Commercial real estate letter of intent to purchase template

A well-structured letter of intent (LOI) is a key step in the commercial real estate acquisition process. It outlines the preliminary terms of the deal and sets the stage for formal negotiations. This document serves as a roadmap for both parties, providing a clear understanding of the basic terms and expectations before drafting a full purchase agreement.

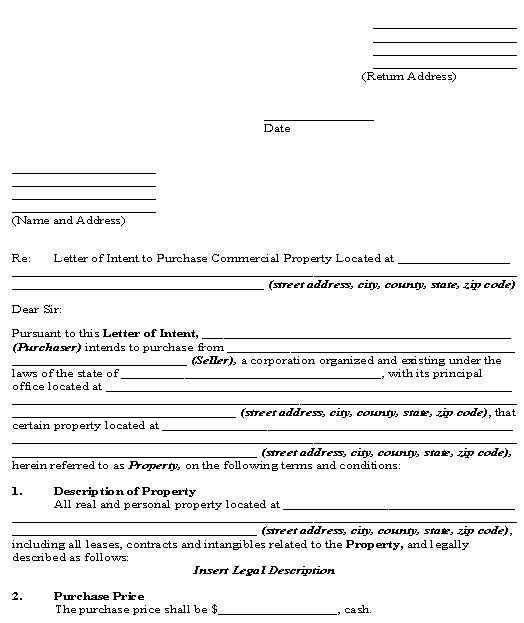

Begin with a brief but clear statement of intent, confirming the buyer’s desire to purchase the property. Follow this with a description of the property, including the address, type, and any specific characteristics that may influence the transaction. Include the agreed-upon purchase price, along with any contingencies that are crucial for the buyer, such as financing or inspections.

Next, highlight key dates that are critical for both parties, including the proposed closing date and any deadlines for inspections or financing approvals. This section ensures that both the buyer and seller are aligned on timelines and expectations.

Conclude the letter with a section on confidentiality, ensuring that both parties maintain discretion throughout the negotiation process. This not only protects sensitive information but also builds trust between the parties involved.

Commercial Real Estate Letter of Intent to Purchase Template

A well-drafted Letter of Intent (LOI) to purchase commercial real estate sets clear expectations for both the buyer and the seller. Begin with basic property details such as the address and a brief description. Clearly state the proposed purchase price, including any adjustments for closing costs or contingencies. Specify the earnest money deposit amount and the intended timeline for closing the deal.

Key Elements to Include

1. Property Description: List the full address, legal description, and any identifying property information. This section should be concise but precise.

2. Purchase Price and Terms: Clearly outline the purchase price, any financing arrangements, and how the price may be adjusted during negotiations. If applicable, specify the proposed amount for a down payment or deposit.

Closing Timeline and Conditions

3. Closing Date: Specify the anticipated closing date, or include language that allows flexibility for due diligence and other contingencies. Include timeframes for inspections, appraisals, and final approval from financing institutions.

4. Contingencies: Mention any conditions that must be met before the transaction is finalized, such as satisfactory inspections or securing financing. Clearly state who bears the cost of each condition.

By incorporating these elements, the LOI can act as a foundation for the formal purchase agreement, saving time and minimizing misunderstandings down the line.

Understanding the Key Components of a Letter of Intent

A letter of intent (LOI) outlines the primary terms of an agreement between a buyer and a seller before the formal contract is finalized. This document helps clarify expectations and ensures both parties are aligned on key aspects of the deal. Below are the most critical components you’ll find in a typical LOI for commercial real estate transactions:

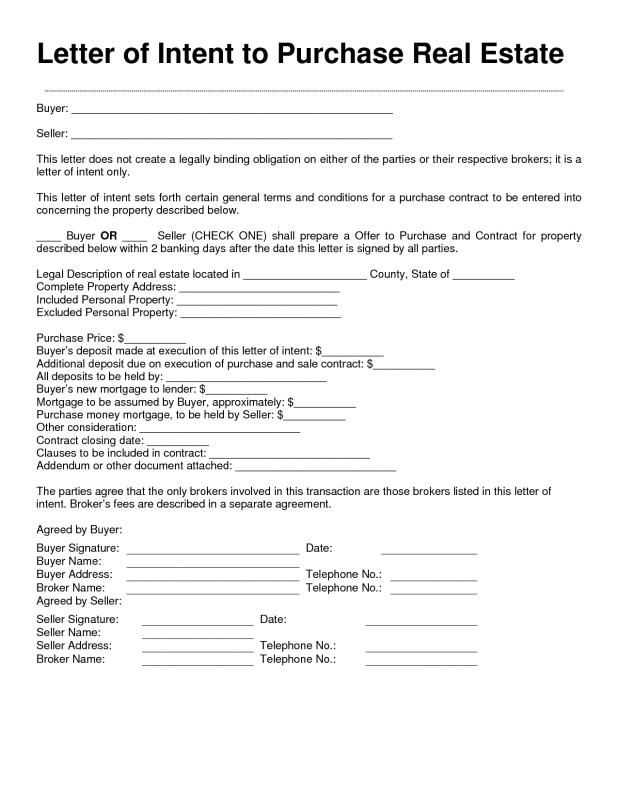

1. Buyer and Seller Information

- Buyer Details: Full name, company name (if applicable), and contact information.

- Seller Details: Full name, company name (if applicable), and contact information.

2. Property Description

- Address: Exact location of the property being sold.

- Legal Description: Specific legal details of the property, including zoning or land use classifications.

- Property Condition: A brief description of the property’s current state, including any notable issues or improvements.

3. Purchase Price and Terms

- Price: The agreed purchase price or an estimated range.

- Deposit: The amount of earnest money or initial deposit required to secure the agreement.

- Payment Terms: Details on how and when payments will be made, including any contingencies or conditions.

4. Timeline and Closing Date

- Effective Date: The date when the LOI becomes legally binding, often the date both parties sign.

- Closing Date: The target date for completing the sale or transfer of the property.

- Inspection Period: The time frame in which the buyer may conduct inspections or due diligence on the property.

5. Contingencies and Conditions

- Financing Contingency: Whether the sale is contingent on the buyer securing financing.

- Inspection Contingency: Conditions allowing the buyer to withdraw from the deal based on inspection results.

- Title and Zoning: The buyer may require confirmation of clear title and zoning compliance.

6. Confidentiality and Exclusivity Clauses

- Confidentiality: A clause protecting sensitive information from being disclosed to third parties.

- Exclusivity: Whether the seller agrees to negotiate exclusively with the buyer for a specified period.

7. Dispute Resolution

- Methods: Specifies the method of resolving any disputes, such as arbitration or mediation.

- Jurisdiction: The location or court system that will handle any legal disputes.

By understanding these key components, both the buyer and seller can ensure that their expectations are clearly communicated, reducing the chances of misunderstandings later in the negotiation process.

Structuring the Purchase Price and Payment Terms

Clearly define the purchase price upfront. Break down the total cost into components such as the base price, potential adjustments, and any additional costs. This ensures both parties understand the financial commitment involved. Outline specific conditions under which the price may change, such as appraisals, inspections, or market shifts.

For payment terms, specify the timeline and conditions for payments. Consider structuring payments as a lump sum or installment plan, depending on the size of the deal and buyer preferences. Determine any deposits or down payments and clarify their purpose, whether for securing the agreement or as part of the total price.

Include details on how and when the final payment is due. For example, a payment may be due at closing or upon completion of certain milestones. Specify acceptable payment methods, such as bank transfer, check, or escrow services. Be explicit about any late fees or penalties for missed payments, ensuring both parties have clear expectations regarding payment deadlines.

| Payment Component | Description |

|---|---|

| Base Price | The initial agreed-upon cost of the property. |

| Deposits/Down Payments | Initial payment made to secure the deal, typically deducted from the total price. |

| Installments | Divided payments scheduled over a defined period before closing. |

| Closing Payment | Final payment due at the closing of the transaction. |

| Late Fees | Penalties for payments not made on time, typically outlined as a percentage of the overdue amount. |

Ensure both parties agree on contingencies related to payment adjustments, such as changes in property value, required repairs, or other unforeseen factors. Always be clear on how these will be addressed to avoid confusion later on.

Clarifying the Property’s Legal and Physical Conditions

Confirm the property’s zoning status with local authorities. This ensures it can be used for your intended purpose without any legal restrictions. Be specific about the zoning code and any required permits for alterations or business operations.

Request a title report to verify the ownership and check for any liens, encumbrances, or legal disputes. Understanding the property’s title history will prevent future ownership issues and clarify your legal position.

Inspect the physical condition of the property. Hire professionals to evaluate structural integrity, including the foundation, roofing, plumbing, and electrical systems. Get a clear picture of any maintenance needs or required repairs, which will impact long-term costs and planning.

Check for environmental hazards. Request an environmental audit to identify potential issues like asbestos, mold, or contamination, especially in older buildings or industrial sites.

Review the property’s compliance with building codes and safety regulations. Any non-compliance could lead to costly fines or required upgrades.

Verify the accessibility of utilities, including water, electricity, and waste disposal. Understand how these utilities connect to the property and if any upgrades are needed.

Setting a Timeline for Due Diligence and Closing

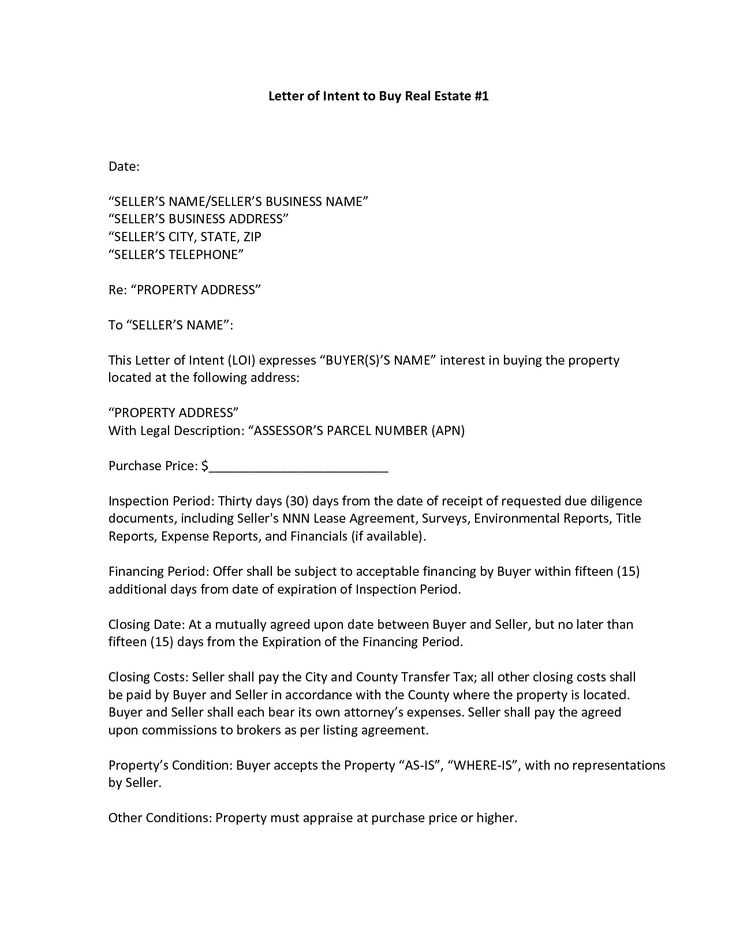

Agree on a clear timeline for due diligence and closing as soon as possible. Establish specific deadlines for each phase to keep the process moving smoothly. Start by setting a due diligence period, typically ranging from 30 to 60 days, during which the buyer investigates the property’s legal, financial, and physical aspects. Ensure this period allows for inspections, document reviews, and any required approvals.

Set realistic dates for completing key tasks, such as securing financing and finalizing inspections. If possible, aim for a closing date no later than 90 days from the agreement’s start. This keeps momentum and ensures both parties stay engaged. During this time, communicate regularly to address any issues or delays.

Be prepared for adjustments. Complex deals may need more time for due diligence, but always keep the final closing date in mind. Consider building in buffer days for unexpected complications, like permitting issues or changes to terms.

Addressing Contingencies and Special Conditions

Clearly outline any contingencies or special conditions to avoid confusion later. These are conditions that must be met for the purchase to proceed. For instance, you may include a contingency regarding financing, stating that the purchase is dependent on securing a loan. Specify the timeline for this condition and any penalties for non-compliance.

Contingency Clauses

Define key contingencies such as inspection or appraisal conditions. Specify the timeframe for inspections, who will bear the costs, and what happens if issues arise. For example, you can stipulate that the seller must repair certain items before the transaction proceeds or allow the buyer to terminate the agreement if significant defects are discovered.

Special Conditions

Special conditions might include specific actions required by either party, like the seller removing personal property from the premises or completing certain improvements before the sale. Outline the specific responsibilities, deadlines, and consequences for failure to comply. These conditions should be precise to prevent any ambiguity and to ensure both parties understand their obligations.

Customizing the Template for Specific Transaction Scenarios

Adjust the terms of your template based on the type of real estate transaction. For lease agreements, for instance, focus on rental terms, duration, and any options for extension or renewal. Ensure clear clauses on rent escalations, maintenance responsibilities, and tenant improvements. For purchases, modify the template to include details about financing arrangements, inspection contingencies, and specific closing conditions. Incorporate clauses that address the unique conditions of the property, like zoning requirements or environmental considerations.

If the property involves multiple parties, like a joint venture, adjust the language to outline roles, profit-sharing percentages, and the specific obligations of each party. For transactions involving government-owned properties, ensure that compliance with local regulations and any required approvals are explicitly stated. If the deal is based on future use, incorporate language that protects both parties’ interests regarding development and the intended purpose of the property.

Don’t forget to adjust the timeline based on the complexity of the deal. Longer transactions, like development projects, require clear milestones and performance benchmarks, while straightforward deals can have simpler deadlines. Tailor the language for dispute resolution to reflect the complexity of the deal and the jurisdiction in which the transaction takes place.