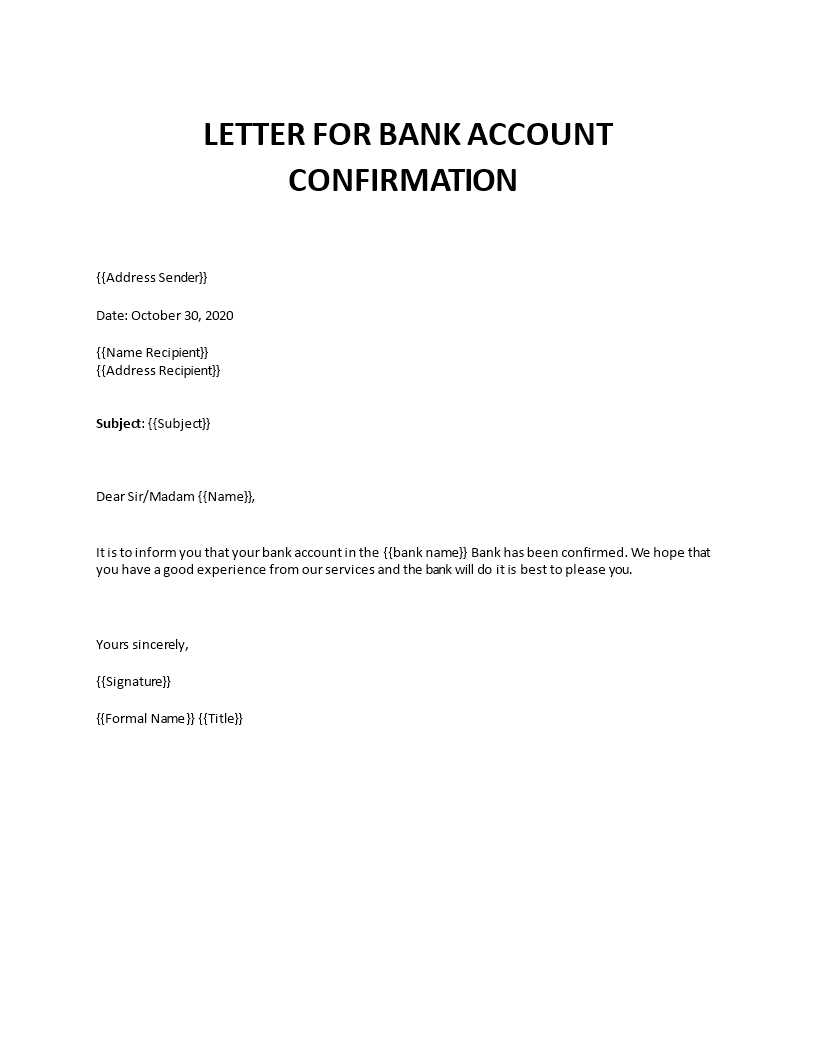

Bank details confirmation letter template

If you need to verify bank account information, a confirmation letter is an ideal way to ensure accuracy. This template allows you to clearly state the details you are confirming, and it sets a professional tone for communication.

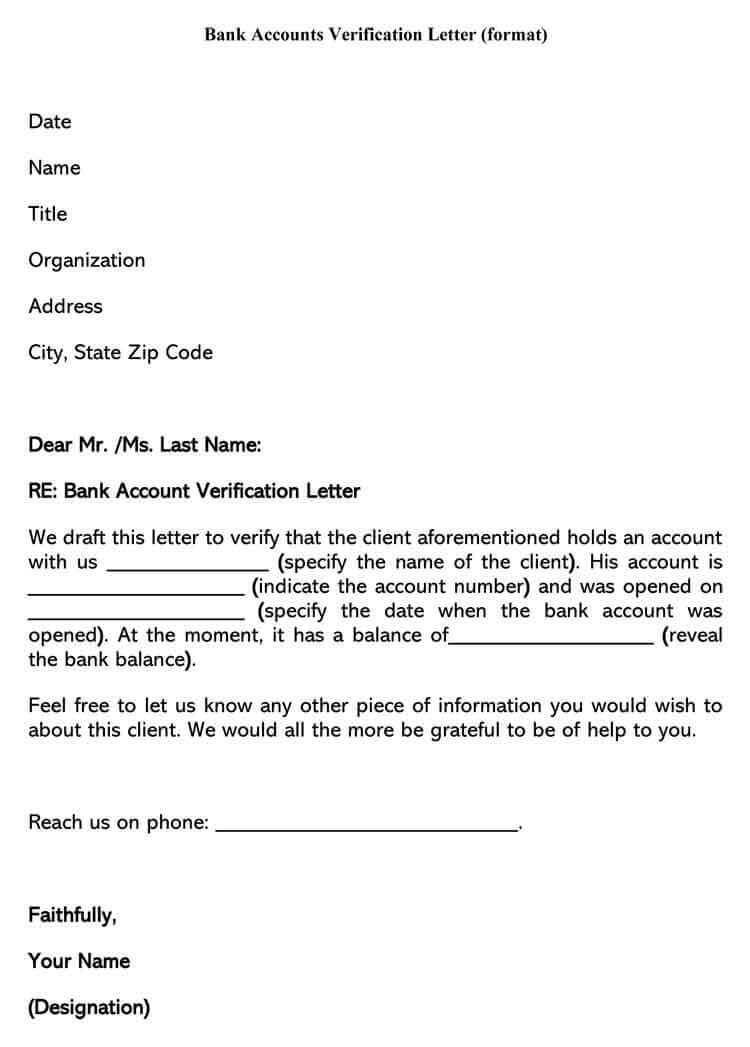

Start by including the recipient’s name, the date, and your contact information at the top of the letter. The body should specifically mention the bank details that are being confirmed, such as the account number, bank name, and routing number. Use clear language to avoid any confusion and ensure the details are correct.

Close the letter by offering the recipient an opportunity to ask any questions or request further clarification if needed. Be sure to include your signature and a note thanking them for their attention to the matter. This approach guarantees clarity and leaves a record of your correspondence.

Here’s the revised version:

Make sure to include all necessary details when confirming your bank information. The letter should be clear and concise, with a professional tone. Start by addressing the recipient and stating the purpose of the letter immediately.

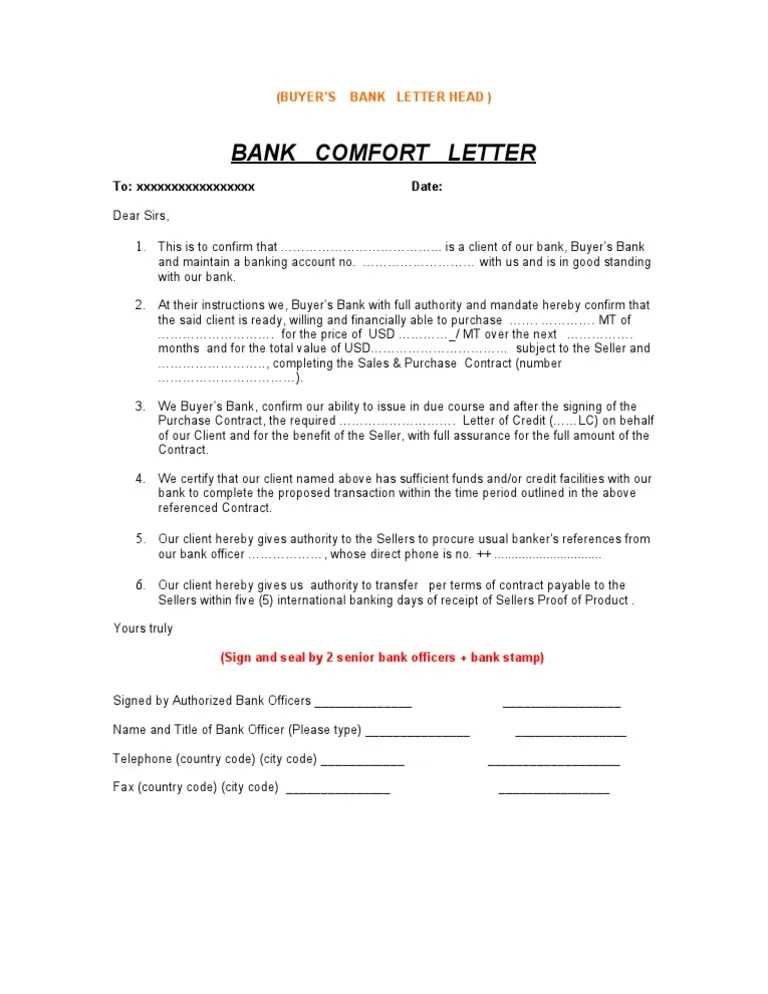

Key Elements of a Bank Details Confirmation Letter

Include your full name, the name of your bank, and your account number. Mention the type of account (e.g., checking, savings) and any relevant branch information. Double-check that the details are accurate to avoid any misunderstandings. If needed, include a reference number or transaction ID for extra clarity.

Formatting Tips

Use a clean, simple format. Avoid excessive decoration or informal language. Align all text to the left for better readability. Ensure that the contact information is placed at the top of the letter, followed by the date, recipient’s information, and body text. Close with a professional sign-off and your signature.

Bank Details Confirmation Letter Template

A bank details confirmation letter must be clear and straightforward. The structure should ensure that all relevant information is accurately communicated and easily verified.

How to Structure a Bank Details Confirmation Letter

Start with a professional greeting and address the recipient by name. Follow with a brief introduction stating the purpose of the letter: to confirm bank details. Clearly list the account details being verified, such as account number, bank name, branch, and other identifying information. Conclude with a request for confirmation or any necessary action.

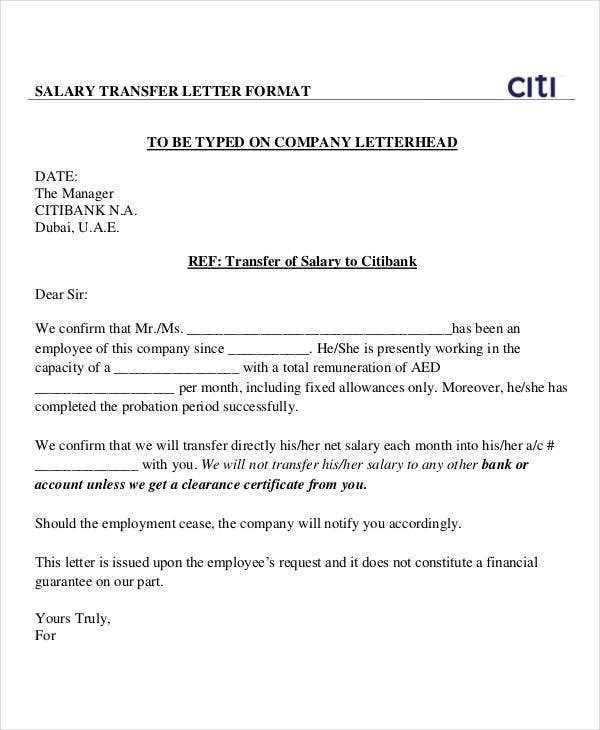

Key Information to Include in the Letter

Include the following:

– The recipient’s full name and address

– The name of the bank and branch

– Account number, routing number (if applicable), and other identifiers

– The date of the confirmation request

– Any relevant reference numbers or transaction identifiers

Ensure these details are accurate to avoid any confusion. Any missing or incorrect data may delay the confirmation process.

Common Mistakes to Avoid When Writing a Confirmation Letter

Avoid including irrelevant information that could obscure the main purpose. Do not omit any critical details, such as the account number or bank’s name. Avoid using complex or technical language–clarity is key. Be sure to proofread for errors in spelling or numbers, as mistakes in financial documents can lead to serious issues.

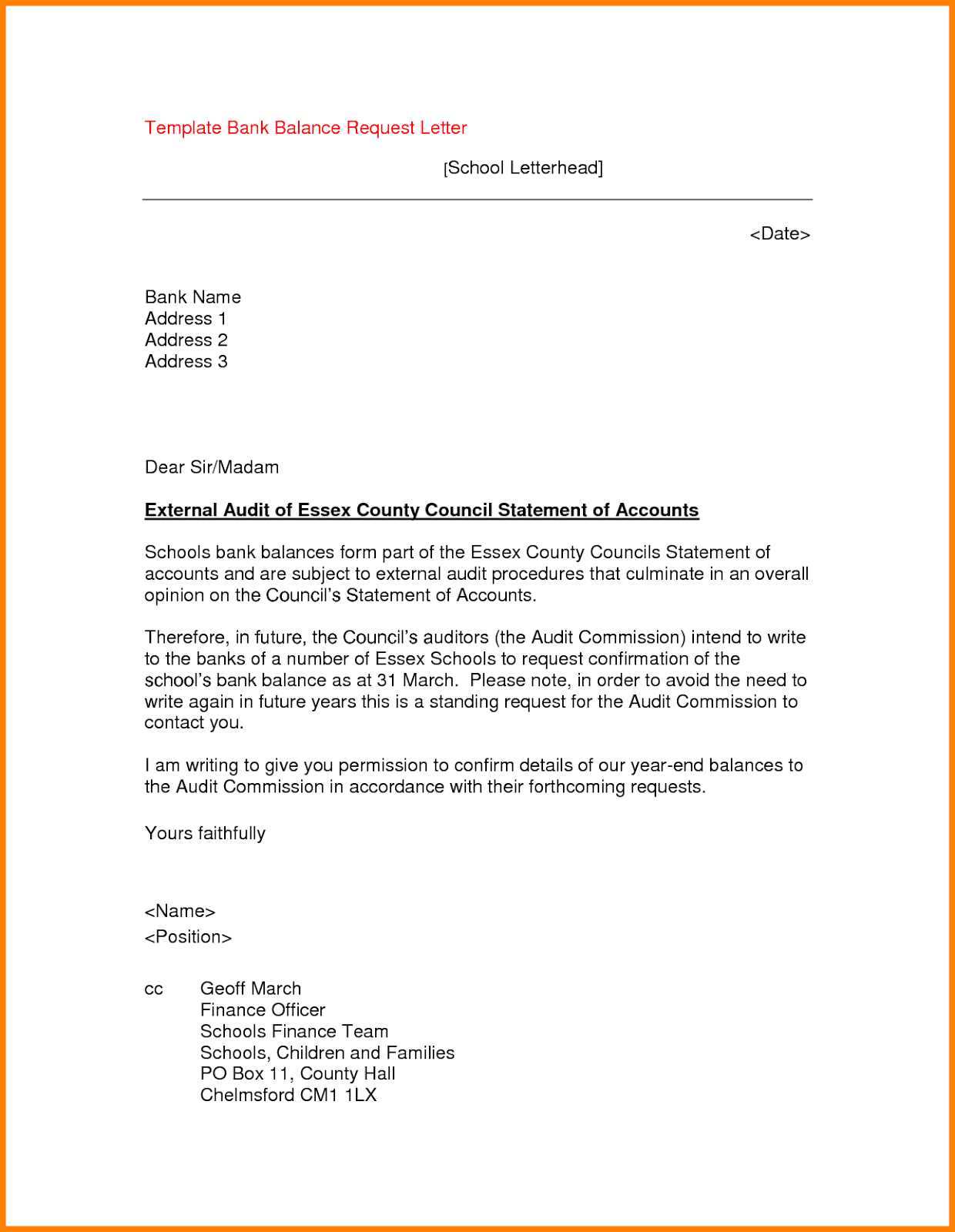

How to Customize the Template for Various Scenarios

Adjust the tone based on the recipient. If sending to a bank, the letter should be formal. For personal use, a less formal approach may be appropriate. You may also need to modify the details based on the specific context, such as including specific instructions for verifying the details or providing additional supporting documents if required.

Best Practices for Ensuring Accuracy in Bank Information

Double-check all numbers and information before sending the letter. If unsure about any detail, confirm it with your bank. Using a template can help prevent omissions, but it’s still important to verify that each section is correct before finalizing the letter.

Legal and Security Considerations When Sending Financial Details

Sending sensitive bank details via unsecured channels can lead to privacy breaches. Always use secure email or postal services, and consider encryption for digital communications. Be aware of phishing attempts and ensure that the recipient is a trusted party before sharing sensitive financial information.