase.

- Security Deposit: Indicate the amount required and the conditions for its return.

- Permitted Use: Specify the use of the space, whether for retail, office, or industrial purposes.

- Maintenance and Repairs: Define the responsibilities for maintenance, such as HVAC, plumbing, and structural issues.

Finalizing the Agreement

Ensure both parties agree on the timelines for signing the full lease agreement. Review any conditions that could affect the final contract, such as zoning approval or financing for the tenant. A well-structured LOI sets the stage for smooth negotiations and prevents surprises down the line.